Are you looking to streamline your financial transactions with a wire transfer? Whether you're sending money for a personal reason or conducting business, having a properly structured wire transfer authorization letter can make the process smoother. This simple yet impactful document ensures that your financial requests are clear and official. Let's delve into how to craft the perfect wire transfer authorization letter and maximize its effectivenessâread on to learn more!

Sender and receiver details (name, address, bank information).

Wire transfer authorization involves providing detailed information about both the sender and receiver for accurate processing. The sender's information includes the name (e.g., John Doe), address (e.g., 123 Maple Street, Springfield, IL 62701), and bank information such as the bank's name (e.g., First National Bank), account number (e.g., 987654321), and routing number (e.g., 123456789). On the receiver's side, details consist of the receiver's name (e.g., Jane Smith), address (e.g., 456 Oak Lane, Chicago, IL 60601), and their bank's information, including bank name (e.g., Community Trust Bank), account number (e.g., 123456789), and routing number (e.g., 987654321). Accurate account information is crucial to prevent delays or mishandling of funds during the transaction process.

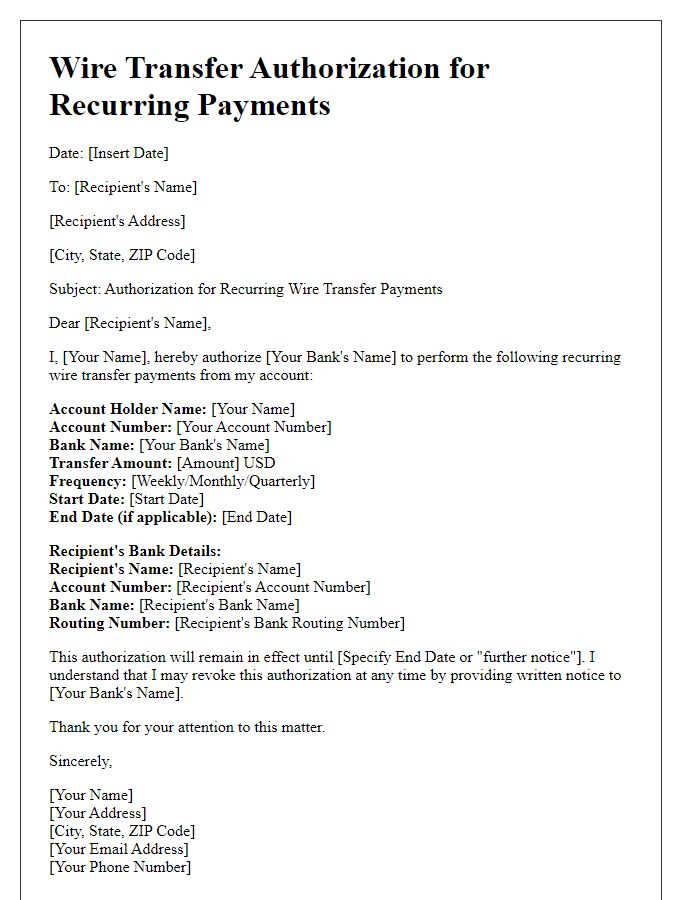

Date and reference number.

Wire transfer authorization requires precise documentation, including the specific date of the transaction, typically formatted as Month Day, Year (e.g., October 15, 2023). Additionally, a unique reference number assigned to the transaction enables easy tracking and verification, often comprising a combination of letters and numbers (for example, WT123456789). This information ensures that financial institutions can accurately process and confirm wire transfers, reducing the likelihood of errors and delays in transferring funds between accounts.

Exact transfer amount and currency.

A wire transfer authorization form must include precise details to ensure proper processing. Essential information includes the exact transfer amount, specified in currency such as US dollars (USD) or euros (EUR). This document facilitates the monetary transaction, often required by banks or financial institutions, ensuring that the receiver's account information is accurate and matches the transfer amount. Proper documentation reduces the risk of errors and enhances security during the transaction process.

Purpose of the transfer.

