Are you struggling to keep up with your installment debt payments? You're not aloneâmany people find themselves in similar situations, wondering how to manage their financial obligations. In this article, we'll guide you through creating a straightforward letter template for an installment debt agreement that can help simplify your communications with creditors. So, if you're ready to take control of your finances, read on for some practical tips and insights!

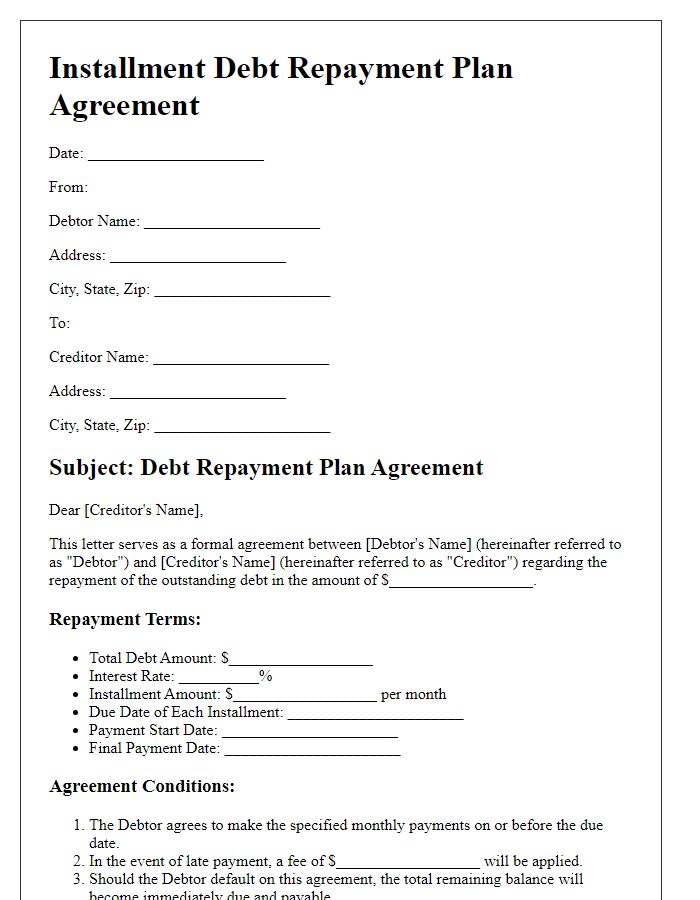

Parties' Full Names and Contact Information

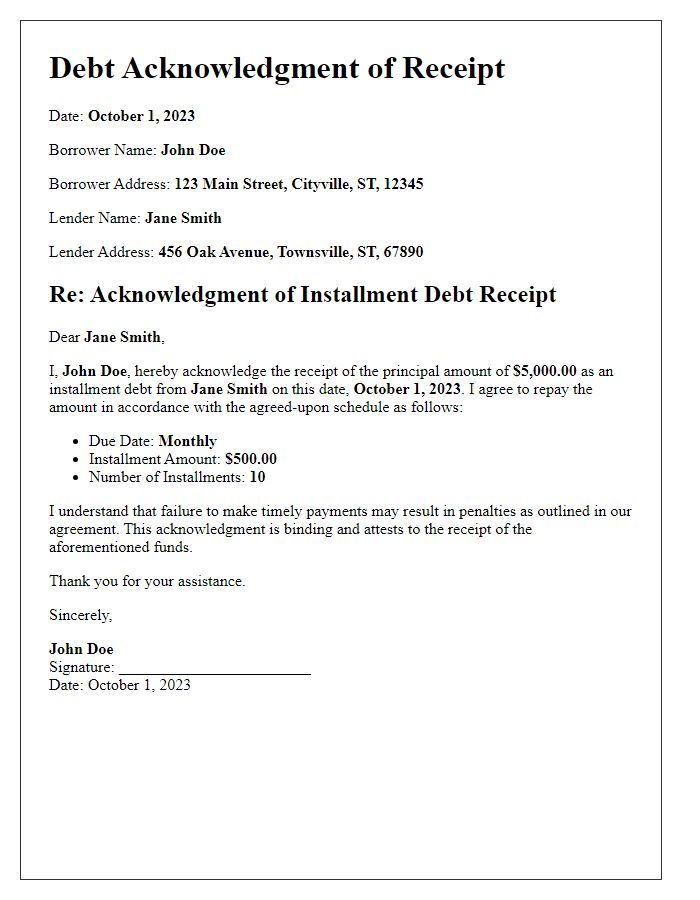

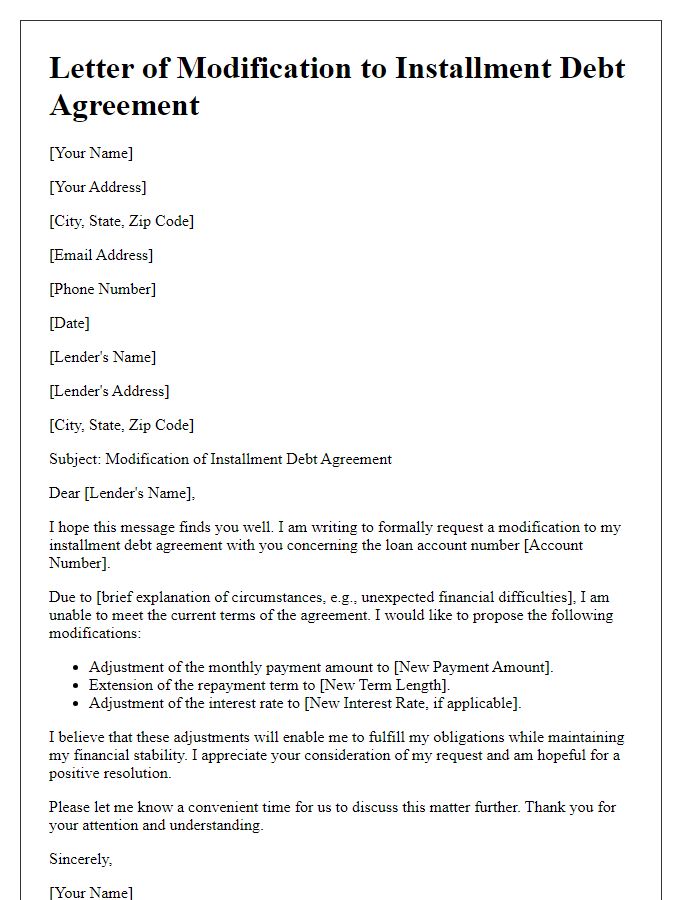

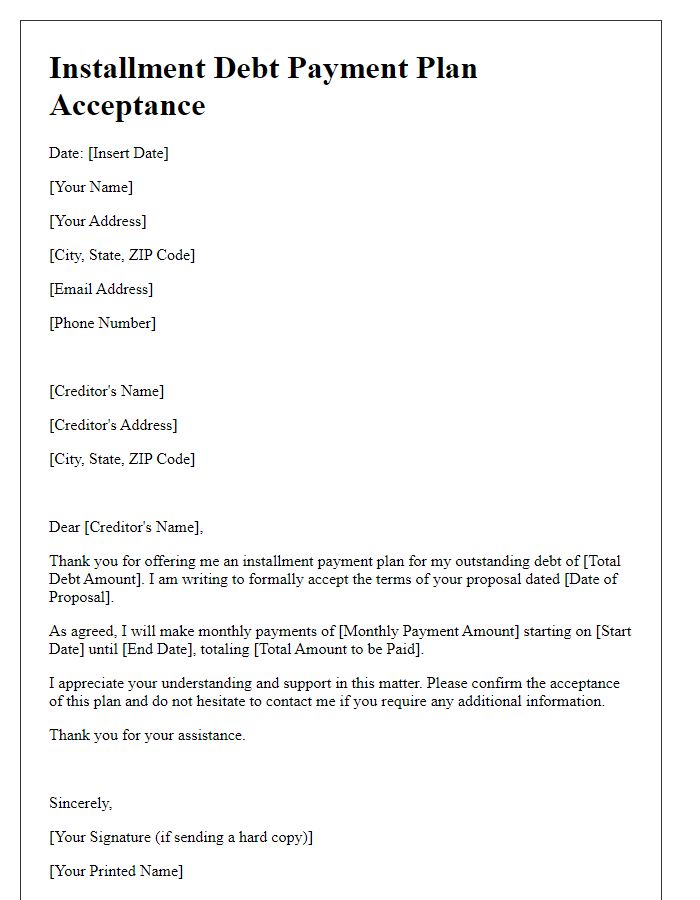

A well-structured installment debt agreement consists of essential details about the parties involved, such as their full names (both the borrower and lender), and comprehensive contact information. The first party, typically the borrower, should provide their full legal name, home address, phone number, and email address, ensuring clarity in identification. The lender, often a financial institution or individual, must also present similar information, including the entity's full name, physical address, and preferred communication methods, which may include email and telephone. This foundational information establishes a clear, formal relationship between the parties, ultimately facilitating smoother communication and effective management of the debt obligations over the agreed-upon installment schedule.

