Are you ready to take control of your finances from the comfort of your home? With internet banking, managing your accounts has never been easier or more convenient. Whether you want to check your balance, transfer funds, or pay bills, everything is just a few clicks away. Keep reading to learn how to get started with your internet banking registration and make banking a breeze!

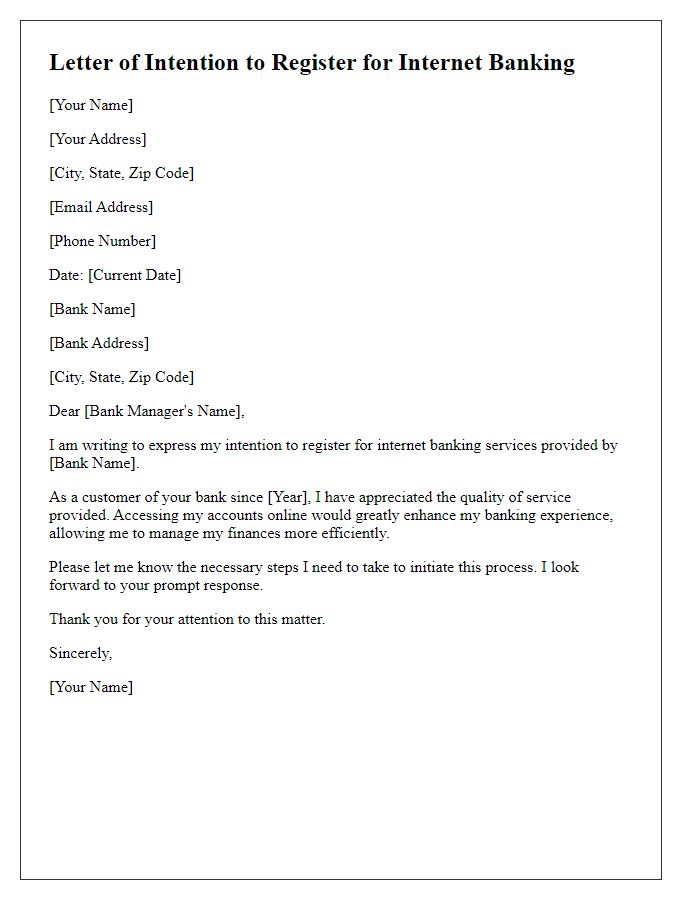

Personal Information

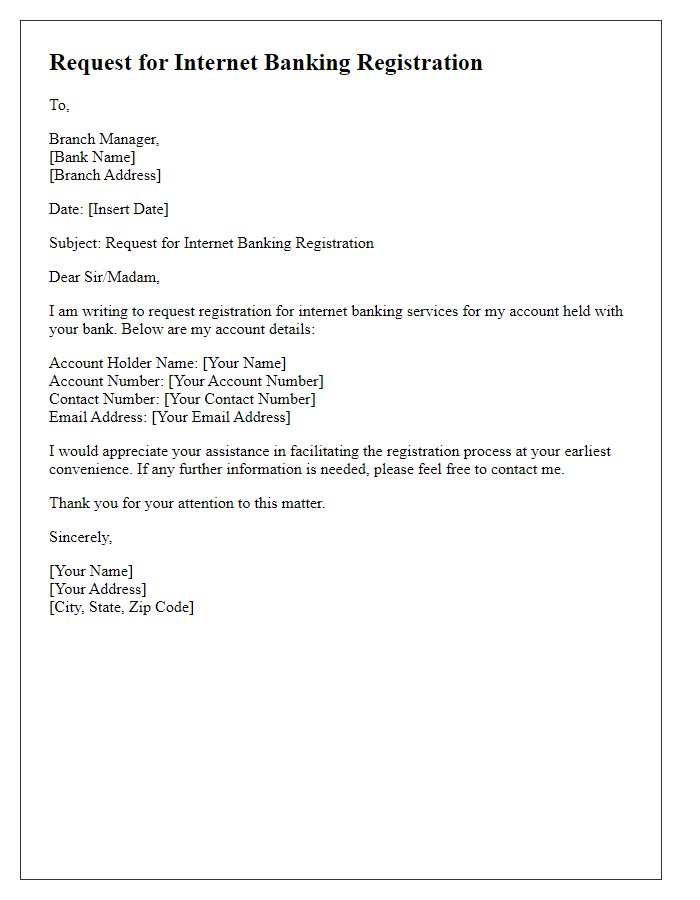

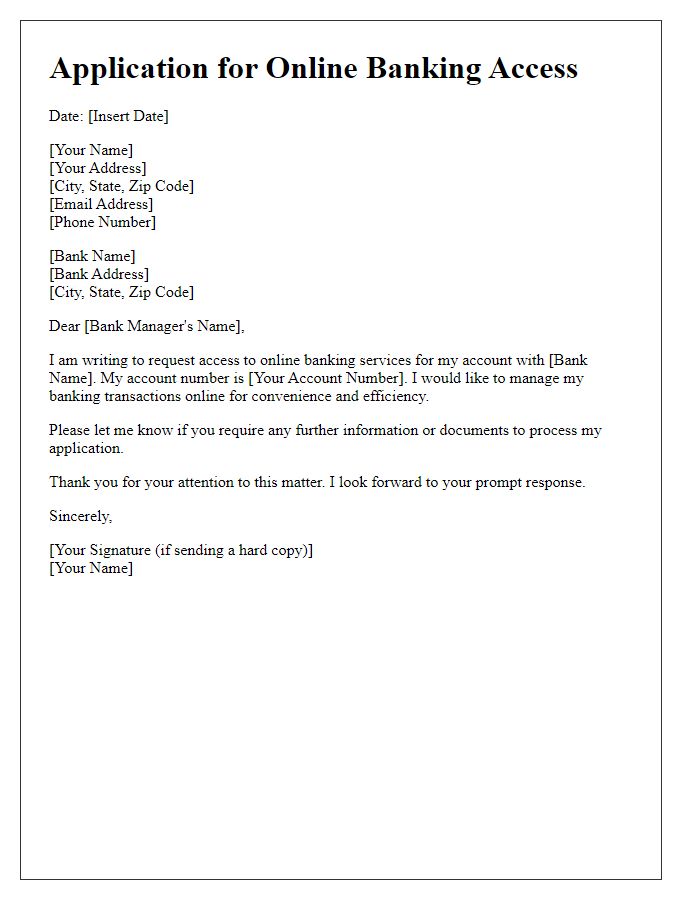

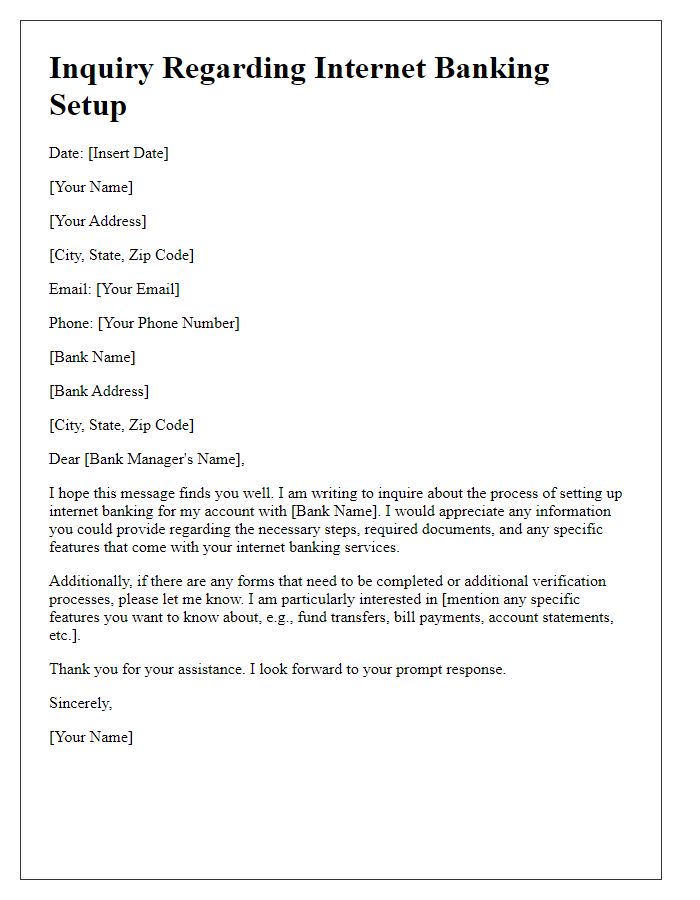

The process of internet banking registration requires the submission of personal information, key for identity verification and account security. A typical registration form may ask for your full name, including any middle names, as recorded in official documents. The date of birth, usually required in the format of day, month, year, ensures applicant eligibility, typically over the age of 18. A residential address, including street number, city, state, and postal code, helps establish the customer's identity. Contact information like a mobile phone number, which may need to be verified via SMS for security purposes, and an email address, for receiving account updates and alerts, are also crucial. Finally, creating a strong password according to specified guidelines is essential for safeguarding the online banking environment.

