Are you looking for a clear and effective way to assert your debt ownership? Drafting a proof of debt ownership letter can be a straightforward process when you know the right elements to include. From stating the amount owed to providing your contact information, a well-structured letter can serve as an essential document in confirming your financial obligations. So, if you want to learn more about creating the perfect letter template, keep reading!

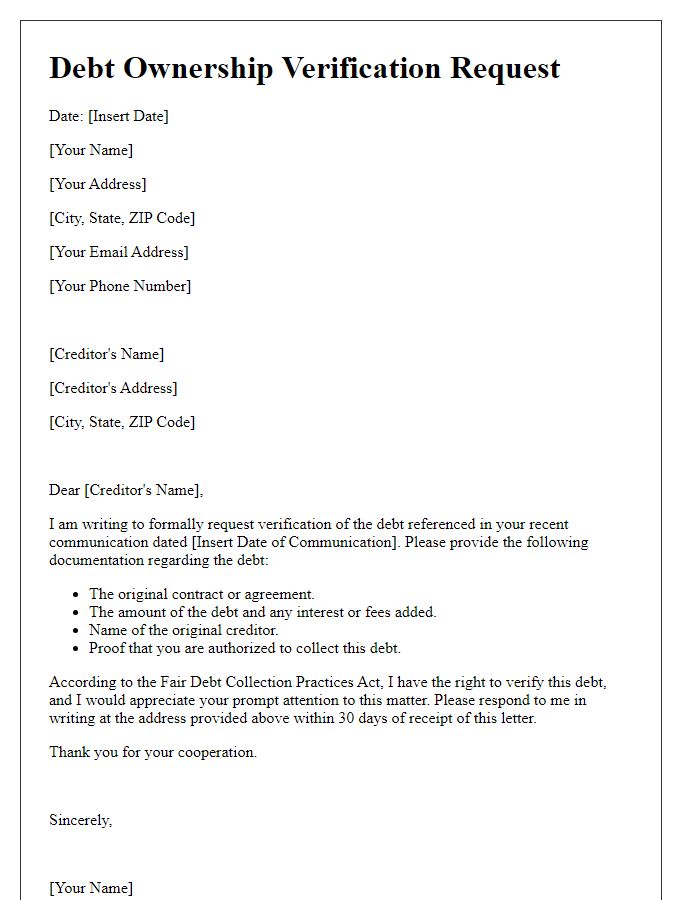

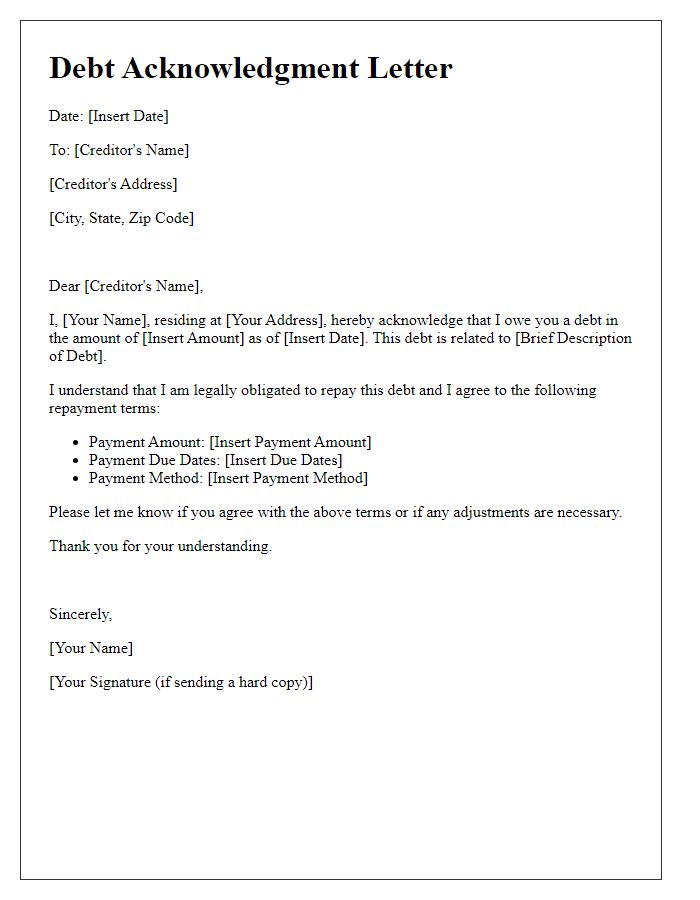

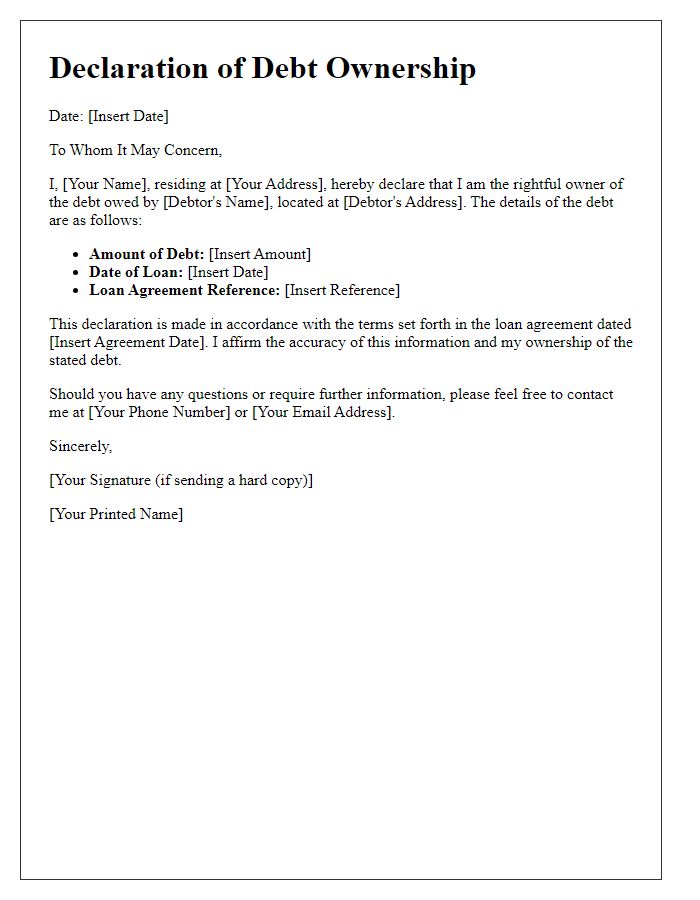

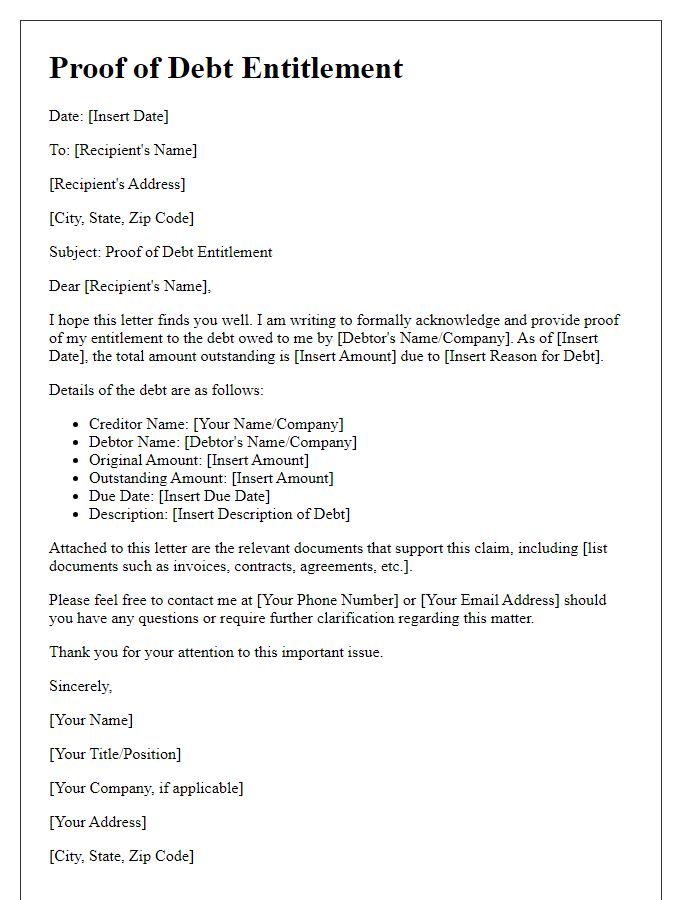

Creditor and Debtor Information

In financial transactions, accurate documentation is vital for establishing proof of debt ownership. The creditor (the entity or individual who is owed money) must provide detailed information, including their full name, address, and contact details. For instance, a bank like JPMorgan Chase may list its headquarters at 270 Park Avenue, New York, NY. The debtor (the individual or business that owes the money) needs to be identified clearly, with their full legal name, mailing address, and any applicable account numbers, such as those assigned to unsecured personal loans or credit lines. This information creates a formal record, ensuring clarity regarding the obligations of the parties involved and reducing potential disputes. Key dates should also be noted, including the date of the loan agreement and any payment due dates, to help delineate the timeline of the debt. This thorough documentation is essential for both parties to understand their rights and responsibilities in the financial agreement.

