Are you considering refinancing your mortgage but uncertain about the process? It can feel overwhelming, but don't fretâyou're not alone! Many homeowners are seeking ways to save money and improve their financial situation through refinancing, and understanding the ins and outs can make all the difference. Join us as we explore the key points you need to know, and let's dive deeper into how refinancing could benefit you!

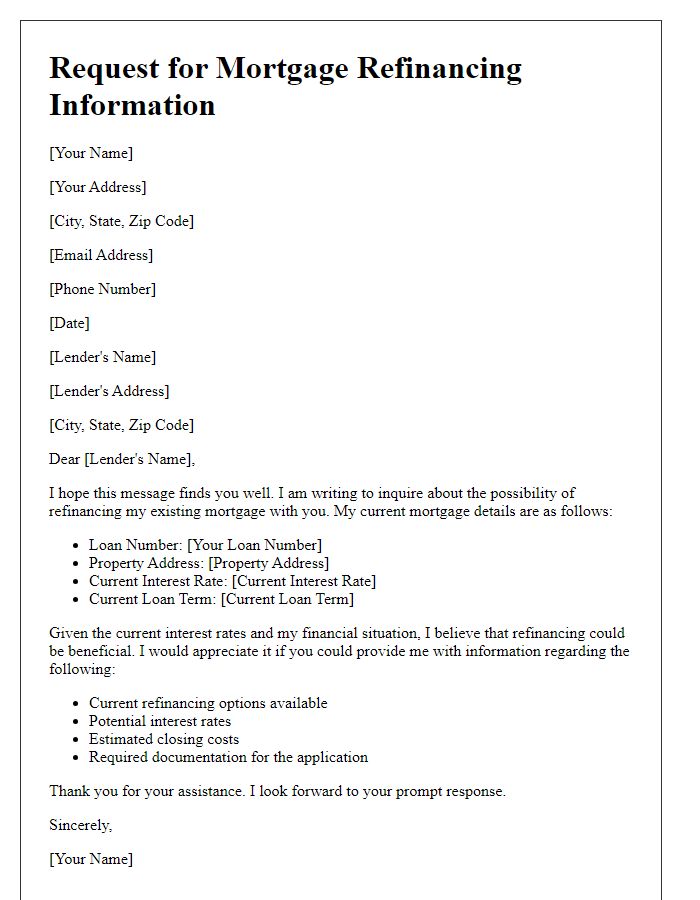

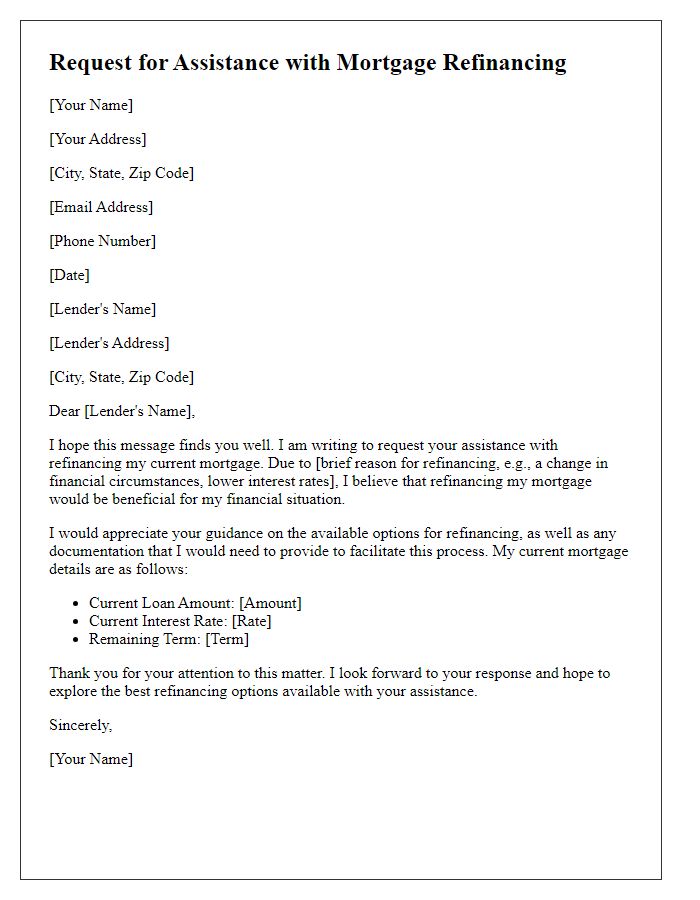

Borrower Information

Mortgage refinancing provides homeowners with the opportunity to modify their existing loan terms, potentially leading to lower monthly payments. Borrower information, including full name, current address, contact details, loan account number, and financial situation (income, debt-to-income ratio), is essential for lenders to assess eligibility. The current mortgage rate, remaining loan balance, and the length of time left on the loan can influence the refinancing process. Additionally, the purpose of refinancing--whether it is for a lower interest rate, cash-out for home improvements, or consolidating debt--plays a crucial role in determining the best refinancing options available.

