In today's fast-paced financial world, understanding your rights and responsibilities can feel overwhelming, especially when it comes to debt compliance with laws. Whether you're managing personal debt or navigating business obligations, knowing the legal framework is crucial for protecting your interests. This article will break down the essential elements of debt compliance and offer practical insights to help you stay informed and proactive. So, if you're ready to demystify debt compliance and ensure you're following the law, read on!

Legal references and citations

Debt compliance involves adhering to regulations and legal frameworks governing financial obligations. The Fair Debt Collection Practices Act (FDCPA), a pivotal federal law established in 1977, provides a guideline for debt collectors regarding prohibited practices and borrower protections. Compliance includes actions such as providing validation notices, ensuring no harassment or deceptive practices, and respecting consumer rights under Section 1692g. Additionally, the Truth in Lending Act (TILA) mandates clear disclosures about loan terms, which is crucial for preventing misunderstandings related to interest rates and payment schedules. State-specific laws, like California's Rosenthal Fair Debt Collection Practices Act, further supplement these federal regulations, enforcing additional rights for consumers. Violations of these laws can result in substantial penalties, making adherence critical for lawful and ethical debt collection practices.

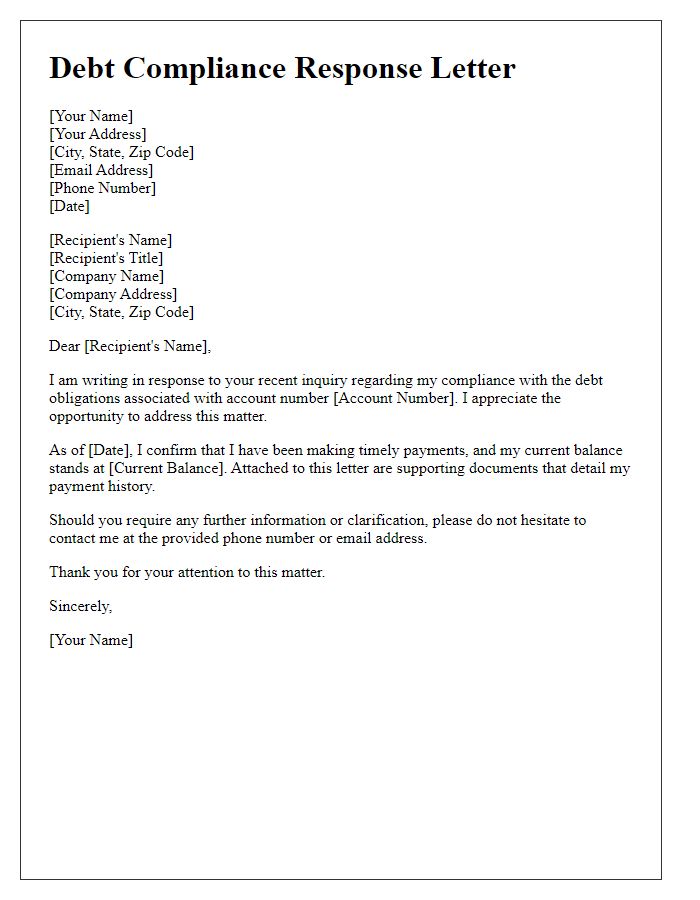

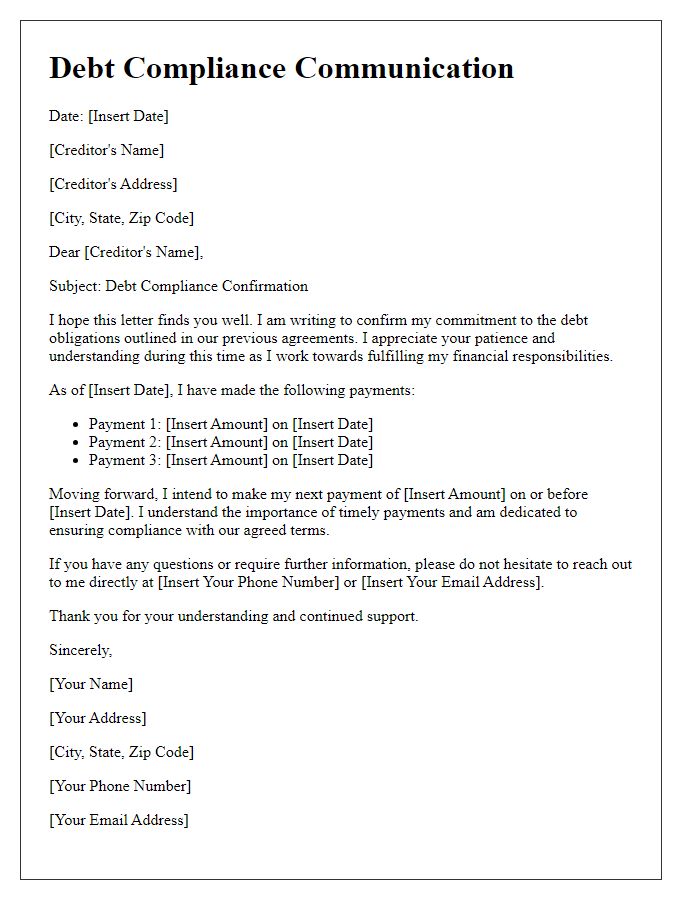

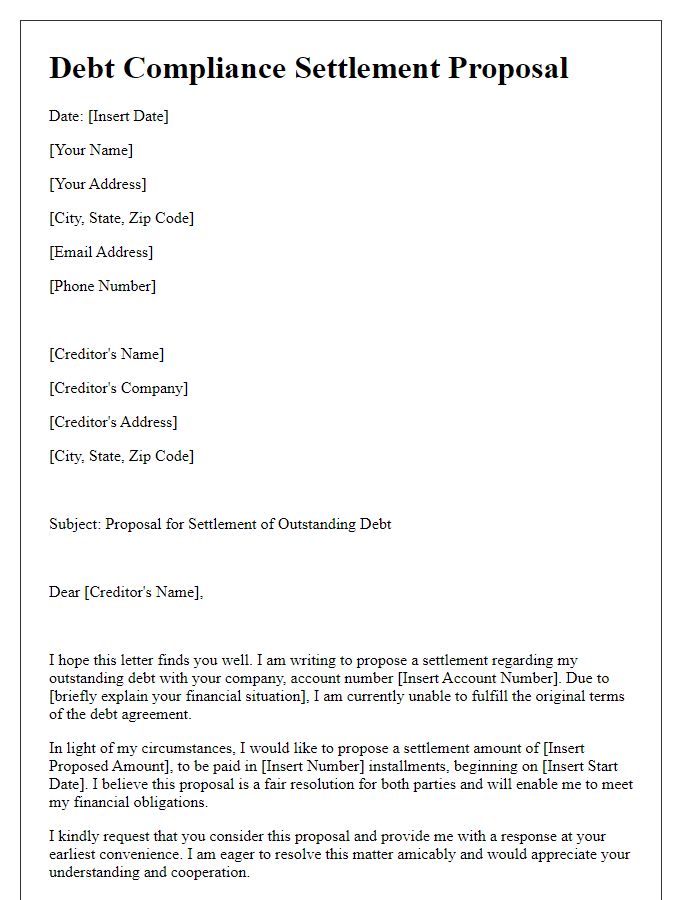

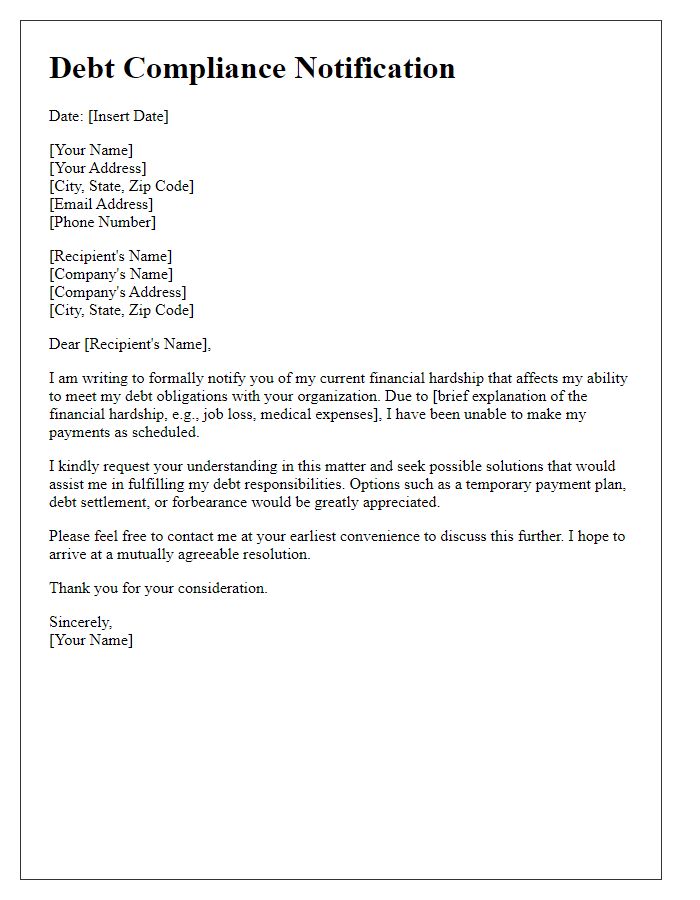

