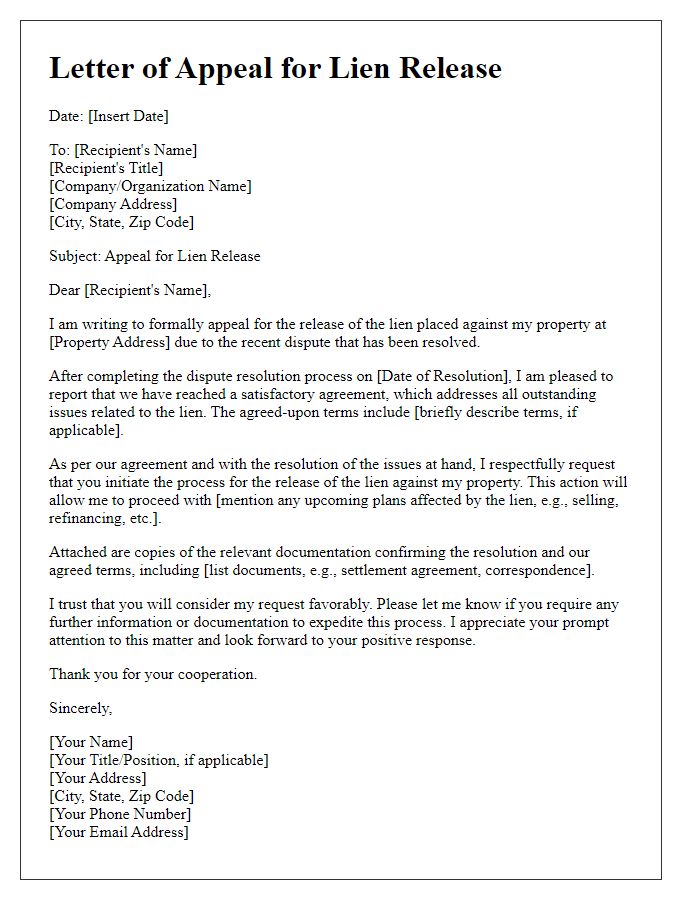

Are you navigating the often complicated world of lien releases? Whether you've just paid off a loan or completed a significant contract, you'll need to ensure that any liens attached to your property are formally released. It's essential to understand the necessary steps and documentation required for this process to protect your ownership rights. Join us as we dive deeper into how to effectively write a lien release request letter and what to include for a smooth transaction.

