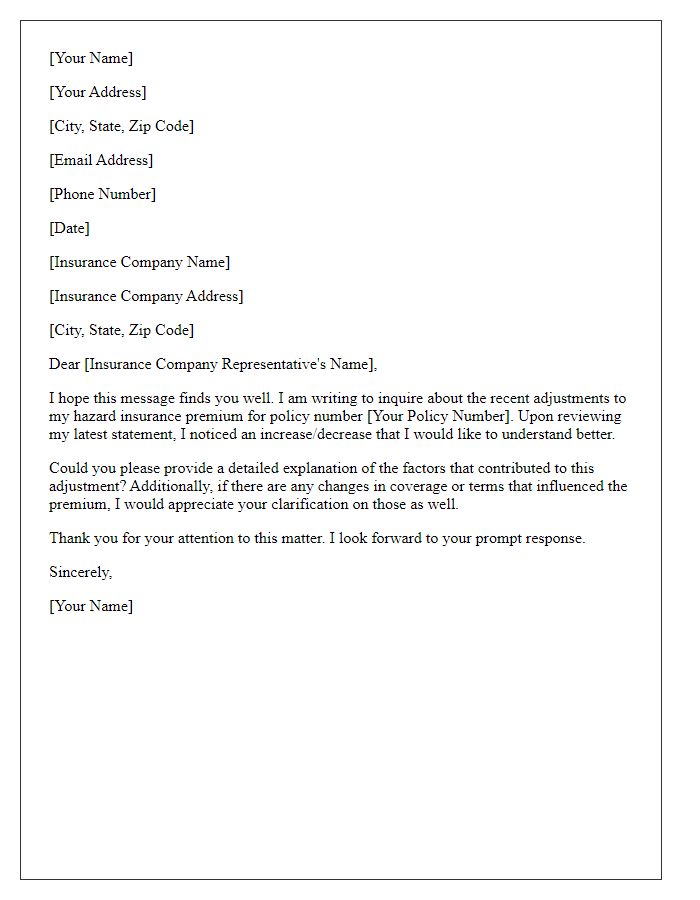

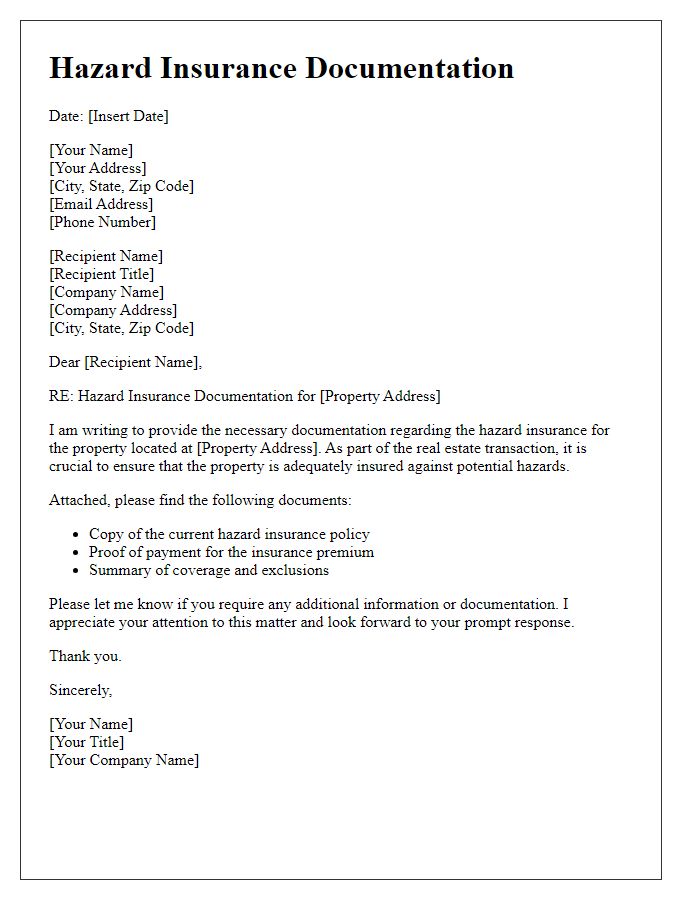

If you're navigating the world of hazard insurance documentation, you've come to the right place! Understanding the ins and outs of these important policies can feel overwhelming, but with the right guidance, it becomes manageable. This article will break down the essential components of hazard insurance letters and provide you with a helpful template to streamline the documentation process. So, let's dive in and make your hazard insurance experience a breezeâread on to discover more!

