Are you aware of how crucial your credit score is to your financial health? It can affect everything from your loan approval rates to the interest rates you receive. If you've encountered errors on your credit report that could be dragging your score down, it's essential to address them promptly. In this article, we'll guide you through a compelling letter template for disputing inaccuracies and help you take control of your credit.

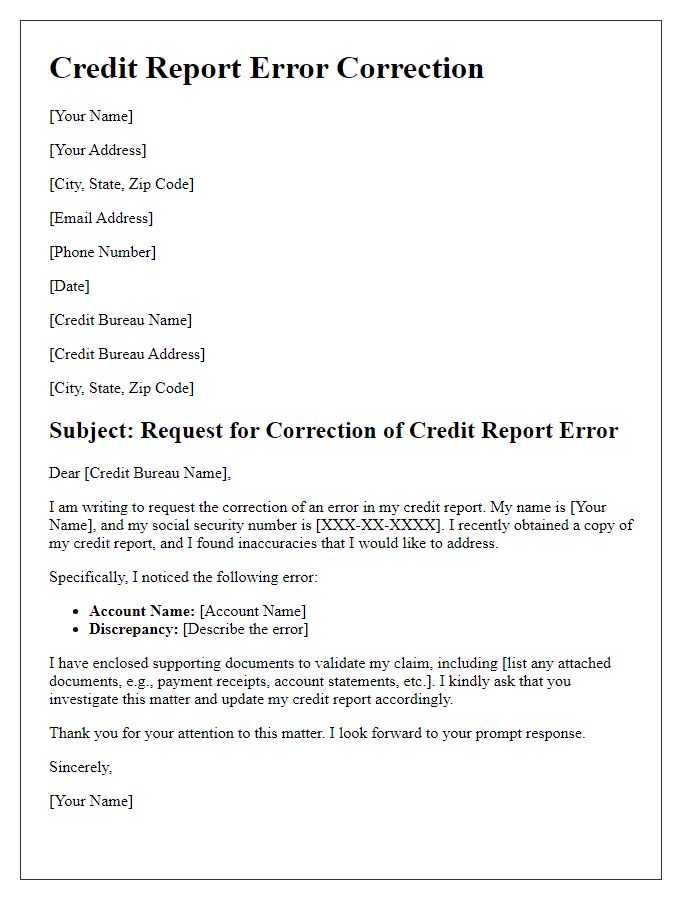

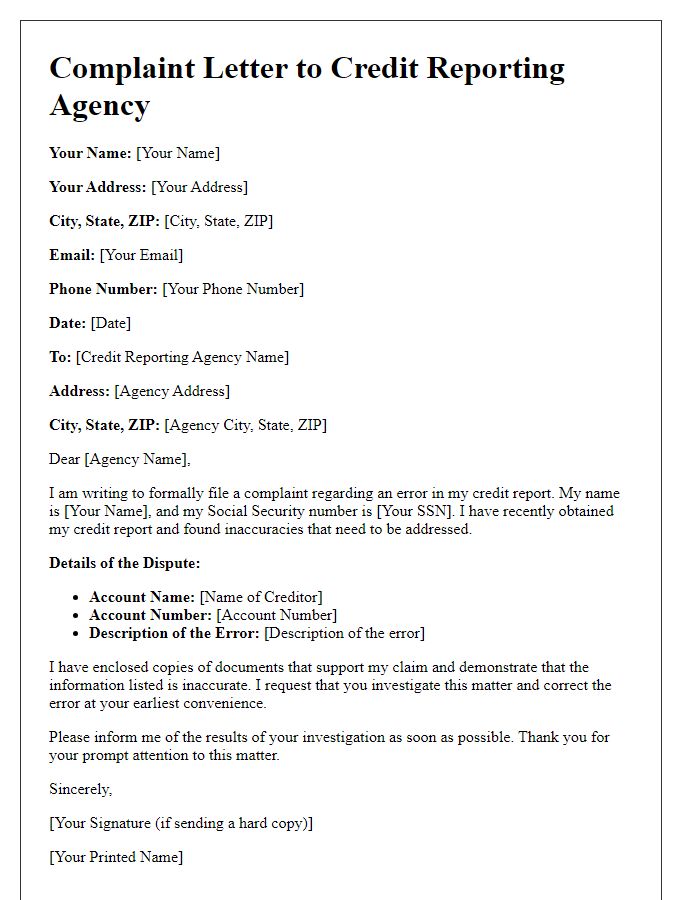

Accurate Personal Information

Disputing inaccurate personal information on credit reports is crucial for maintaining a healthy credit score. Credit reporting agencies (like Experian, Equifax, TransUnion) receive data from various sources including lenders, financial institutions, and public records. If incorrect personal details such as your name, address, or Social Security Number (SSN) appear on your report, it may lower your creditworthiness. The Fair Credit Reporting Act (FCRA) mandates that consumers have the right to dispute erroneous information. Individuals can submit a dispute online or via certified mail to ensure accurate documentation. Corrections can take up to 30 days to reflect on your credit report, impacting future loan applications and interest rates. Maintaining accurate personal information prevents issues during mortgage applications or credit card approvals.