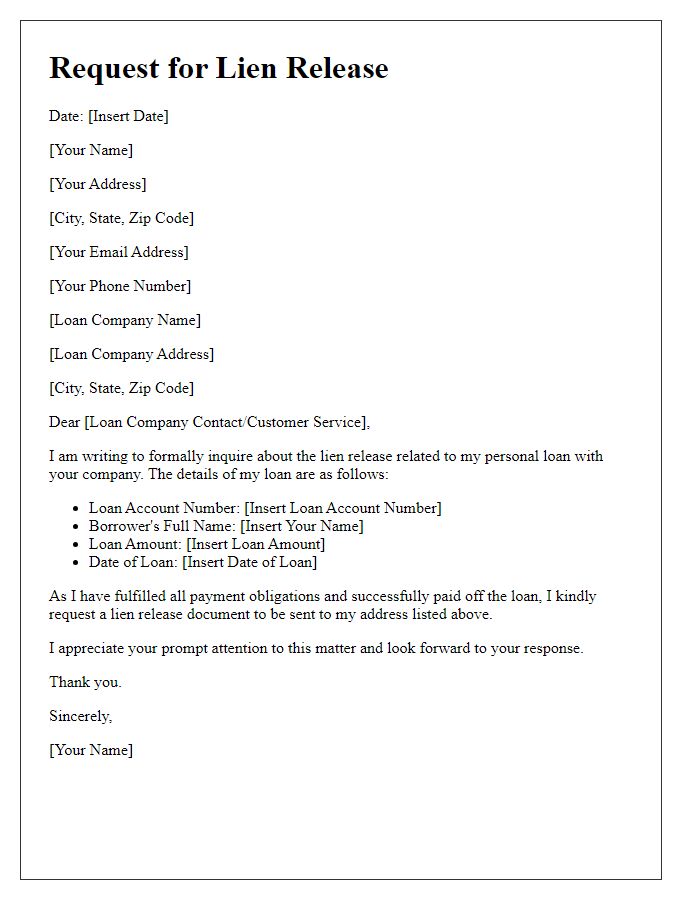

Borrower's Personal Information

A lien release is a document that confirms that a lienholder relinquishes their legal claim on a property after a debt has been satisfied. It is crucial for homeowners, such as individuals residing in suburban neighborhoods of the United States, to obtain this document once their mortgage, often backed by financial institutions like Bank of America or Wells Fargo, is paid off. This allows property owners to clear any encumbrances on their title, ensuring a free and clear ownership. In many cases, the lien release should be filed with the local county recorder's office (often within 30 days of the final payment) to update public records and prevent any complications when selling or refinancing the property in the future. It is essential to provide accurate identification details such as full name, property address (including zip code), and loan account number when requesting a lien release to expedite the process.

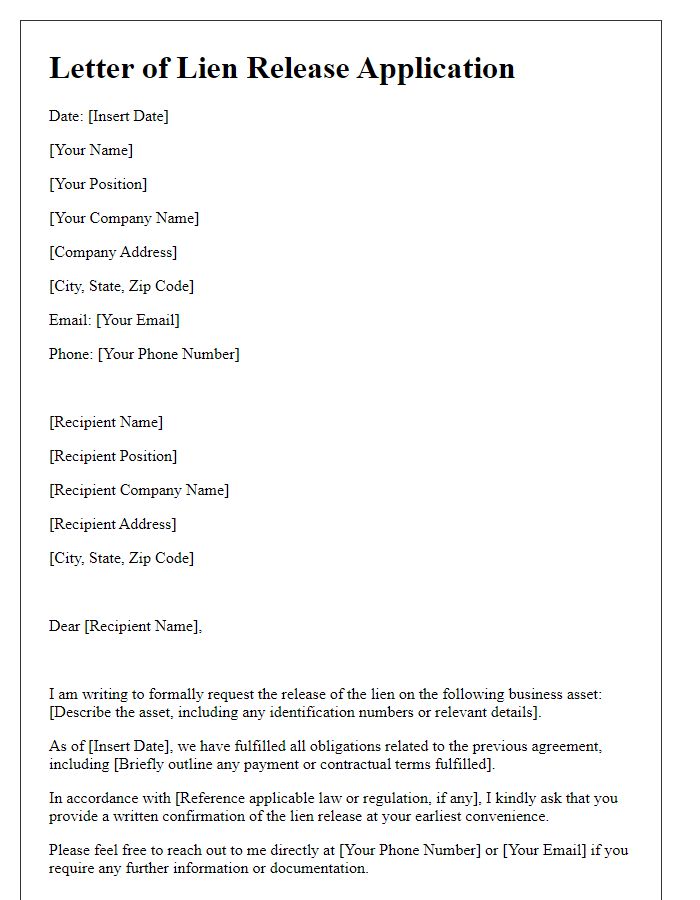

Lender's Contact Details

Requesting a lien release involves specific lender information, ensuring a straightforward process. Accurate lender details include the full name of the lending institution, address (including city, state, and zip code), and the contact person's name or department responsible for handling lien releases. A phone number is essential for direct communication, complemented by a functional email address for prompt digital correspondence. Additional identifiers such as the loan account number tied to the lien ensure the request is processed efficiently. Documenting these details establishes clarity in communication, crucial for expediting the lien release process, especially in cases of completed payments or agreements.

