Are you feeling a bit anxious about your mortgage rate? You're not alone! Many homeowners find themselves in a similar situation, especially when adjustments come into play. In this article, we'll guide you through the process of understanding mortgage rate notifications and provide tips on what steps you can take nextâso keep reading to discover more!

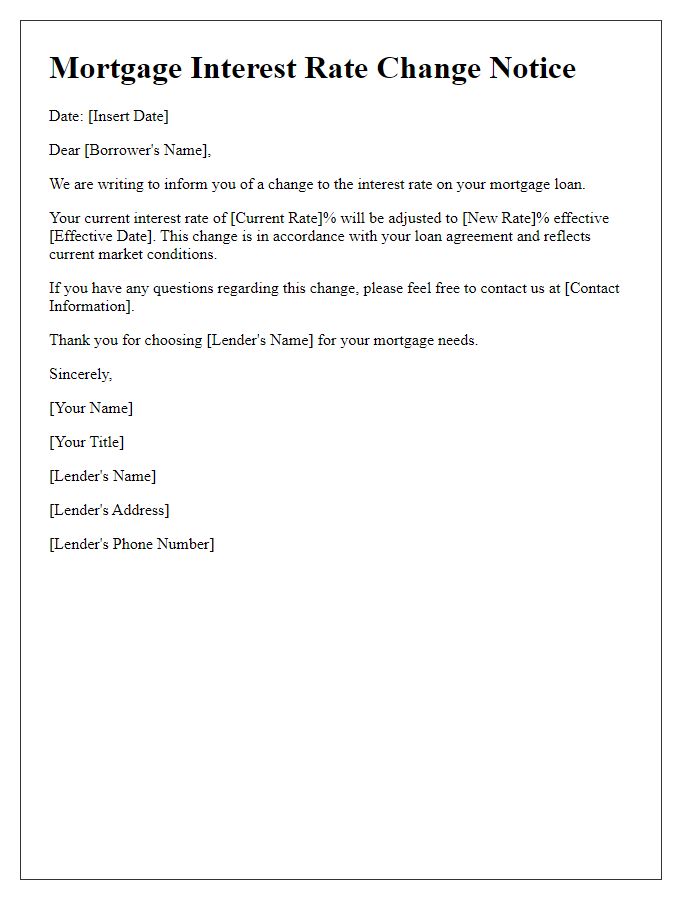

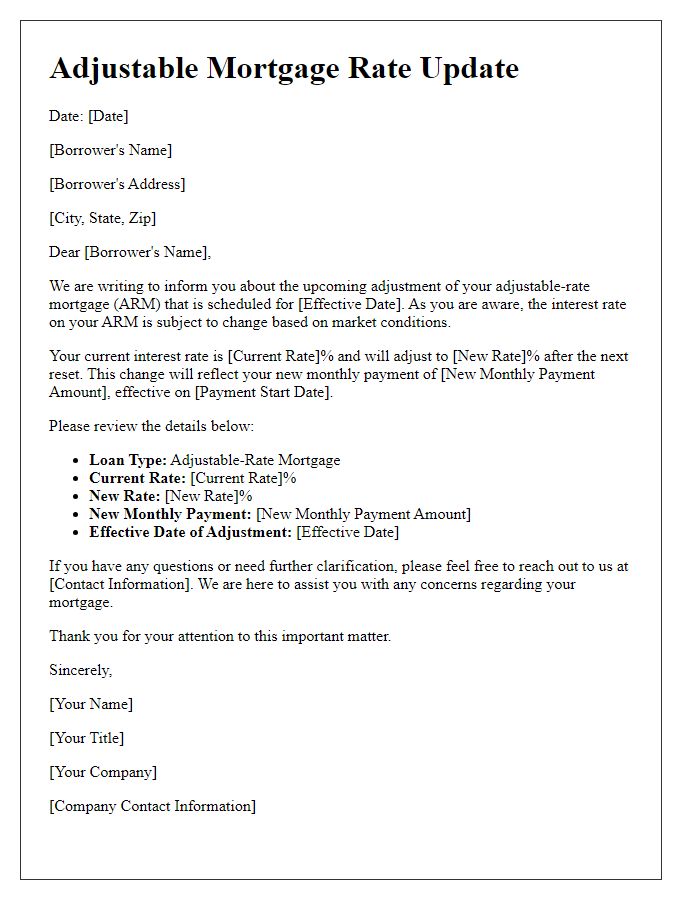

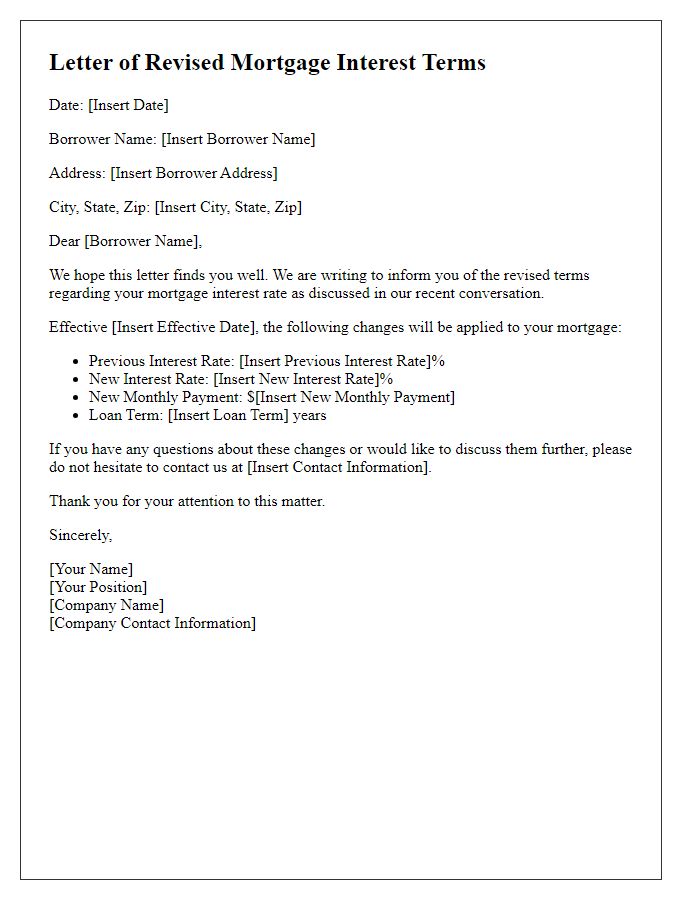

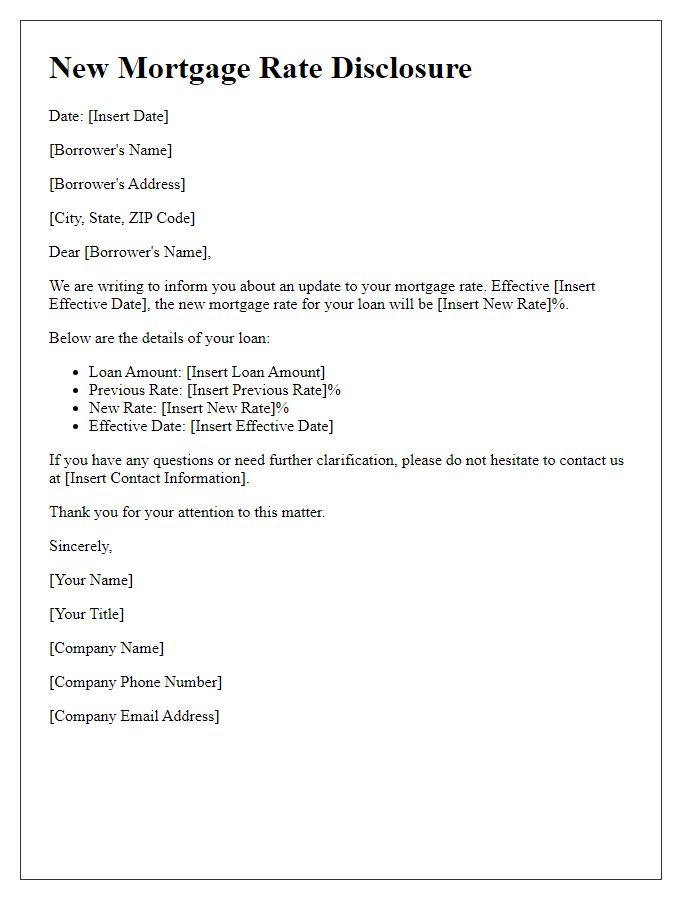

Borrower's account details and identification number.

Mortgage rate adjustments can significantly impact borrowers, particularly those holding adjustable-rate