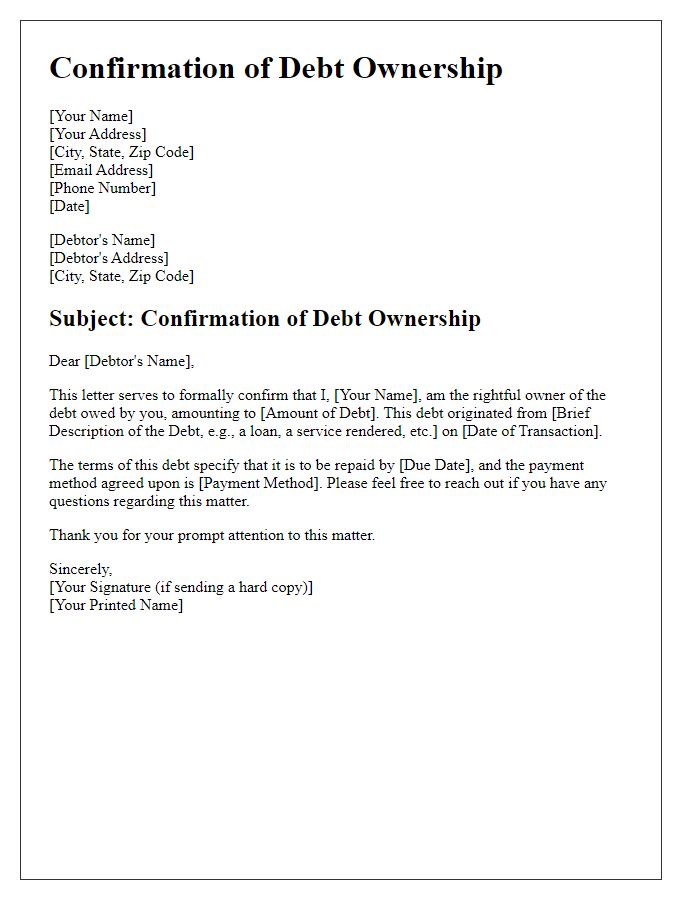

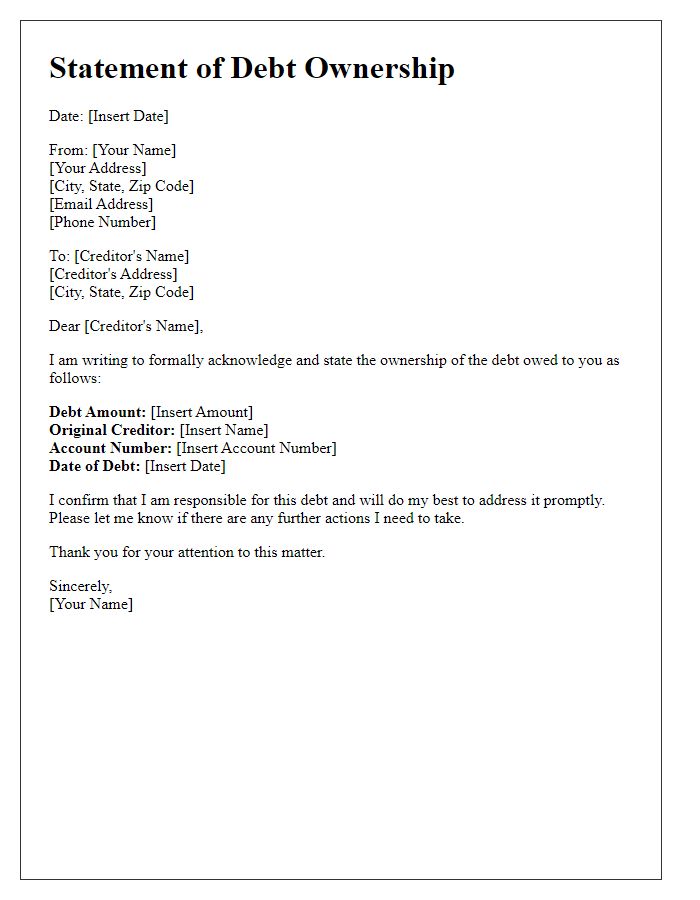

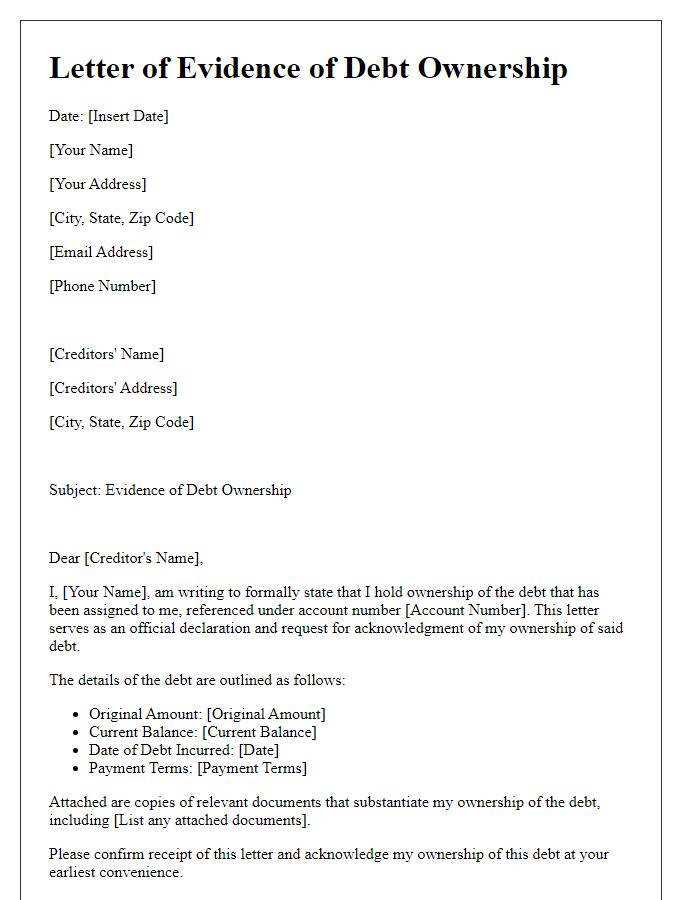

Detailed Debt Description

Debt ownership verification is essential for maintaining clear financial records. This proof of debt document typically outlines the specifics of the obligation in question, such as the loan amount of $15,000, originating from a personal loan taken in May 2021 at XYZ Bank, located in New York City. Terms of repayment included a monthly installment of $300 with an interest rate of 5%. The documentation may also include the original agreement, showcasing the loan duration of five years and the schedule of payments. Furthermore, any missed payments, which may have accrued late fees of $50 each, should be clearly stated to maintain transparency regarding the current outstanding balance, including the total accumulated interest.