Wire transfer authorizations are crucial for financial transactions between banks. This document specifies the intent of funds transfer. It needs to state the purpose, such as purchasing real estate, paying for education, or settling a business invoice, ensuring clarity for both the sending institution and the recipient bank. Precise information (like amounts, dates, and involved account numbers) is required to facilitate smooth transactions while preventing potential fraud. Additionally, accurate purpose definition helps in regulatory compliance and financial tracking.

Authorization signature and contact information.

Wire transfer authorization requires clear identification of the authorizing party, including specific details such as full name, title, and contact information. Authorization signatures should be legible to ensure validation; these typically include a handwritten signature alongside a printed name. Additionally, contact information must encompass a phone number (including area code) and an email address for any necessary follow-up. The date of authorization is critical, marking when the request for funds transfer is officially recognized. Furthermore, the financial institution's name and account details must also be included to direct the wire transfer accurately, ensuring that funds are transferred to the correct banking institution, such as Chase Bank or Bank of America, and the specific account number involved in the transaction.

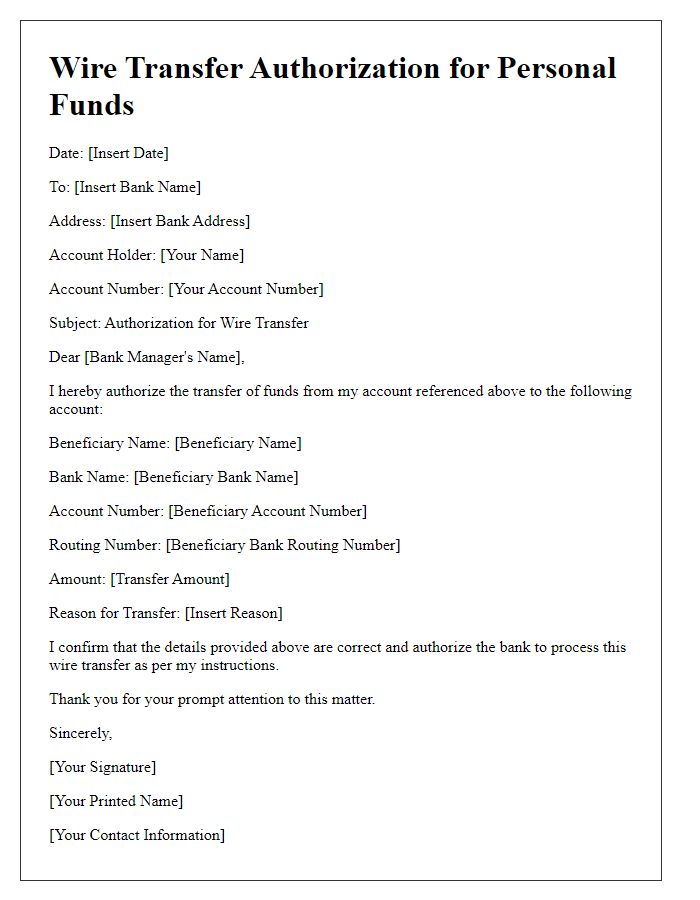

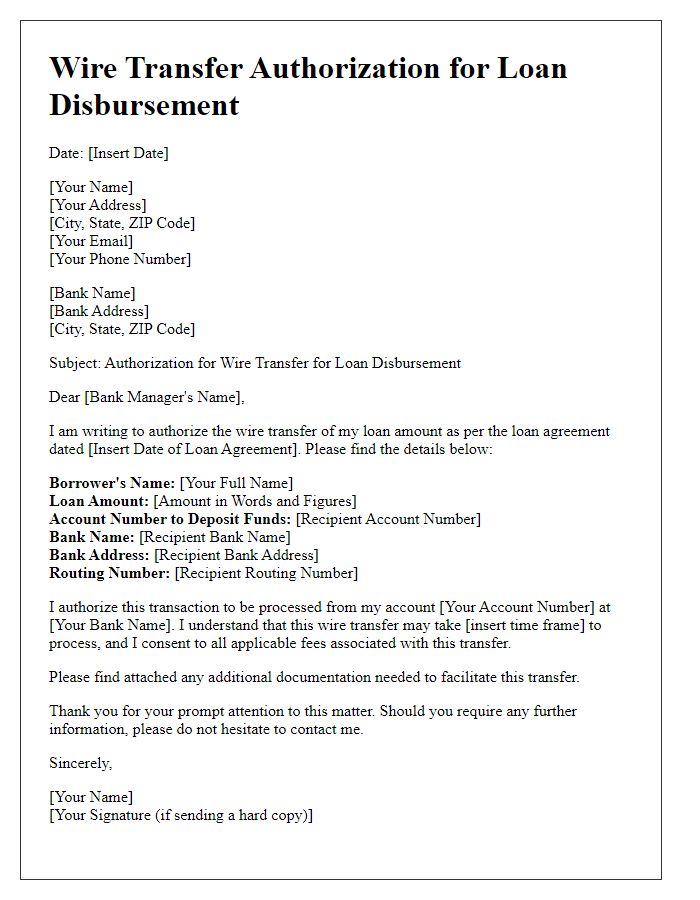

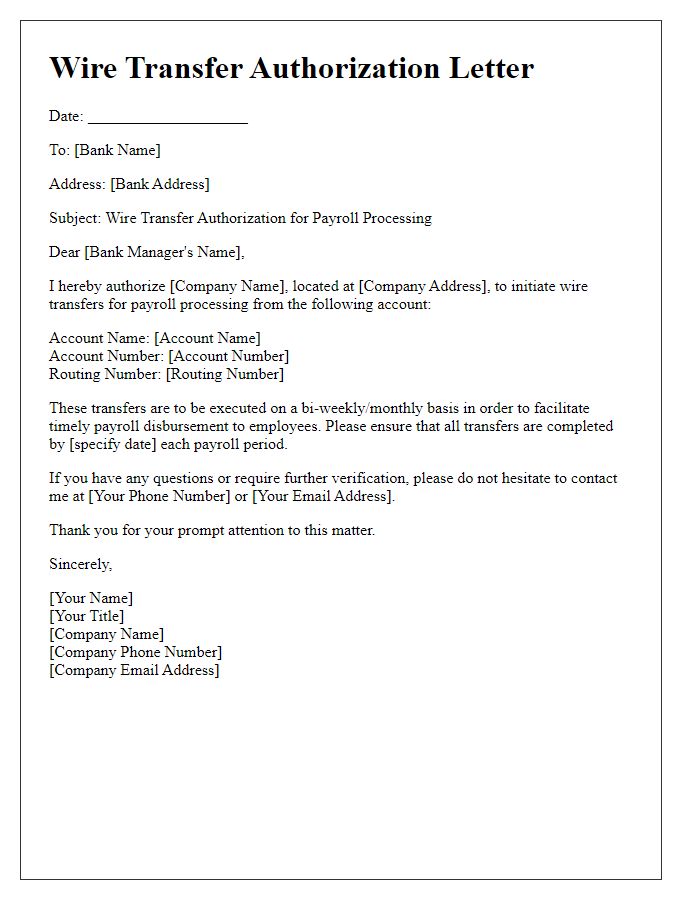

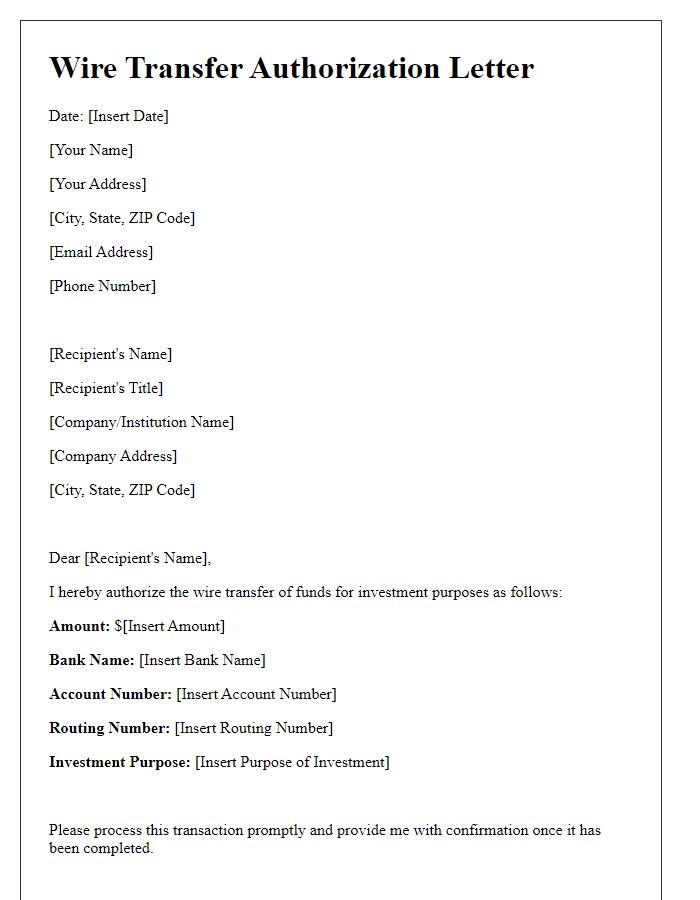

Letter Template For Wire Transfer Authorization Samples

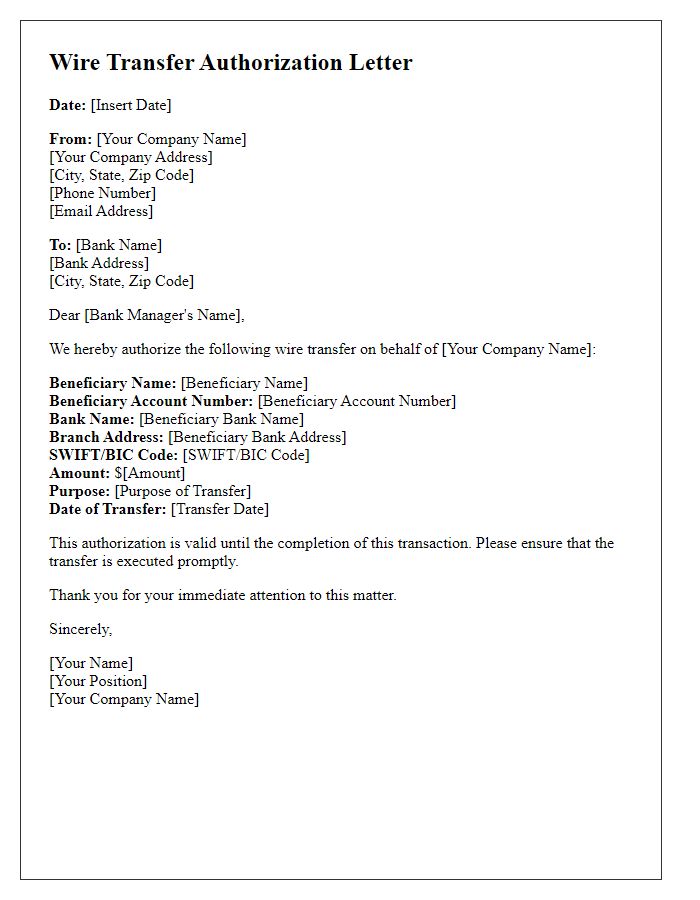

Letter template of wire transfer authorization for business transactions

