Are you struggling with overwhelming debt and looking for a way out? You're not alone, as many people find themselves in similar situations, feeling trapped by financial burdens. One effective solution can be submitting a debt relief application, which can offer a fresh start and a clearer path to financial wellness. If you're curious about how to navigate this process, keep reading to discover essential tips and a helpful letter template that can streamline your application!

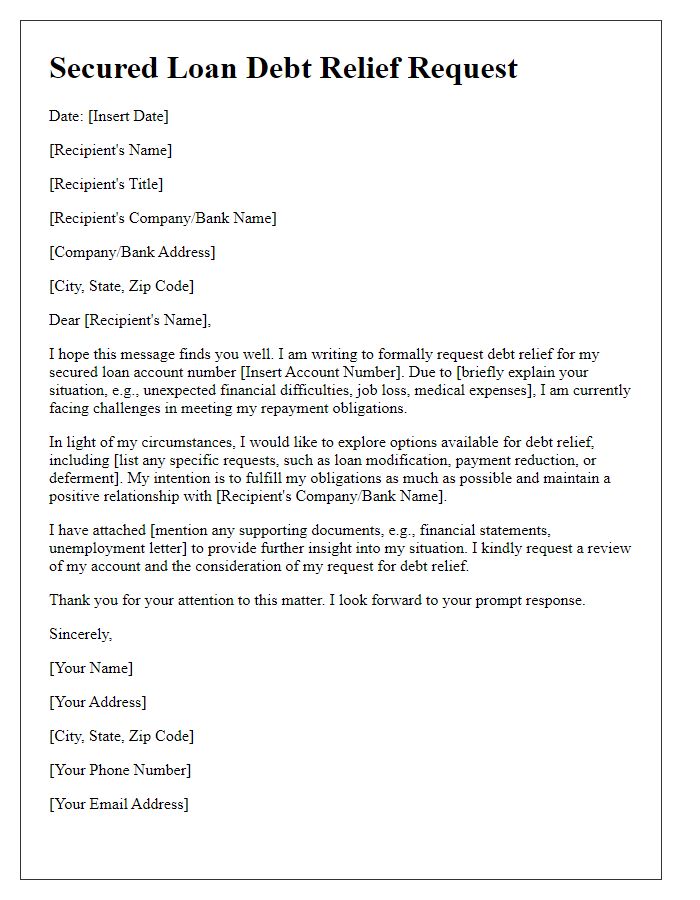

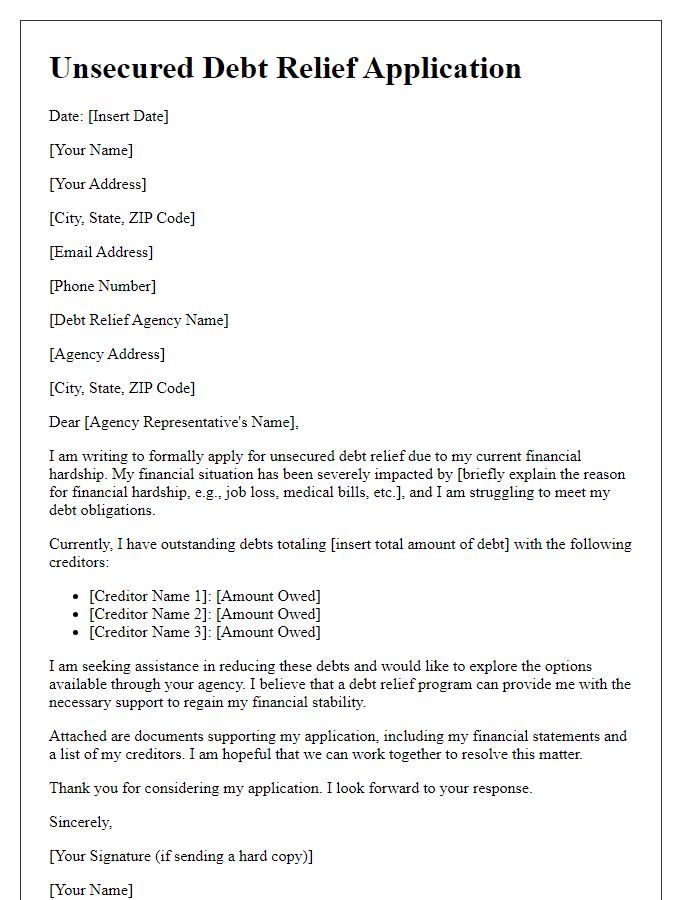

Applicant's Personal Information

The debt relief application process requires comprehensive personal information from the applicant, including full legal name (important for identification), current residential address (enables correspondence with financial institutions), phone number (facilitates communication), and email address (used for sending notifications and updates). Employment details such as job title and employer information provide context regarding the applicant's financial stability and ability to contribute to debt repayment. Additionally, annual income figures reveal the applicant's financial capacity. Information regarding existing debts, including outstanding