The holiday season is a time for joy and celebration, but it can also bring financial stress for many. If you're feeling overwhelmed by holiday debt, you're not aloneâmany people seek relief through payment breaks or manageable repayment plans. Understanding your options can help you regain control of your finances and enjoy the festivities without the weight of financial worries. So, if you're ready to explore how to ease that holiday burden, read on for practical tips and insights!

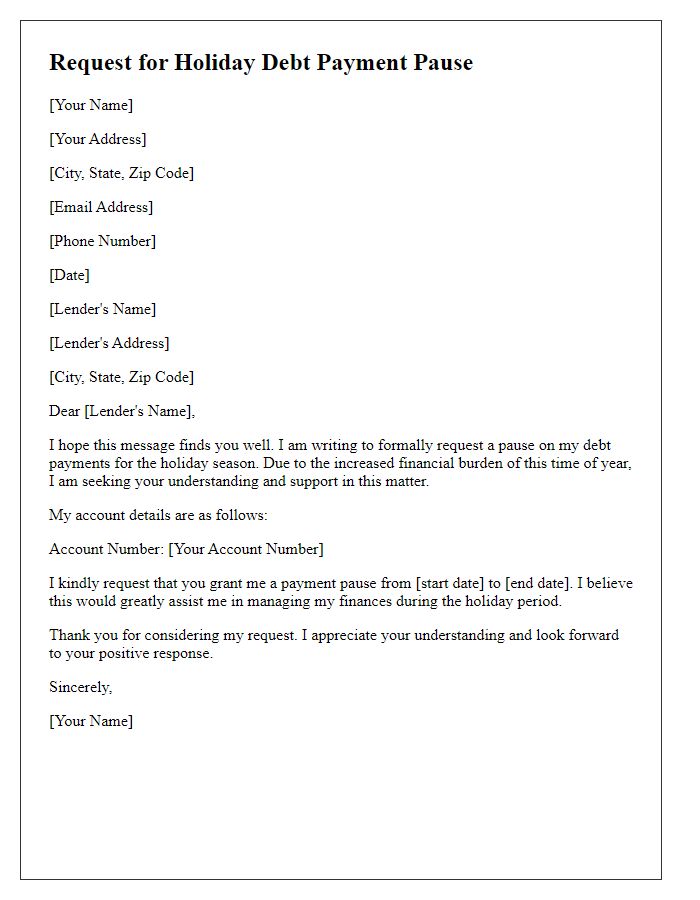

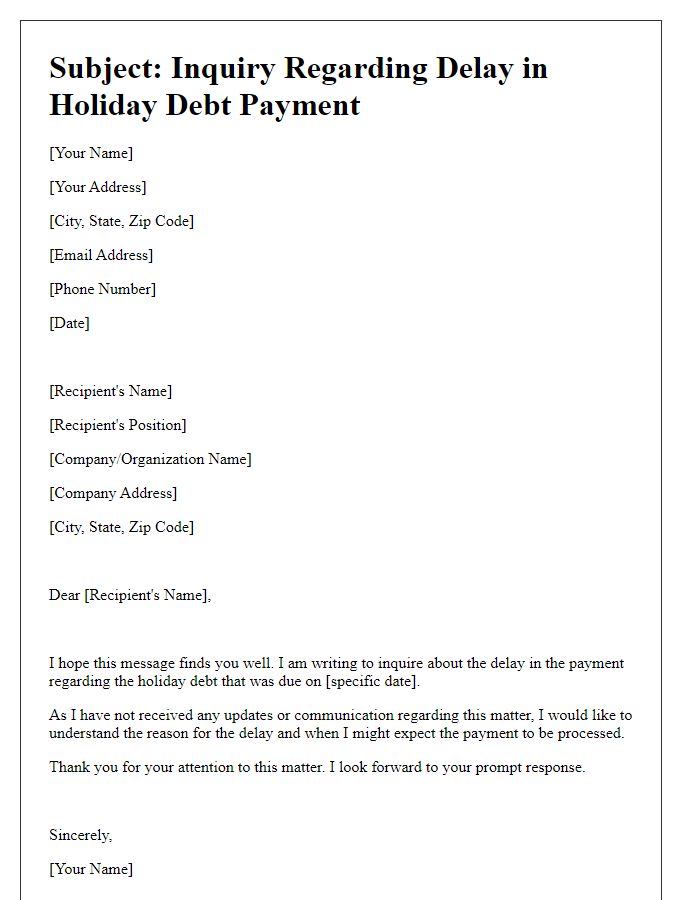

Personal Information: Name, Address, Account Number

Individuals facing financial difficulties during the holiday season may seek a temporary debt payment break to alleviate stress. Commonly offered by financial institutions, this arrangement allows clients to pause repayments on various types of loans, such as personal loans or credit cards, providing relief to those in need. The request typically requires personal information, including name, residential address, and specific account number for verification purposes, ensuring that the institution can efficiently process the request. Seasonal financial strains often arise from increased expenses related to gift giving or travel, making this type of payment relief essential for maintaining financial stability.

