Have you ever experienced the frustrating situation of a false entry on your credit report? It can feel overwhelming, especially when it affects your financial opportunities and peace of mind. Fortunately, disputing an inaccurate credit report entry is a process you can navigate with confidence. Join us as we explore the essential steps and effective letter templates you can use to reclaim your creditworthiness and ensure a brighter financial future.

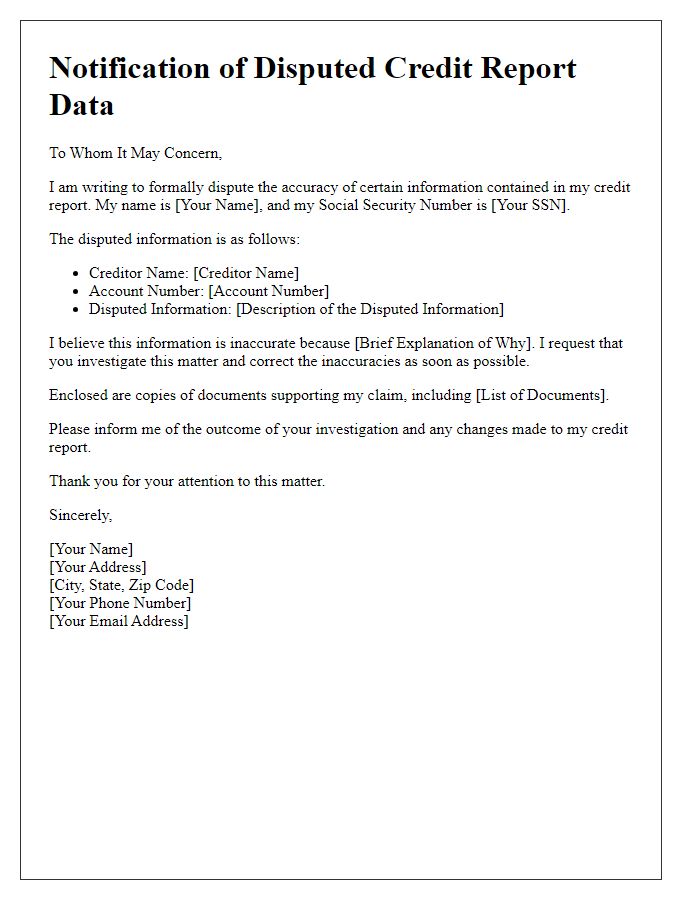

Accurate Personal Information

Inaccurate entries in credit reports can severely impact financial opportunities. Personal information inaccuracies, such as misspelled names, wrong addresses, or incorrect Social Security numbers, can mislead creditors and hinder access to credit. Maintaining accurate data is crucial for consumers, given that credit reports influence loan applications, mortgage rates, and insurance premiums. Credit reporting agencies, like Experian, Equifax, and TransUnion, must correct these errors promptly to uphold consumer rights under laws such as the Fair Credit Reporting Act (FCRA). Disputing incorrect entries can involve providing documentation, such as utility bills or identification, to validate correct information, ensuring future accuracy in financial assessments. Addressing these discrepancies is essential for maintaining a healthy credit score and financial stability.