balances (critical for assessing overall financial health) and specific creditors, ensures a thorough evaluation of the applicant's financial obligations. Documented proof of income, recent bank statements, and any relevant financial documents strengthen the application by offering a transparent financial overview.

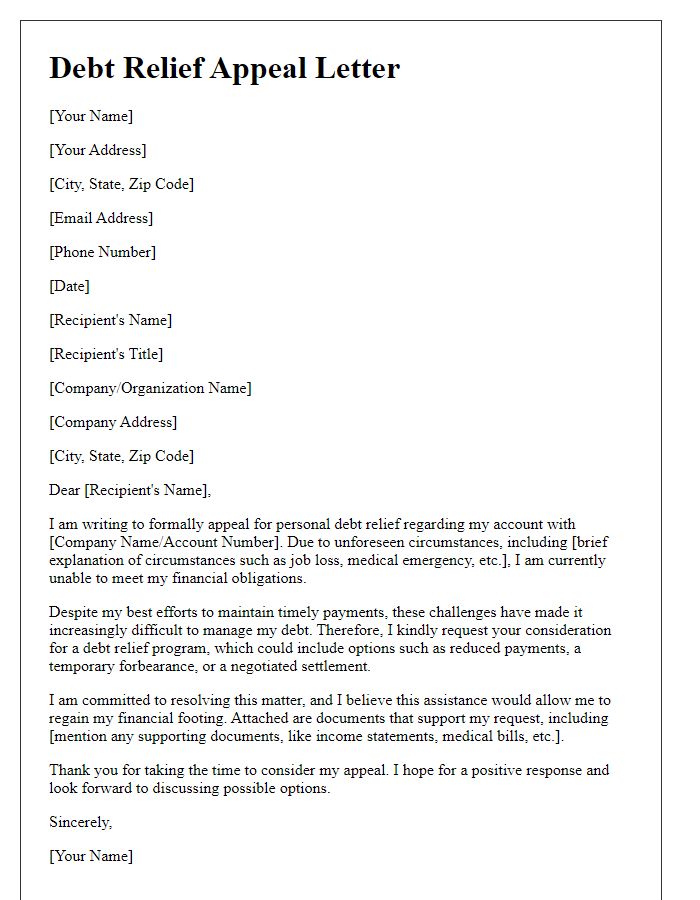

Reason for Debt Relief Request

A debt relief request often stems from challenging financial circumstances impacting the ability to make timely payments. Situations such as unexpected medical expenses, significant job loss, or enduring economic downturns can lead to overwhelming debt levels. For instance, an individual might face a job loss impacting income by 50% due to a company layoff related to the 2020 economic crisis. Moreover, rising costs of living, particularly in metropolitan areas like San Francisco with average rents surpassing $3,500, can exacerbate financial strain. Essential expenses, including mortgage payments, utilities, and healthcare, can exceed monthly income, causing financial distress. Seeking debt relief becomes essential for regaining financial stability, allowing individuals to restructure their loans or negotiate settlements to reduce overall debt obligations.