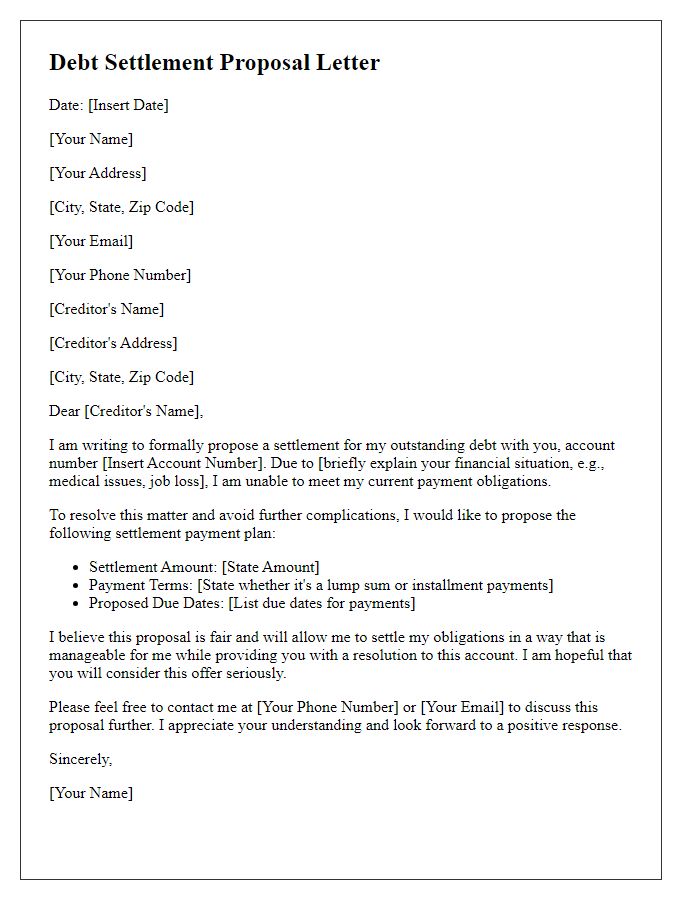

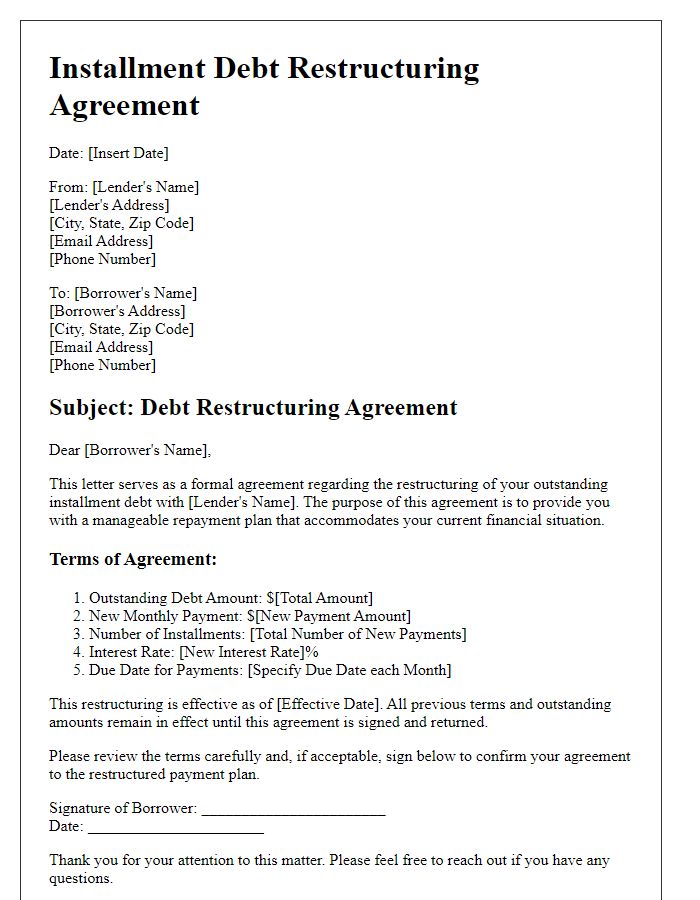

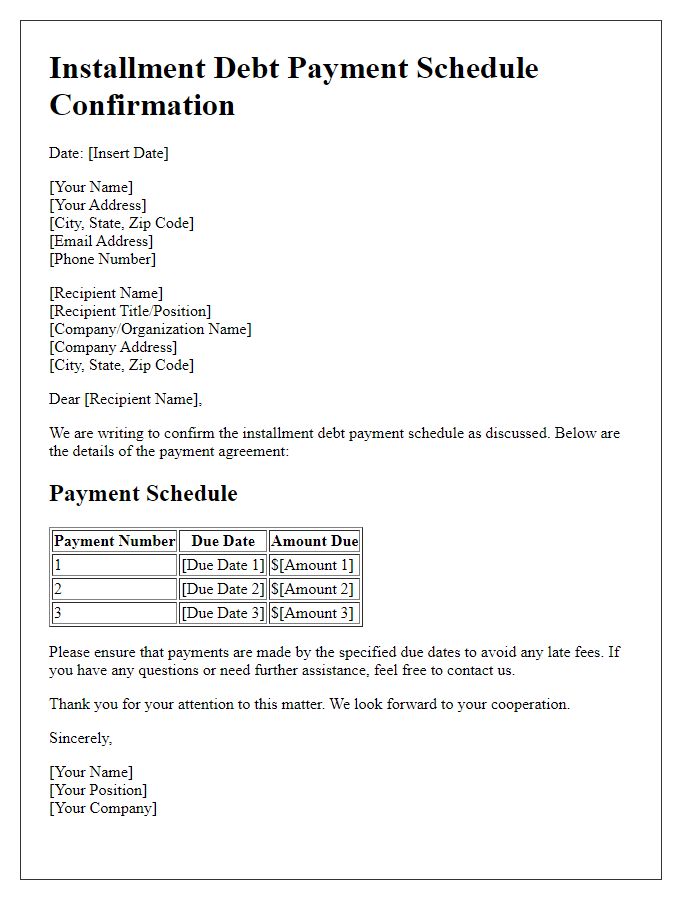

Loan Amount and Payment Terms

An installment debt agreement typically outlines specific details regarding the loan amount, payment schedule, interest rates, and consequences of defaulting on payments. For instance, a borrower may secure a personal loan of $10,000 with an annual interest rate of 7%. The repayment terms could specify monthly payments of $200 over a period of five years. In this scenario, the total repayment would equate to approximately $12,000, which includes $2,000 in interest accumulated over the course of the loan. The agreement may also stipulate that failure to meet payment deadlines may result in late fees totaling $50 for each missed installment, as well as potential negative impacts on the borrower's credit rating. Such agreements are crucial for both lenders and borrowers, ensuring clear communication and expectations during the life of the loan.

Interest Rate and Total Repayment Amount

An installment debt agreement outlines the terms of borrowing, specifying the interest rate applied to the principal loan amount, as well as the total repayment amount due over the loan's duration. For example, if the principal is $10,000 with an annual interest rate of 5%, the total repayment amount over a 5-year term would reach approximately $11,500, including both principal and interest. Detailed terms may specify monthly payments, with adjustments based on the remaining balance after each installment, ensuring clarity regarding payoff schedule and potential penalties for late payments. Additionally, the agreement may highlight legal obligations, providing an enforceable framework for both lender and borrower under applicable jurisdiction laws.

Late Payment Penalties and Default Conditions

Installment debt agreements often include provisions regarding late payment penalties and default conditions. In these agreements, a late payment penalty may be assessed after a grace period of 15 days, resulting in a fee of up to $50. Default conditions may arise if three consecutive payments are missed, leading to the total outstanding balance becoming immediately due. This includes not just the initial principal but also accrued interest, which could be as high as 18% annually. Legal actions may be initiated for collection within 30 days of default, potentially resulting in court costs and additional fees for the borrower. Understanding these terms is crucial for borrowers to avoid significant financial repercussions.

Signatures and Date of Agreement

A well-drafted installment debt agreement outlines the terms of repayment between two parties. The document should include essential information such as the full names of both the borrower and the lender, the exact amount of debt (often specified in U.S. dollars), the payment schedule detailing the frequency and amount of each installment, and any applicable interest rates. Both parties must provide their signatures in designated spaces to validate the agreement. A date of agreement section should be clearly indicated so that both parties acknowledge the commencement of the repayment timeline. Additionally, including a witness signature can strengthen the document, providing further legitimacy to the terms agreed upon.

Comments