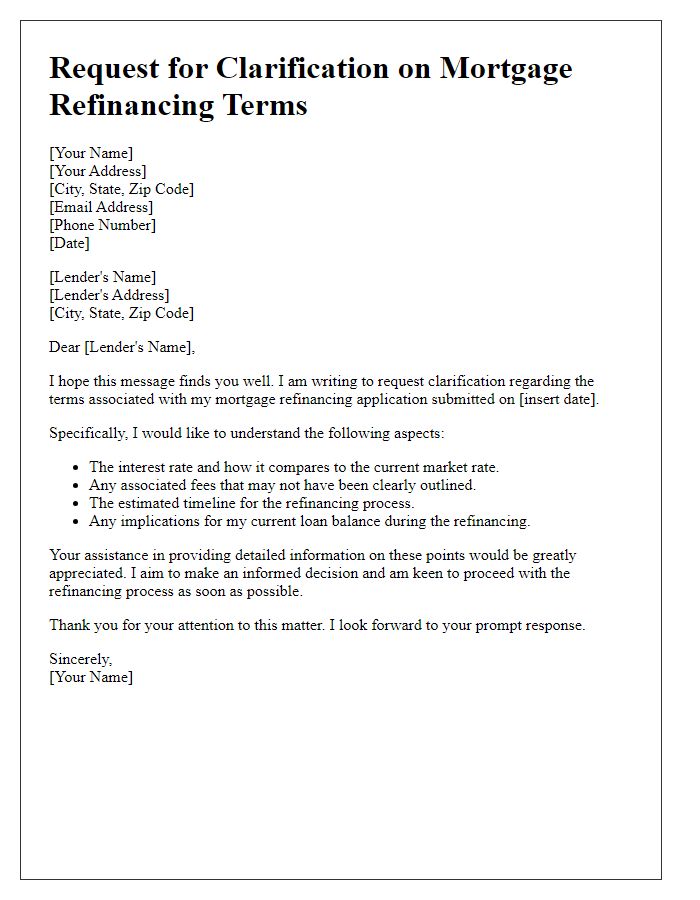

Loan Details

When considering mortgage refinancing, essential loan details include original loan amount, current interest rate, remaining balance, and loan term. For example, a 30-year fixed mortgage initially priced at $300,000 with a 4.5% interest rate may have a remaining balance of $250,000 after five years. Lenders typically seek information such as monthly payment amount, payment history, and current market interest rates, which fluctuated significantly in the past couple of years, sometimes exceeding 5%. Homeowners often inquire about potential savings through lower rates, reduced terms, and associated fees, including closing costs that can average $3,000 to $5,000. Gathering precise data on property value, credit scores, and debt-to-income ratios is crucial for a successful refinancing process.