mortgages (ARMs). Borrowers must be aware of their account details, including the account number (often a unique identifier assigned by their mortgage lender) and identification number, which serves to protect their information and ensure proper processing. Rate changes can occur based on market fluctuations or predetermined schedules outlined in the loan agreement, affecting monthly payments and overall loan costs. Clear communication from lenders, detailing the new interest rate, its effective date, and any ongoing implications for the borrower's financial responsibility, is critical for informed decision-making.

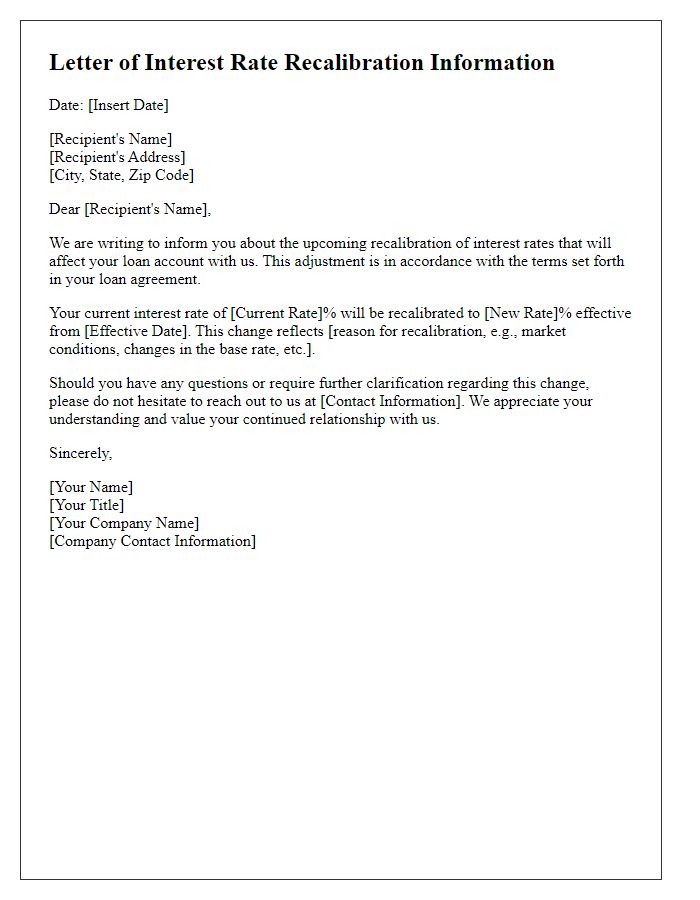

Current and new mortgage interest rates.

Mortgage rate adjustments can significantly impact homeowners' financial obligations. Current mortgage interest rates, such as those at 3.5% annually, can shift due to market fluctuations or lender policies. New mortgage interest rates may be set at 4.2%, representing a noteworthy increase that could result in higher monthly payments, such as an additional $200 depending on the loan amount. Homeowners should review their loan agreements and the terms of their mortgages, including adjustments based on indices like the LIBOR (London Interbank Offered Rate) or the prime rate, to understand the implications of these changes for their overall financial strategy.

