Are you feeling overwhelmed by debt and unsure where to turn for help? Navigating your financial obligations can be daunting, but you don't have to do it alone. With a well-crafted letter for debt payment by proxy, you can give someone else the authority to manage your payments on your behalf, creating a smoother path towards financial stability. Dive into this article to discover the essentials of writing an effective letter that protects your interests and eases your burdenâlet's explore together!

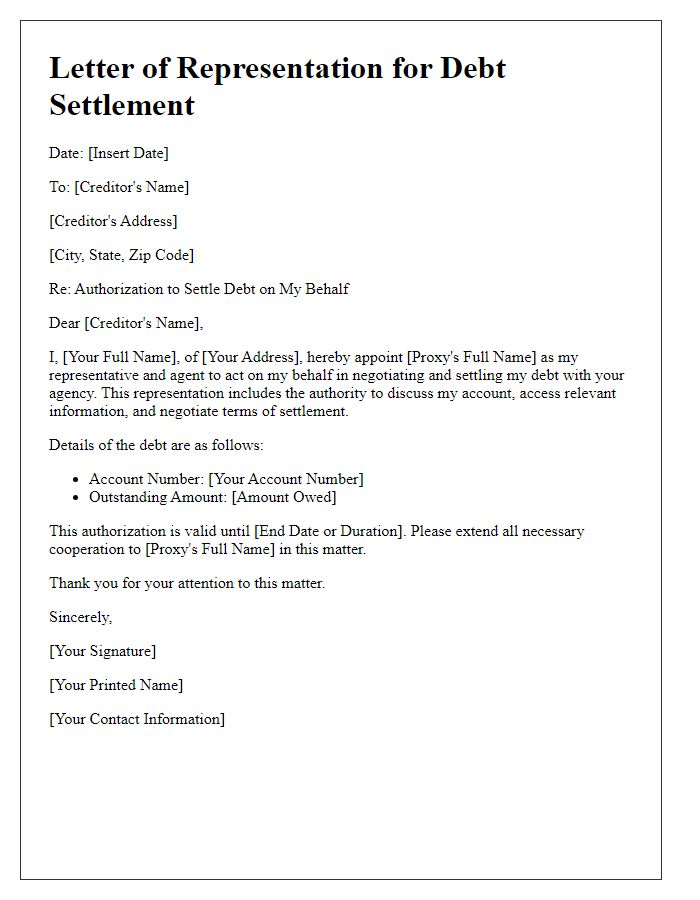

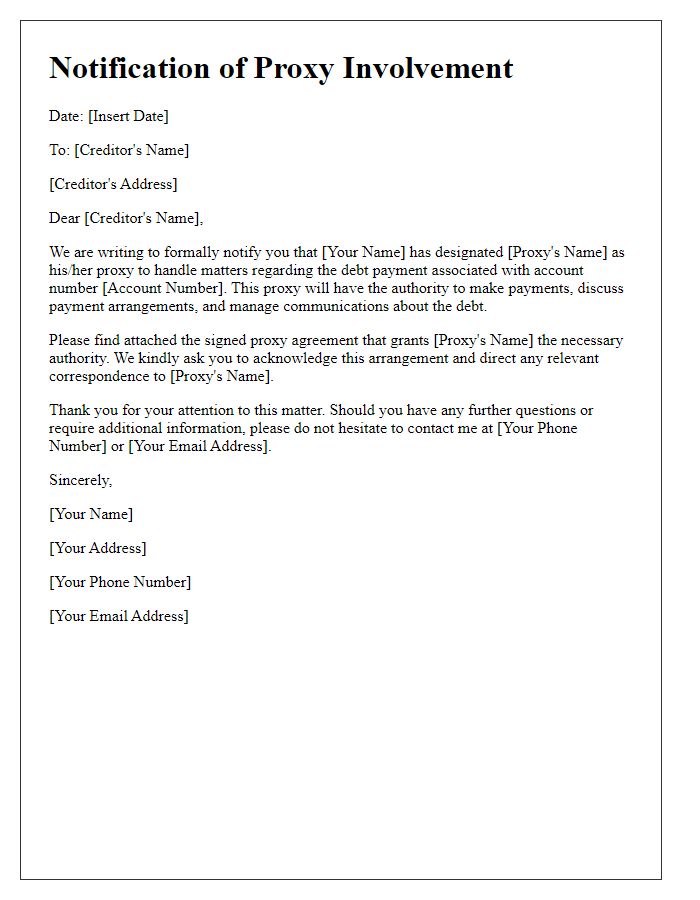

Personalized debtor and creditor information

A debt repayment agreement can streamline the process for settling obligations, especially in instances where payment is made by a proxy. Debtors (individuals or entities liable for payment) must provide specific details, including their name, address, and account number, while creditors (the parties to whom the debt is owed) must similarly include their name, contact information, and any reference number associated with the debt. It is essential to outline the proxy's information, including their name and relationship to the debtor, to ensure proper authorization. This agreement should specify the debt amount, payment date, and method of payment, such as cash, check, or electronic transfer, while also highlighting any applicable fees or interest rates. Documentation supporting the authorization for proxy payment must accompany this agreement to safeguard all parties involved.