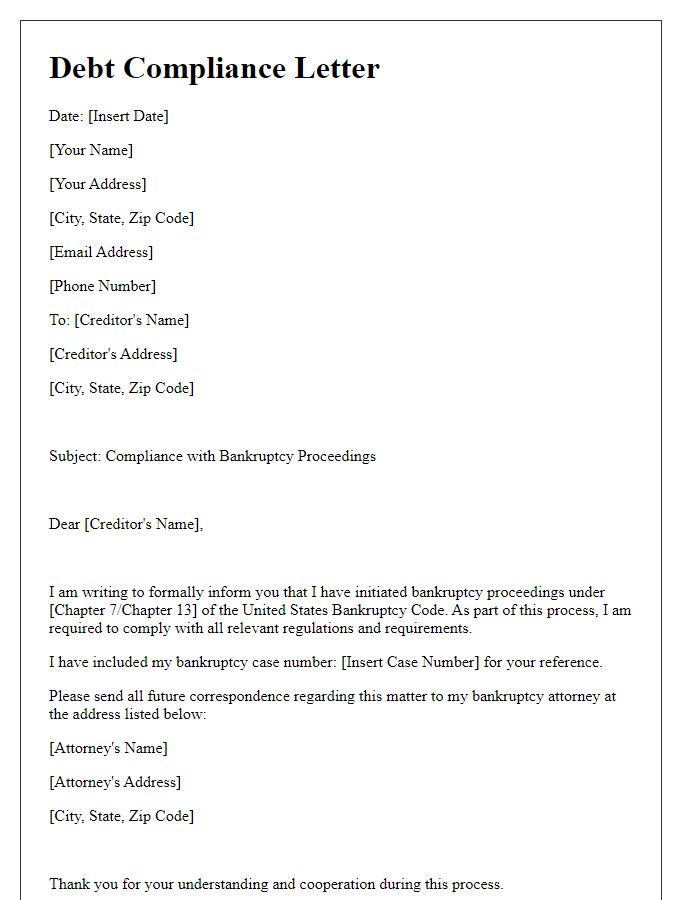

Borrower's and lender's information

Debt compliance requires careful attention to legal obligations regarding loan agreements. Borrower information, such as name, address, contact number, and social security number, is critical for establishing identification and responsibility. Lender information, including the institution's name, address, and representative contact details, clarifies the source of the funds and legal recourse available. Proper documentation ensures transparency throughout the borrowing process and adheres to local regulations, such as the Truth in Lending Act in the United States, which mandates full disclosure of loan terms. Accurate record-keeping of all transactions and communications strengthens compliance and fosters a transparent relationship between borrowers and lenders.

