Are you struggling to keep your finances in check, especially when it comes to managing debt? We all know how overwhelming it can be to navigate through various debt obligations, but understanding your debt ledger is the first step towards regaining control. In this article, we'll explore how to effectively acknowledge and categorize your debts, making it easier to devise a plan that works for you. So, let's dive in and see how you can turn your financial situation around!

Clear identification of parties involved

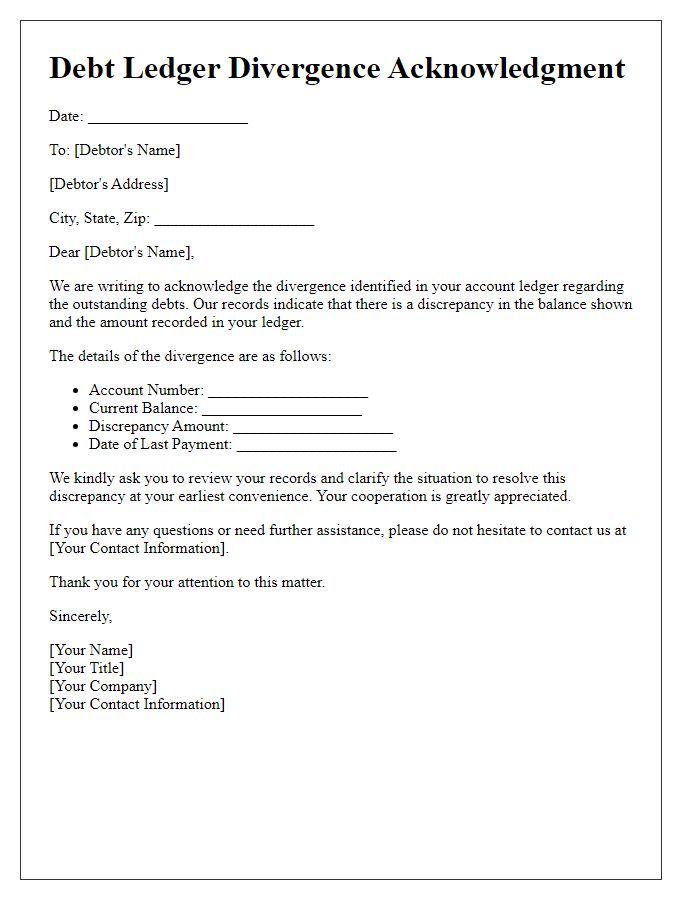

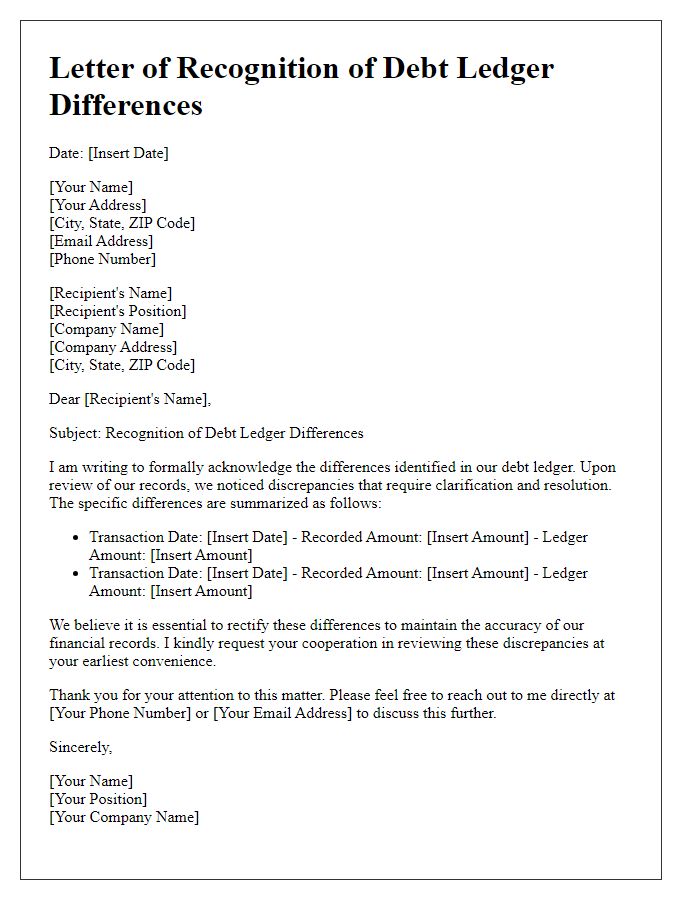

The diverging debt ledger acknowledgment process involves two primary parties: Debtor and Creditor. The Debtor, an individual or entity that owes a financial obligation, must be clearly identified with accurate details such as name, address, and account number. The Creditor, the individual or organization to whom the debt is owed, requires similar identification, ensuring clarity in the relationship. The acknowledgment document should specify the exact outstanding amount, inclusive of any