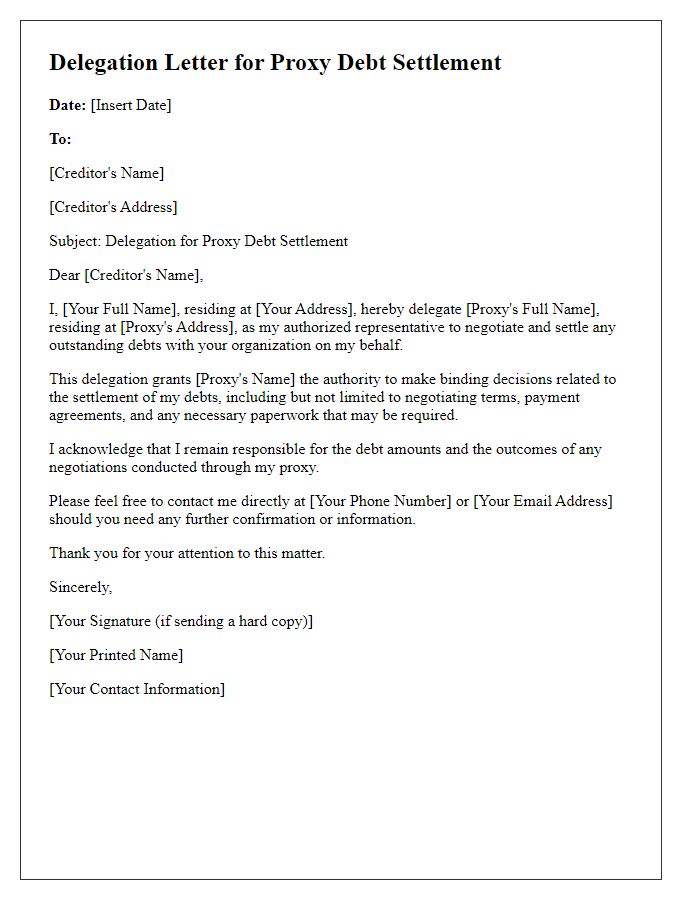

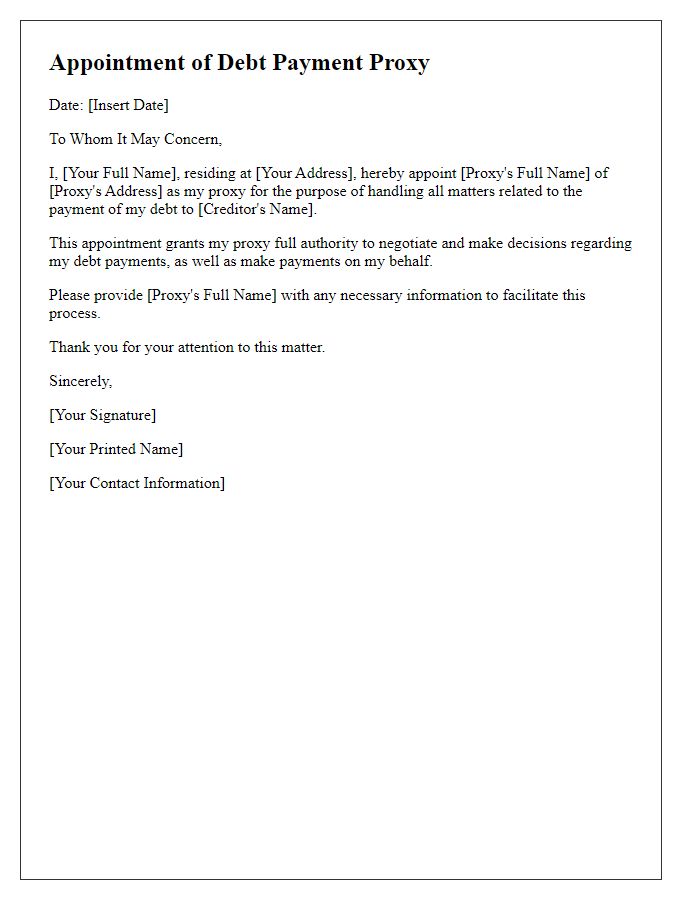

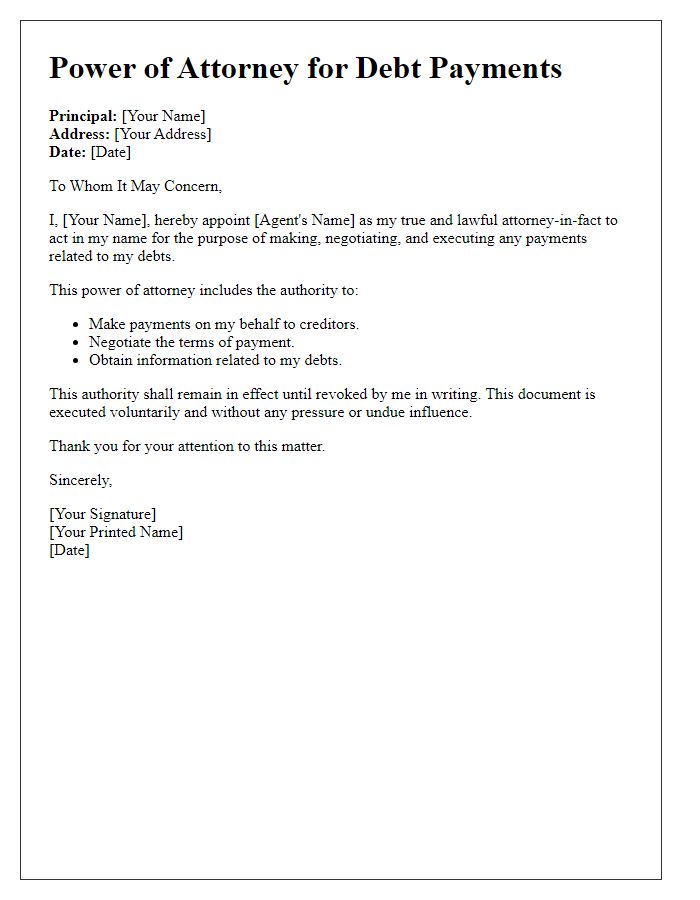

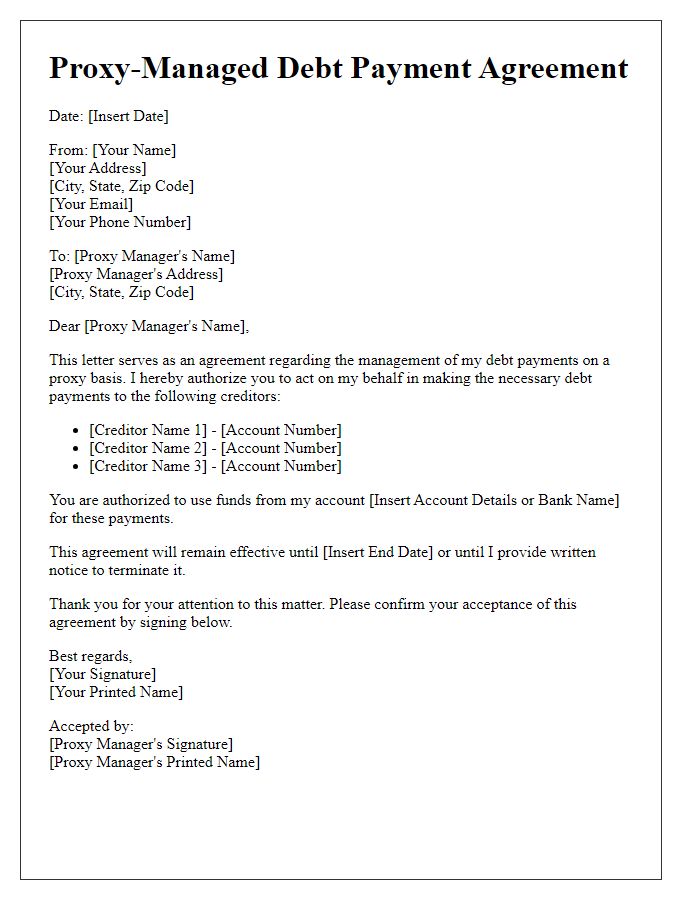

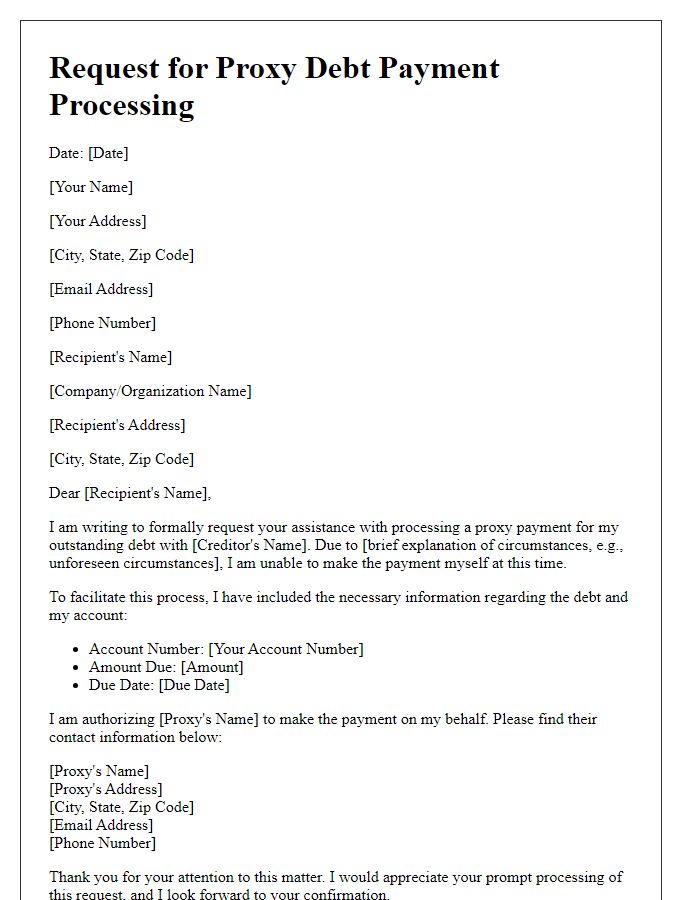

Clear identification of the proxy

A proxy for debt payment authorizes an individual or entity to settle outstanding debts on behalf of the debtor, ensuring financial obligations are met. Identification of the proxy includes essential details such as full name, address, contact number, and any relevant identification number, like a Social Security Number or tax identification, to verify their authority. The document should specify the nature of the debt, including the total amount owed, the creditor's name, and the due date to maintain transparency. Additionally, explicit instructions on how payments should be made--whether via check, electronic transfer, or credit card--are crucial in guaranteeing that the payments are processed correctly. This clear identification fosters trust between all parties involved in the transaction.

