Are you feeling the weight of past debts even after making payments? You're not alone! Many people hope to erase those lingering financial shadows to move forward. In this article, we'll explore how to formally request debt deletion after you've settled your account, helping you reclaim your financial healthâso keep reading for valuable tips and a handy letter template!

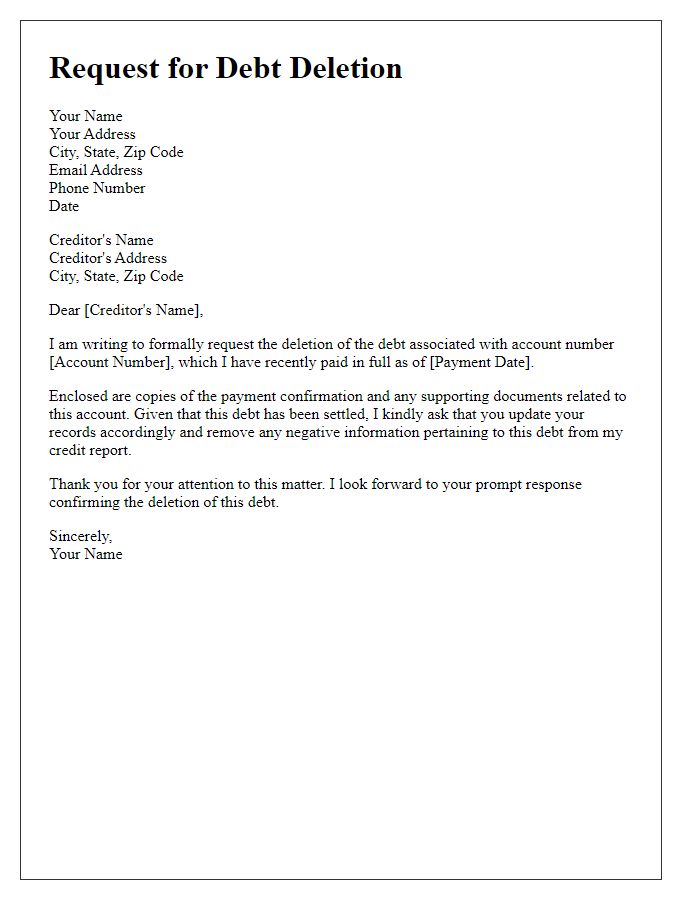

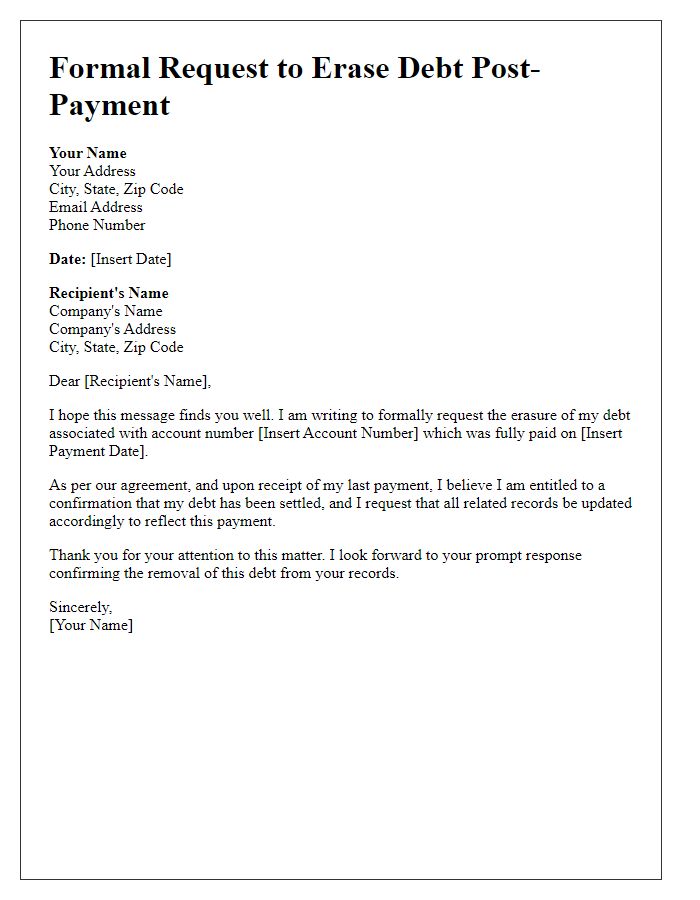

Polite introduction and debtor information

A polite request for debt deletion after payment involves emphasizing gratitude while providing necessary debtor information. This approach ensures clarity while maintaining a respectful tone. The debtor might state their full name for identification, the amount paid toward the debt, and the name of the creditor. Highlighting the date of payment can also strengthen the request, as it confirms compliance with the agreed terms. Adding a note of appreciation for the creditor's understanding can help foster a positive relationship moving forward.

Account details and payment confirmation

Requesting debt deletion after payment involves emphasizing the completion of payment obligations and seeking confirmation of account status. Highlight the account details, including account number (e.g., 123456789), payment date (e.g., October 15, 2023), and payment method (e.g., bank transfer). Mention the amount paid (e.g., $1,500) alongside the confirmation reference number (e.g., REF123456). Request a formal statement reflecting the updated status of the account, confirming zero balance and closing of the debt. Stress the importance of receiving documentation for personal records and potential future credit reporting, as updated debt statuses can significantly impact one's credit score.

Request for debt deletion and credit report update

A request for debt deletion following payment can enhance credit history. Consumers often seek this to improve credit scores impacted by settled accounts. Specific laws, like the Fair Credit Reporting Act (FCRA) in the United States, allow individuals to dispute inaccuracies. When a debt, such as an unsecured personal loan or credit card balance, is paid, a formal request can be submitted to credit reporting agencies, including Experian, TransUnion, and Equifax. Providing proof of payment, such as official receipts or confirmation emails, supports claims for deletion. Timely handling of requests is crucial since reported debts can remain on files for up to seven years. Successful deletion can significantly improve future financial opportunities, including loan approvals and lower interest rates.