interest rates, deadlines, and repayment terms. Each entry in the ledger should be meticulously logged, providing timestamps for actions taken, ensuring transparency and accountability throughout the duration of the transaction.

Accurate description of debts and obligations

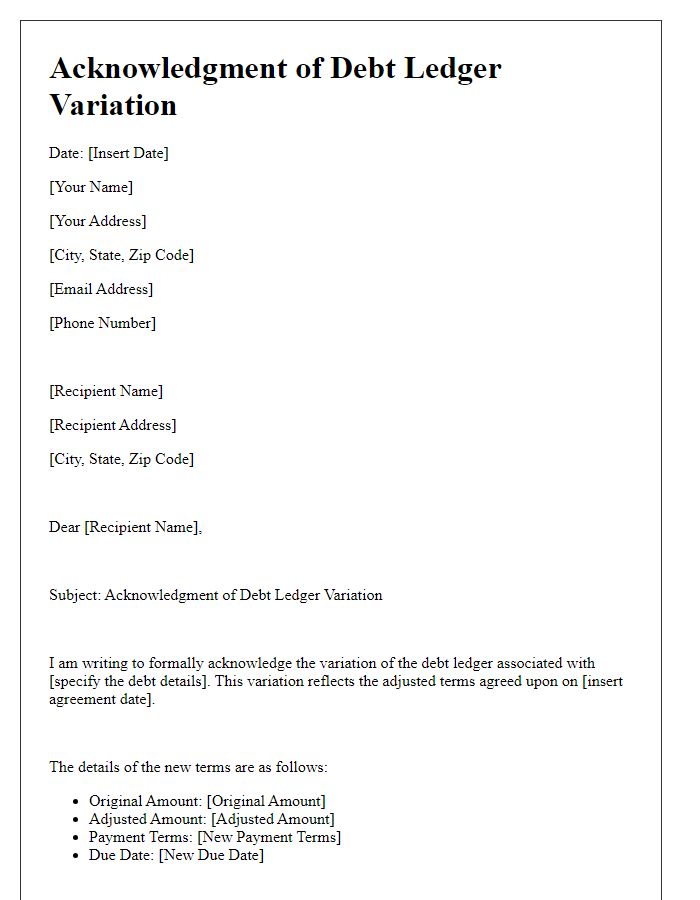

A diverging debt ledger acknowledgment provides a systematic account of financial liabilities, including principal amounts owed, interest rates, and repayment schedules. Creditors may include various entities like banks (financial institutions), service providers (utility companies), and private lenders. Accurate descriptions of debts involve enumerating specific amounts, such as outstanding balances that can range from hundreds to thousands of dollars, and due dates that can span monthly or yearly timeframes. Each entry should detail obligations, including minimum payment requirements and potential penalties for late payments. This clarity ensures transparency between creditors and debtors, guarding against misunderstandings and fostering responsible financial management.