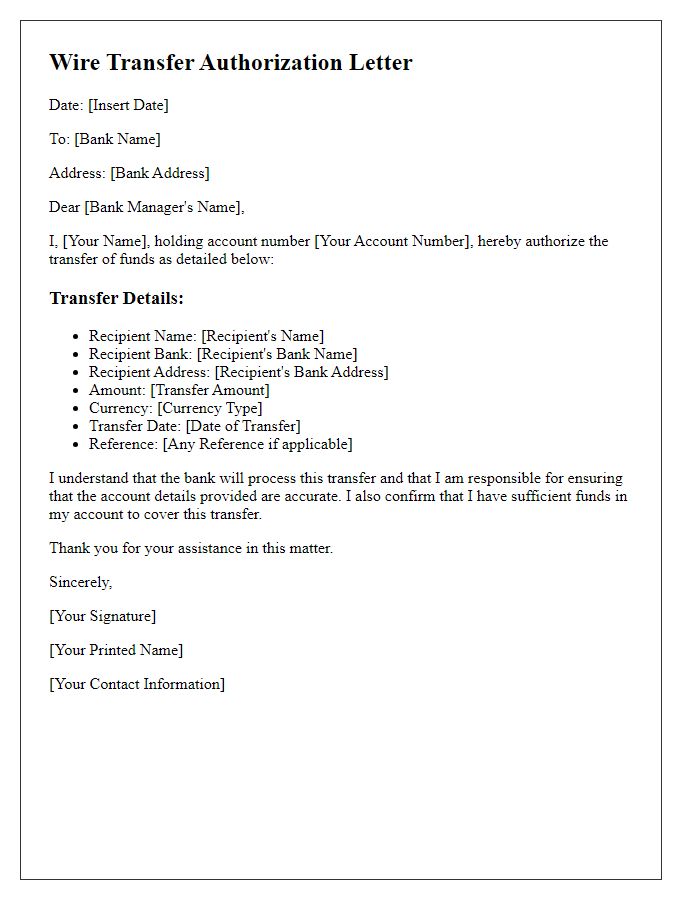

Letter template of wire transfer authorization for international transfers

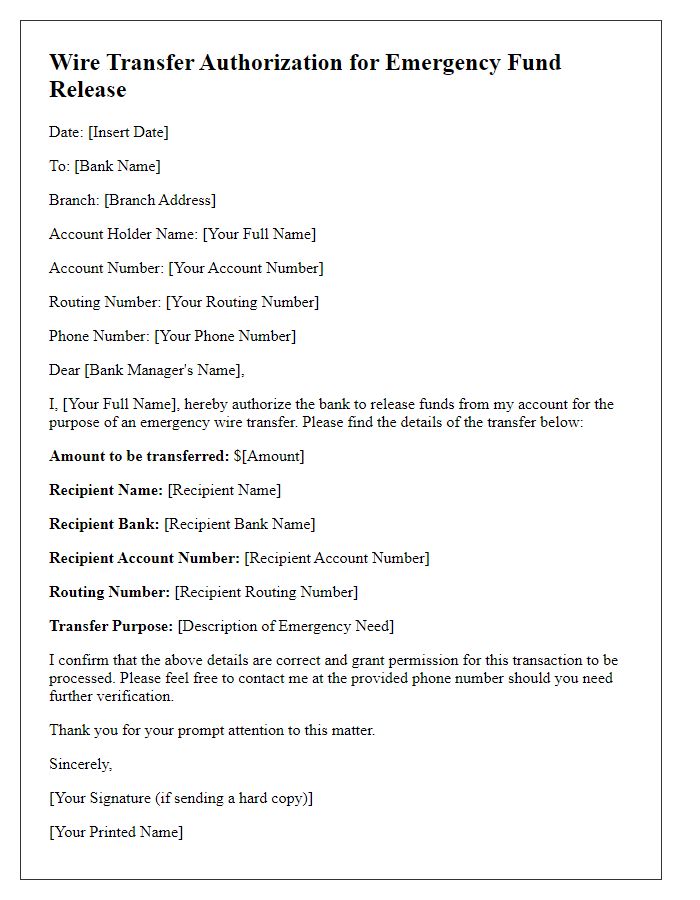

Letter template of wire transfer authorization for emergency fund release

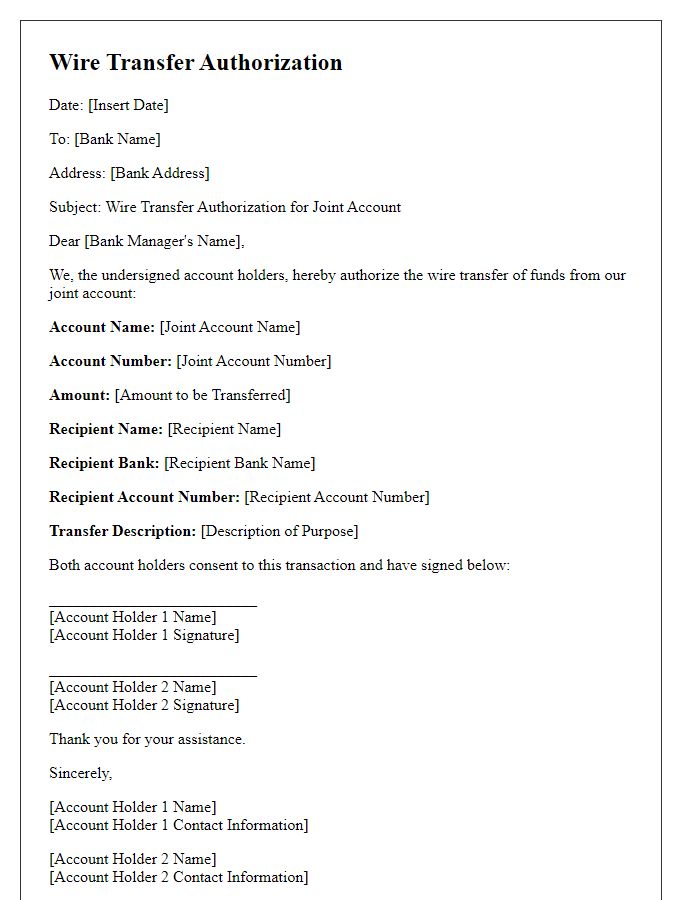

Letter template of wire transfer authorization for joint account holders

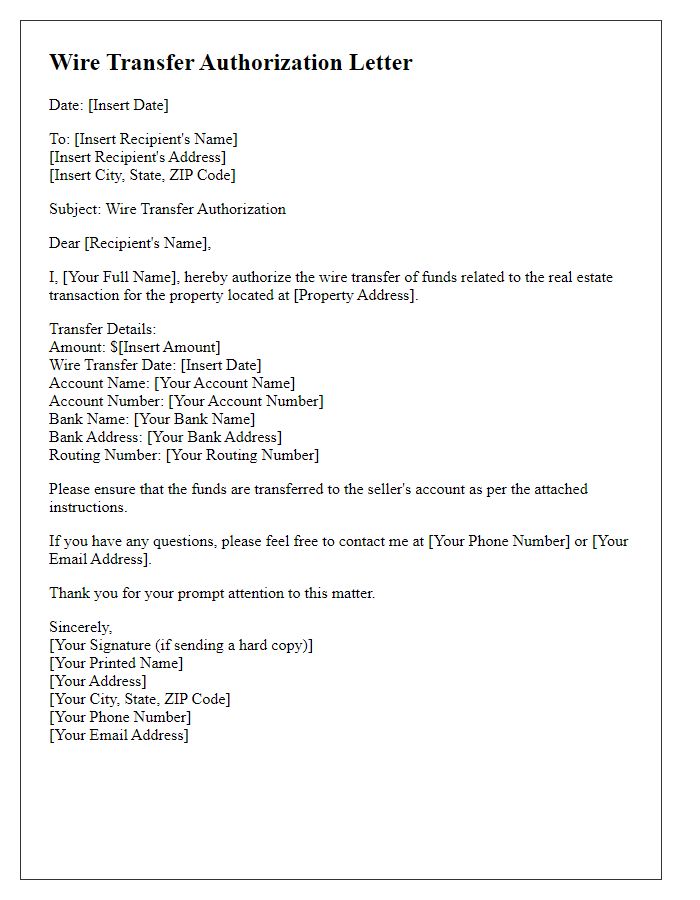

Letter template of wire transfer authorization for real estate transactions

Comments