Are you feeling a little anxious about managing your finances? Overdraft protection can be a lifesaver, giving you peace of mind and helping you avoid those pesky fees. In this article, we'll walk you through how to securely request overdraft protection from your bank in a few simple steps. So, if you're ready to take control of your financial situation, keep reading to learn more!

Clear Subject Line

Overdraft protection serves as a financial safety net for bank accounts, designed to prevent transactions such as checks or debit card purchases from being declined due to insufficient funds. Many banking institutions, including Wells Fargo and Bank of America, offer this service, which may also cover varying fees (up to $35 per transaction in some cases). When overdraft protection is in place, account holders can avoid potential embarrassment when a payment is due, while also maintaining a good standing with service providers. It's crucial for consumers to be aware of the terms, as banks often provide limited grace periods (often 24 hours) to rectify negative balances before penalties are applied. Additionally, education about the implications of repeated overdraft usage is essential, as it can lead to a cycle of financial strain and increased fees.

Recipient's Name and Address

Overdraft protection is a financial service that allows bank account holders to avoid declined transactions due to insufficient funds. This service typically applies to checking accounts, enabling users to cover payments when their account balance drops below zero. Banks in the United States, such as Bank of America and Wells Fargo, often charge a fee (ranging from $30 to $35) per overdraft transaction. Enrollment in overdraft protection can bolster financial stability by preventing bounced checks and declined debit card transactions, although it is crucial for account holders to manage their overdrafts responsibly to avoid falling into debt. The Federal Reserve closely regulates these services to ensure transparency and fair practices for consumers.

Account Details and Personal Information

To access overdraft protection services, individuals should provide essential personal information, such as full name (to verify identity), Social Security number (for credit assessment), and postal address (for account correspondence). Account details should include the bank account number (to specify which account requires overdraft protection) and the type of account (checking or savings). Regular account review is necessary, as current bank policies may vary, and customer requests typically undergo evaluation based on account history, including transaction patterns and average balance over the past six months. Understanding terms and conditions is crucial, as fees for overdraft protection can differ among financial institutions, impacting overall banking expenses significantly.

Specific Overdraft Protection Request

Many banks offer specific overdraft protection plans designed to prevent account holders from incurring overdraft fees when their checking account balance falls below zero. For instance, Wells Fargo provides an overdraft protection service that links a savings account, credit card, or line of credit to a checking account. This mechanism allows automatic transfers or credit advances to cover transactions when funds are insufficient, typically for amounts exceeding $5. Such protection can be particularly beneficial during emergencies or unexpected expenses, ensuring seamless access to funds while minimizing financial penalties. Account holders should inquire about eligibility requirements, fees associated with the service, and the process for setting up or modifying overdraft protection with customer service representatives.

Contact Information and Formal Closing

Overdraft protection is a financial safeguard provided by banks, allowing account holders to withdraw more money than they currently possess in their checking accounts. This service is often linked to personal accounts, such as those offered by major institutions like Bank of America or Wells Fargo. Depending on the bank's policy, overdraft fees can reach up to $35 per transaction, potentially impacting a customer's financial stability. Numerous financial experts recommend setting up an overdraft line of credit instead, as it generally involves lower fees and interest rates compared to traditional overdraft protection, which can save customers substantial amounts in the long run.

