Are you feeling overwhelmed by high-interest rates on your loans or credit cards? You're not aloneâmany people are seeking relief from these financial burdens. In this article, we'll explore how you can effectively request a lower interest rate and the benefits that come with it. Join us as we dive into tips and a sample letter to help you take control of your finances!

Personal Account Details

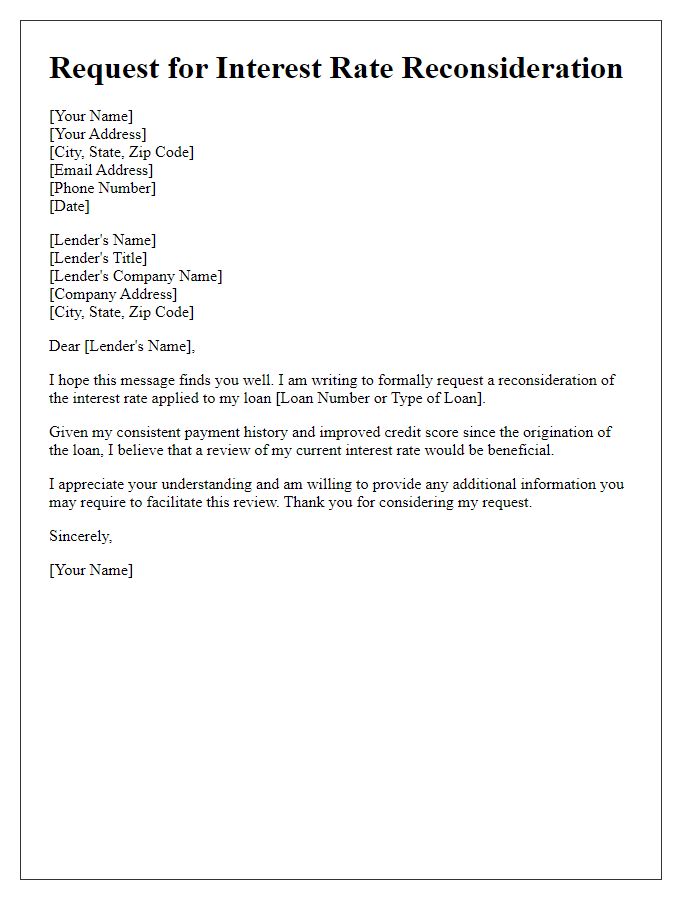

Requesting a lower interest rate on a personal account can significantly enhance financial stability. Various financial institutions, including banks such as JPMorgan Chase or Bank of America, often consider adjustments to interest rates based on several factors. Applicants typically need to provide personal account details, including the account number, current interest rate (commonly between 5% and 25% for personal loans), and repayment history (at least 12 months of on-time payments viewed favorably). Highlighting improvements in credit scores (for example, above 700) and consistency in income can strengthen the request. Additionally, referencing loyalty, such as maintaining the account for over five years, may lend weight to the appeal. Effective communication can lead to favorable terms, ultimately reducing financial burdens for the account holder.

Current Interest Rate Information

High-interest rates can significantly impact mortgage affordability and loan repayments, particularly in regions like the United States where the average rate hovers around 6-7% as of late 2023. Borrowers facing financial strain due to elevated interest rates may seek to negotiate with lenders for favorable terms. A lower interest rate can lead to substantial savings over the life of a loan, potentially saving thousands of dollars in interest payments. Critical documents such as income statements, credit reports, and explanations of current financial hardships can support requests for rate reductions. Factors like consistent payment history and improvements in credit scores may strengthen borrowers' cases for reduced rates.

Justification for Rate Reduction

A lower interest rate on a mortgage can significantly alleviate financial burdens for homeowners, particularly in economically challenging times. Current interest rates, such as those hovering around 6% for fixed-rate mortgages, can create substantial monthly payments, which may strain budgets. A reduction to competitive rates, traditionally around 3% to 4%, can lead to savings of hundreds of dollars monthly. This adjustment not only enhances affordability but also increases the likelihood of timely mortgage payments, benefiting lenders by reducing default risks. Furthermore, with the Federal Reserve's recent moves to stabilize the economy, many lenders are revisiting loan agreements to offer favorable terms, thus creating a timely opportunity for homeowners to request rate reductions based on improved credit profiles or long-standing positive payment histories.