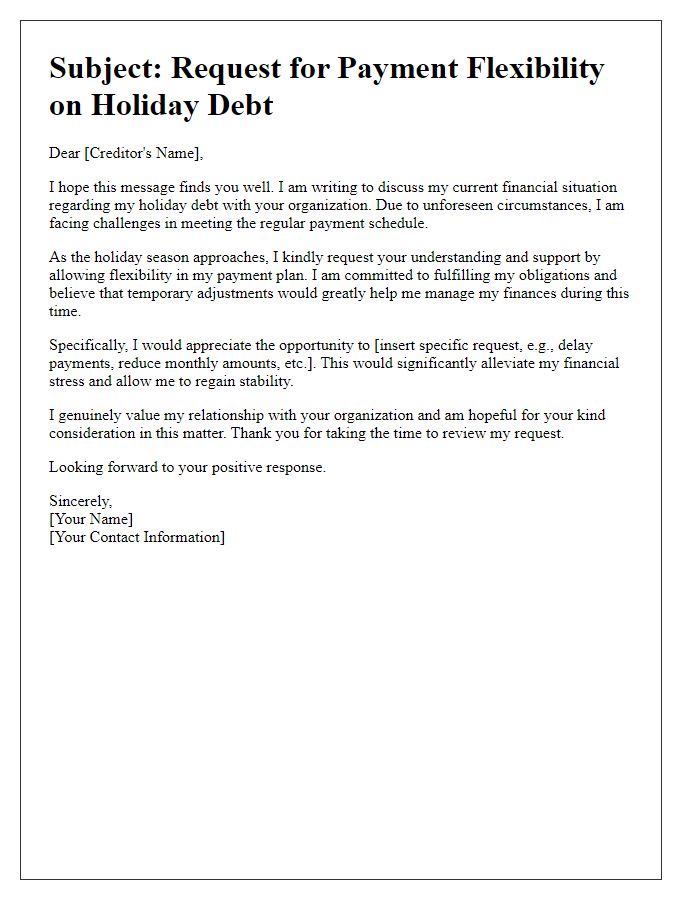

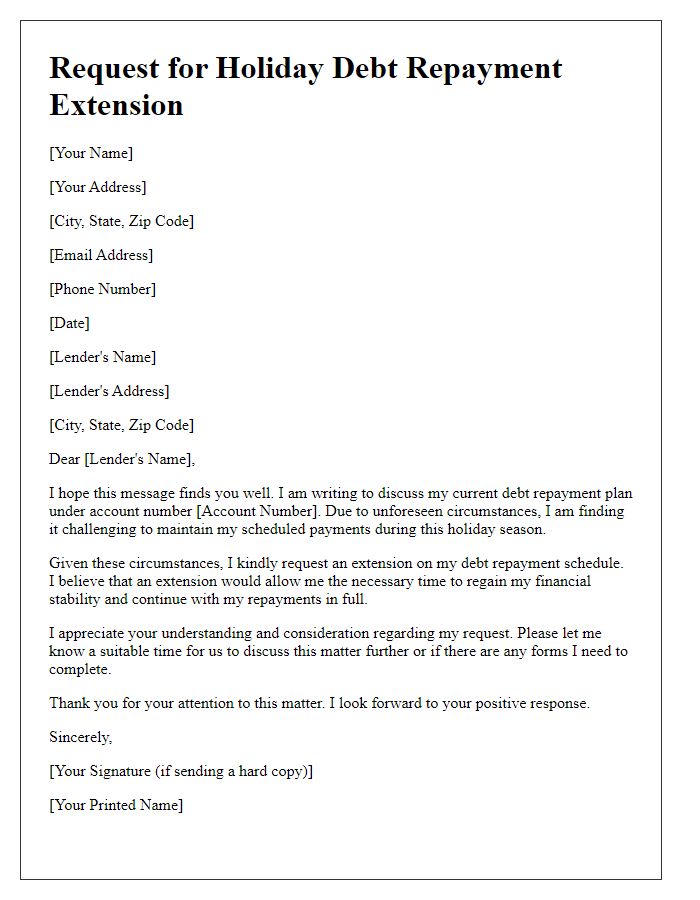

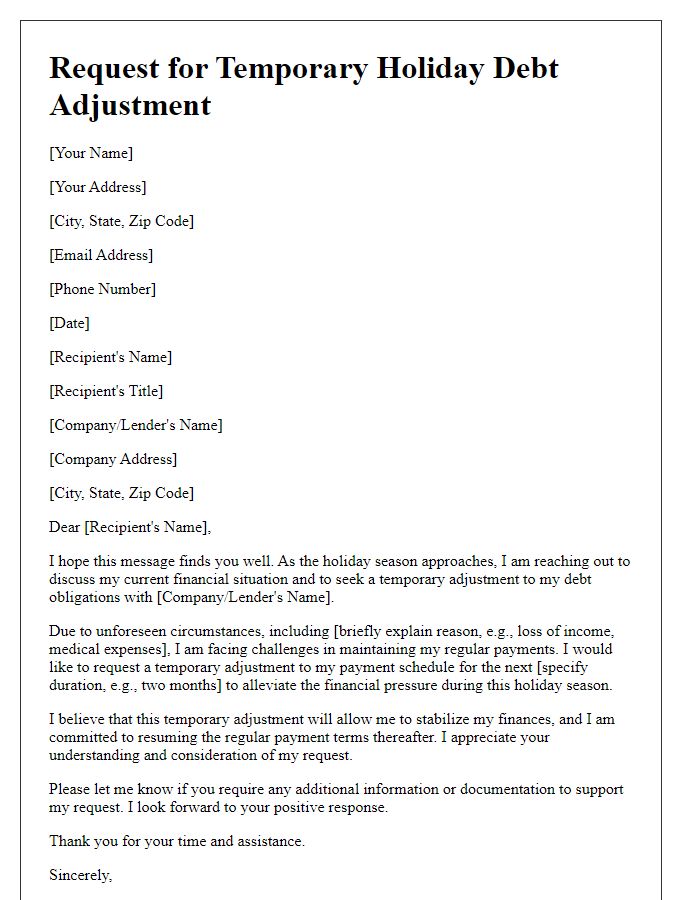

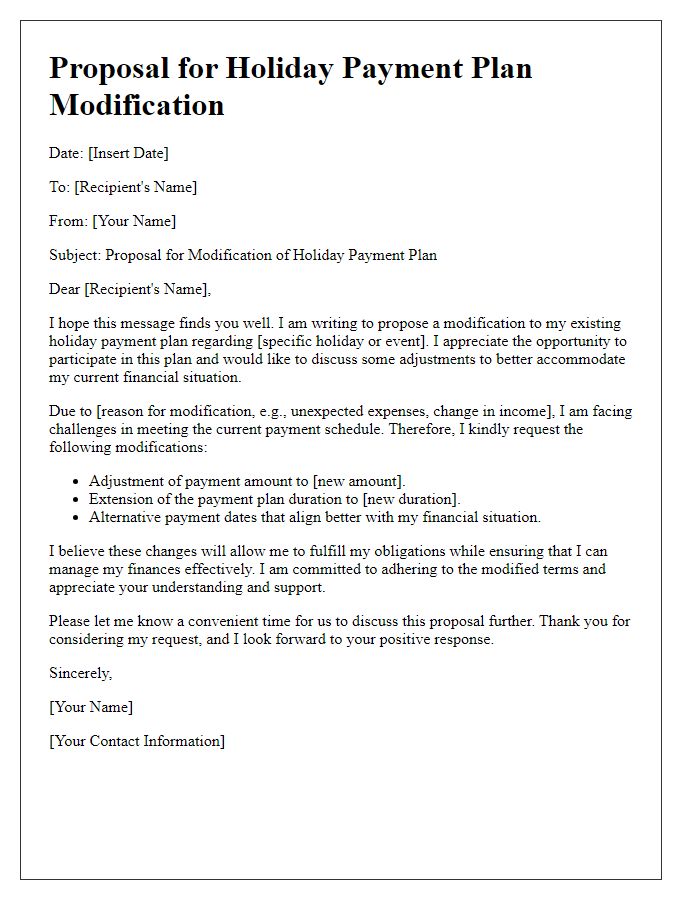

Request Details: Specific Debt, Payment Pause Duration

Requesting a holiday payment break for personal finance management can provide relief during significant financial burdens. For instance, individuals experiencing stress from a credit card debt of $5,000 with a monthly payment of $200 might seek a three-month pause on payments. This temporary relief can offer an opportunity to regroup financially and manage other essential expenses, such as holiday shopping or utilities, which may increase during the festive season. By addressing the lender, outlining the specific debt, and clearly stating the proposed three-month payment pause, individuals can potentially enjoy a healthier balance between managing debts and celebrating seasonal festivities without overwhelming financial strain.