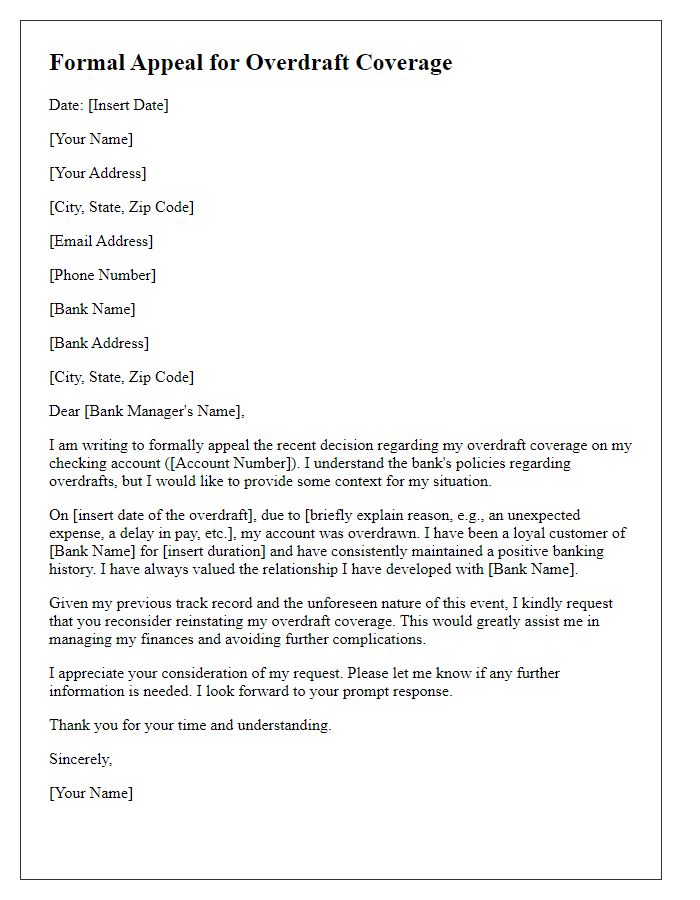

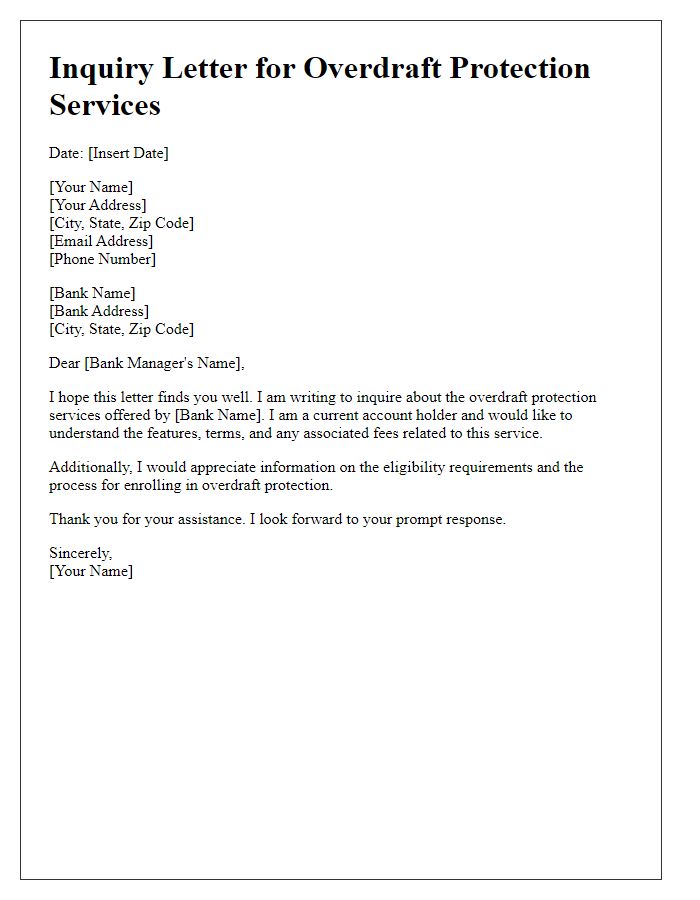

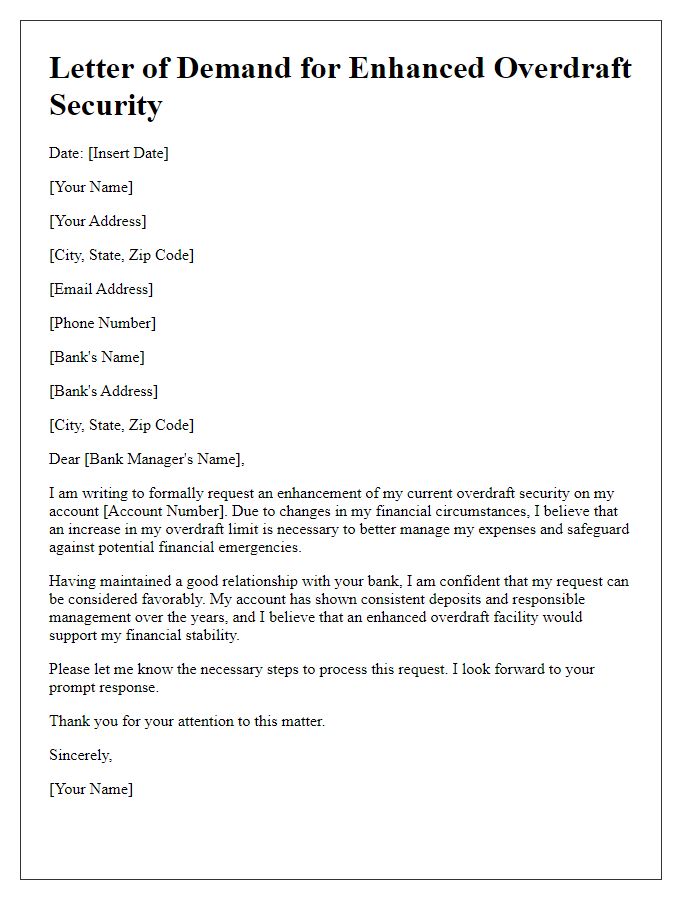