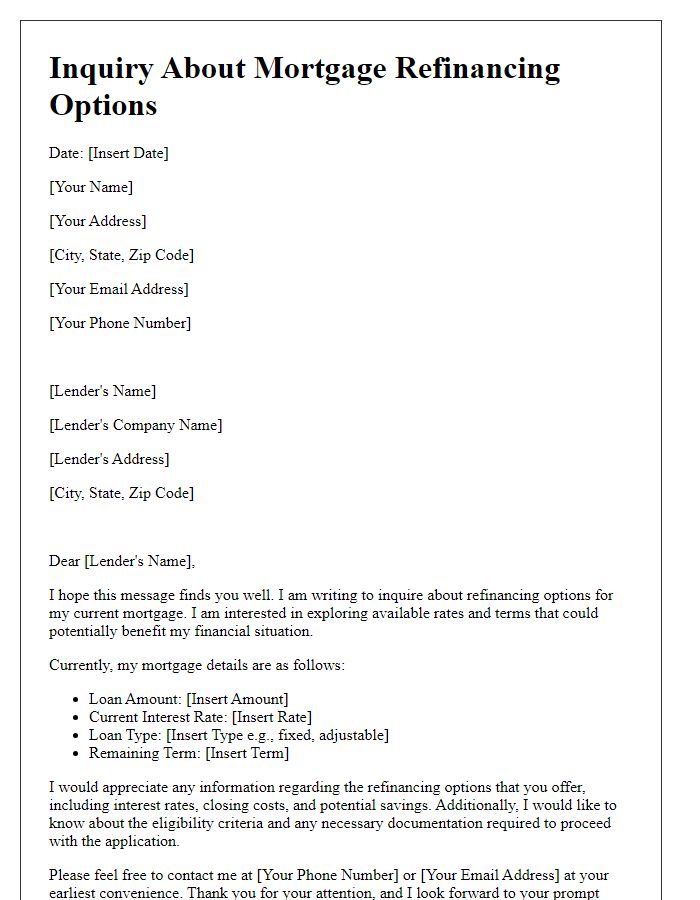

Financial Overview

A financial overview is essential when considering mortgage refinancing, as it allows homeowners to assess their current mortgage situation and explore potential savings. The current mortgage balance, which may average around $200,000 for many homeowners, is important to note. The interest rate on the existing loan, potentially around 4% or higher, significantly impacts monthly payments. Additionally, homeowners should evaluate their credit score, which ideally should be above 700 to qualify for better rates. Income verification, which may include recent pay stubs totaling approximately $80,000 annually, is necessary to confirm financial stability. Lastly, understanding the home's current appraised value, possibly around $300,000 in rapidly appreciating markets, can influence refinancing options and potential cash-out amounts.

Property Information

Acquiring pertinent property information is essential when pursuing mortgage refinancing for residences, such as single-family homes or condominiums. Important details include the property value, which can be determined through home appraisals (typically conducted by certified appraisers) and comparable market analysis (CMA) referencing similar properties within the vicinity. The location, including neighborhood statistics, school district ratings, and recent sales data, helps lenders gauge market trends, such as the appreciation rate (the increase in property value over time) and overall housing market performance. Property improvements, renovations, or any alterations can significantly influence the assessment, as well as property tax information which contributes to monthly mortgage calculations. Understanding these facets can streamline the refinancing process and potentially secure better loan terms.

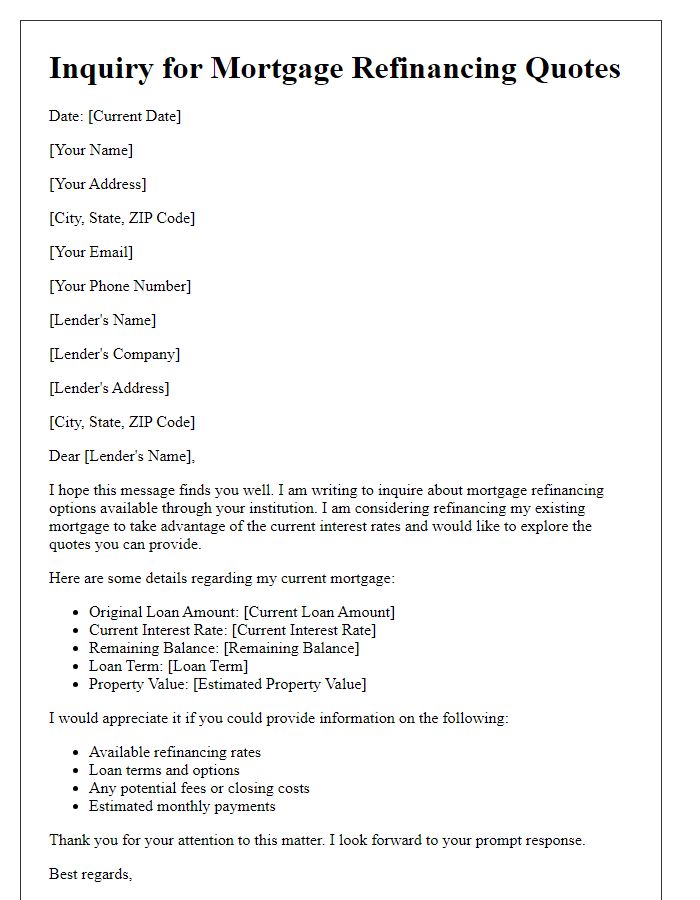

Contact Preferences

Mortgage refinancing inquiries can be streamlined through clear communication with lenders. Homeowners often prefer various contact options, such as phone calls or emails, to discuss loan terms. During the inquiry process, providing detailed information about personal finances, including credit scores and current mortgage rates, can facilitate a smoother experience. Specific timeframes for contact, like weekdays between 9 AM and 5 PM, may also enhance communication efficiency. Additionally, preferences for in-person meetings at the lender's office, such as locations in major cities like New York or Los Angeles, can be stipulated to ensure comprehensive discussions regarding mortgage options.

Comments