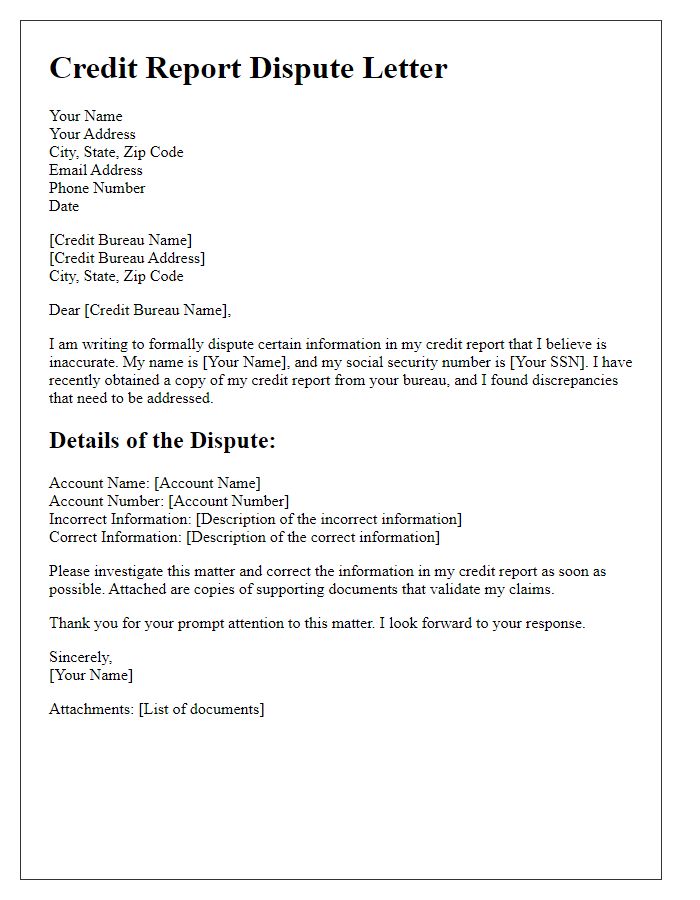

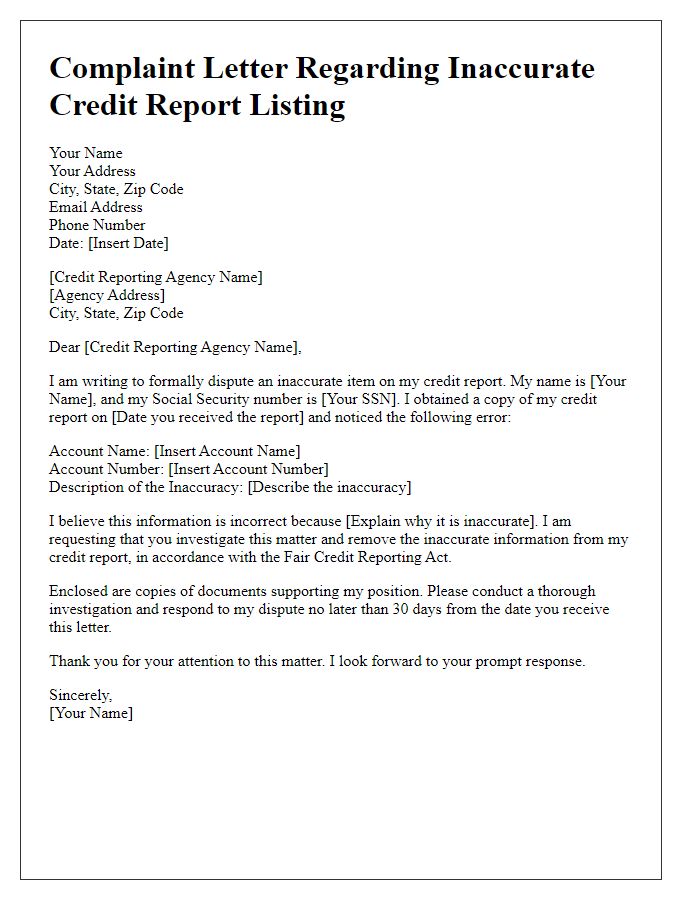

Detailed Account Information

Disputing false entries in credit reports is crucial for maintaining a healthy financial reputation. A credit report comprises various elements, such as personal identification details (e.g., name, Social Security number) and account information (e.g., account number, payment history). An example of a false entry could be a delinquent account report by a creditor that incorrectly lists missed payments. This may lead to a decreased credit score, impacting loan approvals with lenders like banks or mortgage companies. Timely submission of a dispute, which includes comprehensive details about the entry in question and evidence such as bank statements, is essential for rectifying inaccuracies. Credit reporting agencies, such as Equifax and TransUnion, are required by law to investigate these disputes within 30 days, ensuring that consumers have a fair opportunity to correct their financial histories.