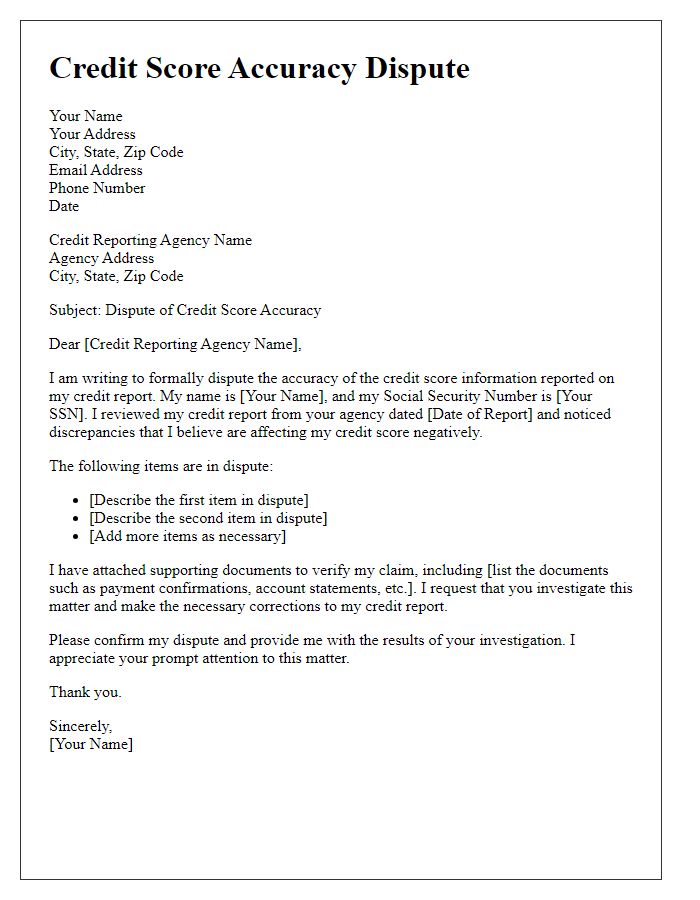

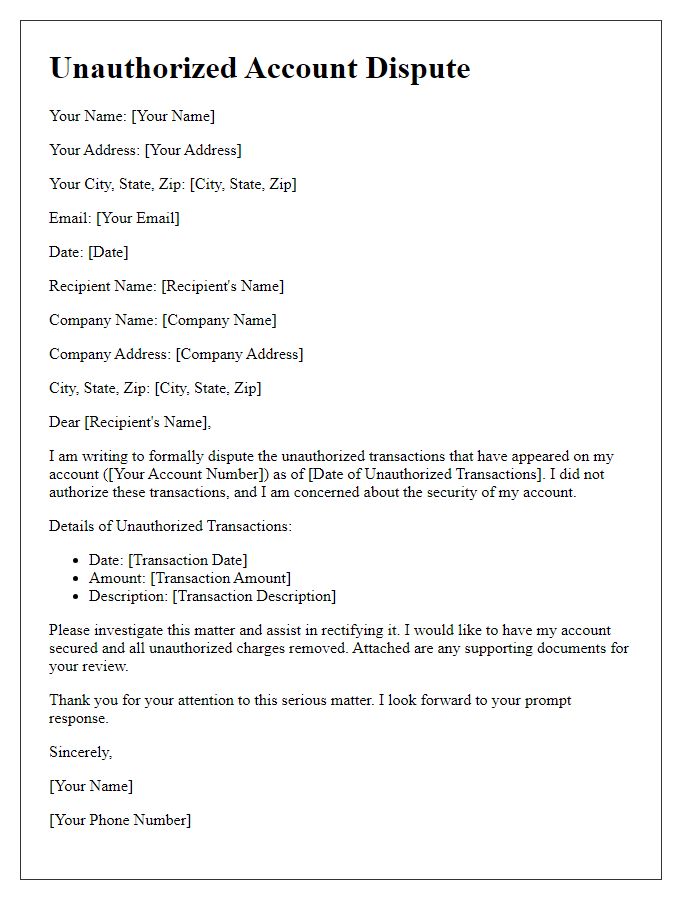

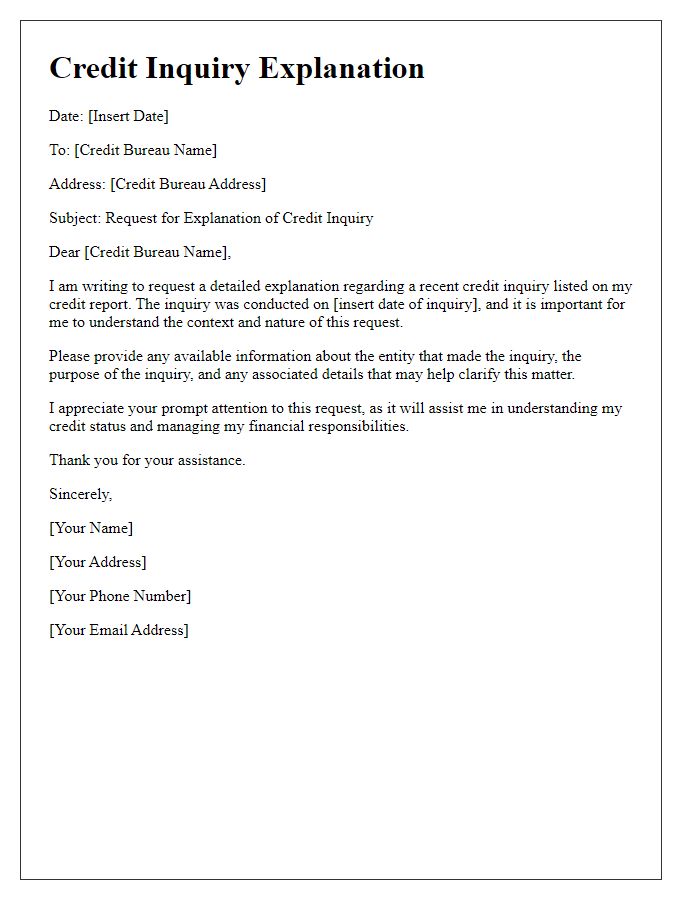

Dispute Details and Explanation

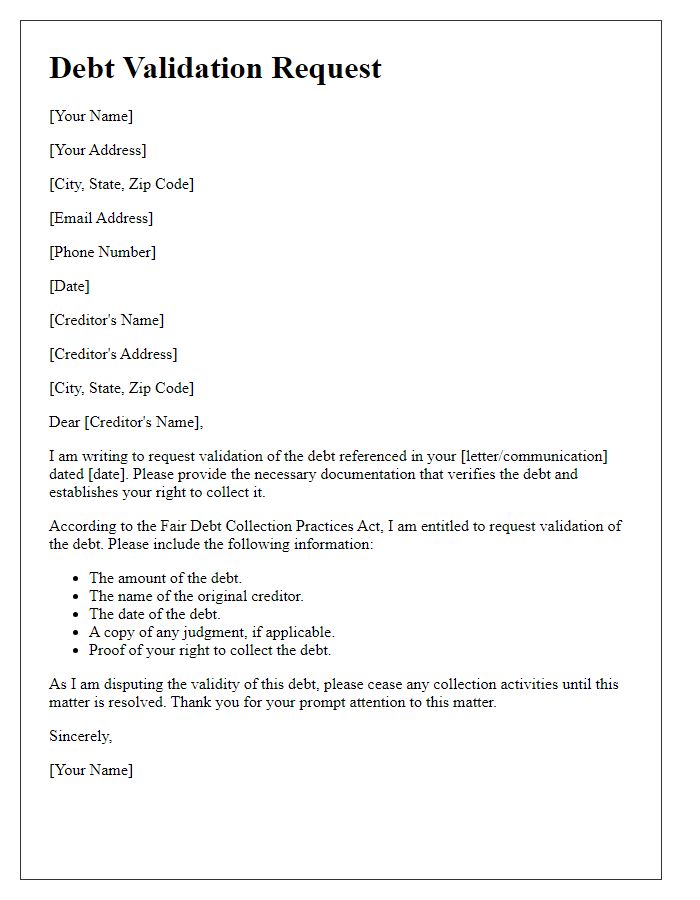

Consumers often encounter inaccuracies in their credit reports that can adversely affect their credit scores, such as late payment entries, erroneous account balances, or accounts that do not belong to them. A credit score dispute is essential for rectifying such errors, which can lead to higher interest rates and denied credit applications. When initiating a dispute, individuals should gather relevant documentation, including credit reports from