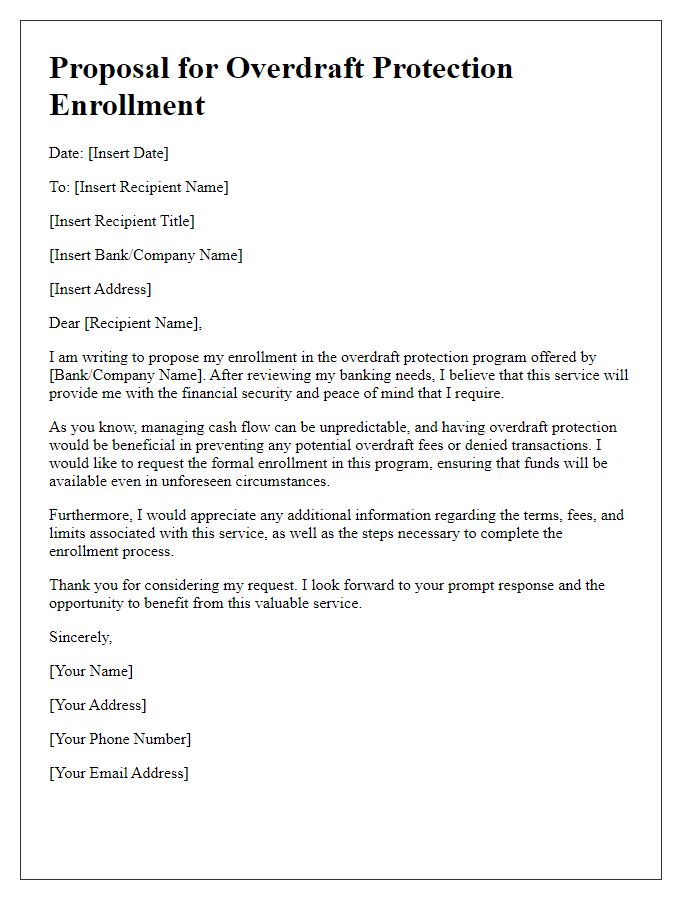

Letter Template For Overdraft Protection Request Samples

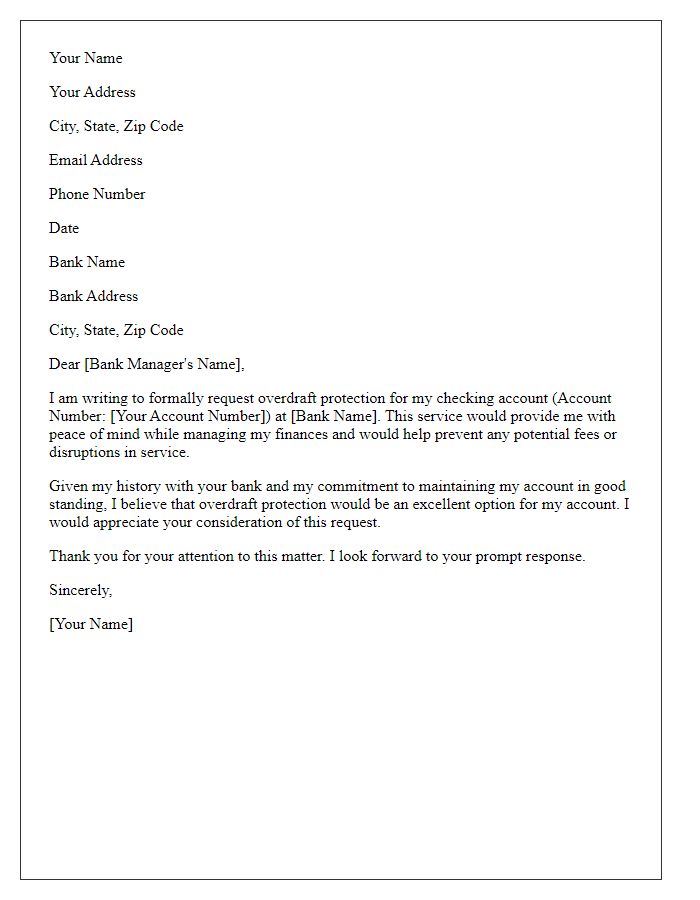