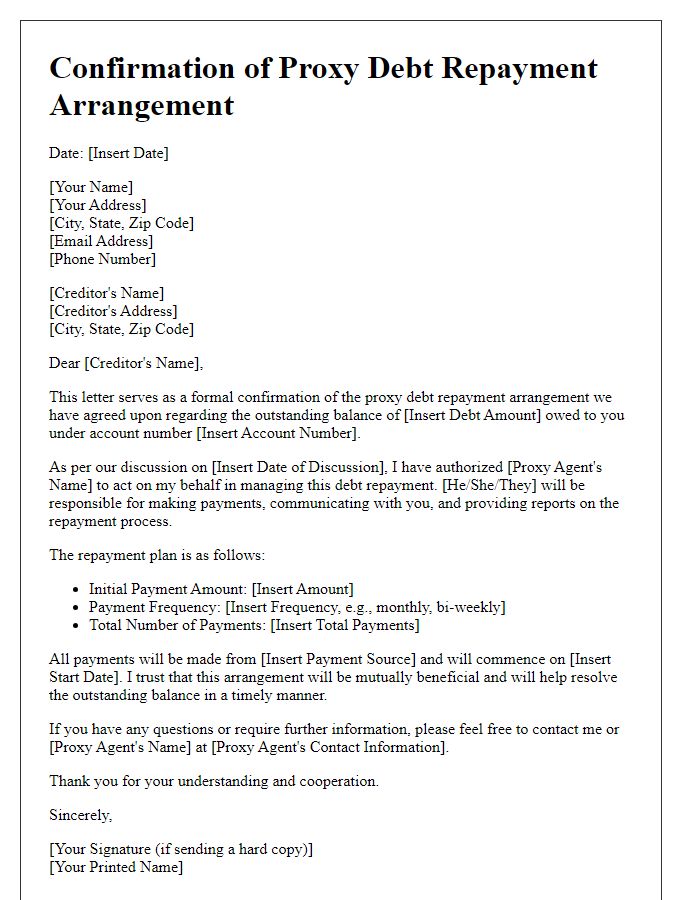

Detailed payment plan and terms

A well-structured debt payment plan outlines a systematic approach to repaying outstanding financial obligations, including specific terms and conditions. This plan typically begins with the total debt amount, which can vary widely based on individual circumstances and agreements, often ranging from hundreds to thousands of dollars. An essential component is the proposed schedule for payments, specifying frequency such as monthly or bi-weekly, with clear due dates, for example, the 1st and 15th of each month. Interest rates applied may be included, which can affect the overall repayment amount significantly, often between 3-15% annually. Additionally, having an agreed-upon method for payment, such as direct bank transfers or checks, enhances clarity and accountability. The plan might also address potential consequences for failure to pay, including late fees or increased interest rates, ensuring both parties understand their responsibilities. Overall, a comprehensive debt payment plan fosters transparency and cooperation between creditor and debtor, promoting successful resolution of the financial obligation.