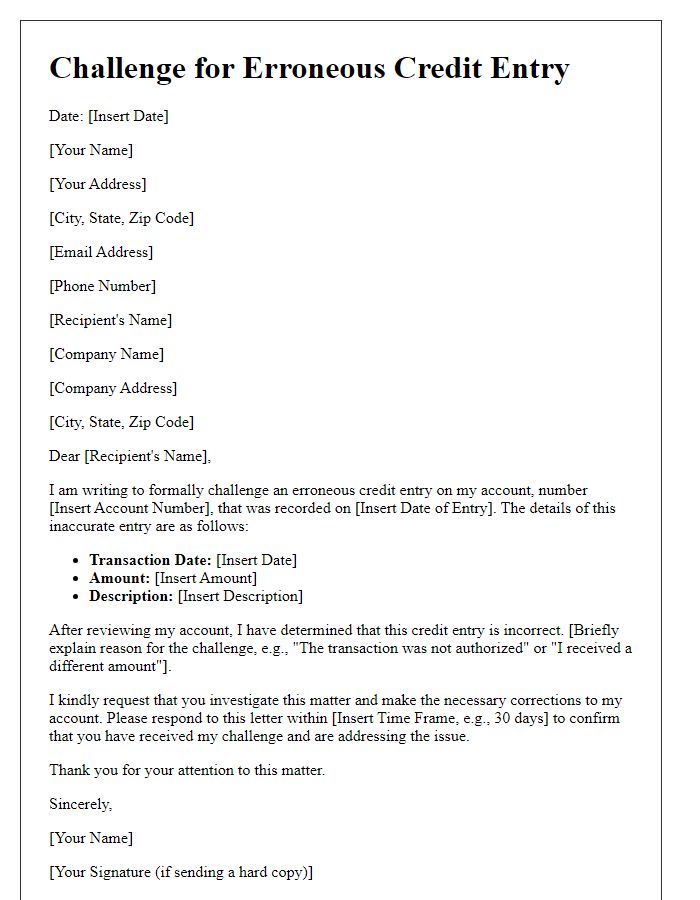

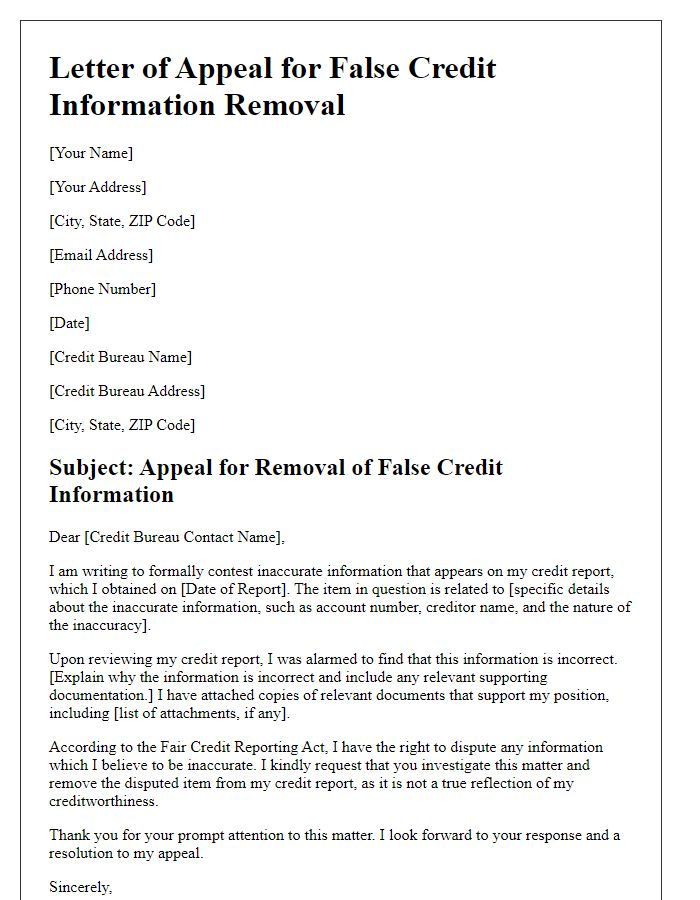

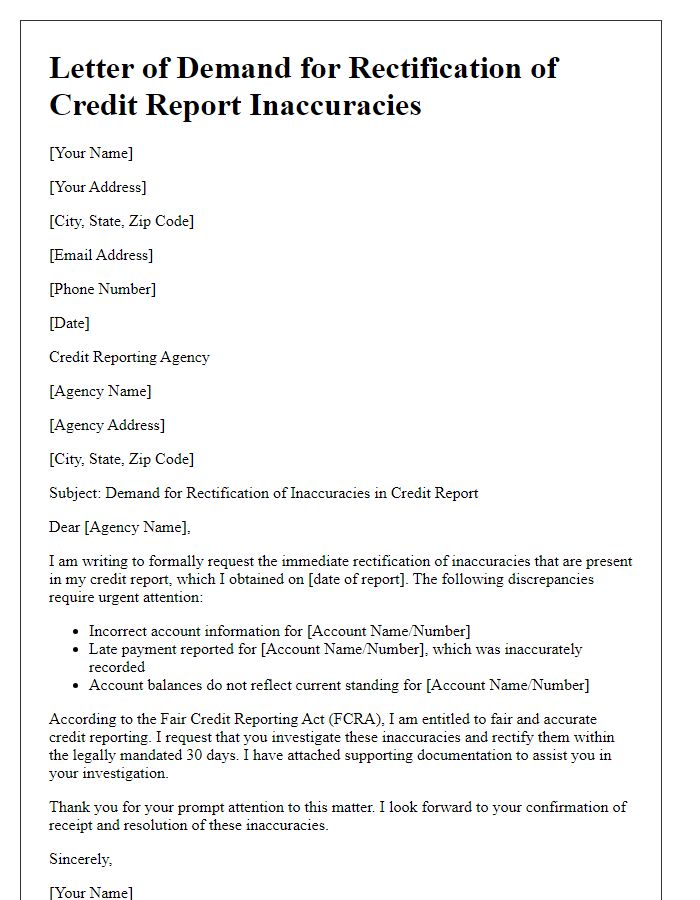

Specific Inaccuracies Listed

An inaccurate credit report can significantly impact one's financial health, particularly regarding loans, mortgages, and credit card applications. Misreported entries, such as late payments or erroneous account balances, require immediate attention to prevent potential damage to credit scores. Disputes should clearly outline specific inaccuracies, including the account number and creditor name, along with supporting documentation, such as payment confirmations or account statements. The Federal Trade Commission (FTC) guidelines state that individuals have the right to dispute errors and must receive a timely response from credit bureaus. Addressing inaccuracies swiftly can enhance creditworthiness, allowing individuals to secure favorable interest rates and credit terms in the future.