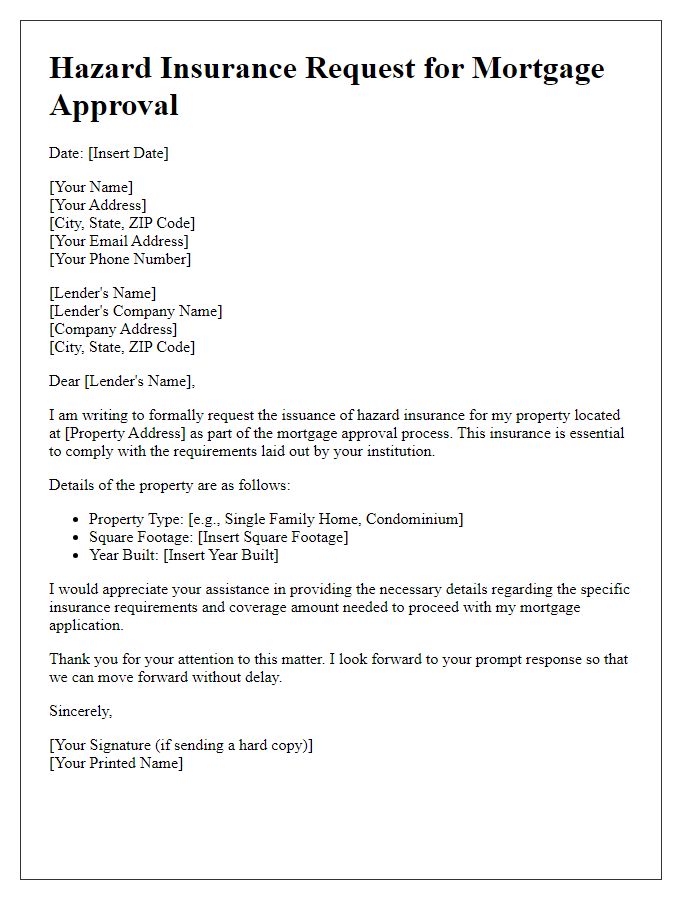

Accurate Property Description

Accurate property description plays a critical role in hazard insurance documentation, ensuring correct coverage and assessment. Details such as the property's address (e.g., 123 Maple Street, Springfield), square footage (e.g., 2,500 square feet), and year built (e.g., 1995) must be meticulously noted. Additionally, the type of structure (e.g., single-family home, condominium), the number of floors (e.g., two-story), and the presence of safety features (e.g., smoke detectors, fire alarms) significantly impact insurance premiums and claims. Geographic location details, including proximity to fire stations (within 5 miles), flood zones (Zone A), and earthquake risk areas (high risk), are also essential. Such comprehensive property descriptions facilitate accurate valuation and effective risk management for both property owners and insurers.