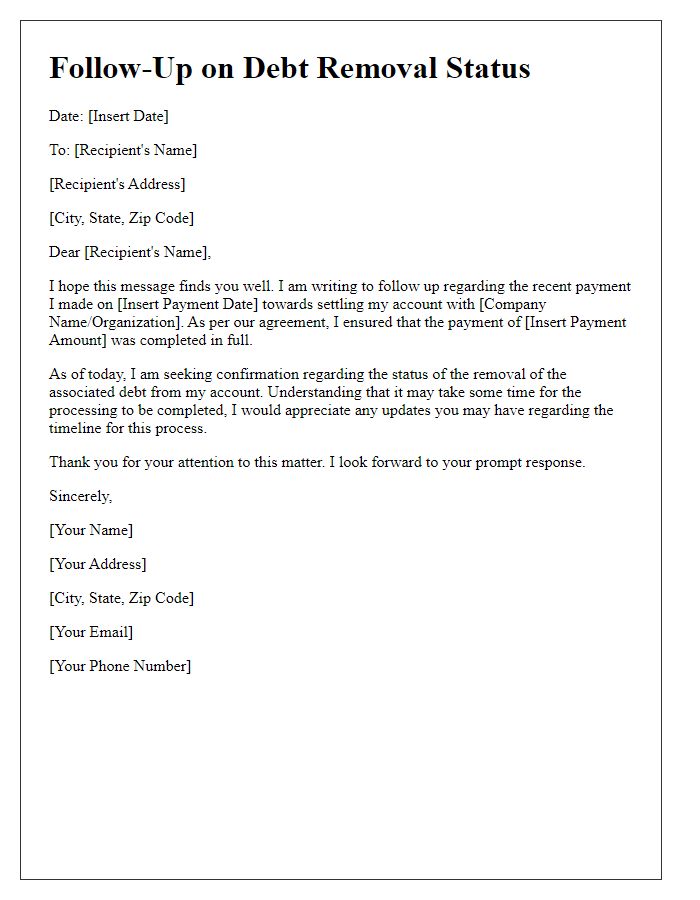

Contact information for follow-up

After settling a debt, consumers may seek debt deletion from their credit report to improve their financial standing. A formal request should include personal details such as full name, address, and phone number to facilitate follow-up communication. The creditor's name should be mentioned clearly along with the account number related to the settled debt. Additionally, a request for confirmation and a specific timeline for response will help in tracking the process efficiently. It is advisable to send this request via certified mail to ensure receipt and maintain records for future reference.

Express gratitude and future communication willingness

To Whom It May Concern, I express sincere gratitude for your understanding and support throughout the recent process regarding my debt. Following my recent payment, I kindly request the formal deletion of this debt from my records. I appreciate our ongoing communication and look forward to continuing our positive relationship in the future. Thank you once again for your assistance. Best regards,