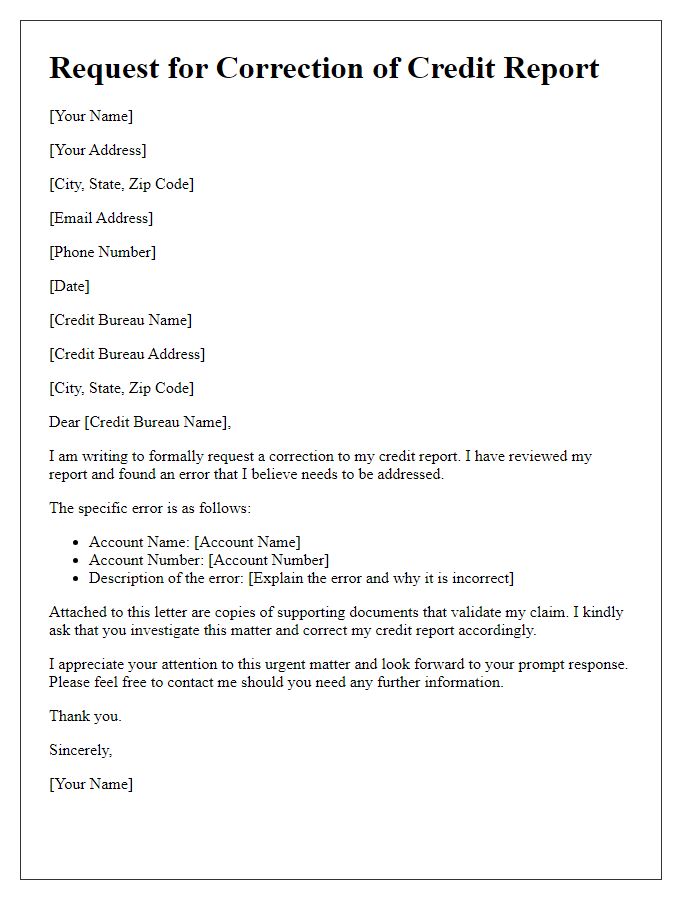

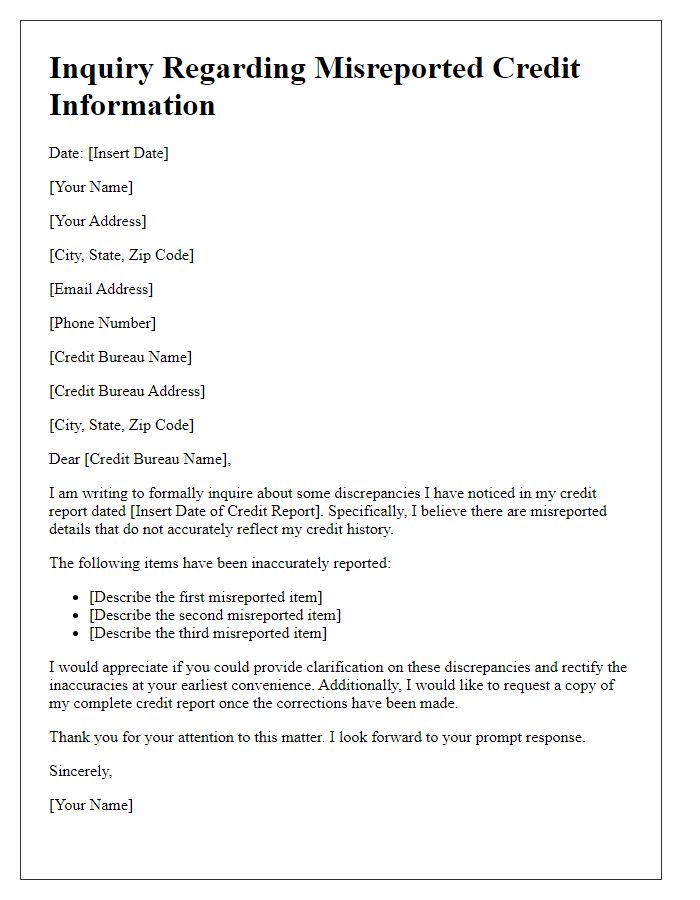

Supporting Documentation

Supporting documentation plays a critical role in disputing false entries on a credit report, such as inaccurate account information, incorrect late payments, or identity theft incidents. Essential documents include copies of identification (such as a government-issued ID or Social Security card) to verify identity, bank statements highlighting discrepancies, payment records proving on-time payments, and any correspondence with creditors related to the disputed entry. Additional evidence may consist of police reports in the case of identity theft incidents, as well as utility bills to confirm residence. Gather these documents carefully since they must be organized chronologically, clearly labeled, and accurately presented to enhance the credibility of the dispute and ensure a swift resolution.