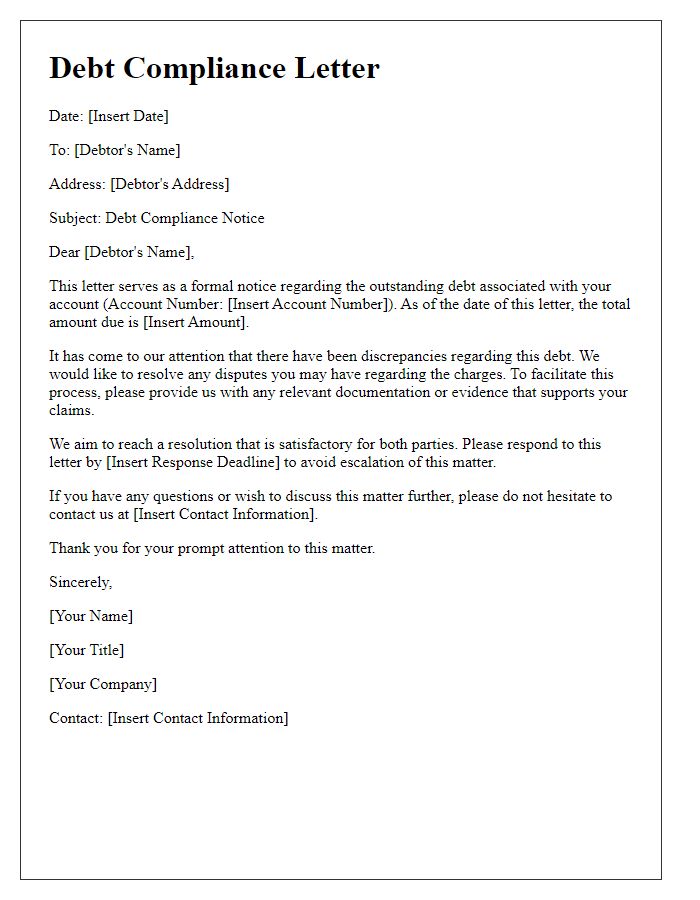

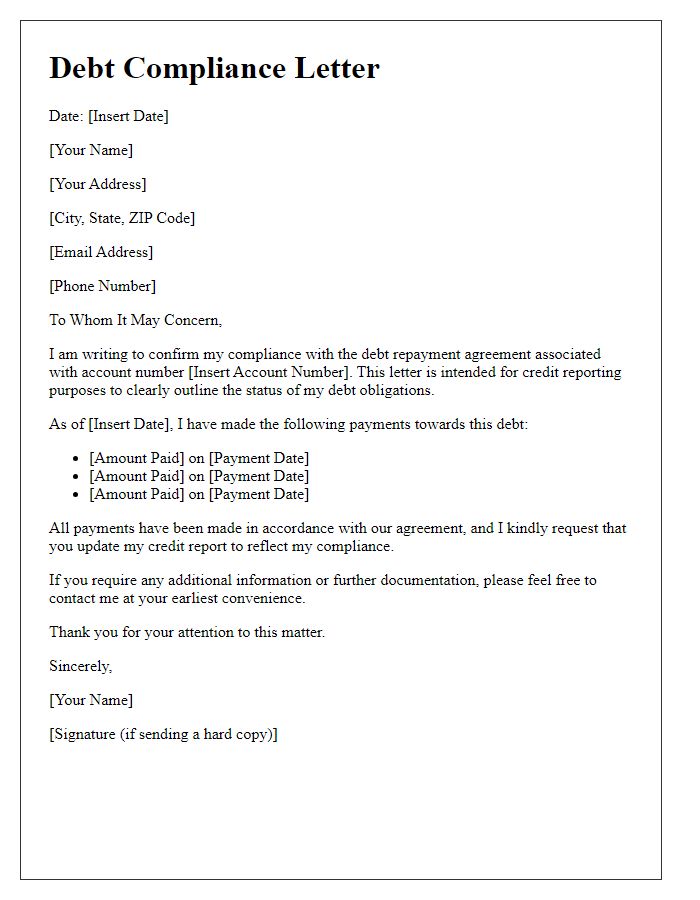

Clear statement of compliance

Debt compliance with federal and state regulations is critical for financial institutions, ensuring transparency and fairness in lending practices. The Fair Debt Collection Practices Act (FDCPA) sets guidelines for third-party debt collectors, prohibiting harassment and requiring clear communication of the debtor's rights. Compliance also involves adherence to the Truth in Lending Act (TILA), which mandates disclosure of loan terms and interest rates to borrowers, promoting informed decision-making. Additionally, local laws may impose further requirements on interest rates and fees applicable in specific jurisdictions, such as California's Rosenthal Fair Debt Collection Practices Act, enhancing consumer protection. Regular audits and staff training on these laws contribute to maintaining compliance and mitigating legal risks.