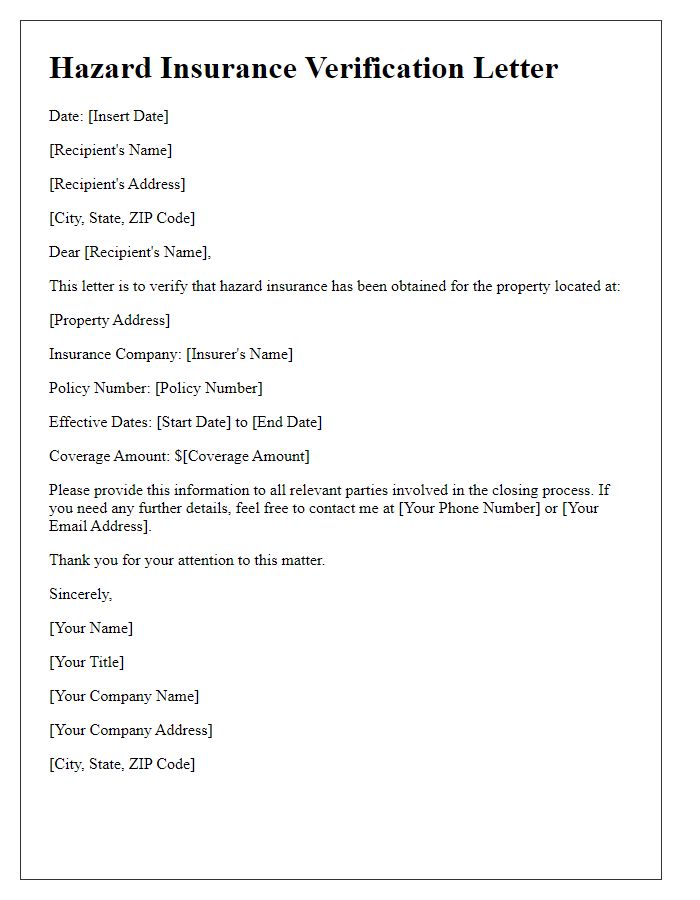

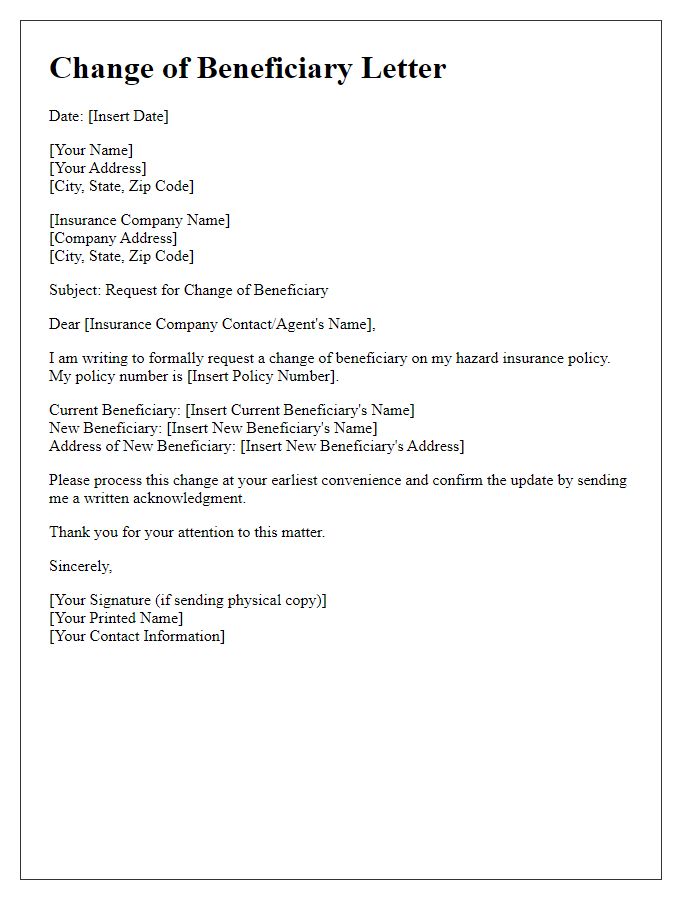

Policy Coverage Details

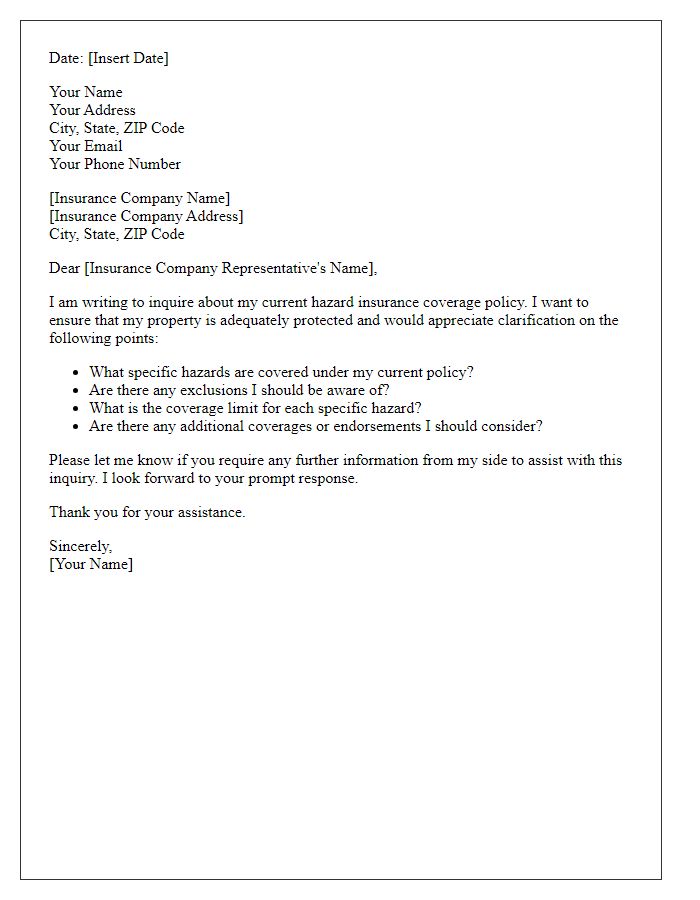

Hazard insurance policies provide essential coverage for property owners, protecting against risks such as fire, theft, and natural disasters. Typical policies cover structural damage to residential properties, including homes, garages, and other attached structures, often with coverage limits set according to the replacement cost, which can range from $100,000 to over $1 million. Personal property within the structure (furniture, appliances, clothing) generally receives coverage as well, usually up to 50% of the dwelling's coverage limit. Specific events, known as covered perils, are listed in the policy; common examples include hurricanes, earthquakes, and vandalism. Homeowners may opt for additional riders to address exclusions like flood or earthquake damage, which requires separate policies often mandated by lenders in high-risk zones, such as coastal areas prone to hurricanes. Additionally, liability