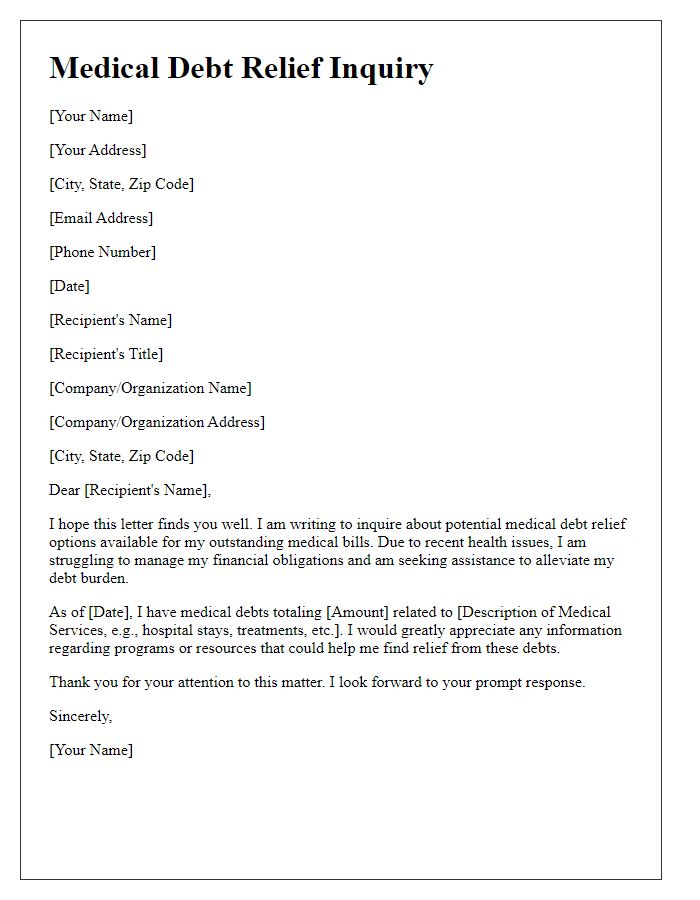

Financial Hardship Explanation

Individuals facing financial hardship often grapple with overwhelming debt, requiring assistance in navigating relief options. Key factors contributing to this situation include unexpected medical expenses, job loss, or significant life events such as divorce. For instance, a sudden medical emergency, with costs potentially soaring above $20,000, can deplete savings and disrupt income flow. Job loss, fluctuating unemployment rates between 3% to 6% in 2023, exacerbates financial instability, leading individuals to seek debt relief solutions. Understanding the specific conditions of one's hardships is crucial, as it provides a foundational context for addressing creditors. Documenting income sources, monthly expenses, and outstanding debts fosters transparency during the application process, enabling a clearer picture of the financial crisis at hand.