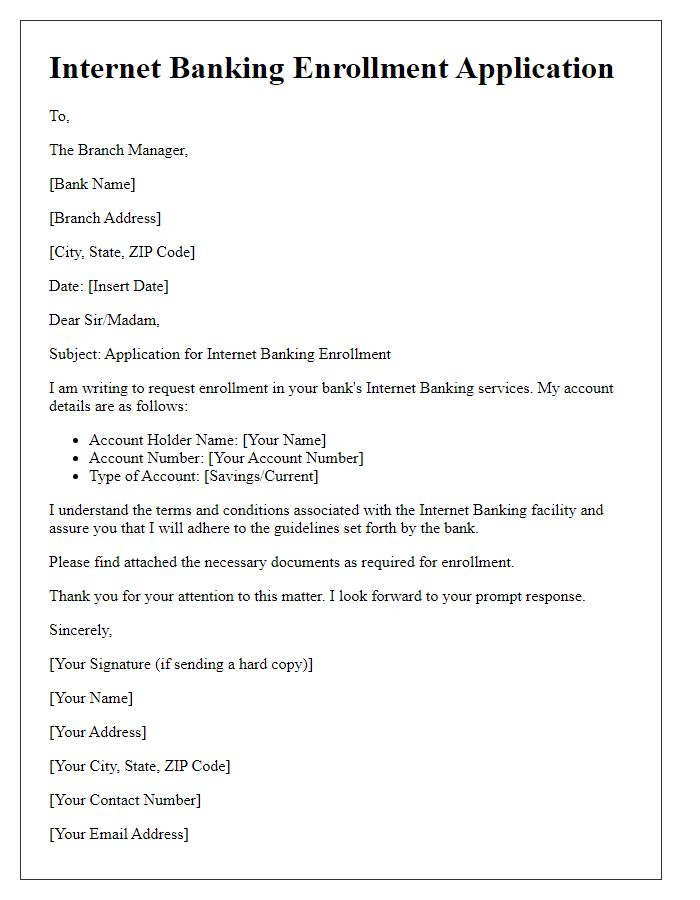

Account Details

When applying for internet banking registration, individuals must provide essential account details, including the Bank Account Number, typically a unique 10 to 12-digit identifier for the customer's account. The Account Holder's Name, which reflects the name registered with the bank, should match official documents for verification purposes. The branch name is required to identify the physical location of the account, alongside the Bank's Routing Number, which enables accurate electronic transfers and transactions. Additionally, the Special Security Code, often a 4 to 6-digit PIN issued by the bank, may be needed to enhance security during the internet banking setup.

Security Questions

Security questions play a crucial role in internet banking registration, safeguarding users' accounts from unauthorized access. Commonly selected queries include the name of the first pet, mother's maiden name, or the city of birth, providing personalized layers of security. For users, answers must be memorable yet difficult for others to guess, enhancing account protection. Banks often require a combination of these questions to strengthen security protocols, aiming to prevent identity theft and fraud. Furthermore, adhering to best practices in creating answers involves avoiding easily discoverable information, such as birthdays or anniversaries, ensuring account safety during online transactions.

