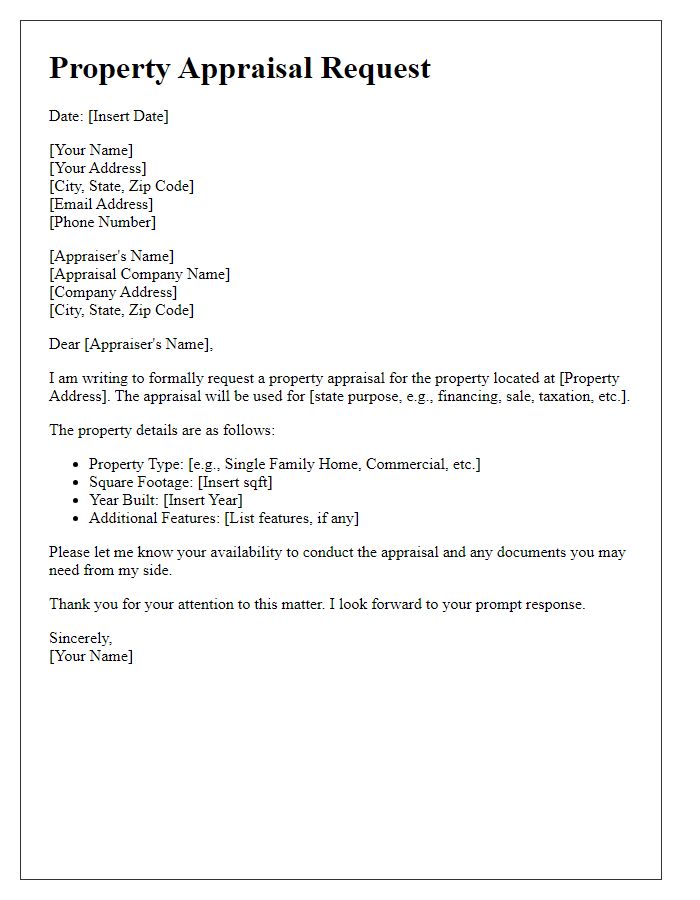

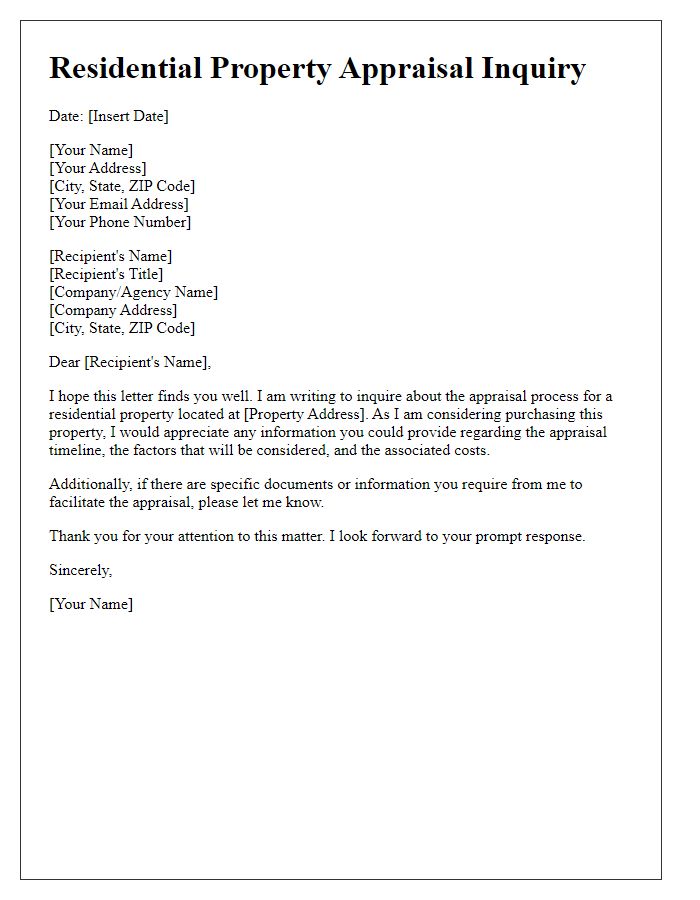

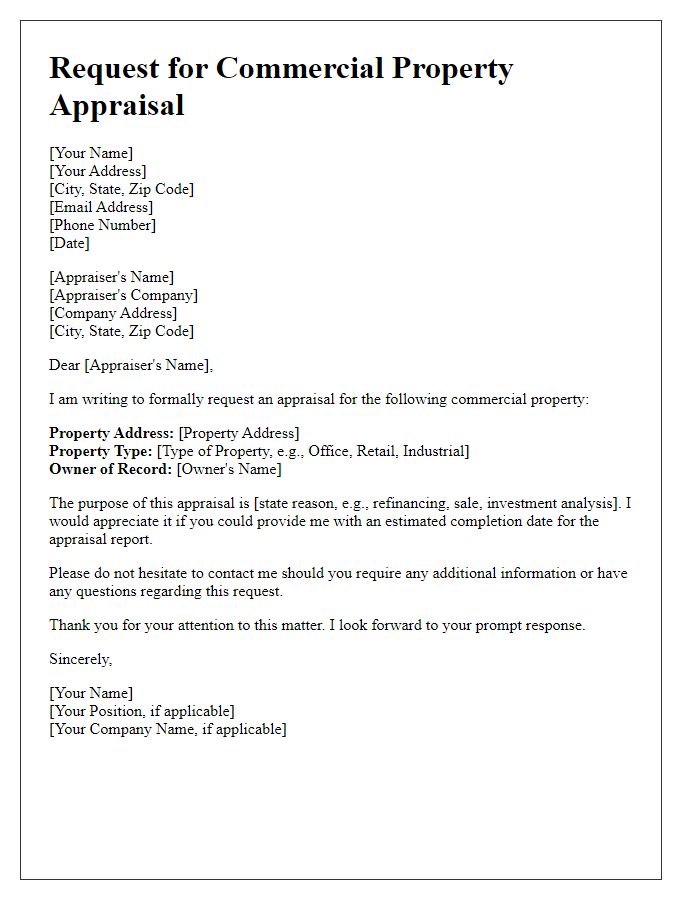

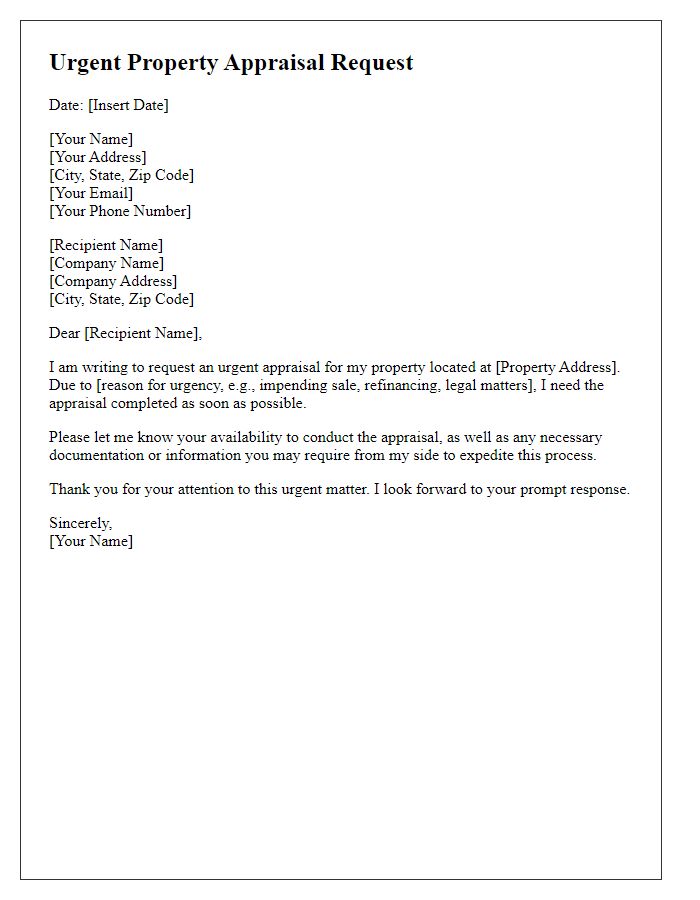

Are you considering getting your property appraised but unsure where to start? Writing a clear and concise request letter can make all the difference in securing the valuation you need. In this article, we'll break down the essential elements of a property appraisal request letter and provide a handy template to simplify the process. So, grab a cup of coffee and let's dive into the details!

