Are you ready to take control of your financial future? In today's ever-changing economy, having a solid financial advisory agreement can make all the difference. This essential document not only outlines your goals and expectations but also establishes a trusted relationship between you and your advisor. Dive in to discover how a well-crafted financial advisory agreement can set you on the path to financial success!

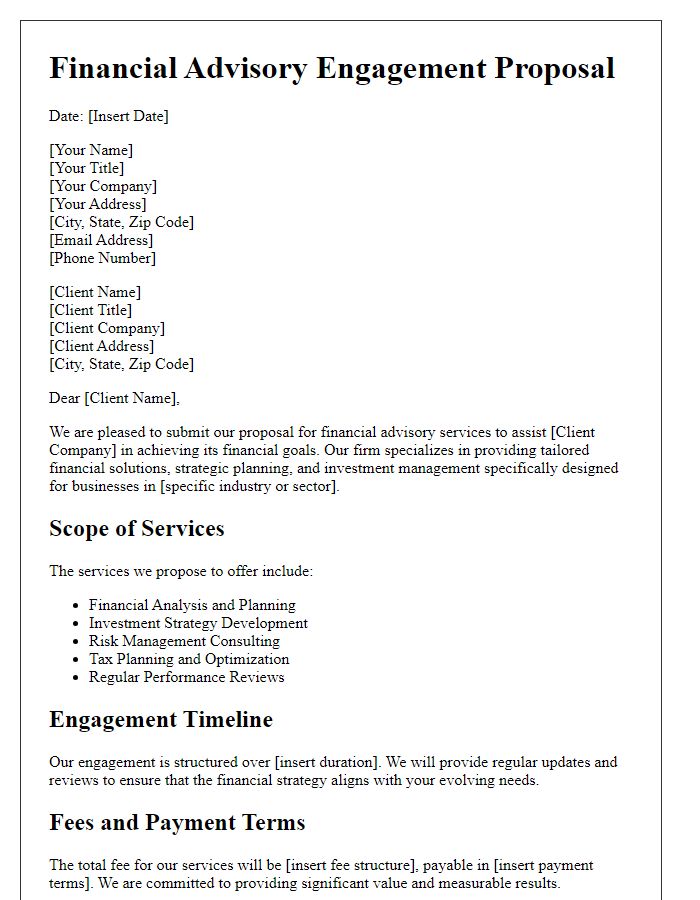

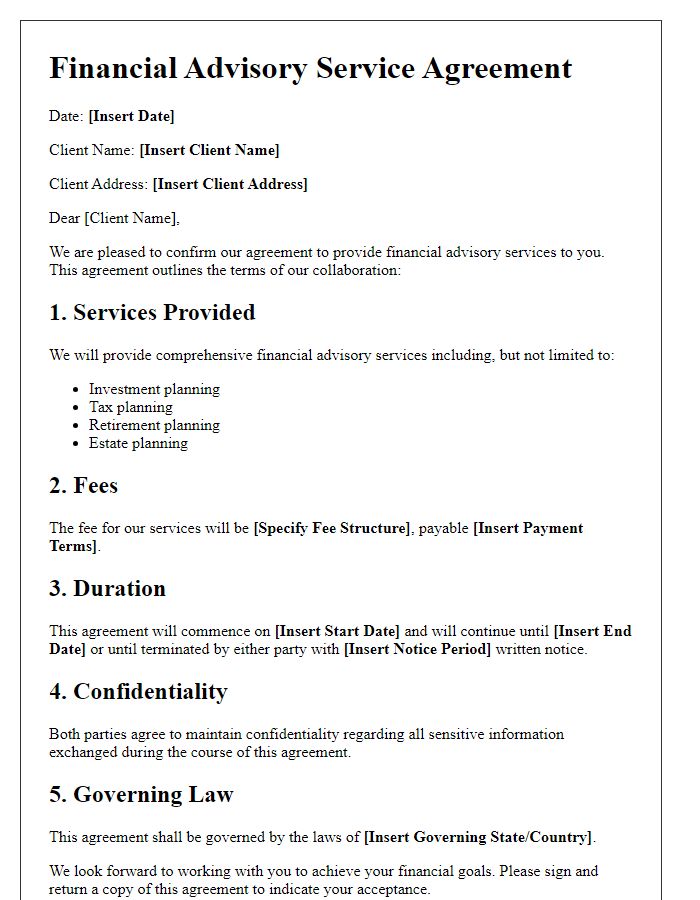

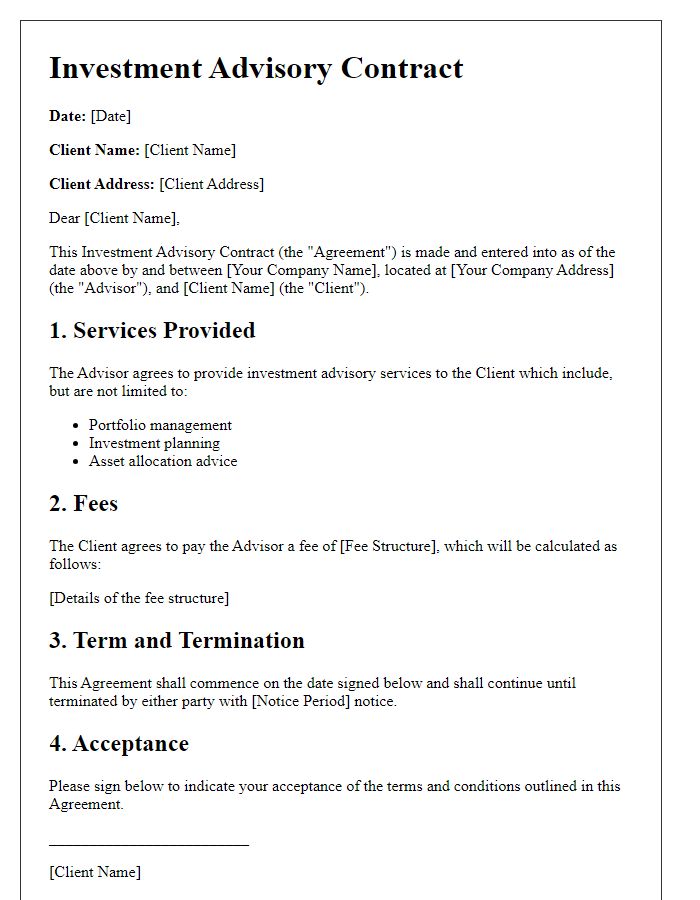

Introduction and Parties Involved

The financial advisory agreement serves as a foundational document outlining the relationship between the financial advisor and the client, establishing clear expectations and responsibilities. This agreement typically identifies the parties involved, such as a certified financial planner and an individual client or a corporate entity, ensuring that both parties are explicitly recognized within the context of the agreement. Essential details include the full legal names of the advisor and the client, their respective addresses, and any professional designations that signify credentials and expertise. Additional context about the nature of the advisory services, such as investment management, retirement planning, or tax consulting, is critical for clarity. The agreement may also highlight the duration of the engagement, specifying if it is a one-time consultation or an ongoing advisory relationship. Documenting these details helps foster mutual understanding and trust, essential for a successful financial partnership.

Scope of Services

Financial advisory agreements, especially in the context of comprehensive financial services, establish clear expectations. The scope of services section may detail investment management, retirement planning, tax optimization strategies, and estate planning. Each service component specifies the advisor's responsibilities, such as portfolio analysis and asset allocation. It typically outlines the frequency of performance reviews, ongoing communication channels, and criteria for risk assessment. Compliance with relevant regulations, such as the Securities Exchange Commission (SEC) guidelines, emphasizes the fiduciary duty of the advisor to act in the client's best interests. Specific benchmarks may be included to measure the success of implemented strategies.

Compensation and Fees