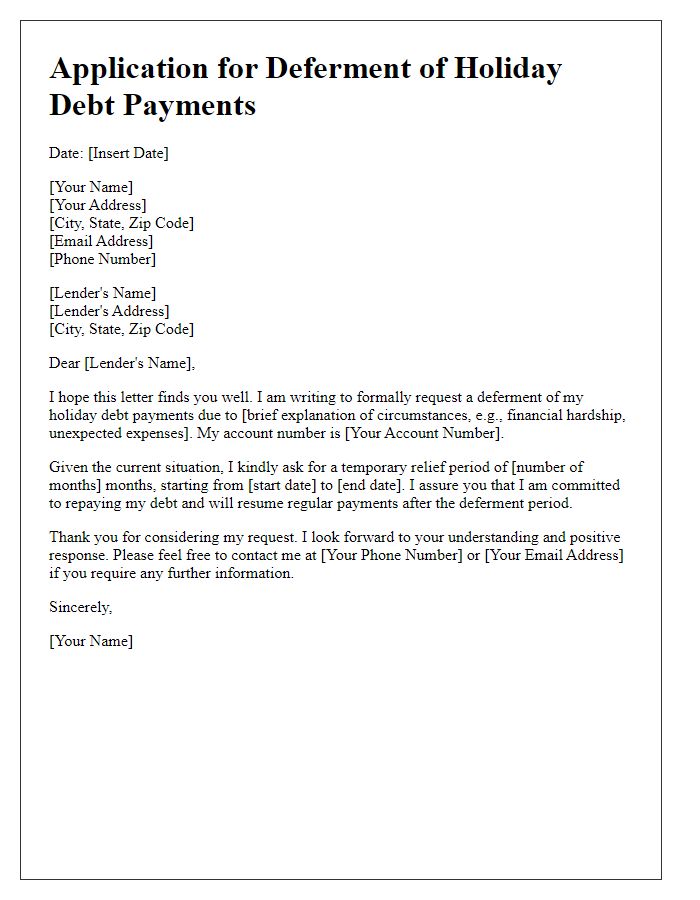

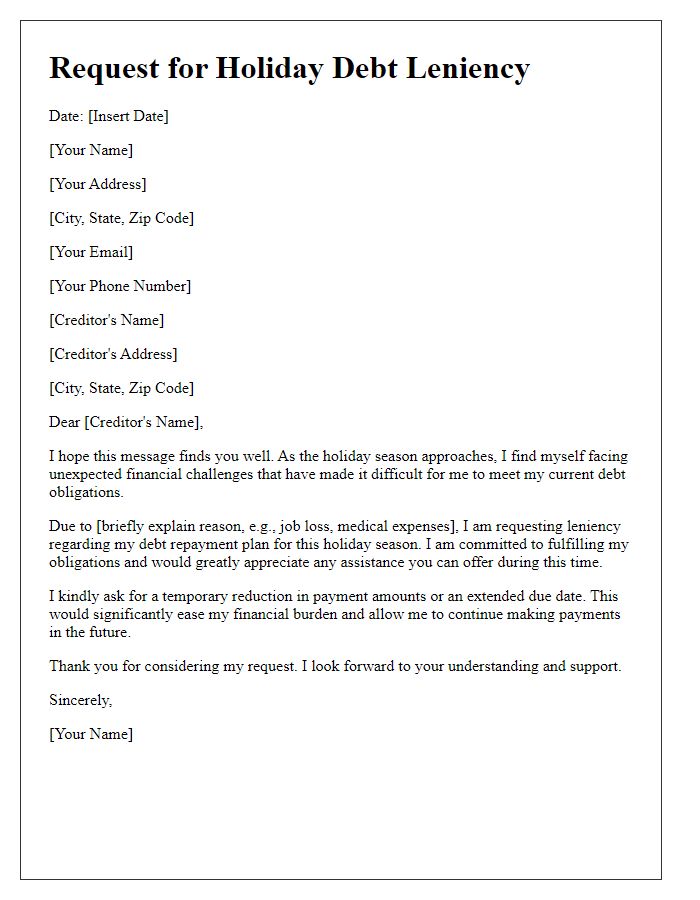

Financial Hardship Explanation: Current Circumstances, Impact on Finances

Many individuals face financial hardship during the holiday season, experiencing unexpected expenses and declining income. For instance, individuals such as retail employees may see reduced hours due to seasonal layoffs or other economic downturns, impacting their overall earnings significantly. Rising costs of living in urban areas like New York City or San Francisco can strain budgets, leading to difficulty in managing existing debt. This period can also bring about unavoidable expenses, such as increased utility bills due to winter heating or holiday-related spending on gifts and travel. Such financial pressures can create a perfect storm, severely impacting one's ability to make timely debt payments, resulting in missed deadlines or increased interest rates. Seeking a temporary payment break can provide much-needed relief during these challenging times.

Supporting Documents: Income Proof, Expense Summary

Individuals seeking a holiday debt payment break often need to provide specific supporting documents to lenders. Income proof, such as recent pay stubs or tax returns, should demonstrate financial stability or changes affecting repayment capability. An expense summary detailing monthly obligations like rent, utilities, and groceries can illustrate financial strain during the holiday season. Submitting these documents to financial institutions can facilitate a clearer understanding of the borrower's situation, thereby assisting in negotiating favorable terms for debt relief. Additionally, maintaining clear communication with lenders can foster a supportive relationship, potentially easing repayment burdens amidst festive spending.

Polite Conclusion: Appreciation, Contact Information

During the holiday season, many individuals face financial strains due to increased spending. Acknowledging financial challenges, individuals may seek a temporary relief in debt payments. This compassionate approach recognizes the need for breathing room, particularly after events like Thanksgiving and Christmas, where expenses can skyrocket. Contacting your financial institution or creditor can initiate discussions regarding potential payment breaks. Expressing gratitude for their understanding and offering clear contact information fosters a collaborative atmosphere, enhancing communication and support during this trying time.