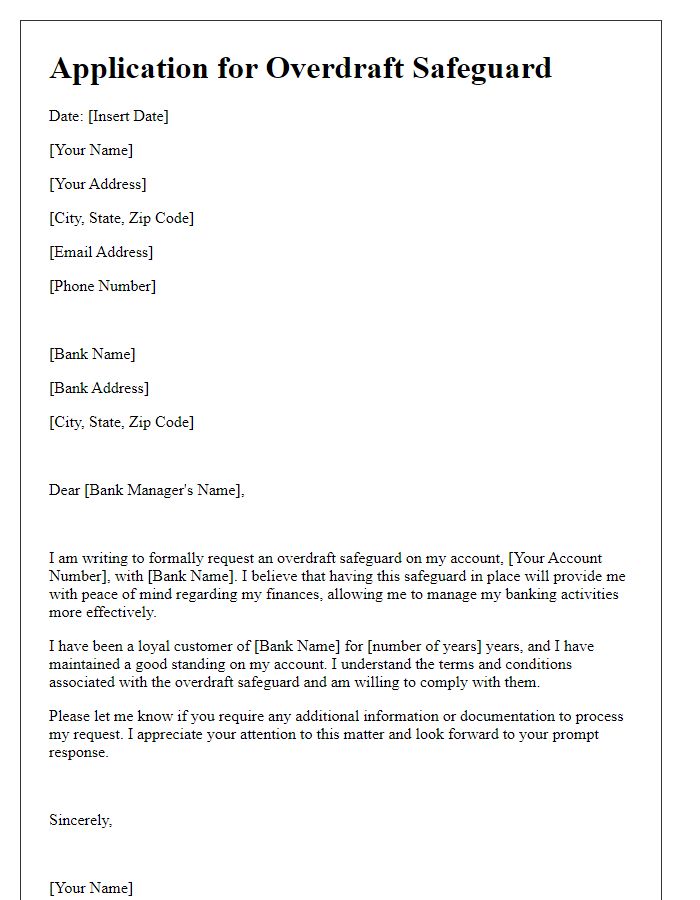

Letter template of request for overdraft protection on checking account.

