Are you struggling with a recent denial of your student loan forgiveness application? You're not alone, and many have faced similar challenges while trying to navigate the complexities of loan forgiveness programs. In this article, we'll explore effective strategies and tips to craft a compelling appeal that can improve your chances of success. So, if you're ready to take action and reclaim your financial future, keep reading to discover how to strengthen your appeal letter!

Personal Identification and Loan Details

Submitting an appeal for student loan forgiveness denial requires precise documentation and clear articulation of personal and loan information. The first step includes personal identification details, such as full name, Social Security number, and contact information including mailing address and email. Essential loan details need to be included as well, which consist of the loan servicer's name, account number, and the type of loan--specifically, whether it's a Direct Subsidized Loan, Direct Unsubsidized Loan, or a Federal Perkins Loan. Clearly outlining these key details establishes the foundation for a compelling appeal, making it easier for the loan servicer to identify and assess the case efficiently.

Grounds for Appeal

Many individuals encounter challenges when applying for student loan forgiveness through programs like the Public Service Loan Forgiveness (PSLF). Common grounds for appeal include failure to meet qualifying payment criteria, issues related to employment verification with a qualifying employer, or improper completion of required paperwork. Each of these scenarios can lead to denial decisions, often due to strict eligibility requirements mandated by the U.S. Department of Education. It is essential to gather supporting documentation, such as payment history, employer certification forms, and correspondence with loan servicers, to strengthen an appeal. Understanding the specific denial reasons and addressing them thoroughly can significantly increase the chances of a successful resolution.

Supporting Documentation

When appealing a student loan forgiveness denial, it is essential to provide supporting documentation that substantiates your case. Include a copy of the initial denial letter from the Department of Education, clearly stating reasons for denial, often based on eligibility criteria such as employment status or loan type (e.g., Direct Loans, FFEL Loans). Gather pertinent financial records, including income statements or tax returns, demonstrating financial hardship. Relevant employment documentation like pay stubs or letters from employers showcasing periods of qualifying employment in public service roles under programs like PSLF (Public Service Loan Forgiveness) can be crucial. Additional documents might include proof of residence or other circumstances that reinforce your eligibility. These meticulously collected pieces of evidence together advocate for a reconsideration of the denial, illustrating your adherence to the program's requirements.

Mitigating Circumstances

Affected students often face denial of student loan forgiveness applications due to various mitigating circumstances that can influence eligibility. Events such as unexpected medical emergencies leading to substantial expenses can hinder financial stability, making it challenging to meet repayment obligations. Additionally, changes in employment status, including layoffs from reputable organizations, can dramatically alter one's income level, creating further difficulties in fulfilling loan commitments. Situations like natural disasters, such as hurricanes or wildfires, can also displace individuals, causing a significant impact on their financial situation and ability to make timely payments. It is critical for applicants to clearly document these circumstances, providing supporting evidence from relevant sources like medical records, employment letters, or disaster relief notices to strengthen their appeal for loan forgiveness.

Formal Request and Closing

Student loan forgiveness programs, like the Public Service Loan Forgiveness (PSLF) initiated in 2007, can alleviate financial burdens for qualifying borrowers. Denials often stem from complexities in eligibility requirements, which include specific employment types, loan types, and payment histories. Crafting a formal appeal entails addressing key points of denial, referencing pertinent regulations like the 2021 Expanded PSLF, and providing documentation such as employment verification or proof of qualifying payments. A well-structured closing statement reinforces commitment to public service and the significant impact of loan forgiveness on future career endeavors.