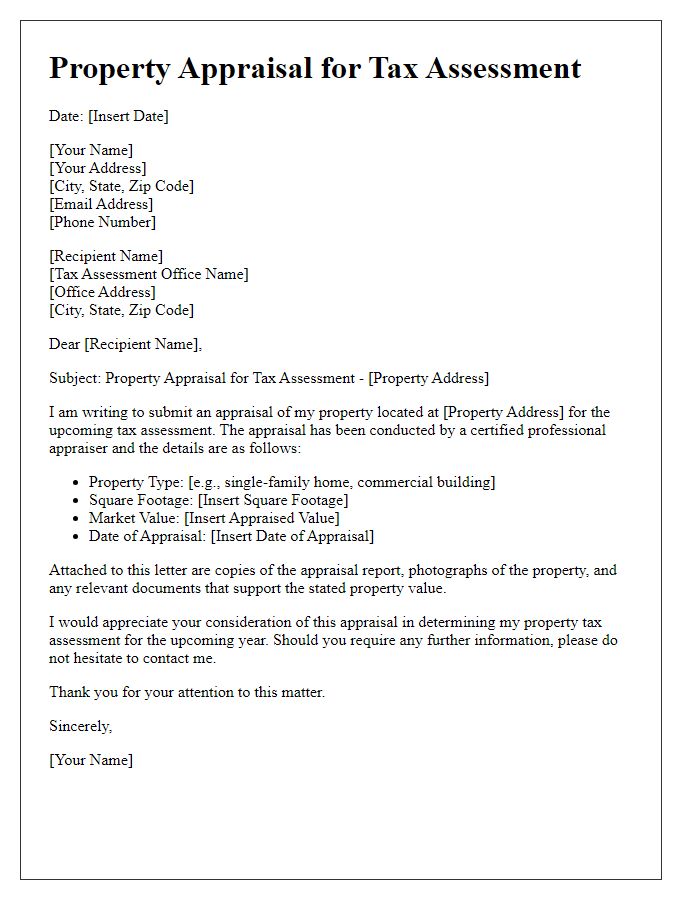

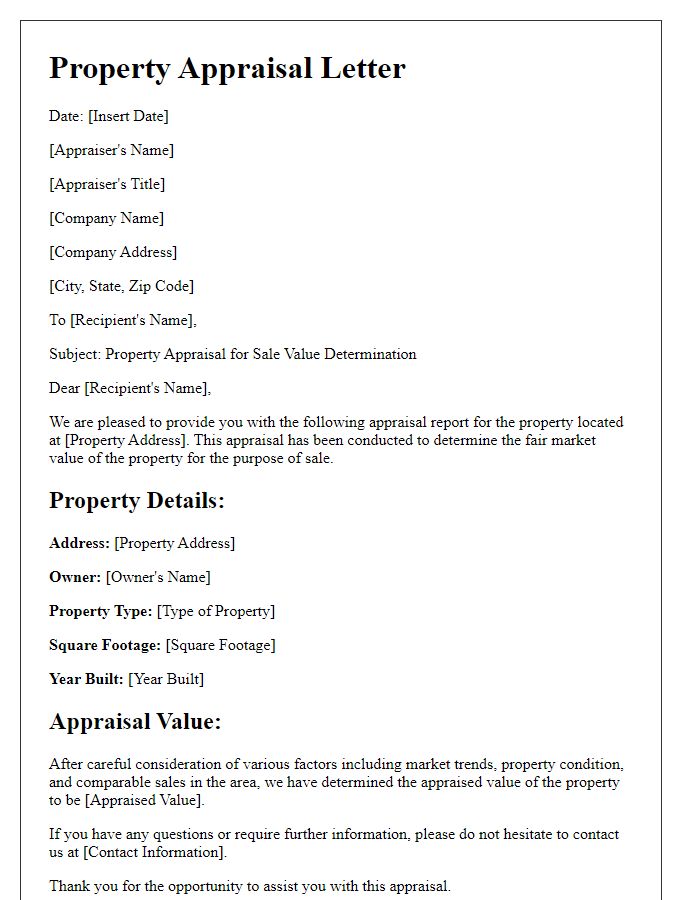

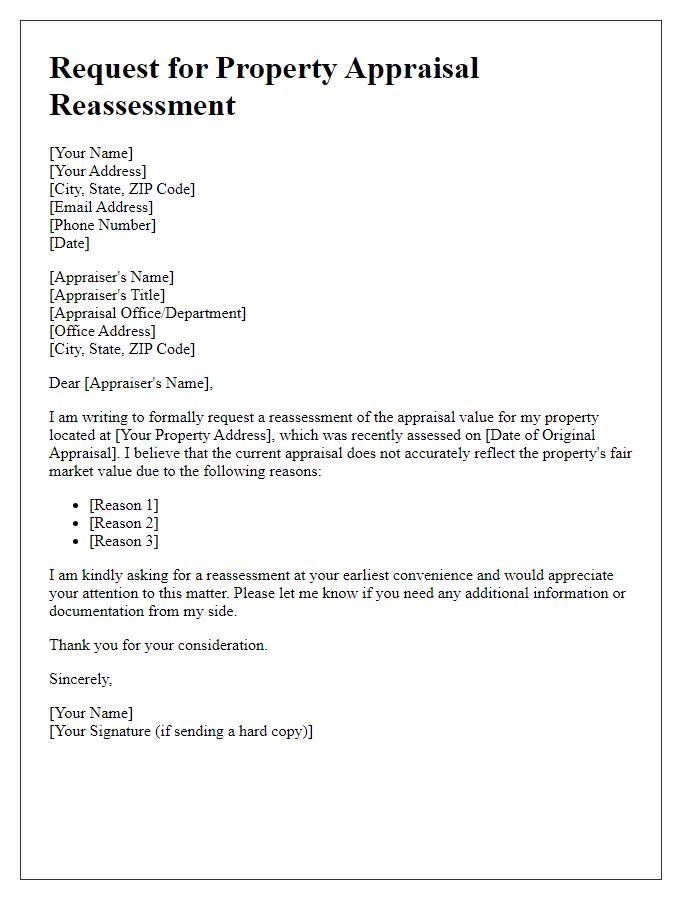

Purpose of Appraisal

Property appraisal serves a crucial role in real estate transactions, helping determine the market value of residential or commercial properties. The appraisal process typically involves a licensed appraiser evaluating various aspects such as location (like urban neighborhoods or rural zones), property condition (including structural integrity and required repairs), and recent sales of comparable properties (often referred to as "comps"). Accurate appraisals support lenders in making informed decisions about mortgage approvals, ensuring fair pricing for buyers and sellers. Additionally, appraisals can be essential for tax assessments, investment analysis, and estate planning considerations, providing clarity on property value for all stakeholders involved.