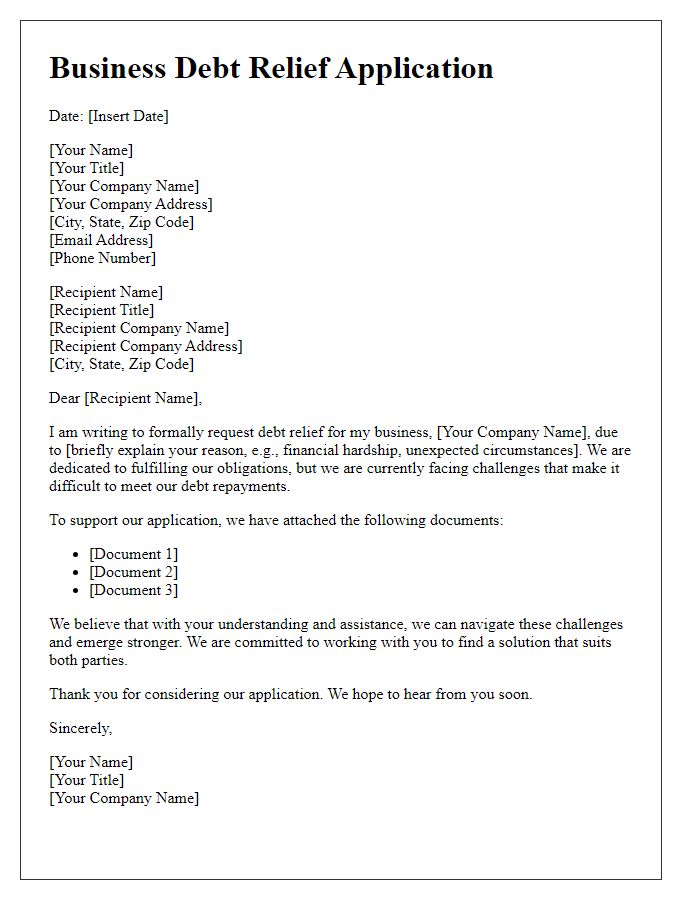

Proposed Repayment Plan

A proposed repayment plan for debt relief should detail specific terms and conditions for settling financial obligations, addressing key aspects like payment amounts, frequency, duration, and any potential interest reductions. Typically, the plan outlines monthly payments based on the total debt amount, for instance, a sum of $10,000, over a period of 36 months, suggesting a payment of approximately $278 per month. Furthermore, it may propose a waiver of late fees and a reduction of the annual interest rate from 18% to 10%, thus easing the financial burden on the debtor. Such a plan fosters open communication between creditors and borrowers, facilitating negotiation opportunities in personal finance management. Locations of financial institutions, such as local credit unions or national banks, may also be specified for convenience in payment processing.

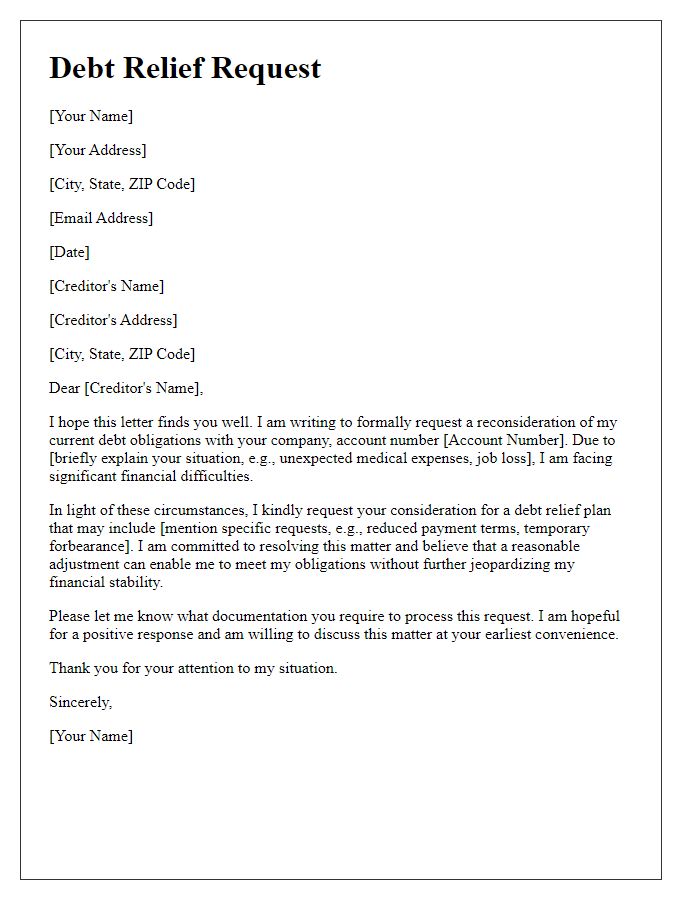

Contact Information and Sign-Off

Debt relief applications often require specific contact information, including full name, address (street, city, state, zip code), phone number, and email address for effective communication. Clear identification ensures that correspondence regarding the application is properly directed, facilitating timely assistance. Additionally, a professional sign-off should ideally include a courteous closing statement, such as "Sincerely" or "Best regards," followed by the applicant's signature (in the case of paper applications), and their typed name underneath. This structured approach enhances the professionalism and clarity of the application.

Comments