Are you navigating the complex waters of marine insurance and feeling a bit overwhelmed? You're not alone! Understanding the intricacies of marine insurance policies can be challenging, but it's essential for protecting your valuable assets at sea. Dive into this article to discover key insights and tips that will help you confidently inquire about your marine insurance policy!

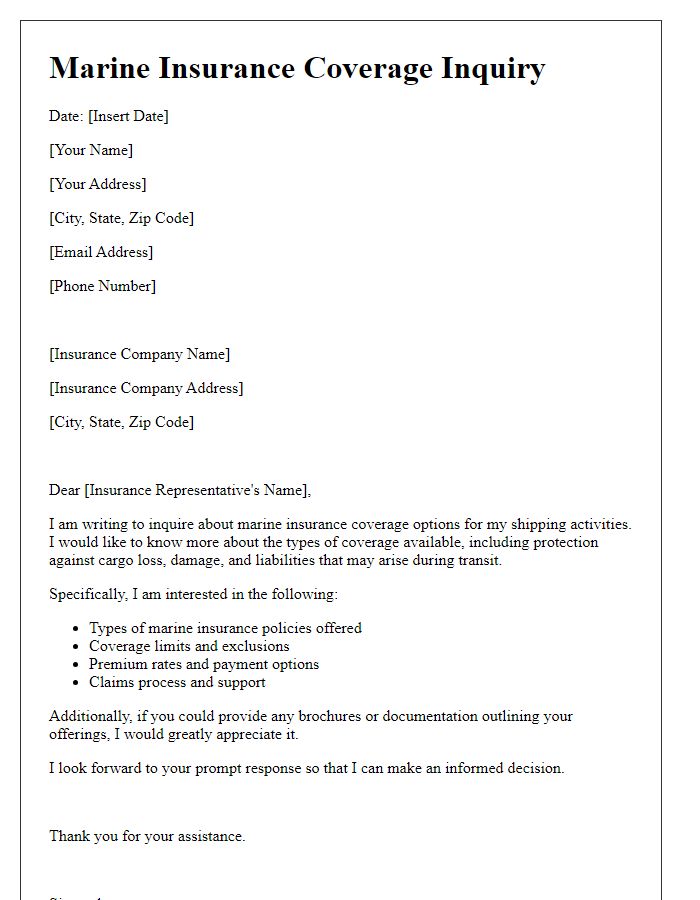

Policy Coverage Specifications

Marine insurance policies are critical for safeguarding maritime interests, covering various risks associated with shipping and cargo. Key coverages often include hull insurance, which protects vessels against physical damage, typically valued in millions of dollars, and cargo insurance that secures goods in transit, commonly worth thousands per shipment. Liability coverage is also essential, addressing incidents that may occur during operations, including environmental damages or cargo loss. Specific terms and conditions may vary by the insurance provider, like Lloyd's of London or AIG, necessitating a thorough review of policy exclusions and deductibles. Understanding the geographic scope of coverage is vital, especially for international voyages involving multiple regulations and risk factors. Overall, an in-depth examination of limits, endorsements, and premium calculations ensures comprehensive protection for shipowners and cargo stakeholders against unforeseen maritime disasters.