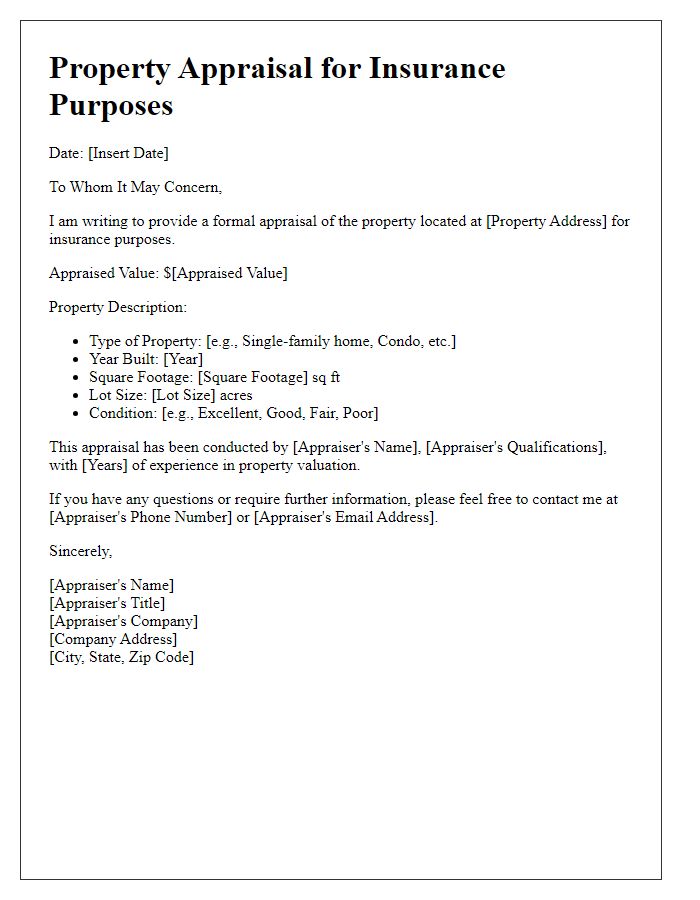

Property Details

A property appraisal request requires specific details to ensure accuracy and relevance. The residential property located in Springfield, IL (123 Maple Street), built in 2010, consists of 2,000 square feet of living space, three bedrooms, and two bathrooms. The property includes a 0.25-acre lot with a fenced backyard, garage space for two vehicles, and a recently updated kitchen featuring energy-efficient appliances. Comparable sales in the neighborhood include similar homes sold in the last six months, such as 125 Oak Street and 130 Pine Street, which have appreciated by 8% annually. The objective is to determine the current market value of the property, especially with the recent economic fluctuations and interest rates hovering at 7%, influencing buyer behavior within the market.