Letter Template For Asking Debt Deletion After Payment Samples

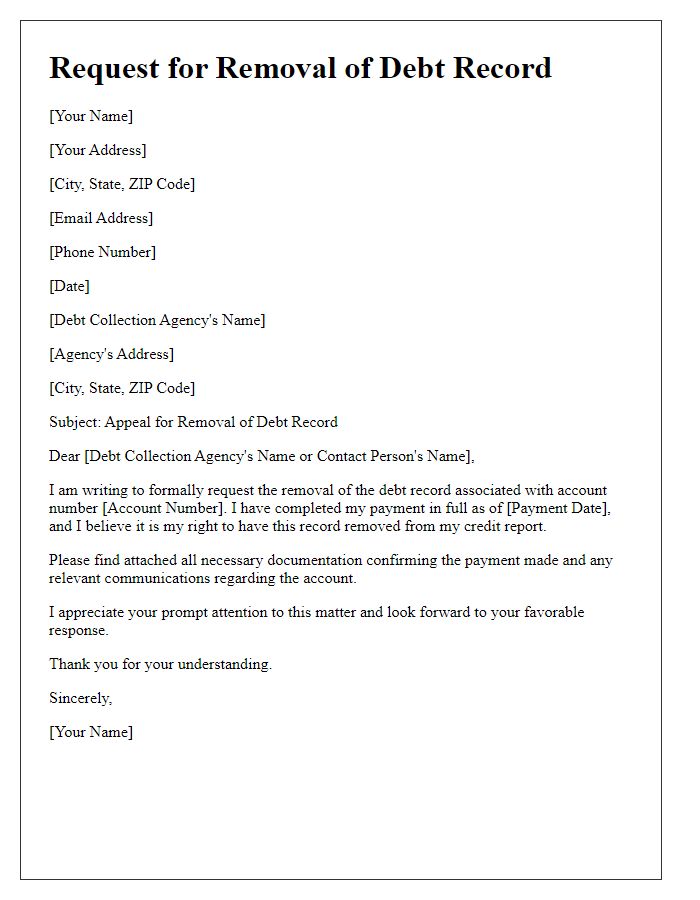

Letter template of appeal for removal of debt record after completion of payment

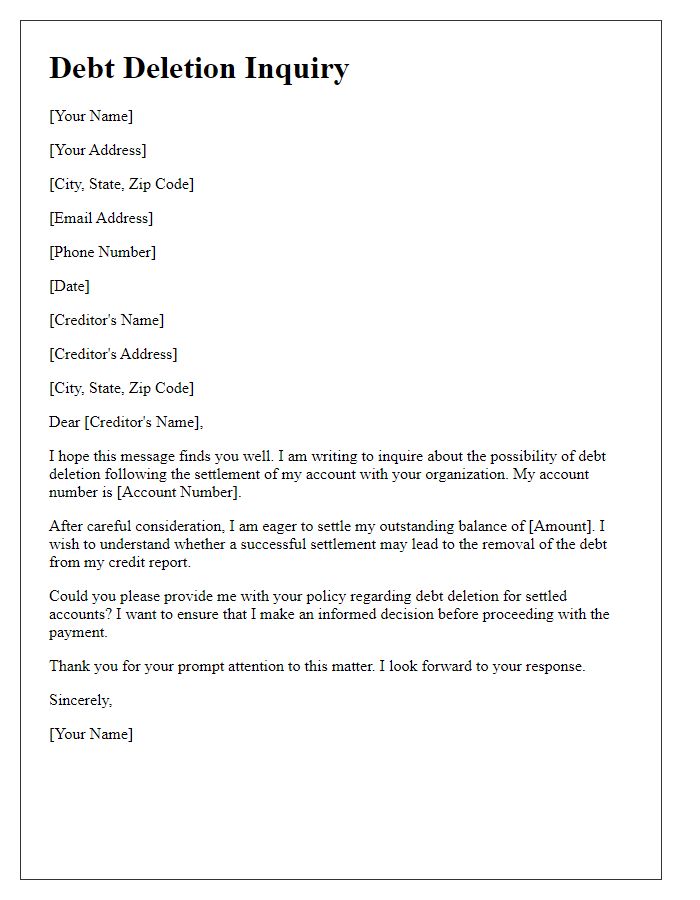