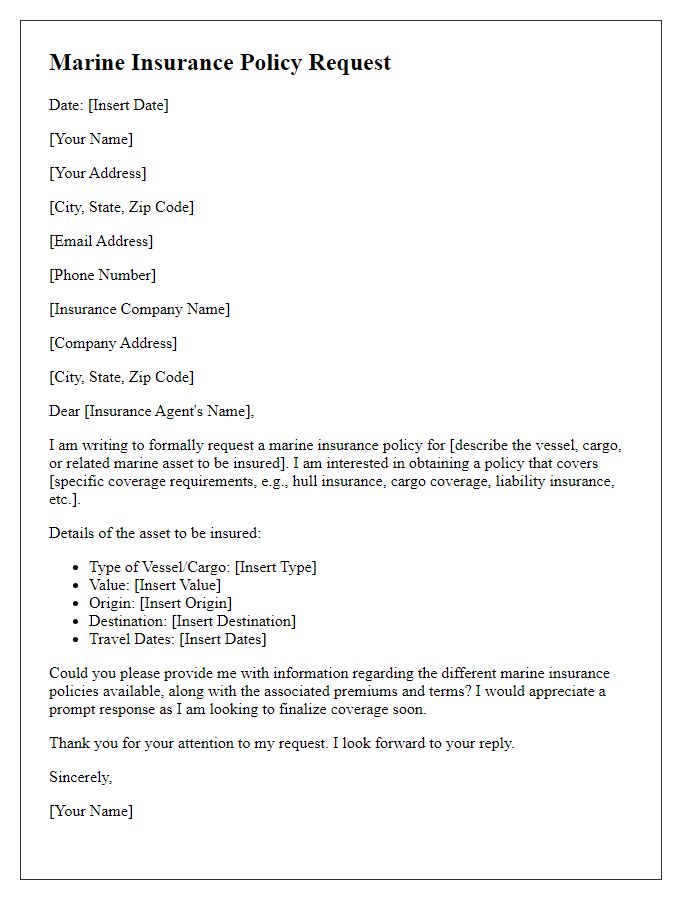

Vessel Details and Characteristics

Inquiring about marine insurance policies requires detailed information about the specific vessel under consideration. The vessel's name, such as "SS Ocean Explorer," alongside its international maritime identification number (IMPN) is essential for identification purposes. Key specifications including the type of vessel, such as cargo, fishing, or recreational yacht, contribute to understanding potential risks. The vessel's year of build, for instance, 2015, along with its length overall (LOA) of 30 meters and gross tonnage (GT) of 200, affects the marine insurance coverage options available. Additionally, details about the vessel's engine type, such as inboard diesel, alongside its horsepower rating of 400, play a critical role in assessing insurability. Information about the navigation area, like North Atlantic waters, and typical sailing routes, will further assist in evaluating policy terms and conditions. Historical data on claims, if applicable, can influence premium calculations and coverage eligibility.

Navigational Limits and Zones

Navigational limits define the geographic area where a marine vessel is permitted to operate under an insurance policy. These limits can vary based on the type of insurance coverage, often specified in navigational zones such as coastal waters, inland rivers, or territorial seas. For instance, a vessel operating within 200 nautical miles from a specified coastline may enjoy full coverage, while excursions beyond this zone could expose the owner to significant risk. It is crucial to verify any alterations to these limits, as vessels venturing into unapproved areas face a higher likelihood of insurance claims denial. Moreover, understanding the implications of zones such as international waters, which typically extend 12 nautical miles from a nation's baseline, is essential for compliance with maritime law and insurance stipulations.

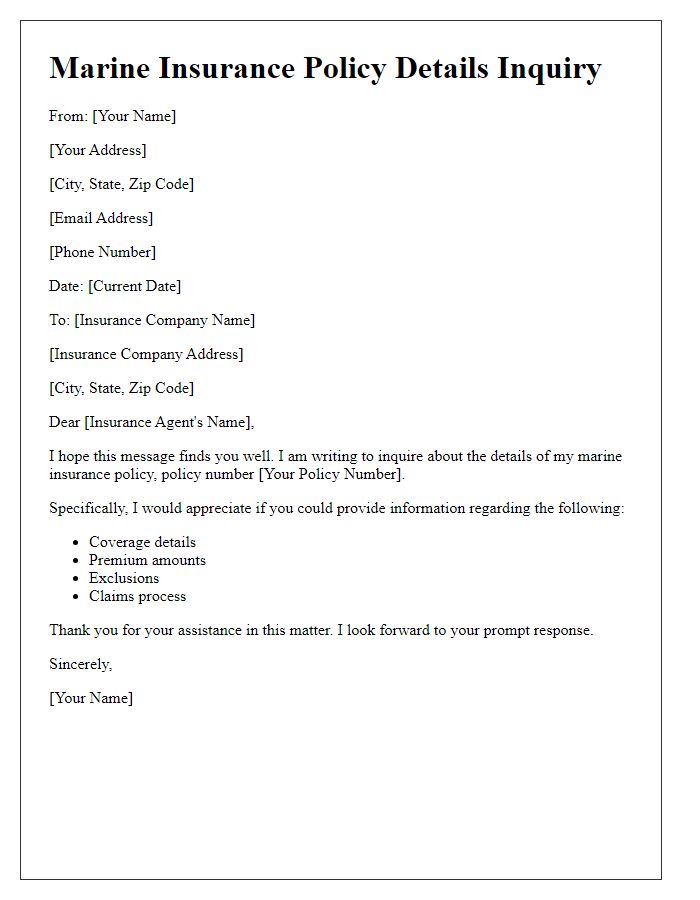

Premium and Deductible Information

Marine insurance policies provide coverage for ships, cargo, ports, and terminals against various risks. Premium rates for these policies often depend on factors such as the type of vessel, the value of goods transported, and the routes taken. Common premium ranges vary significantly, often from 0.1% to 1.5% of the insured value, based on risk assessments. Deductibles are the amounts that the insured must pay out-of-pocket before coverage applies. Typical deductible amounts might range from $500 to $10,000 depending on the policy and specific coverage terms. Understanding these key variables is crucial for adequately evaluating costs and risks associated with maritime operations.

Claims Process and Documentation Requirements

Marine insurance policies protect cargo and vessels from risks during transit. When filing a claim, specific documentation is crucial for a seamless process. Essential documents include a written claim statement detailing the incident, the marine insurance policy itself, and proof of loss (such as invoices, bills of lading, and photographs of damage). Additionally, claimants must provide any relevant correspondence with carriers or freight forwarders, as well as Loss Adjuster reports when applicable. Timeliness remains vital; many insurers require claim notifications within a specified period, often within seven days of the loss event. Familiarity with your insurer's specific requirements can significantly expedite the process and alleviate potential disputes regarding coverage and compensation.

Comments