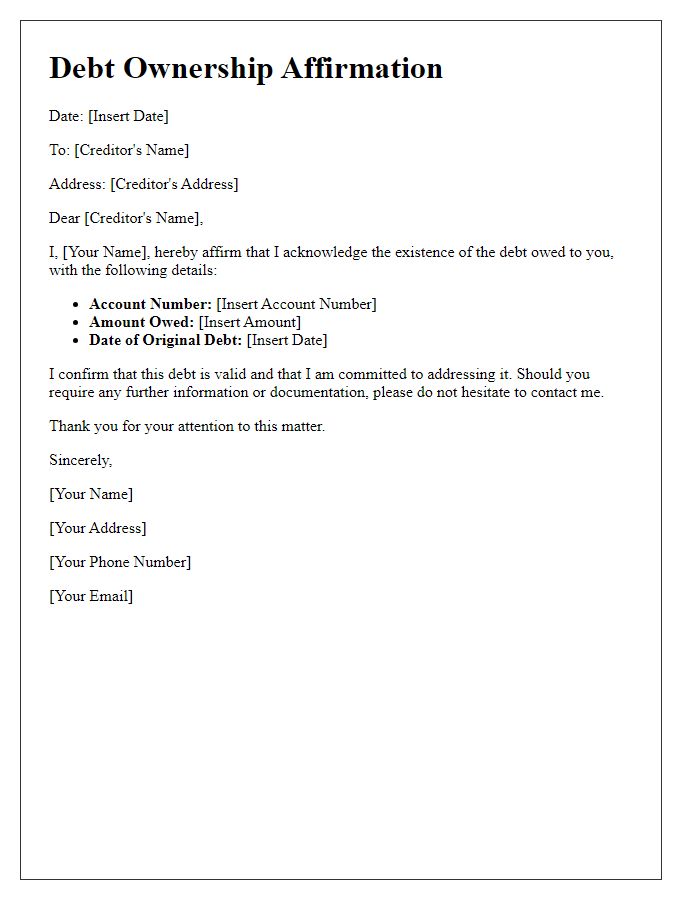

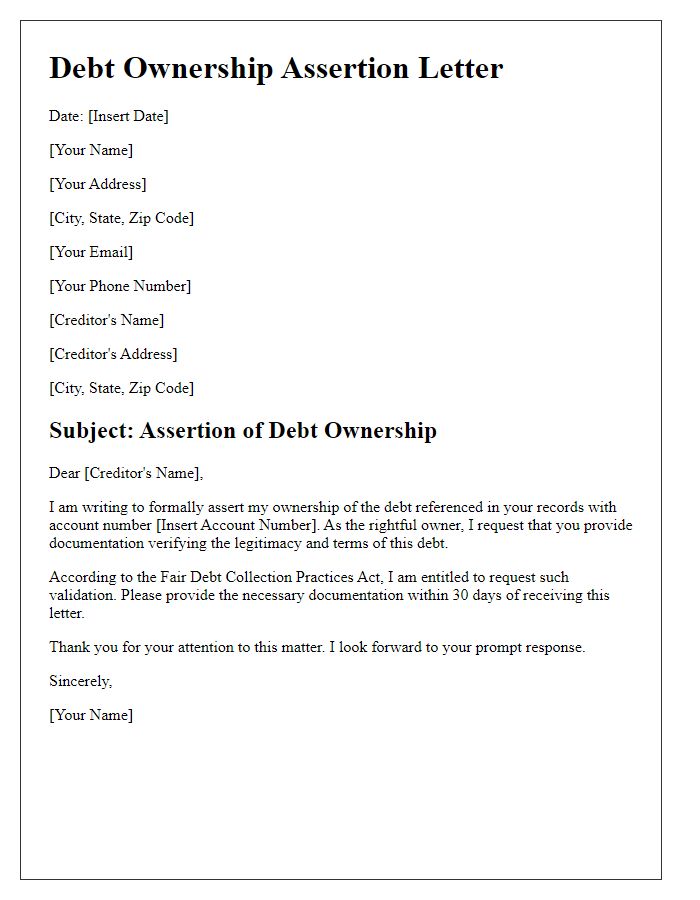

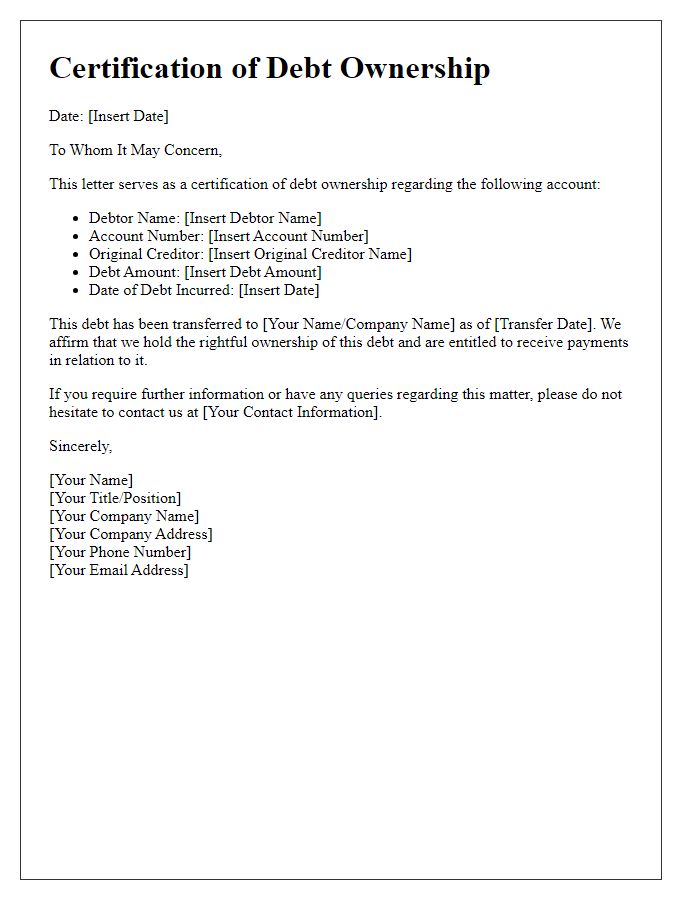

Ownership Proof Documents

Ownership proof documents are essential when claiming a debt, providing clear evidence of the legitimacy of the claim. These documents typically include financial statements, which reflect outstanding balances, invoices detailing services rendered, or goods provided that have not been paid for. Signed contracts or agreements can also serve as legal confirmation of the debtor's obligation, outlining terms and conditions agreed upon. Additionally, communication records such as emails or letters demonstrating attempts to collect the debt may support the creditor's position. Official documents, like court judgments or liens, can further establish the creditor's rights regarding repayment.

Authorized Signature

A proof of debt ownership document includes important elements such as the original creditor's name, debtor's name, account number, and specific amount owed. This document validates that the individual or entity asserting the debt has the legal right to collect, often linked to financial agreements or contracts. It may also reference relevant dates, such as the original transaction date or last payment date, which underscores the timeline of the debt. Documentation may require an authorized signature, confirming the legitimacy of the claim and enabling further collection activities or legal proceedings if necessary.

Contact Information for Verification

Individuals seeking to verify debt ownership must ensure to provide accurate and detailed contact information. This includes a complete name, mailing address (preferably an official one), phone number (including area code), and email address for potential correspondence. Such contact details should align with the records held by the creditor or collection agency to facilitate easier validation. Furthermore, including an identification number, such as a Social Security Number (last four digits) or an account number assigned by the creditor, enhances the authenticity of the request. This comprehensive approach streamlines the verification process, ensuring legal and financial clarity for all parties involved in the debt ownership inquiry.

Comments