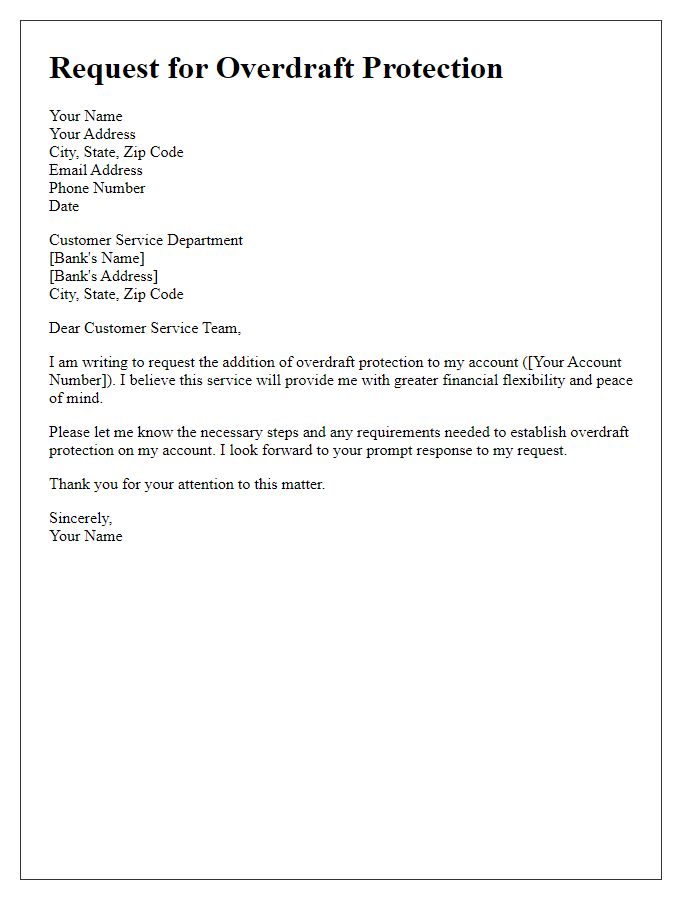

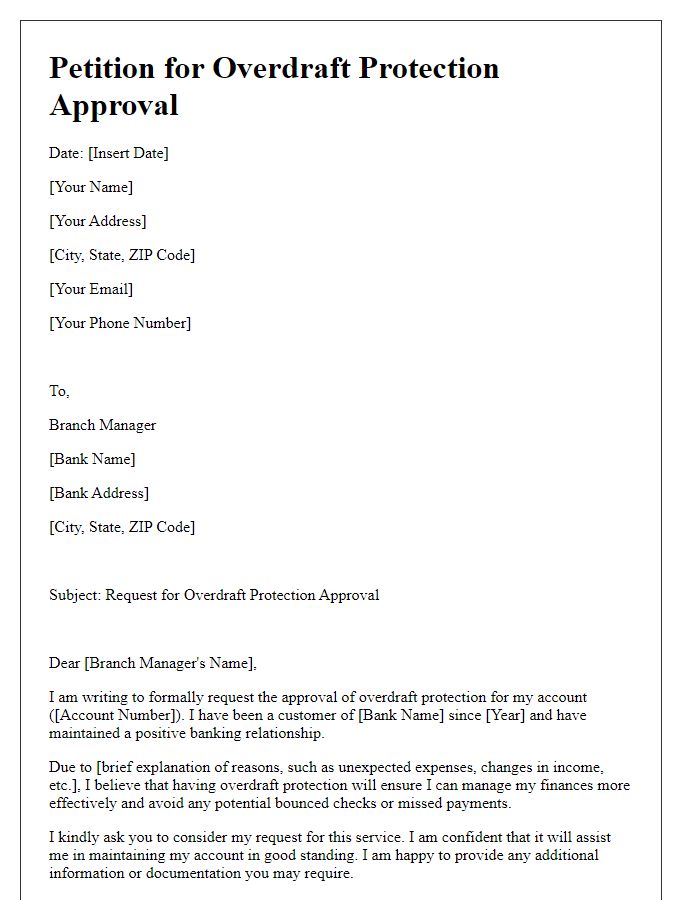

Letter template of request for adding overdraft protection to my account.

Comments