Compensation structures in financial advisory agreements often include management fees, which can be a percentage of assets under management (AUM), typically ranging from 0.5% to 2% annually. Additionally, flat fees might be charged for specific services, such as financial planning or investment analysis, usually amounting to $1,000 to $10,000, depending on the complexity of the client's financial situation. Performance-based fees may be utilized, particularly in hedge funds, typically 20% of profits over a predetermined benchmark. It's also common for financial advisors to outline any additional fees for transactions, custodial services, or structured products, ensuring the client fully understands the total expense of the advisory services. Ensuring transparency in the fee structure is crucial, as it helps build trust and aligns the advisor's incentives with the client's financial goals.

Confidentiality and Data Protection

Confidentiality and data protection agreements in the financial advisory context are crucial for safeguarding sensitive client information. Financial advisors must ensure compliance with regulations such as the General Data Protection Regulation (GDPR) in Europe, which mandates strict measures for personal data processing and protection. The agreement should outline key elements like the definition of confidential information, which includes financial statements, personal identification, and investment strategy documents. Additionally, it must specify obligations regarding data security measures, detailing encryption protocols, access controls, and reporting procedures in case of data breaches. Violations of confidentiality can lead to significant repercussions, including legal action and loss of client trust, making these agreements essential for maintaining integrity and professionalism in financial practices.

Termination Conditions and Amendments

A financial advisory agreement letter template outlines the specific conditions for termination, detailing the circumstances under which either party may conclude their professional relationship. Termination conditions may include events such as unsatisfactory performance by the advisor or a breach of contract terms by either party. Furthermore, amendments to the agreement can be specified, allowing for modifications to the terms through mutual consent. These changes ensure adaptability in response to evolving financial circumstances or regulatory requirements. Including clear termination clauses and amendment procedures enhances the clarity and effectiveness of the financial advisory relationship.

Comments