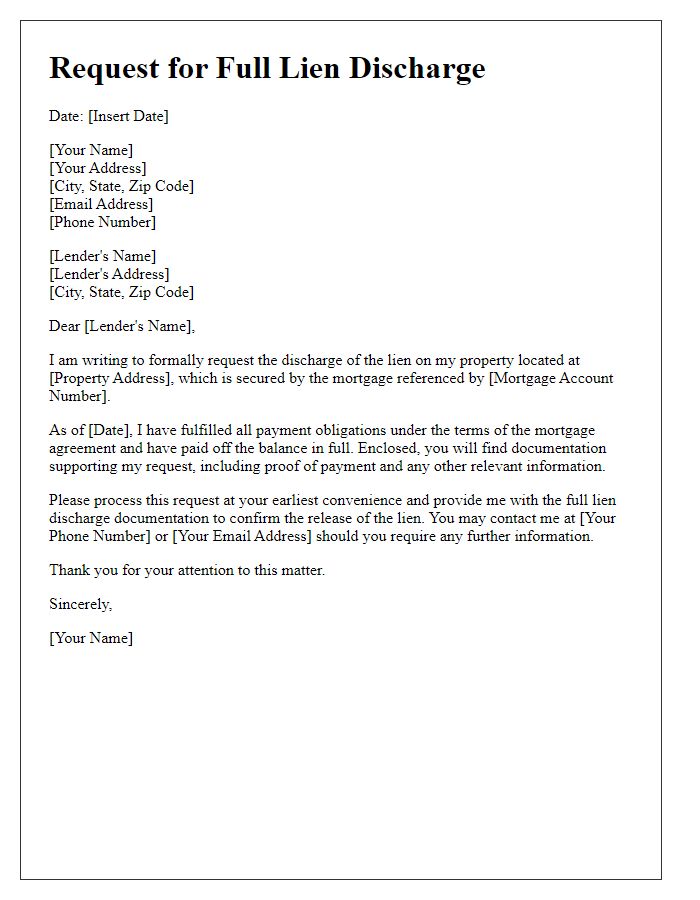

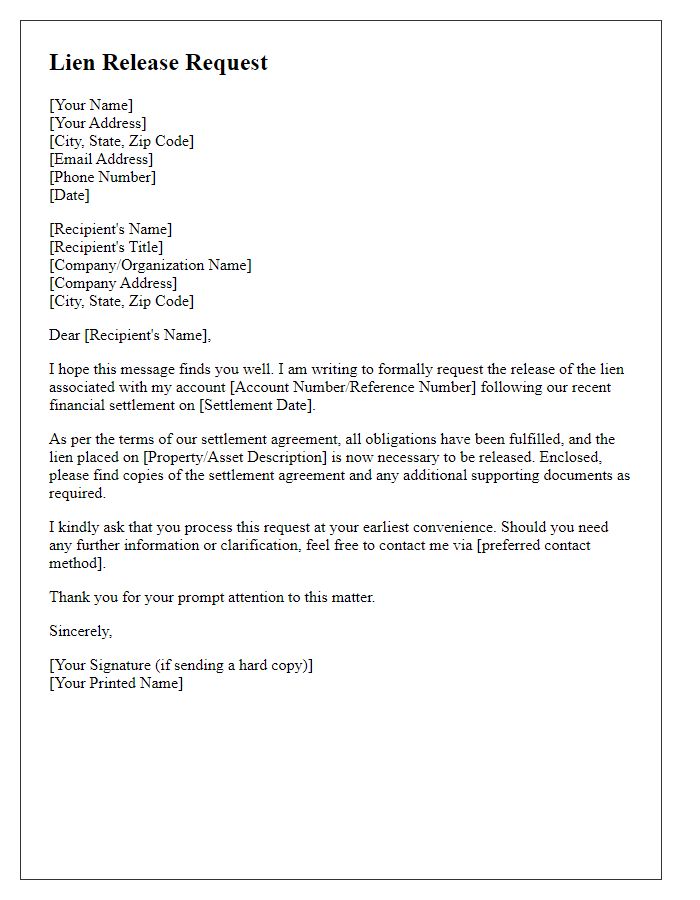

Loan or Account Number

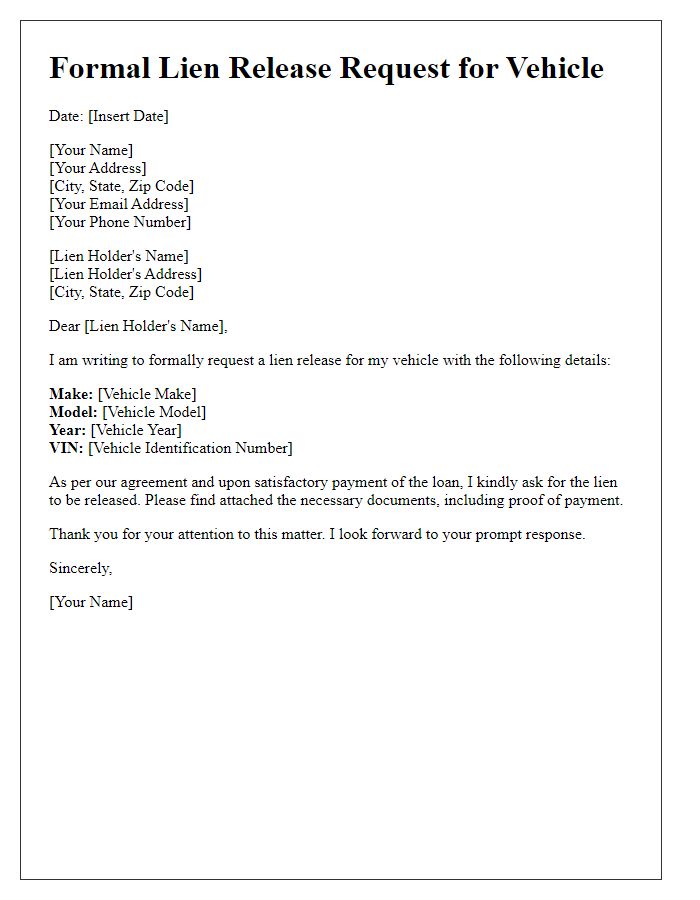

A lien release is an essential document signifying the removal of a legal claim against a property or asset, often associated with loans or accounts. When requesting a lien release, include specific details such as the loan or account number, enabling the lender or financial institution to identify the relevant transaction efficiently. Ensure to reference pertinent information regarding the asset involved, such as the property address or description of the vehicle. Mention any previous correspondence or documentation provided, reinforcing the legitimacy of the request. Timely submissions follow guidelines set forth by institutions, often essential to finalize this release, and may require notarization for legal validation.

