Navigating the world of health insurance can often feel overwhelming, and it's crucial to understand the specifics of your coverage. Whether you're exploring new options or reviewing your existing plan, having a clear grasp of your benefits is essential for making informed decisions. This article will break down the key components of health insurance coverage, including what's typically included, how to assess your needs, and tips for maximizing your benefits. So, let's dive in and unravel the complexities of health insuranceâread on to learn more!

Personal Information (Name, Address, Contact Details)

Health insurance coverage details encompass essential elements, including personal identification (name), residential information (address), and communication information (contact details). Individuals seeking coverage should provide accurate and current information to ensure seamless access to benefits. For instance, names should match official documents, while addresses must reflect the current residing location to avoid discrepancies during the claims process. Contact details, including phone numbers and email addresses, offer a reliable way for insurers to reach individuals for policy updates or necessary verifications, supporting effective communication throughout the insurance journey.

Policy Information (Policy Number, Coverage Dates)

Health insurance policies contain essential information regarding the insured individual's coverage. The policy number serves as a unique identifier for the insurance plan, typically composed of alphanumeric characters, allowing easy reference for claims and inquiries. Coverage dates indicate the duration of the policy's validity; these encompass the start date, when coverage begins, and the end date, when the policy may require renewal or reevaluation. Understanding these specific details is crucial for ensuring access to medical services and benefits.

Coverage Details (Benefits, Inclusions, Exclusions)

Health insurance policies offer a variety of coverage details that encompass numerous benefits, inclusions, and exclusions to cater to individual healthcare needs. Benefits typically include hospitalization expenses, outpatient consultations, emergency services, and preventive care screenings, ensuring members can receive necessary treatments without financial strain. Inclusions may cover prescribed medications, surgeries, maternity care, and mental health services, enhancing overall well-being. However, exclusions often comprise cosmetic procedures, pre-existing conditions within specified time frames (usually two years), and non-prescribed alternative therapies, highlighting the importance of understanding policy limitations. Familiarity with these aspects ensures individuals can navigate their coverage effectively and utilize benefits as intended.

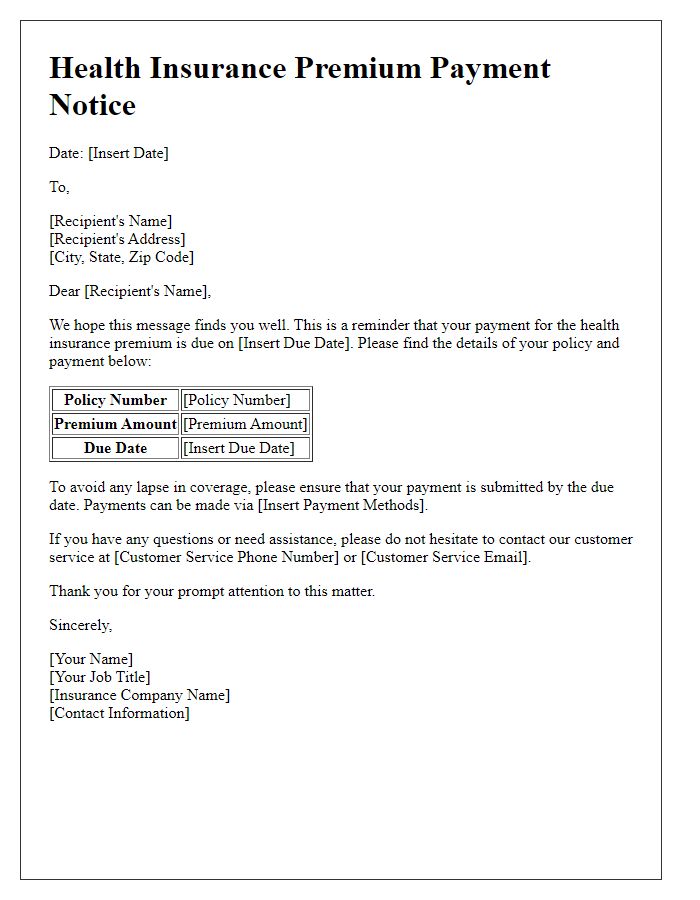

Financial Information (Premiums, Discounts, Payment Terms)

Understanding health insurance coverage involves analyzing financial information, which includes premiums, discounts, and payment terms. Premiums represent the monthly cost that policyholders pay for coverage; they can vary significantly based on factors such as age, location (for example, New York versus Texas), and the specific plan selected (like HMO or PPO). Discounts may be available through initiatives such as healthy lifestyle programs or employer sponsorship, potentially reducing premium costs by 5-20%. Payment terms dictate how and when premiums must be paid; common options include monthly, quarterly, or annual payments, with some insurers offering flexibility in payment methods, such as automatic bank withdrawals or credit card transactions. Understanding these financial components is crucial for effective budget management and ensuring comprehensive healthcare access.

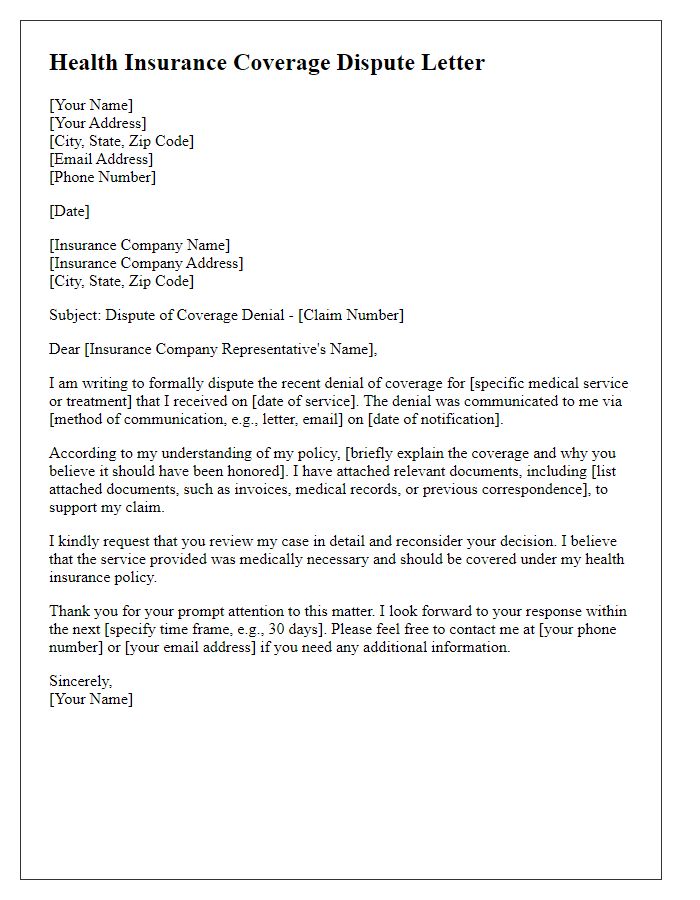

Contact Information (Customer Service, Claims Department)

Health insurance coverage often involves navigating through various departments, including Customer Service and Claims Department. Customer Service, typically reachable at 1-800-555-0199, provides assistance with policy inquiries, benefit explanations, and enrollment questions. Claims Department, located at the insurance provider's headquarters in Chicago, Illinois, processes claims submitted by healthcare providers and ensures timely reimbursements. Detailed references to policy numbers (usually a combination of letters and digits) can expedite claims processing, while understanding key timelines, such as the 30-day period for claim filing, is critical for efficient service. Note that coverage details may vary by plan type, such as HMO or PPO, impacting the network of doctors and hospitals available to policyholders.

Comments