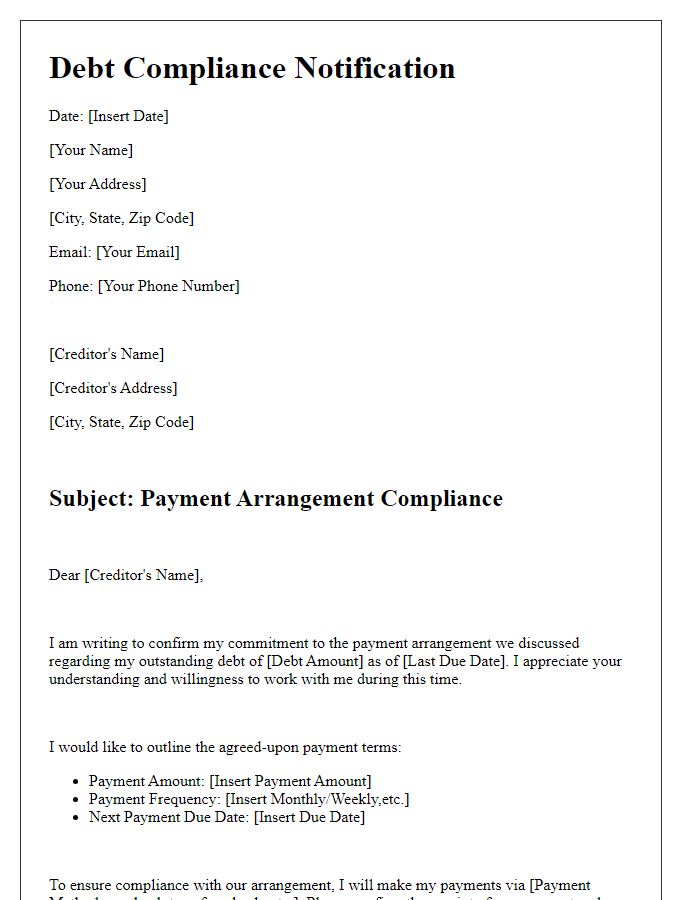

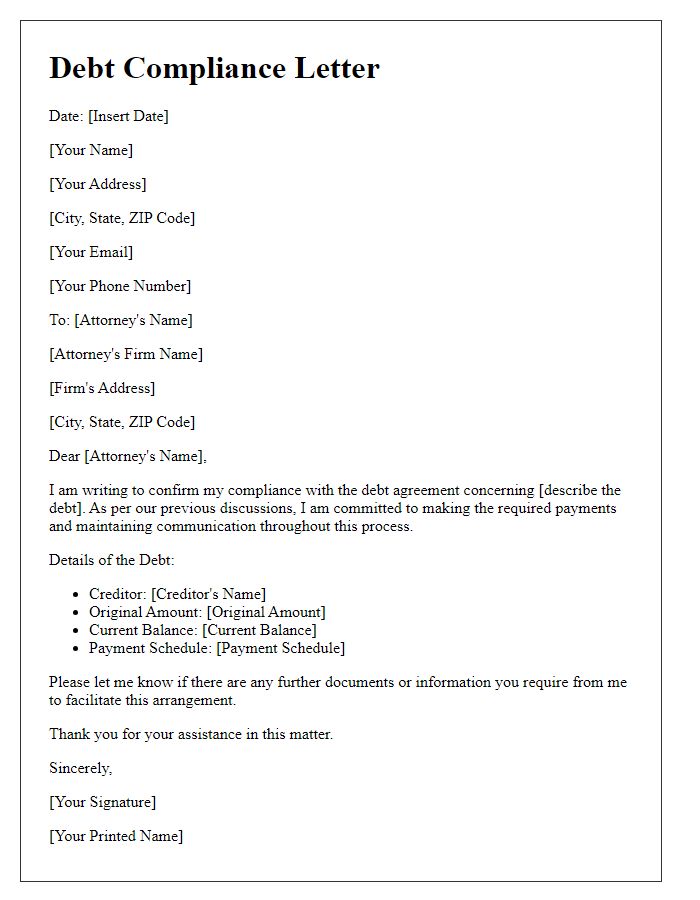

Payment details and instructions

Debt compliance requires meticulous attention to payment details and adherence to legal instructions. Timely payments must align with established deadlines, often specified in the debt agreement. For example, monthly installments on a personal loan may require amounts like $200 due on the 15th of each month. Accepted payment methods typically include electronic transfers, checks, or online payment portals, each accompanied by specific instructions to avoid delays. Accurate documentation, including payment confirmation numbers, is critical for record-keeping and future reference. Compliance with federal regulations, such as the Fair Debt Collection Practices Act, ensures all transactions are conducted lawfully and transparently, safeguarding the rights of both the lender and borrower.