Financial Improvements or Stability

Many homeowners in the United States seek lower interest rates on their mortgages to enhance financial flexibility. Current average mortgage rates hover around 3.5% to 4%, with numerous banks competing for favorable customer terms. Details such as improved credit scores (a score above 700 can significantly affect offers) often influence banks' willingness to reduce rates. Furthermore, demonstrating increased income stability, such as consistent employment income over two years, can strongly support requests for lower rates. Economic indicators, including the Federal Reserve's interest rate adjustments, further affect mortgage refinancing options, making it crucial for borrowers to stay informed about market trends as they negotiate better lending terms.

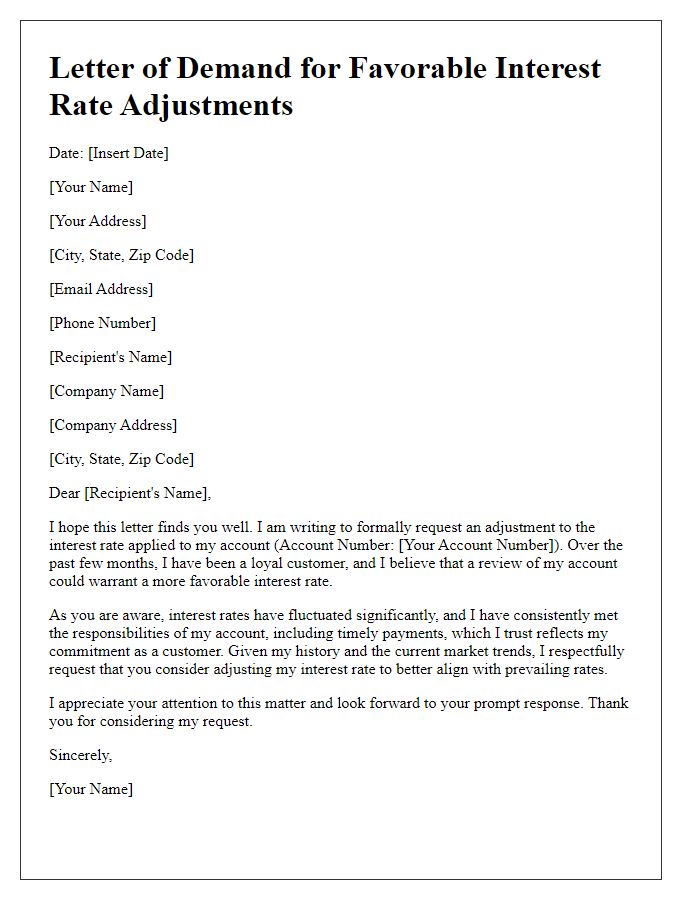

Competitive Offers from Other Lenders

Numerous financial institutions, such as banks and credit unions, offer competitive interest rates on personal loans, mortgages, and credit cards. For instance, prominent banks like Wells Fargo and Chase have recently advertised rates as low as 3.25% APR for home loans, substantially lower than the current rate of 4.75% I am being charged. A review of credit card offers from companies like Capital One reveals introductory rates of 0% APR for the first 15 months, appealing for those seeking financial relief. These options indicate a market with favorable rates, prompting a request for a reassessment of my existing loan terms. This could potentially enhance my financial situation and ensure customer loyalty amidst attractive alternatives.