major bureaus like Experian, TransUnion, and Equifax. Their dispute letter should clearly state the errors in detail, referencing specific account numbers and providing an explanation supported by evidence, such as payment confirmations or statements. Timeliness is crucial, as the Fair Credit Reporting Act mandates a 30-day response window for credit bureaus to investigate and rectify incorrect information.

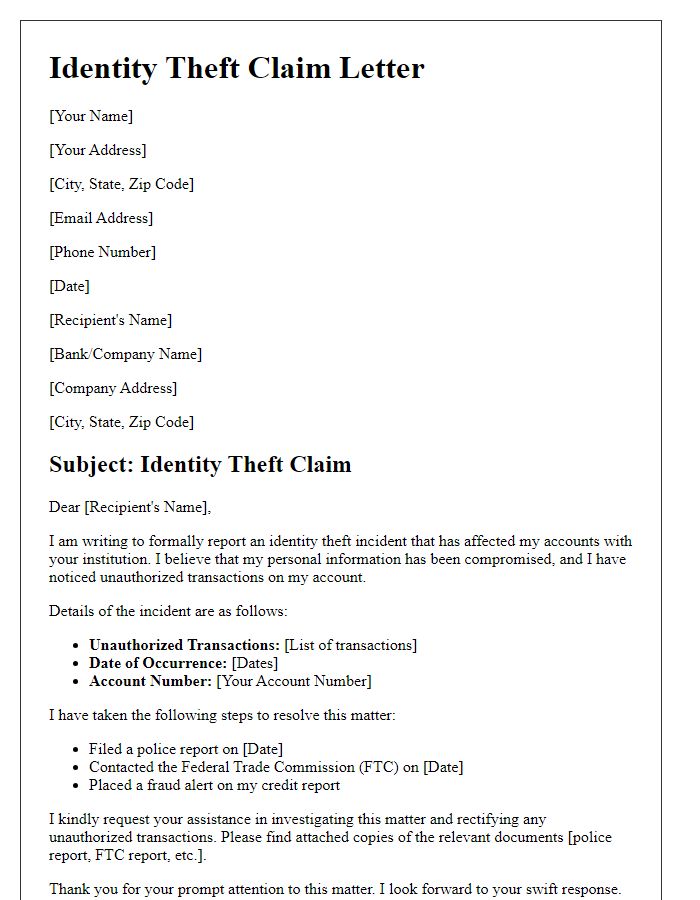

Supporting Documentation

A credit score dispute requires comprehensive supporting documentation to validate claims regarding inaccuracies in credit reports from agencies such as Experian, TransUnion, and Equifax. Essential documents for submission include copies of recent credit reports indicating discrepancies, identification proof such as a driver's license, and evidence of payment history like bank statements or receipts. Dispute letters should reference specific accounts, including account numbers and creditor names, to enable efficient investigation by credit bureaus. Additional documents may comprise court records for bankruptcies or payment agreements with creditors to substantiate the resolution of debts. All materials should be organized and sent via certified mail for tracking purposes, ensuring a formal record of correspondence.