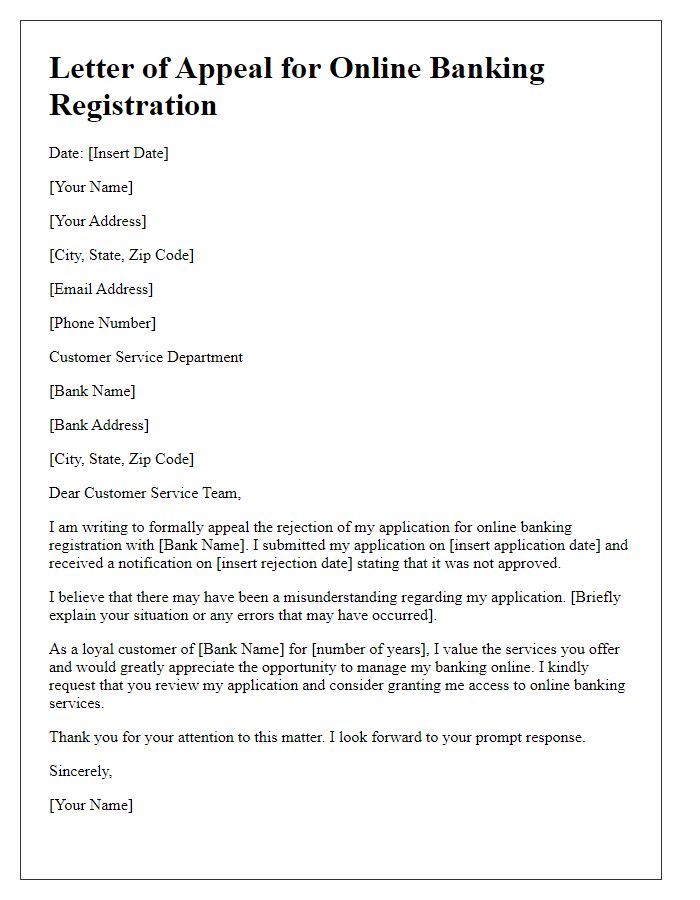

Terms and Conditions Agreement

Internet banking registration involves agreeing to specific terms and conditions that outline the responsibilities and rights of users and financial institutions. These agreements detail aspects such as user security protocols, transaction limits, and liability in cases of fraud. Users must acknowledge understanding of privacy policies, including data protection regulations outlined by laws such as the General Data Protection Regulation (GDPR). Additionally, banks commonly include clauses regarding service availability, maintenance schedules, and dispute resolution procedures, ensuring users are informed about operational protocols and customer support resources. Signed agreements are typically stored digitally, creating a compliance record for both users and banks.

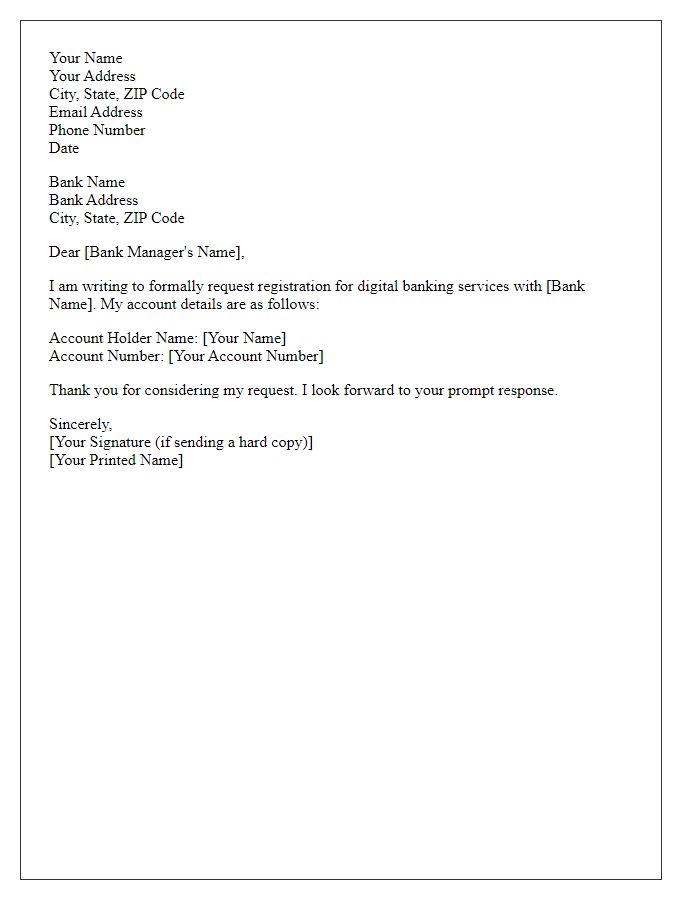

Signature and Date

Internet banking registration requires providing personal information along with a signature for verification. The signature serves as an authorization method, confirming the legitimacy of the information submitted. Date entry (typically in the DD/MM/YYYY format) indicates when the registration request was made, which is crucial for tracking and processing the application. This ensures a secure and validated registration process for accessing online financial services.

Comments