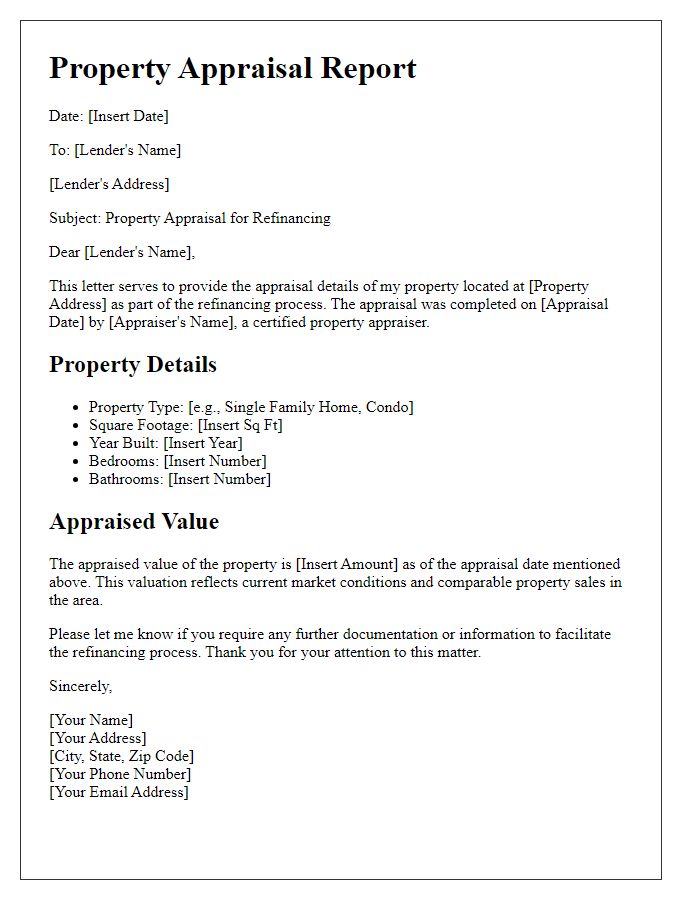

Appraisal Date

A property appraisal represents a formal assessment of a property's value, typically conducted by a certified appraiser. An appraisal date signifies the specific day when this evaluation occurs, often influenced by market conditions, property improvements, or recent comparable sales. Accurate appraisals are vital for real estate transactions, refinancing decisions, and property tax assessments. In places like California, appraisals must comply with guidelines set by the Uniform Standards of Professional Appraisal Practice (USPAP). Factors considered during the appraisal include location, square footage, property condition, and recent sales data from the neighborhood. Timely scheduling of an appraisal date ensures that stakeholders can make informed decisions regarding the property in question.

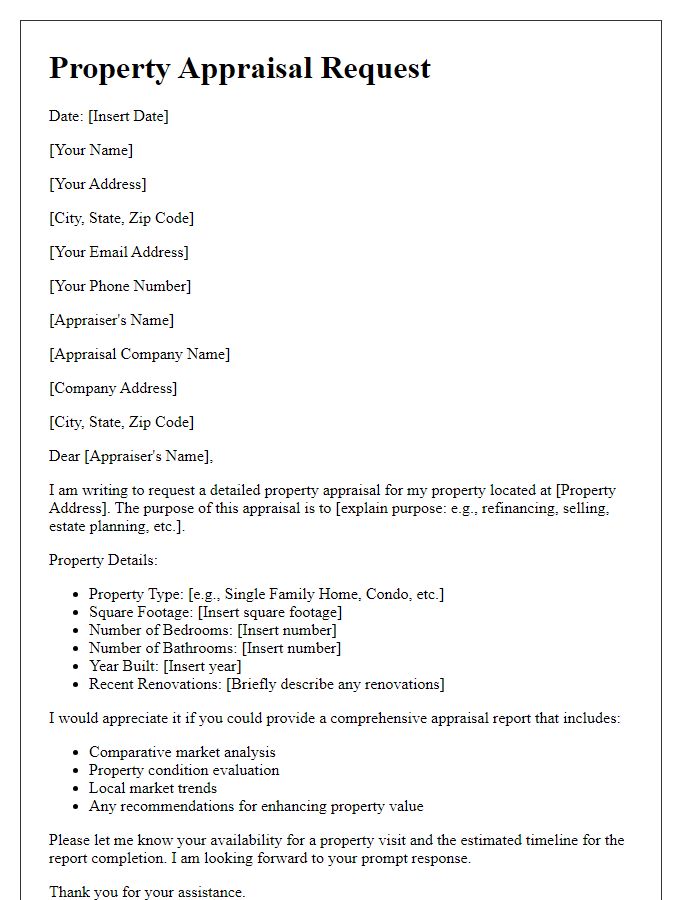

Recipient Information

Property appraisal requests often require specific details to ensure clarity and efficiency. An ideal recipient for such a request could be a property appraisal company or a certified appraiser. Notable elements to include in the recipient information section are: the full name of the appraiser (e.g., John Smith, Certified Residential Appraiser), the name of the appraisal company (e.g., Smith & Associates Appraisals), their complete mailing address (e.g., 123 Main Street, Suite 100, Springfield, IL 62701), contact number (e.g., +1-217-555-0123), and email address (e.g., john.smith@appraising.com). Including these details enhances communication and facilitates the appraisal process.

Contact Information and Signature

Professional property appraisal is essential for determining the market value of real estate assets. This process typically involves a certified appraiser who evaluates various factors such as location, property size, and structural conditions. Appraisal reports may influence financial decisions, mortgage approvals, or sales strategies. In urban areas like New York City or Los Angeles, property values can fluctuate significantly based on recent sales in the vicinity or unique features of the property. Comprehensive appraisals often include comparisons to similar properties sold in the last six months, ensuring accuracy in valuation. Timeliness is crucial in the appraisal process, especially when market conditions are rapidly changing.

Comments