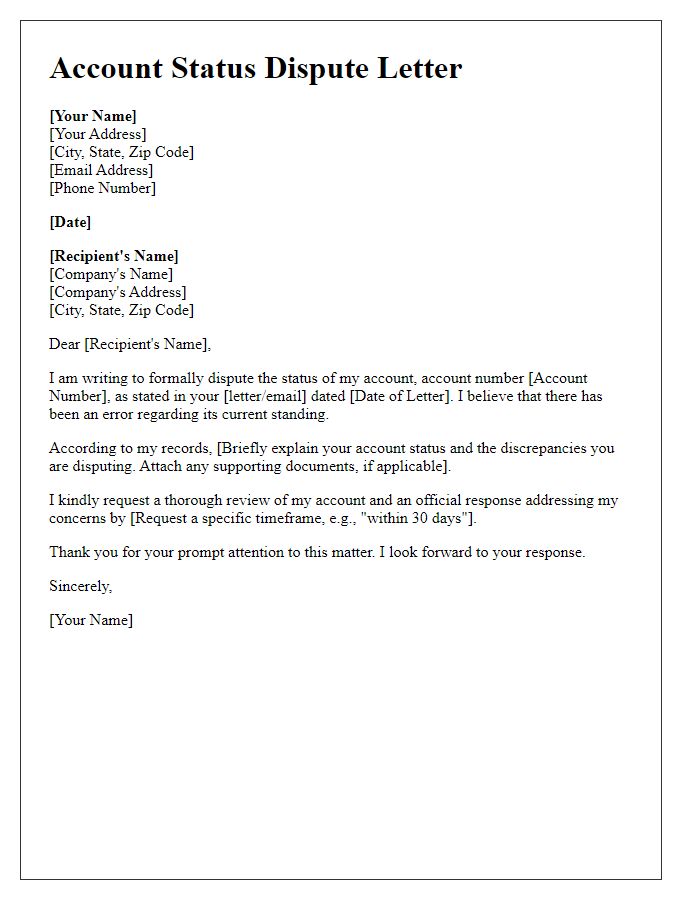

Request for Investigation and Correction

Disputing inaccuracies on credit reports is crucial for maintaining a healthy financial profile. A credit report contains essential financial data, such as payment histories and outstanding debts, which impact credit scores. When disputing errors, specifically incorrect account balances or late payments reported by companies like Experian or TransUnion, a formal request should be submitted. Providing documentation, such as bank statements or payment receipts, is essential to support the claim. Timely resolution is vital, as credit scores can directly affect loan approvals and interest rates on mortgages or auto loans. The Fair Credit Reporting Act mandates a 30-day investigation period, and timely communication between consumers and credit agencies leads to improved credit standings.