coverage is included to protect against legal claims from injuries occurring on the property, with limits typically starting at $100,000 but commonly reaching $300,000 or higher in many policies.

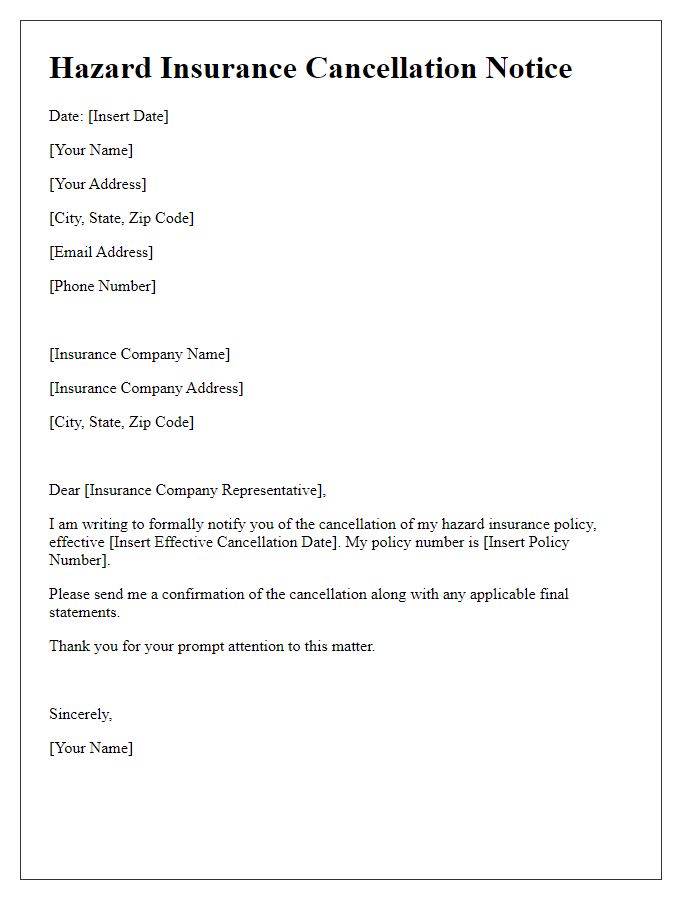

Named Insured and Contact Information

Hazard insurance documentation typically requires key details about the insured party and their contact information. The named insured, often the policyholder, usually represents individuals or entities like homeowners, renters, or businesses. Contact information consists of essential data such as full name, physical address (including city, state, and zip code), phone number (home and mobile), and email address for communication purposes. This information ensures prompt communication regarding policy updates, claims processing, or emergencies. Accurate and complete contact details are crucial for effective management of hazard insurance policies, allowing for timely assistance and risk mitigation in events like natural disasters or property damage.