Specific dates and terms of debt

An acknowledgment of a diverging debt ledger involves details like the total outstanding amount, specific payment dates, and terms associated with the debt. For instance, if Company A owes $50,000 to Bank B, with a repayment schedule commencing on January 15, 2024, it's critical to note the interest rate of 5% per annum, which compounds monthly. Moreover, if the agreement specifies a grace period until February 28, 2024, before penalties apply, this should be documented. Record keeping must reflect each transaction accurately, such as April 15, 2024, when $10,000 of the principal is paid, adjusting the remaining balance accordingly. Clear entries with dates and amounts ensure transparency and facilitate easier management of financial obligations.

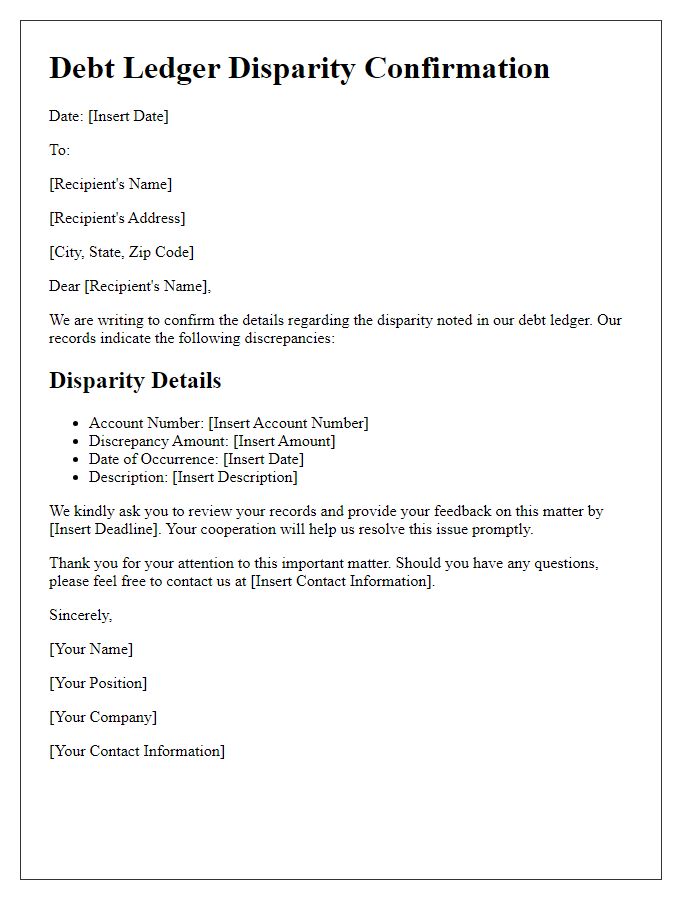

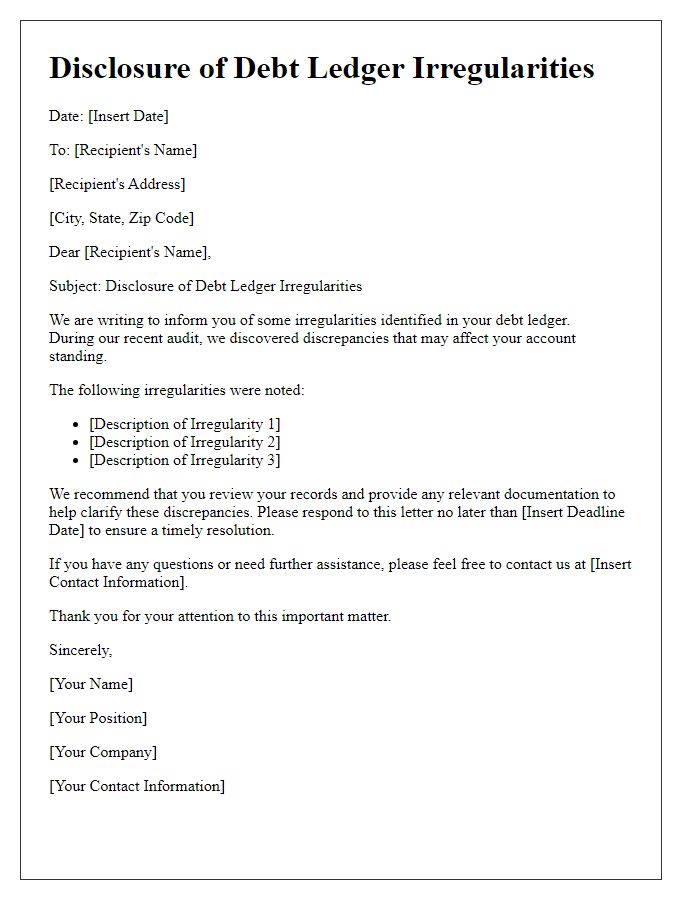

Acknowledgment clause with confirmation

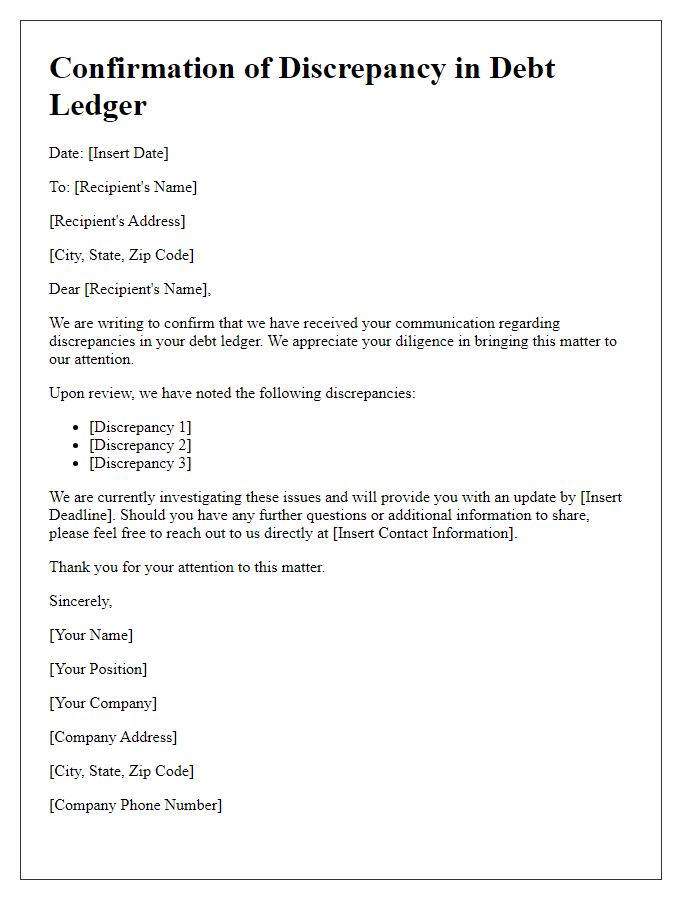

In financial management, organizations often face the necessity of confirming their accounts, particularly regarding diverging debt ledgers. An acknowledgment clause serves as a formal recognition of discrepancies or variations between recorded amounts. This clause typically includes precise figures indicating the debts in question, dates of transactions, and specific reasons for divergence, such as accounting errors or late payments. Confirmation from both parties, often accompanied by signature verification, solidifies an agreement on the current state of the ledger, ensuring transparent communication and fostering trust. This process is crucial to maintaining accurate financial records, minimization of disputes, and enhancing overall fiscal accountability within organizations.

Provision for future communication and updates

A diverging debt ledger acknowledges discrepancies in financial records, critical for maintaining accurate accounting practices. These ledgers serve to reconcile outstanding balances, often influenced by external factors like interest rates, payment schedules, and borrower reliability. Regular updates ensure transparency with stakeholders, including creditors and debtors. Established protocols may facilitate effective communication, detailing upcoming reports or audits. Financial institutions, such as banks or credit unions, utilize this system to manage risks associated with lending practices, crucial for long-term viability. Implementing a structured approach nurtures trust between parties involved, aiding in the resolution of outstanding issues.

Comments