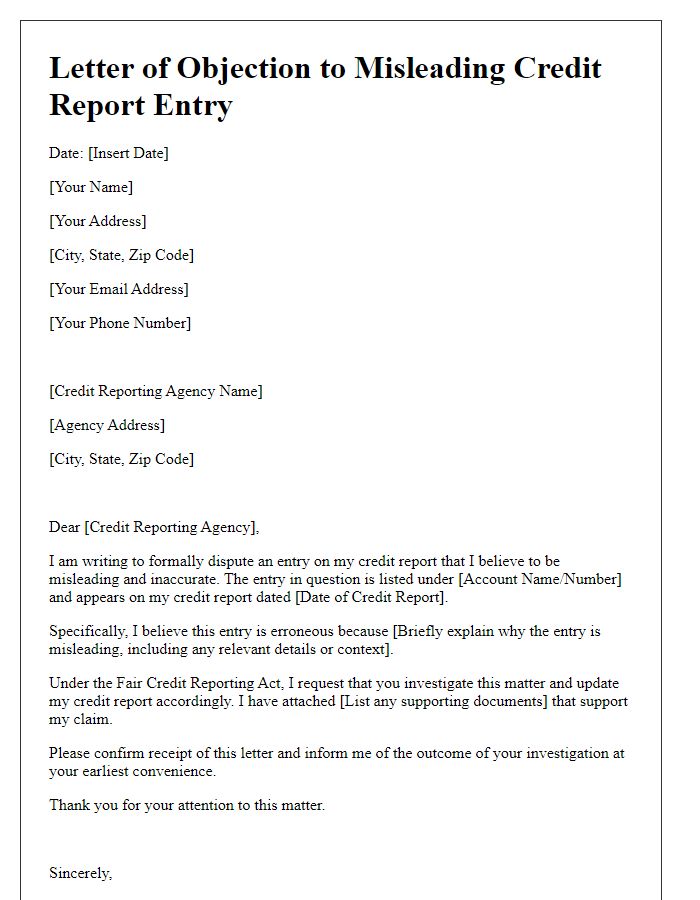

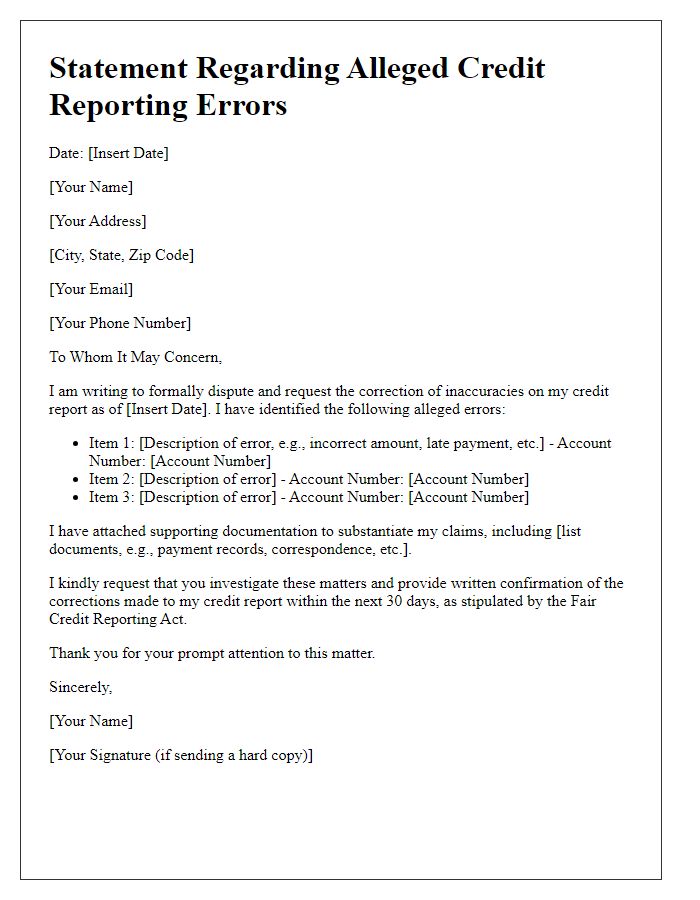

Formal Request for Correction or Removal

Inaccurate credit report entries can significantly impact an individual's financial stability and overall creditworthiness. A recent study by the Consumer Financial Protection Bureau (CFPB) revealed that approximately 20% of consumers have identified errors on their credit reports, leading to potential denials of loans and higher interest rates. The Fair Credit Reporting Act (FCRA) mandates that credit reporting agencies, such as Experian and TransUnion, investigate disputes filed by consumers regarding erroneous information within 30 days. To initiate a dispute, individuals must provide specific details regarding the inaccurate entry, such as account numbers and dates of the transactions, along with supporting documentation, like bank statements or letters from creditors, to substantiate their claims. Properly addressing these inaccuracies can ultimately improve the consumer's credit score, enhancing their chances of securing favorable loan terms in the future.

Comments