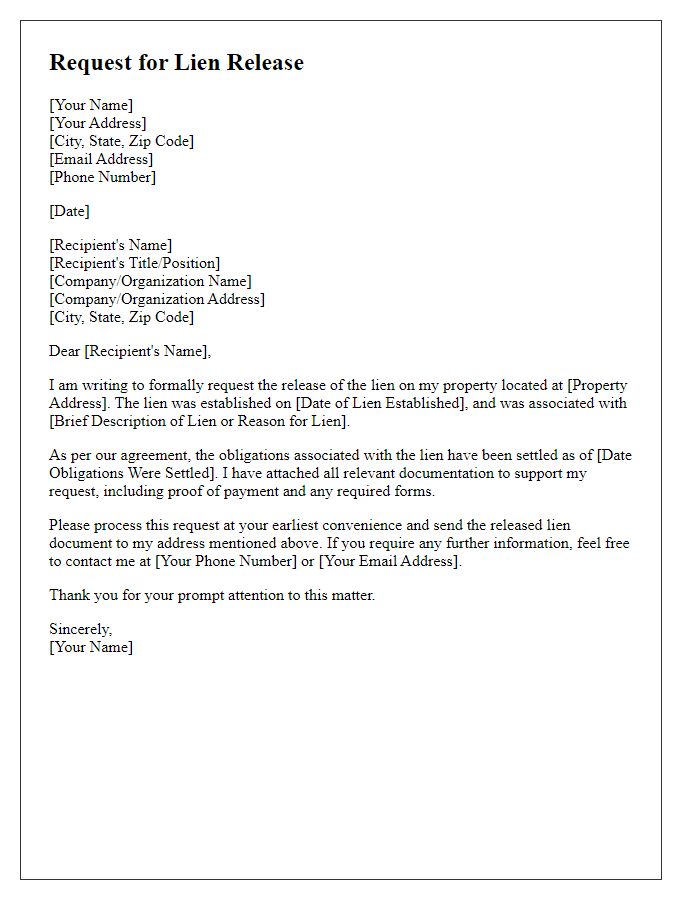

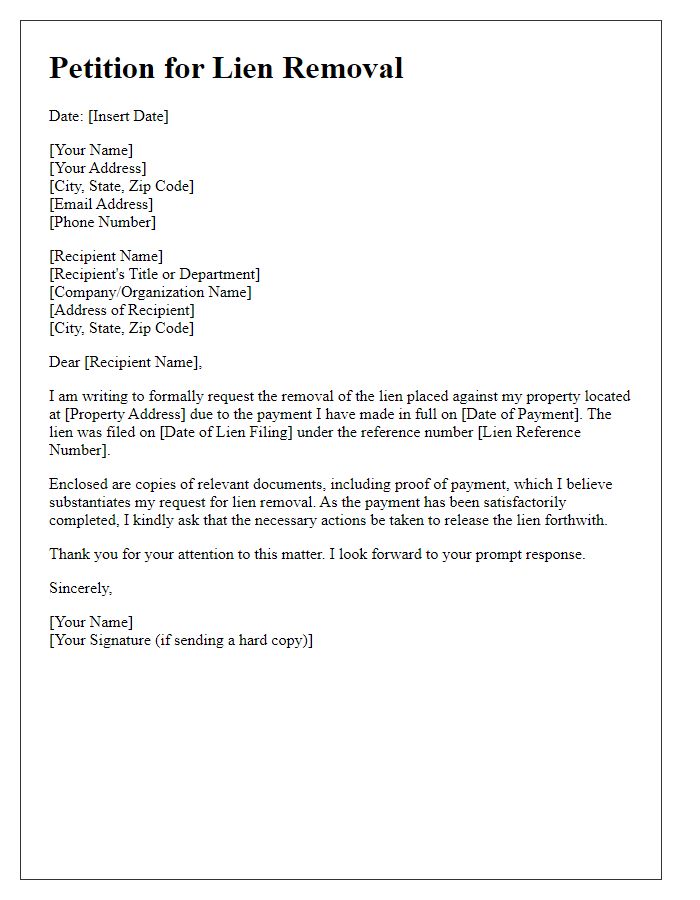

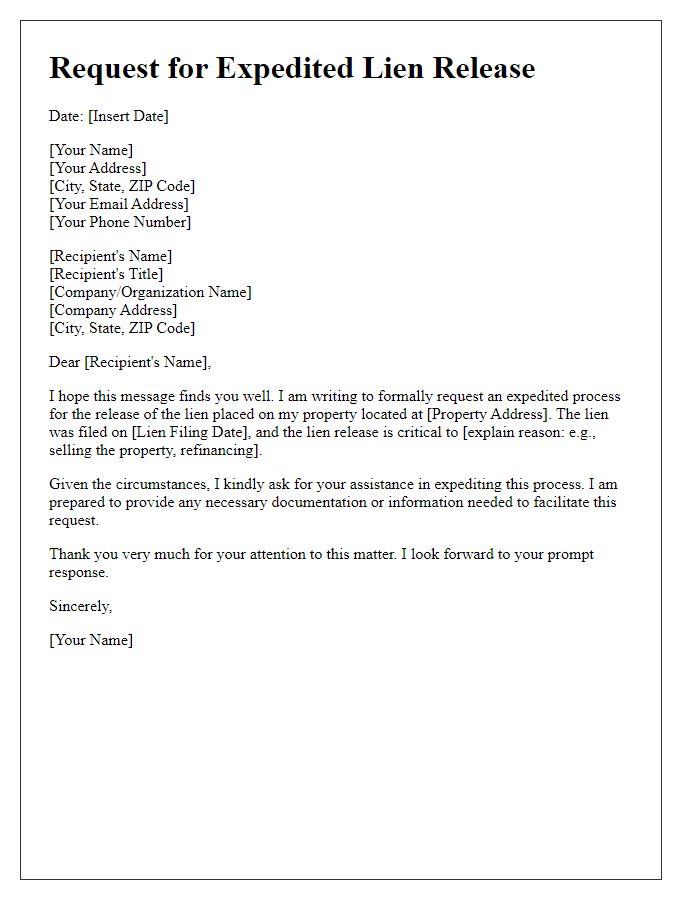

Clear Request for Lien Release

A lien release is a formal document indicating that a lien, which is a legal claim or hold on a property, has been removed. This release typically applies to various lien types, such as mortgage, tax, or mechanic's liens. Completing this process often involves contacting the lienholder and providing necessary information regarding the property, such as the address and lien details. Following this, the lienholder issues a lien release, which must be filed with the appropriate local government office, such as a county recorder's office, to ensure the property title is clear for future transactions or sales. Ensuring that these steps are accurately followed can prevent future disputes and confirm that the property is no longer encumbered by any legal claims.