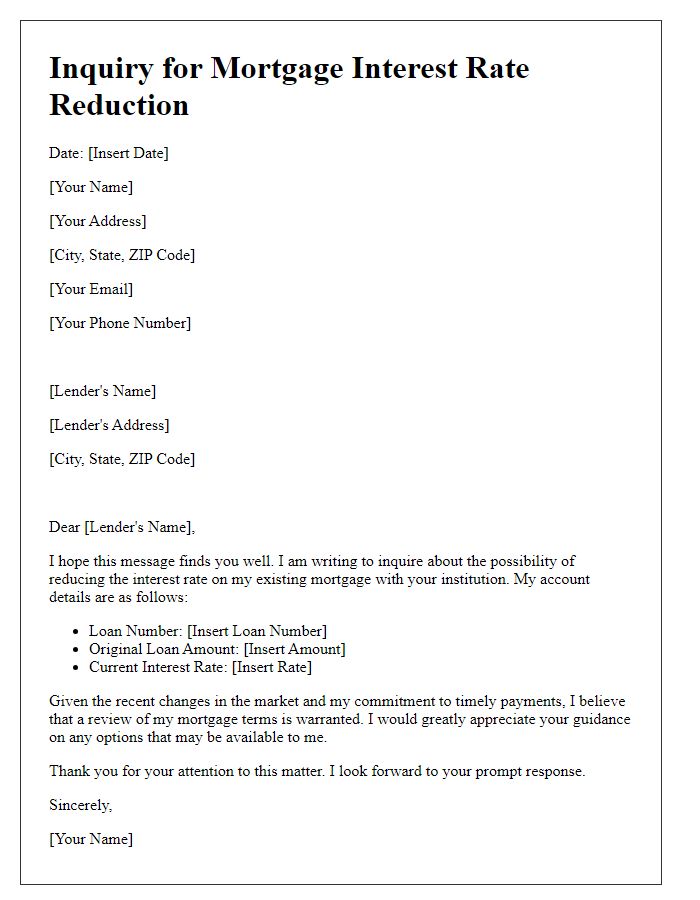

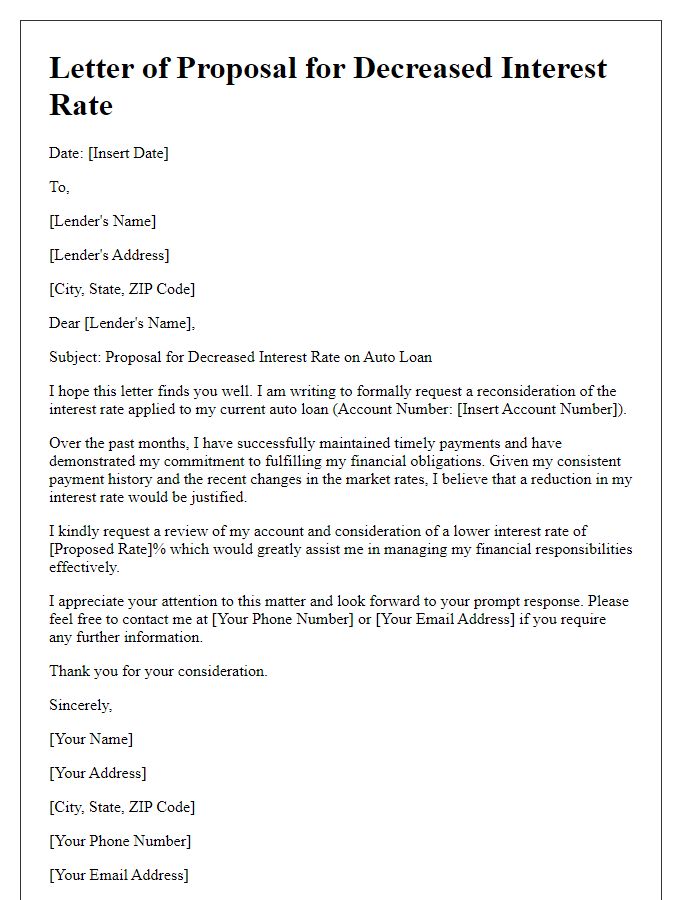

Letter Template For Requesting Lower Interest Rate Samples

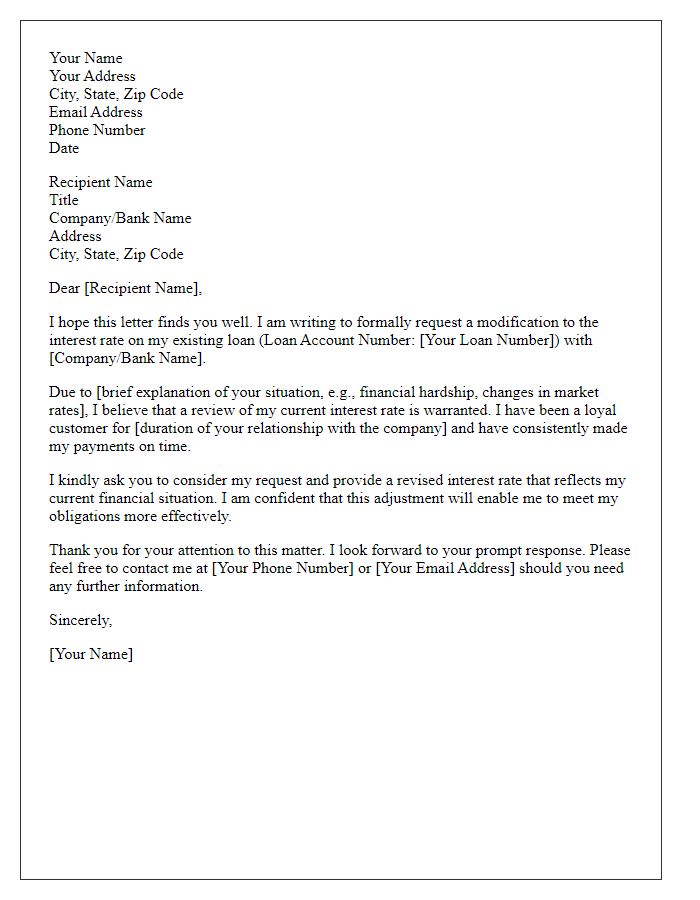