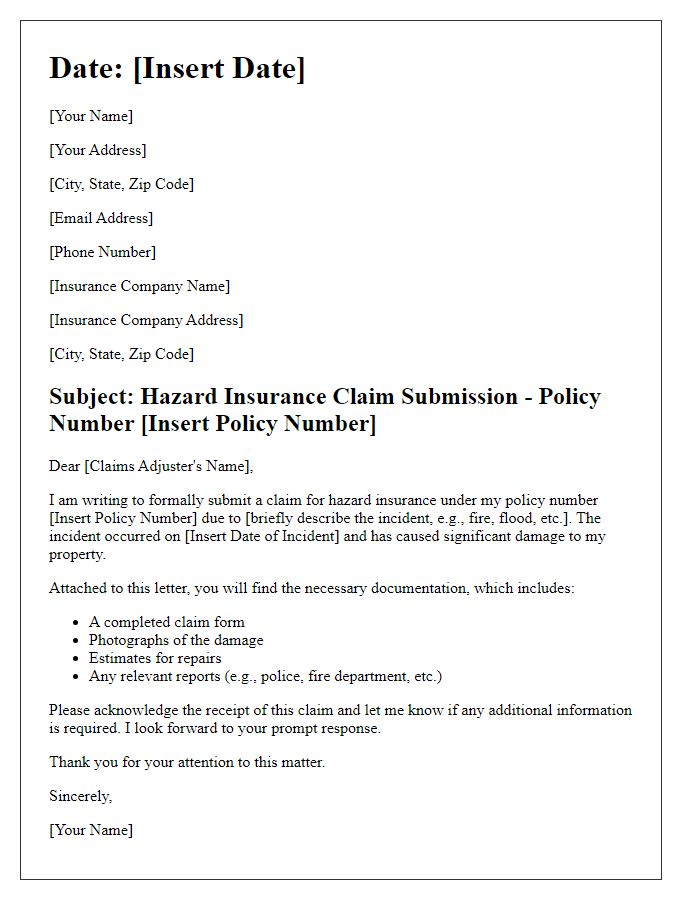

Hazard Specifics and Risk Assessment

Hazard insurance documentation focuses on specific risks associated with property such as natural disasters or accidents. For instance, flooding (often caused by heavy rainfall or storm surges) can severely damage structures in coastal areas like New Orleans, where the average annual rainfall exceeds 60 inches. Earthquakes, particularly in seismically active zones like California, pose a risk with magnitudes often exceeding 5.0 on the Richter scale, potentially leading to catastrophic structural failures. Fire hazards are prevalent in regions susceptible to wildfires; California alone reported over 9,000 wildfires in 2020, devastating thousands of acres. Assessments must include the assessment of local building codes, emergency services response times, and environmental conditions to accurately gauge risk levels and provide suitable coverage options. Historical data (e.g., frequency of events, economic losses) further informs decisions about hazard-specific insurance policies, ensuring appropriate protection against potential financial impacts.

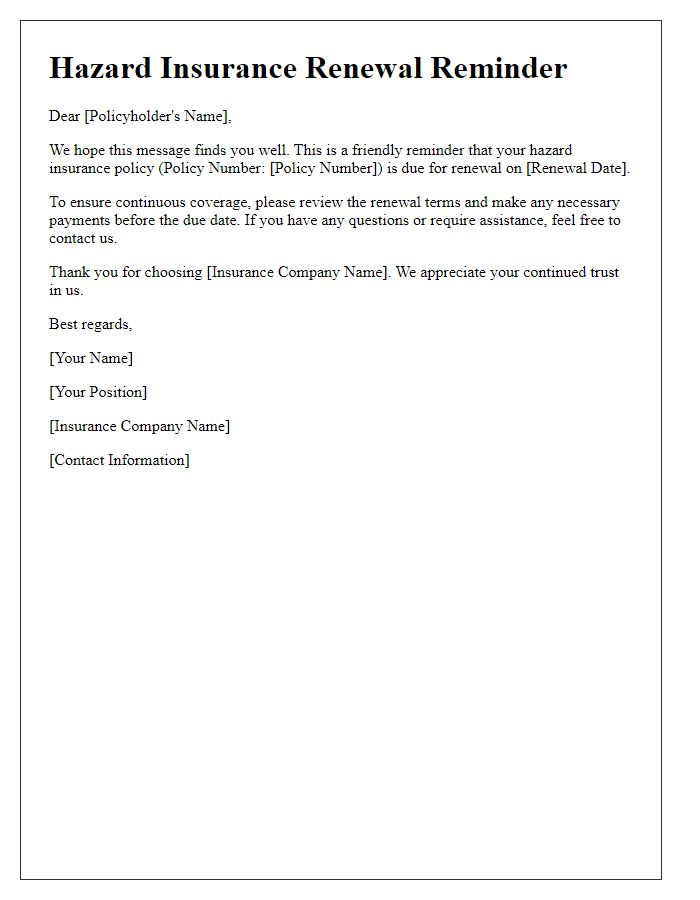

Policy Term and Effective Dates

Hazard insurance documentation outlines critical information regarding policy terms and effective dates for property coverage. Typically, a policy term lasts one year, with effective dates marking the beginning of coverage, such as January 1, 2023. Policyholder responsibilities include ensuring timely renewal before expiration, emphasizing the importance of maintaining continuous coverage that protects against risks like fire, theft, or natural disasters. Specific details about the geographic location of the insured property, such as a residential home in Miami, Florida, can influence premium rates and coverage terms. Understanding these elements is crucial for homeowners to safeguard their investments and comply with mortgage lender requirements.

Comments