Supporting Documentation Enclosures

In the process of requesting a lien release, it is essential to include supporting documentation that validates your claim. This may encompass the original lien document, proof of payment such as bank statements or receipts, and any correspondence with the lienholder that confirms agreement on the release. Additionally, providing a government-issued identification document can help verify your identity. When submitting the request, ensure all documents are organized and clearly labeled, as this can facilitate smoother processing by the lienholder or relevant authorities. Efforts to accurately present your case can lead to a timely and efficient release of the lien, thereby reinstating your rights over the property in question.

Letter Template For Requesting Lien Release Samples

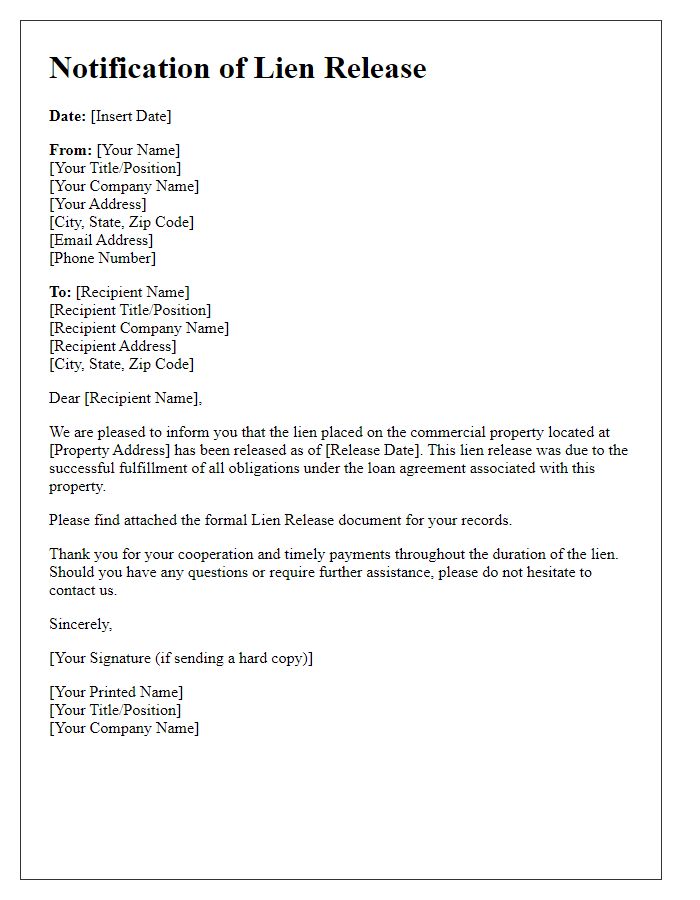

Letter template of notification for lien release on commercial property.

Comments