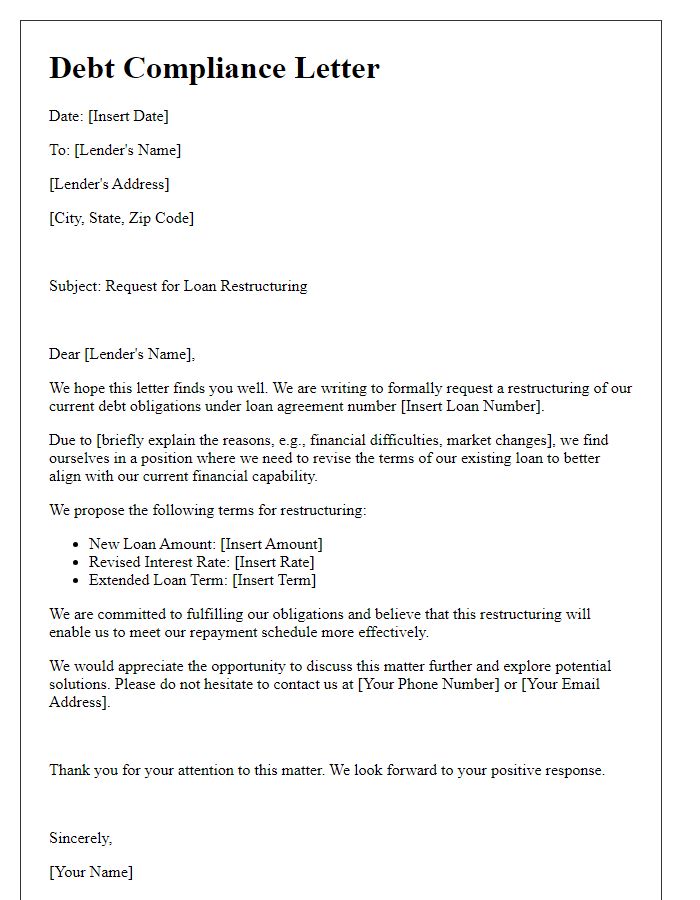

Contact information for queries

Debt compliance regulations ensure that lenders and borrowers adhere to financial laws, protecting individuals from predatory practices. Federal Trade Commission (FTC) guidelines outline fair debt collection practices, while the Truth in Lending Act (TILA) mandates clear disclosure of terms. Creditors must provide accurate information regarding outstanding debts, including the balance, interest rate, and payment deadlines. Clear communication is essential; thus, contact details should include a designated phone number and email address for queries related to debt compliance. This transparency fosters trust and allows individuals to seek clarification on their financial obligations.

Comments