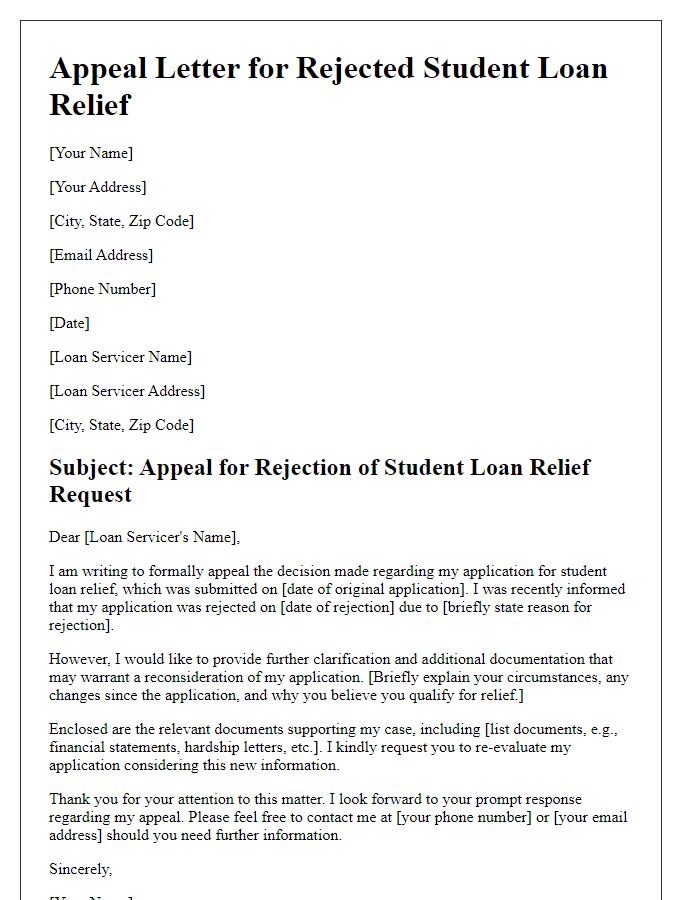

Letter Template For Appealing Student Loan Forgiveness Denial Samples

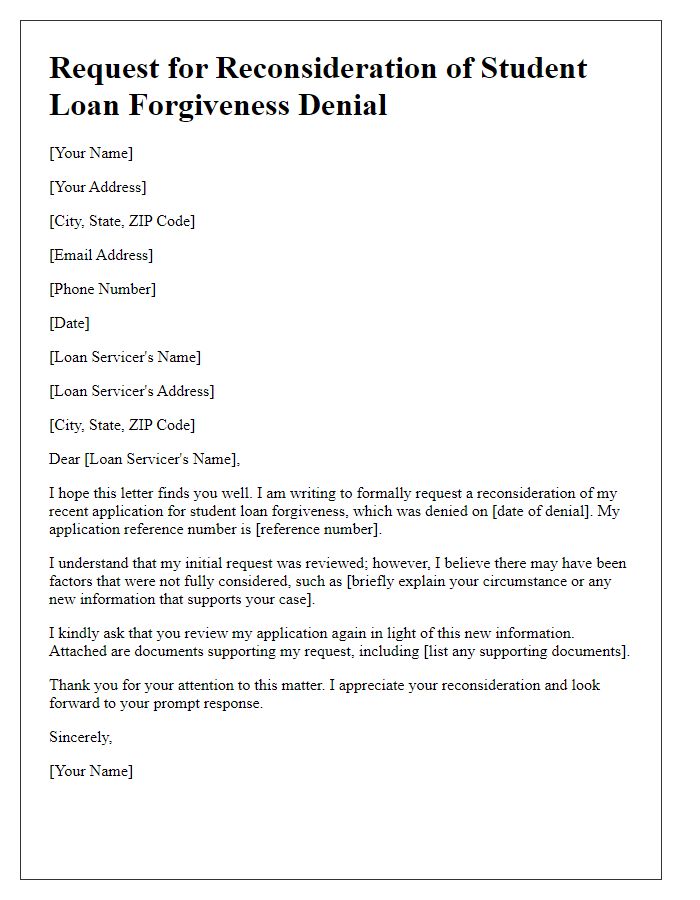

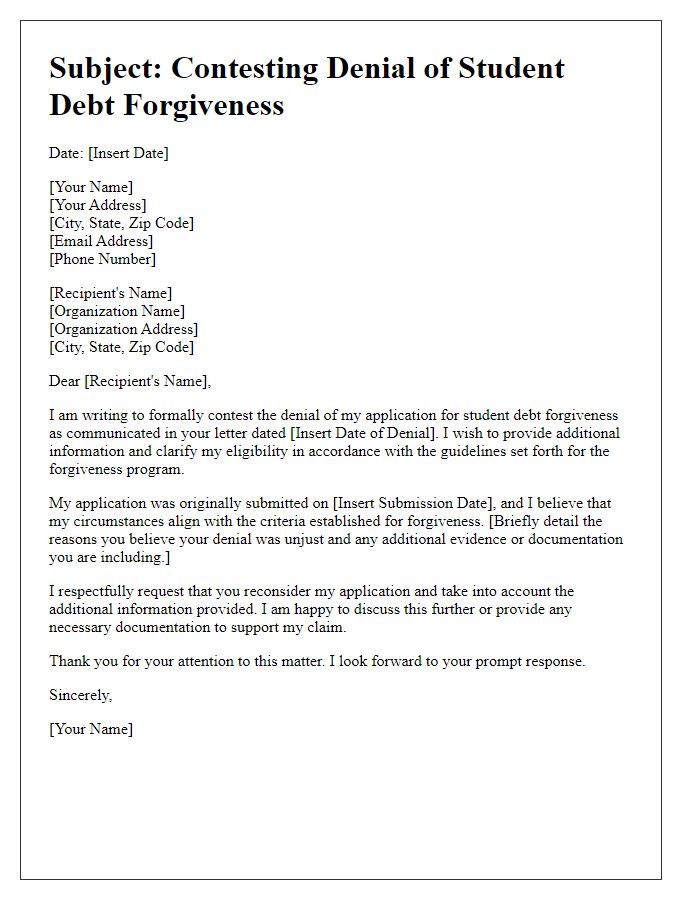