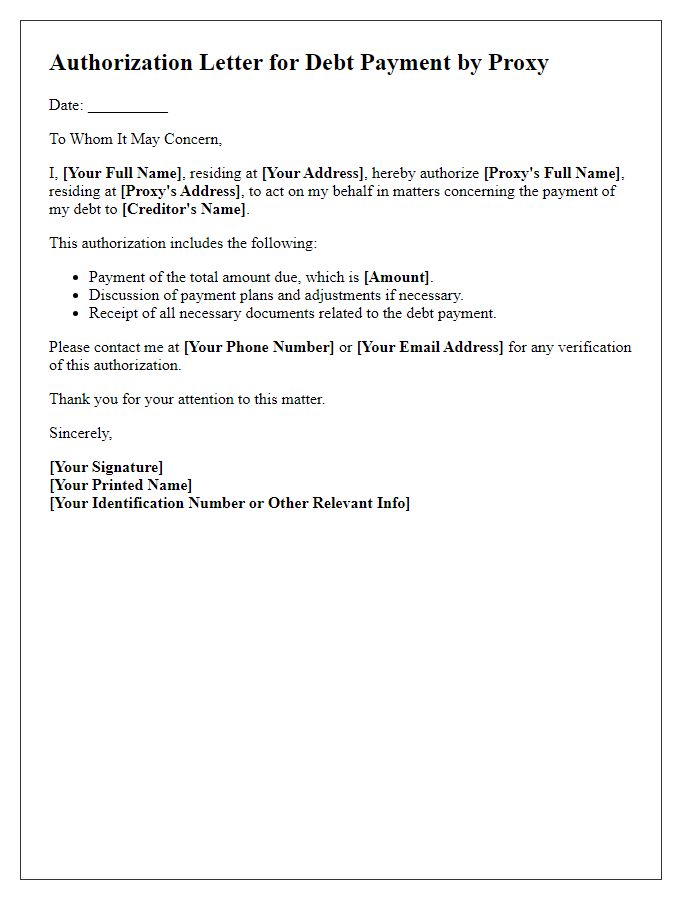

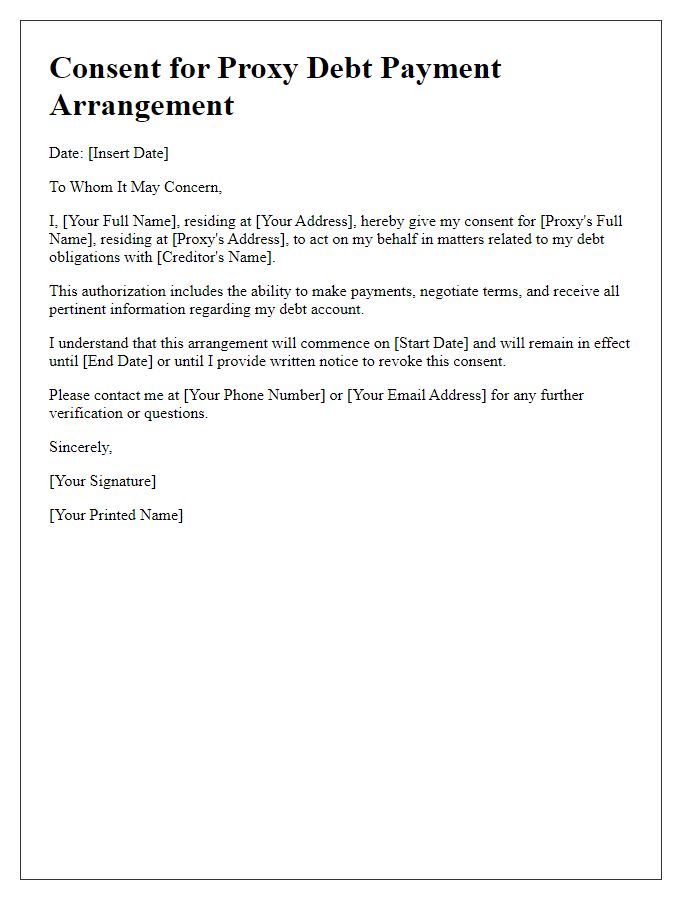

Authorization and consent from the debtor

Authorization for debt payment by proxy involves the debtor granting permission for a third party to handle their financial obligations. This written consent outlines specific details, including debtor's name, debtor's account number, and total debt amount, ensuring clarity. The proxy, often a trusted individual or financial advisor, must be identified by name along with contact information, facilitating communication. This document should include a statement declaring the debtor's understanding of their responsibility, even when payments are made by the proxy. Additionally, the debtor's signature and date should be provided to validate the agreement, confirming legitimacy in financial transactions. Legal ramifications and potential consequences of missed payments should also be noted to ensure transparency and accountability.

Contact information for communication and follow-up

Effective communication and follow-up regarding debt payment by proxy necessitate a structured approach. Primary contact details should include name, phone number, and email address of the debtor's representative, ensuring clarity in communication. Documenting preferred methods of contact is essential, highlighting urgency, such as indicating the best times to reach the representative during business hours (9 AM to 5 PM, Monday to Friday). Additionally, providing a physical mailing address for formal correspondence can facilitate the exchange of documents relating to the debt, ensuring that all parties are kept informed. Keeping organized records of all communication will serve as a reference point, further streamlining the resolution process.

Comments