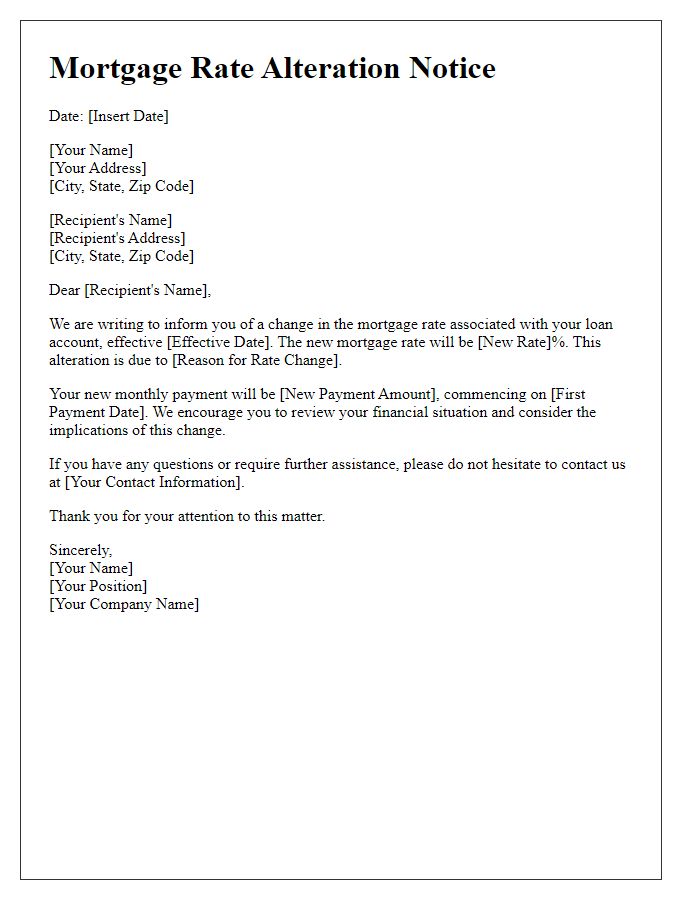

Effective date of rate adjustment.

Mortgage rate adjustments significantly impact homeowners' finances, particularly the effective date. For many borrowers, a mortgage rate adjustment occurs annually or semi-annually, depending on the loan type and agreement terms. This adjustment can result in an increase or decrease in monthly payments based on current market interest rates. For instance, a rate adjustment on November 1, 2023, could be influenced by the Federal Reserve's benchmark rate decisions made during previous months. Homeowners in specific regions, such as California or Texas, may experience more pronounced fluctuations due to local economic conditions, housing demand, and real estate market performance. Understanding the effective date of rate adjustments is crucial for budgeting and financial planning, ensuring that borrowers are adequately prepared for any changes in their mortgage payments.

Explanation of reason for rate change (market conditions, agreement terms).

Mortgage rate adjustment notifications can occur due to fluctuating market conditions, such as changes in the federal interest rate set by the Federal Reserve or economic indicators like inflation and employment rates. For instance, if the Federal Reserve increases rates to combat inflation, lenders typically follow suit by adjusting mortgage rates accordingly. Additionally, specific terms within the mortgage agreement, like adjustable-rate mortgage (ARM) stipulations, may trigger a change after a set period or an event, such as the end of an initial fixed-rate period. This adjustment aims to reflect the current lending environment and align with the original contractual agreement, ensuring that the lender's risk is managed effectively while keeping the borrower informed.

Contact information for further inquiries and support.

Notifying homeowners about mortgage rate adjustments is essential for maintaining transparency and trust. Loan servicing contacts, including customer service numbers (usually displayed prominently), can offer clarification regarding changes. Clients should seek support through these channels for personalized assistance, including inquiries about payment schedules and potential impacts on overall loan balances. Detailed step-by-step instructions may be provided to ensure understanding of new terms, potential rate increases, or decreases in financial obligations. Homeowners may also be encouraged to review their mortgage agreements (typically outlined under state regulations) for specific details pertaining to rate adjustments.

Comments