Letter template of inquiry regarding debt deletion upon settling account

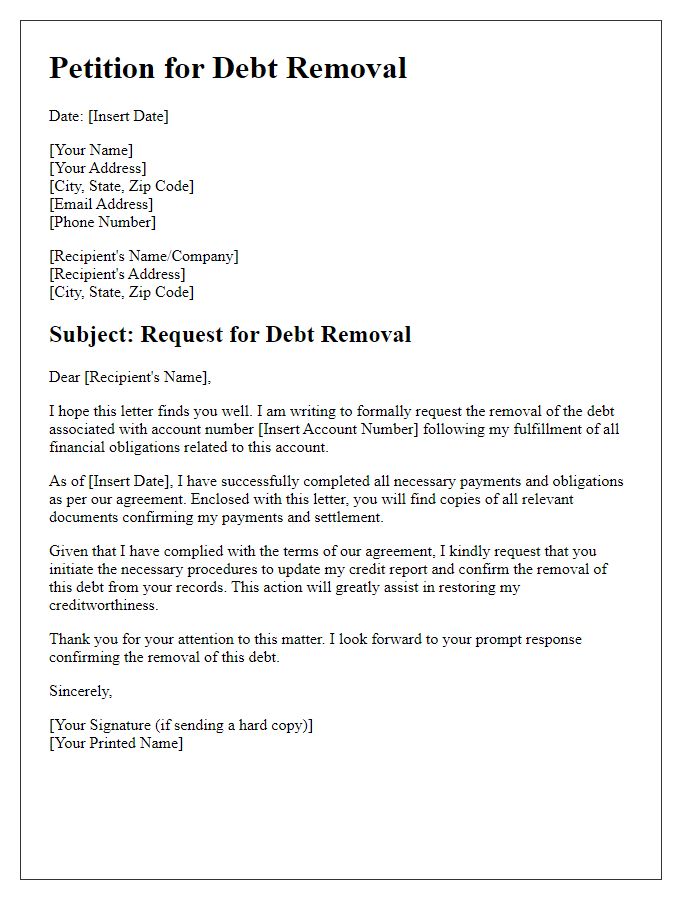

Letter template of petition for debt removal after fulfilling financial obligation