Letter template of student loan forgiveness appeal for denied application

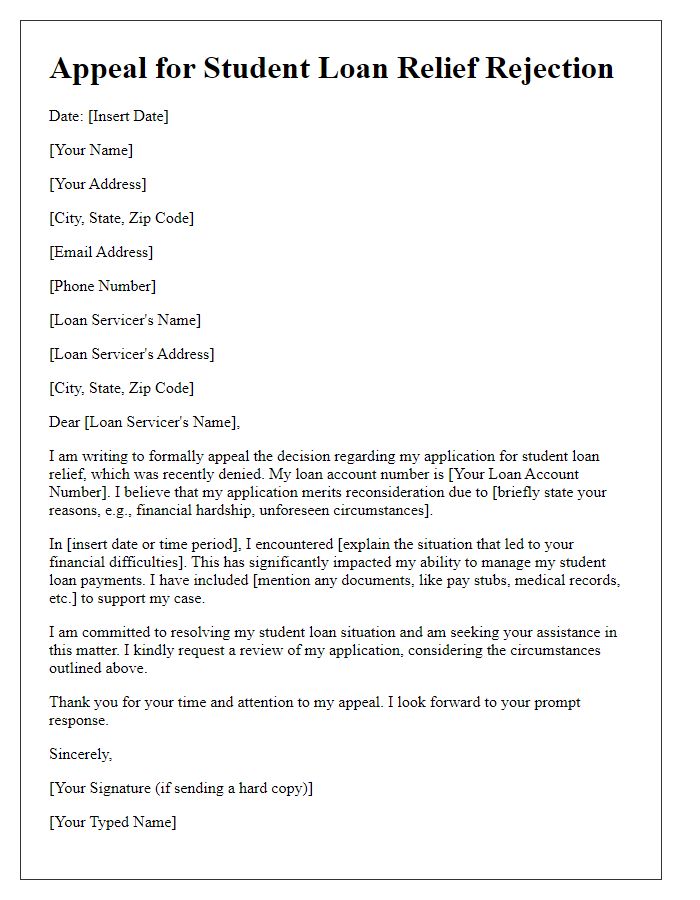

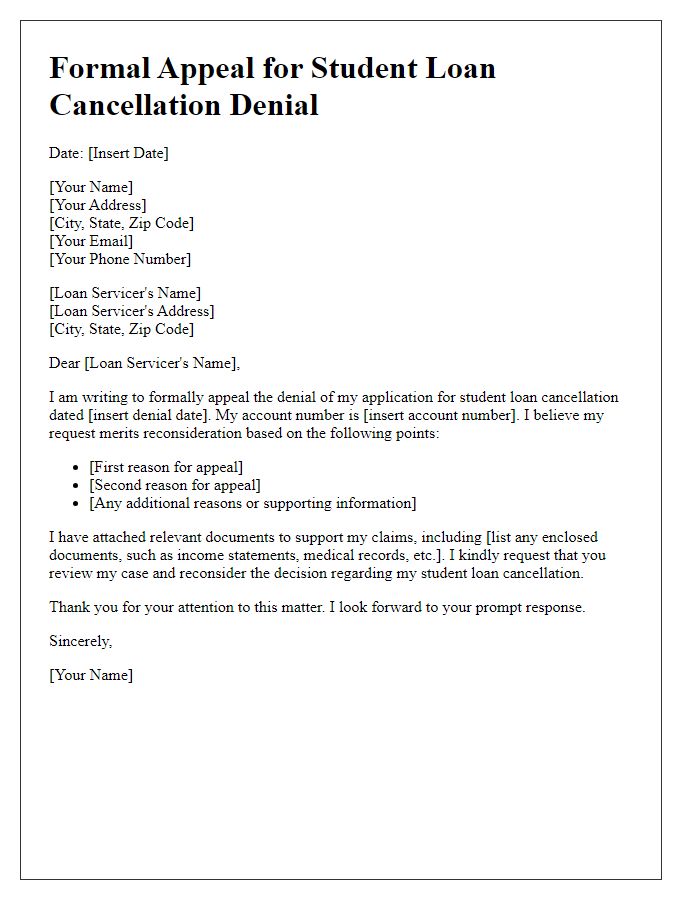

Letter template of reconsideration request for