Letter template of application for adjusted interest rate on personal loan

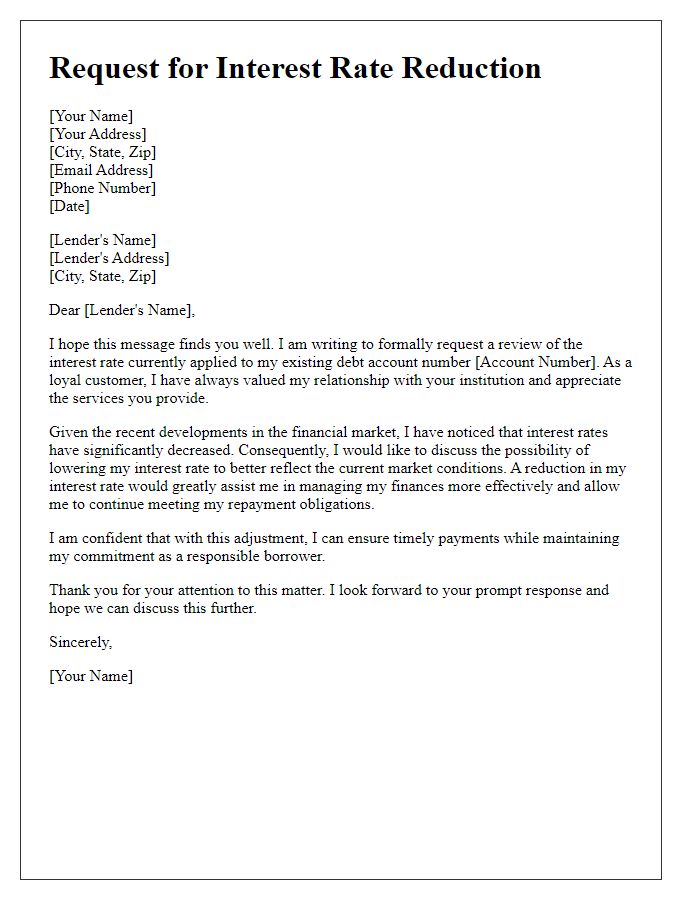

Letter template of negotiation for lower interest rates on student loans

Comments