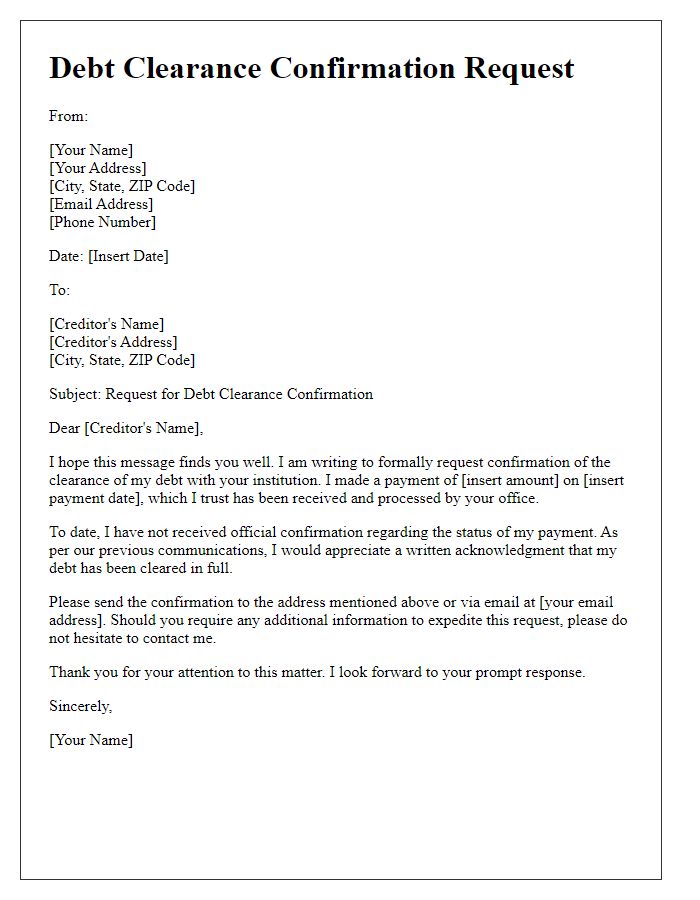

Letter template of demand for debt clearance confirmation after payment made

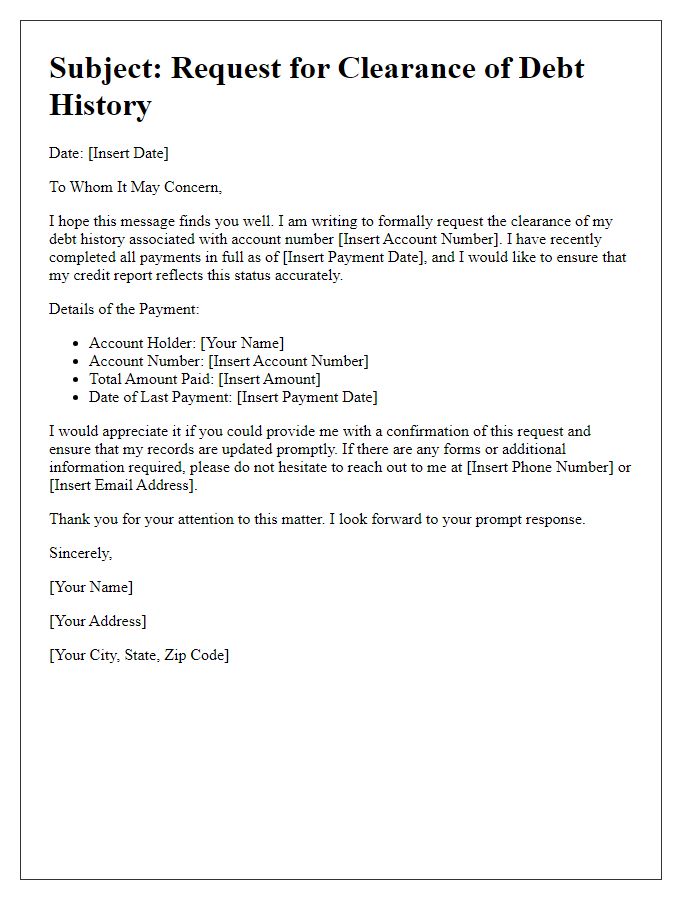

Letter template of communication for clearing debt history after complete payment