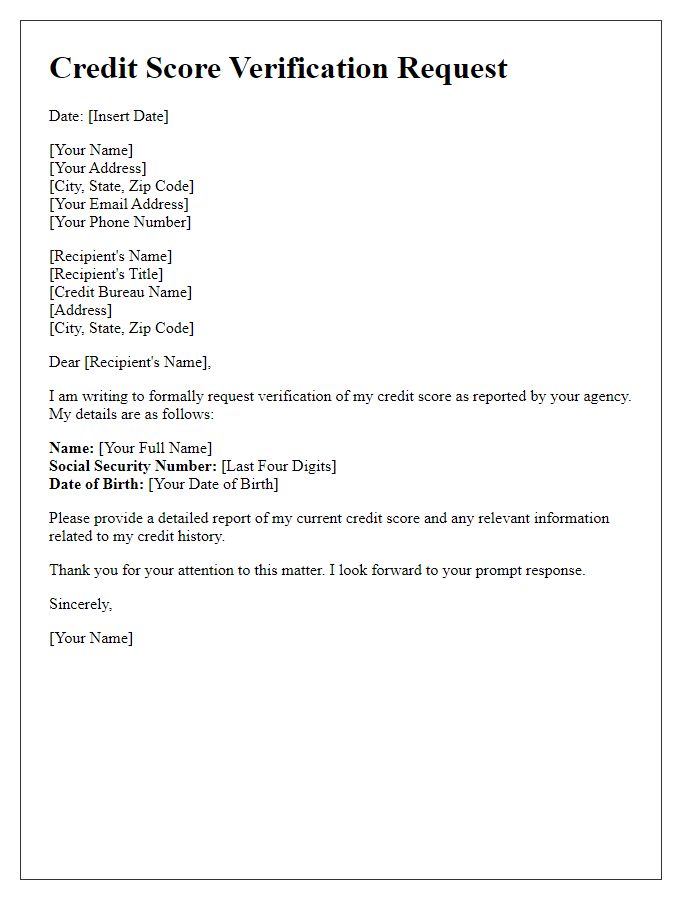

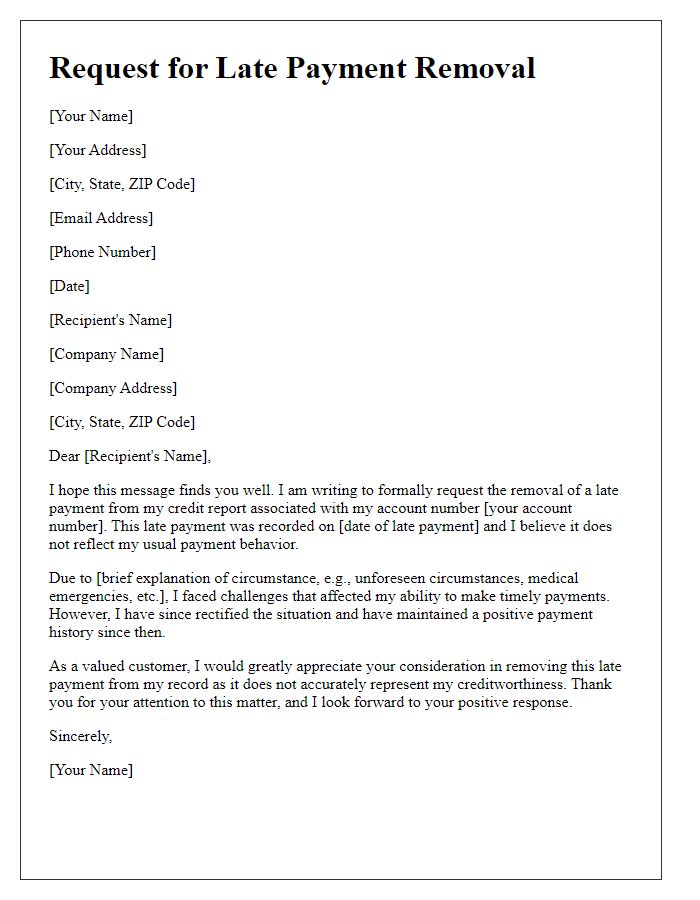

Contact Information and Next Steps

When disputing inaccuracies in a credit score report, follow a structured process. Begin with complete contact information, including your name, address, phone number, and email address. Include the date of the dispute letter for record-keeping. Clearly reference the specific credit reporting agency (TransUnion, Experian, or Equifax) that generated the report, indicating the report number if available. State the reasons for the dispute, detailing any errors such as incorrect account balances, late payment misreporting, or accounts that do not belong to you. Attach supporting documentation, such as payment records, identification, or other verifiable evidence. Specify your desired outcome, whether it's correction of the errors or removal of inaccurate entries from your report. Lastly, outline the next steps for both parties: request written confirmation of the dispute's resolution and provide a timeframe (usually 30 days) for the agency to investigate and respond.

Comments