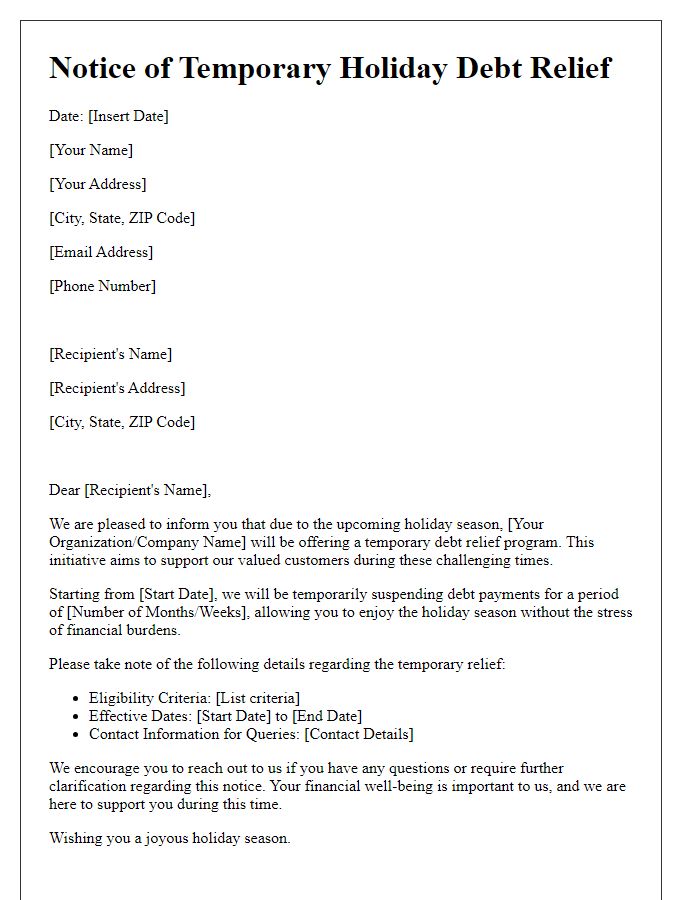

Letter Template For Holiday Debt Payment Break Samples

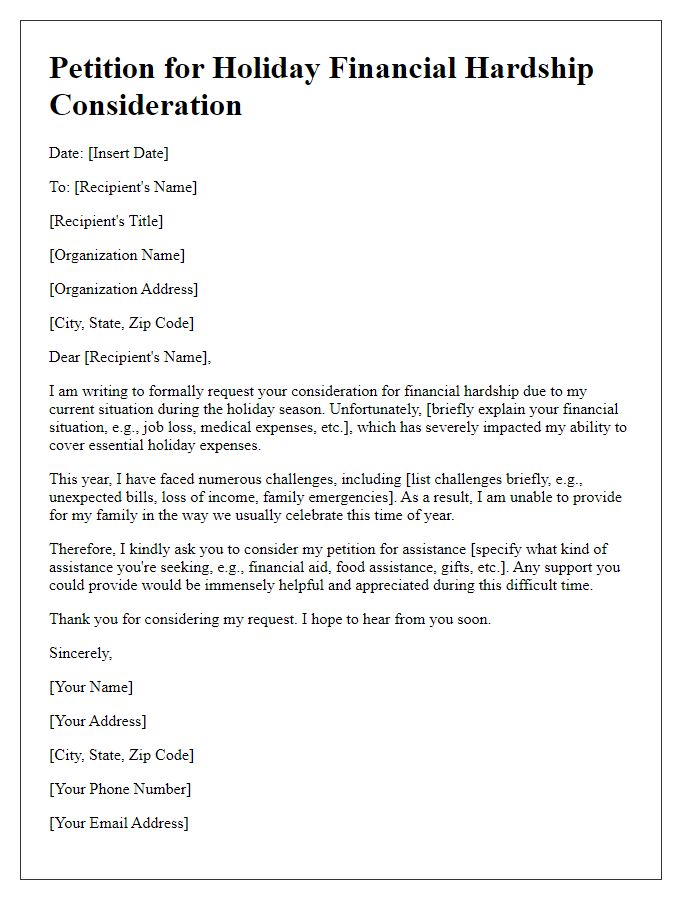

Letter template of petition for holiday financial hardship consideration

Comments