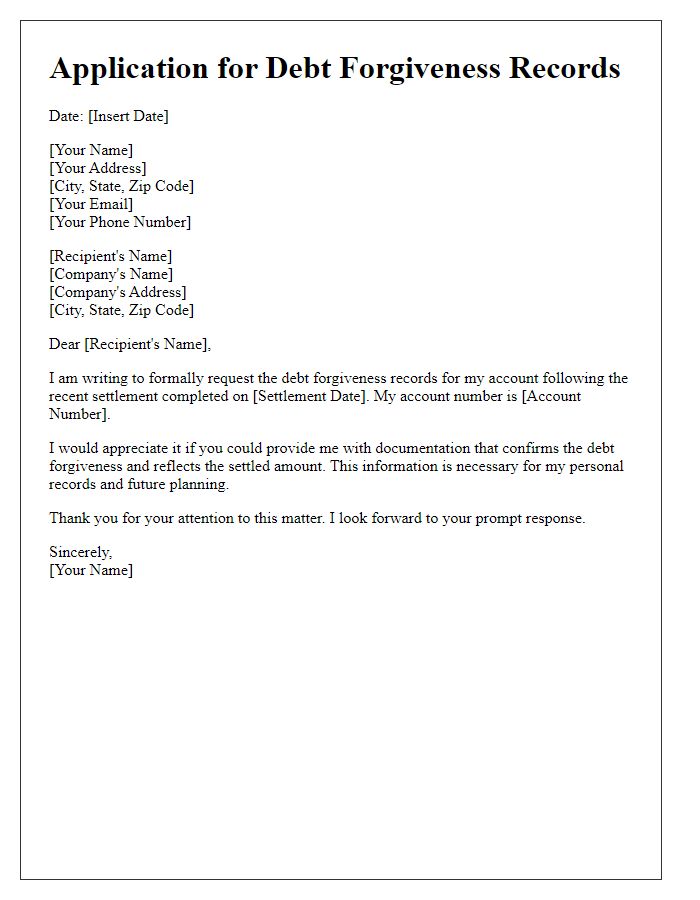

Letter template of application for debt forgiveness records after account settlement

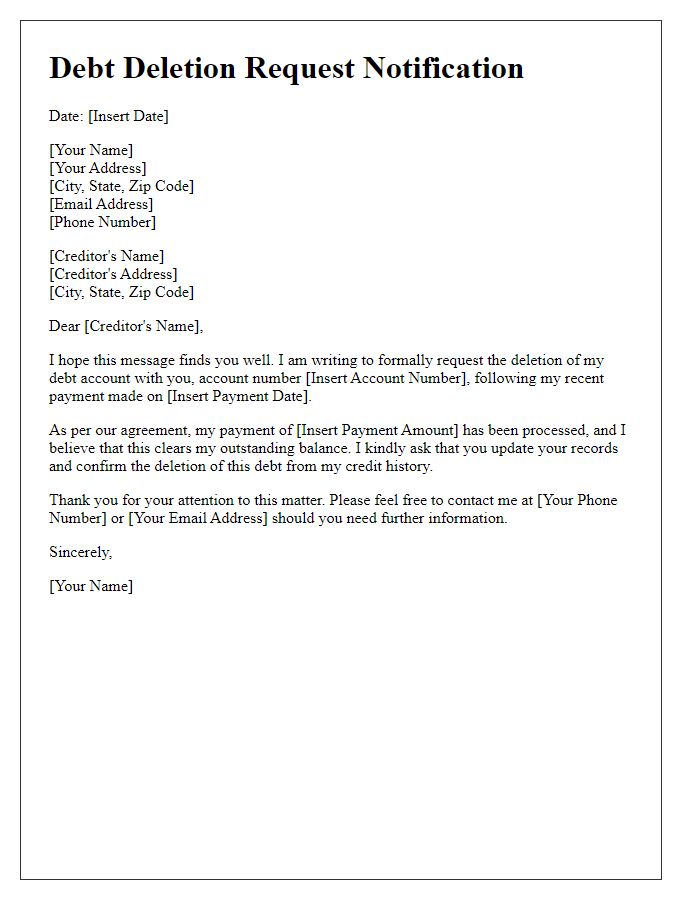

Letter template of notification for debt deletion request after recent payment

Comments