student loan forgiveness denial

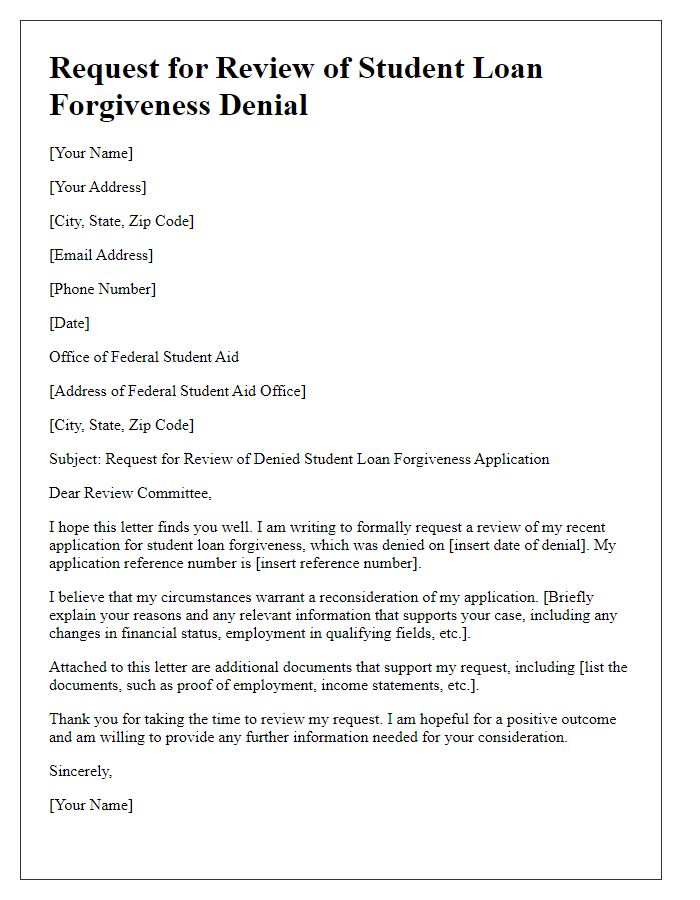

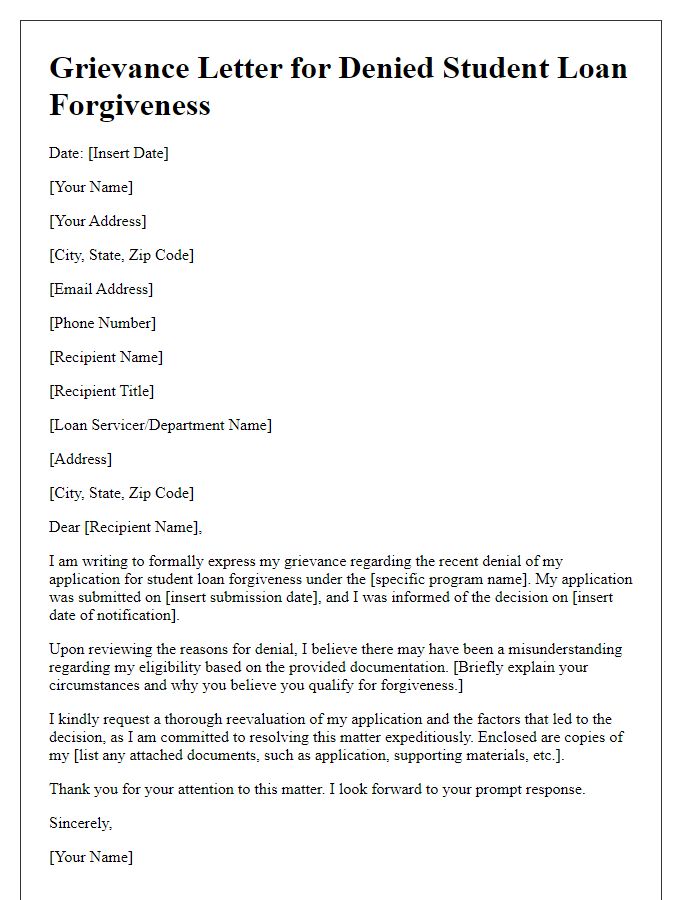

Letter template of request for review of student loan forgiveness denial

Comments