Are you looking to improve your credit score or simply ensure your credit report is accurate? Writing a credit report update request letter can be a key step in addressing any discrepancies that might be affecting your financial health. In this article, we'll guide you on how to craft a concise yet impactful request, ensuring you include all the necessary details. So let's dive in and empower you to take control of your credit profile!

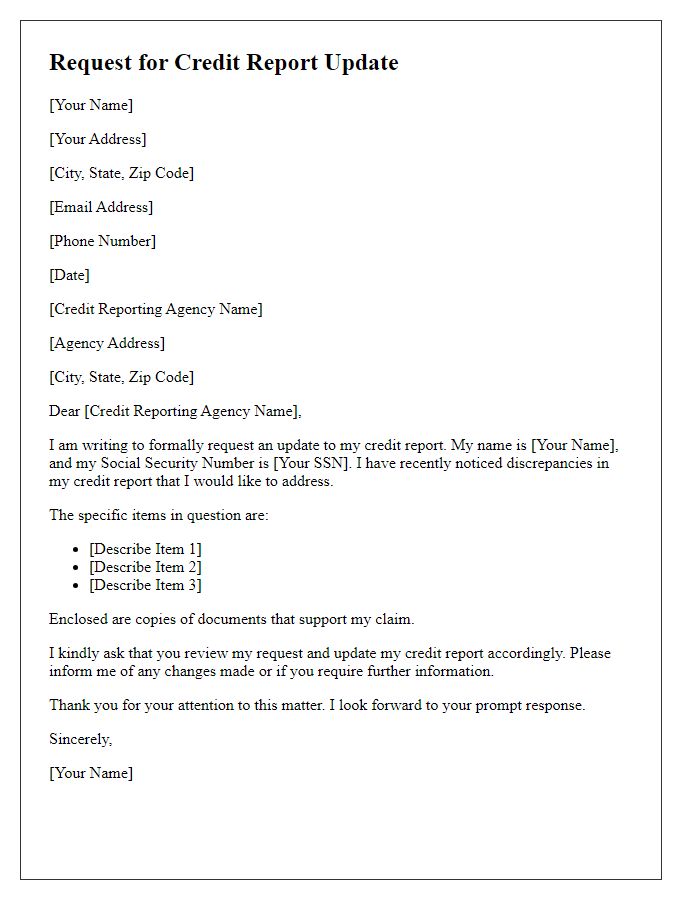

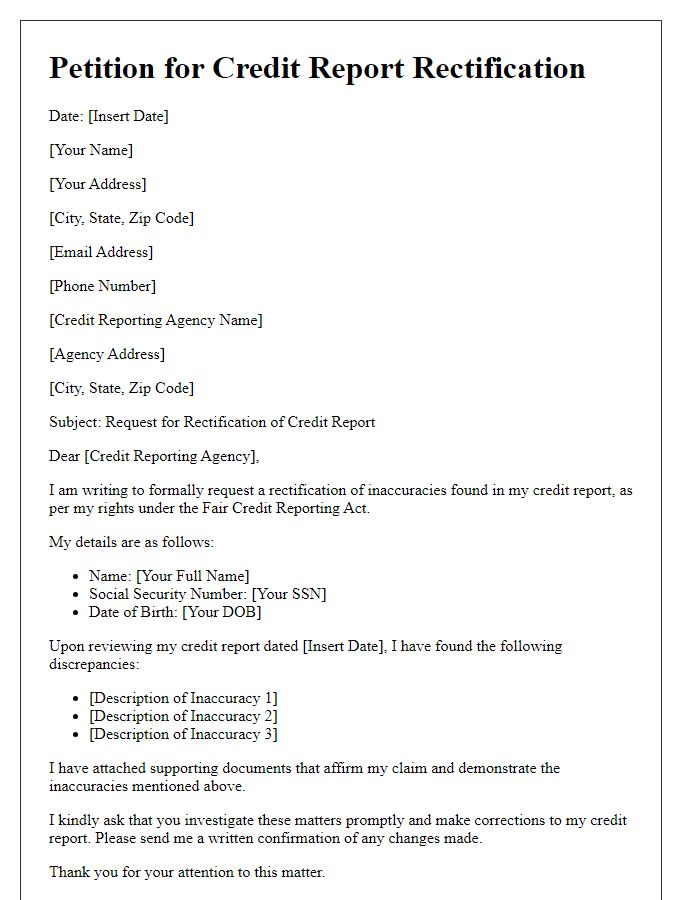

Accurate personal information

An accurate credit report is essential for maintaining a healthy financial profile. In the United States, individuals may request updates to ensure their personal information, such as name, address, and Social Security number, is correct. Discrepancies can arise due to various events, including identity theft or clerical errors during data entry by credit reporting agencies like Experian, TransUnion, or Equifax. According to the Fair Credit Reporting Act (FCRA), consumers have the right to dispute inaccuracies, ensuring their credit score (the three-digit number lenders use to assess creditworthiness) remains unaffected by erroneous data. Timely updates can help individuals secure favorable loan terms and promote financial well-being.

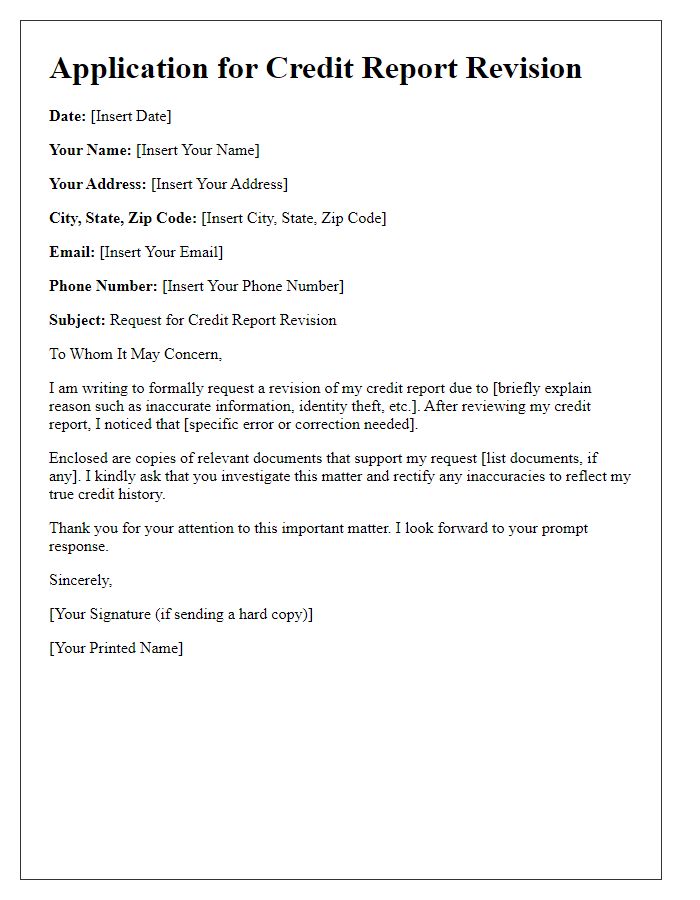

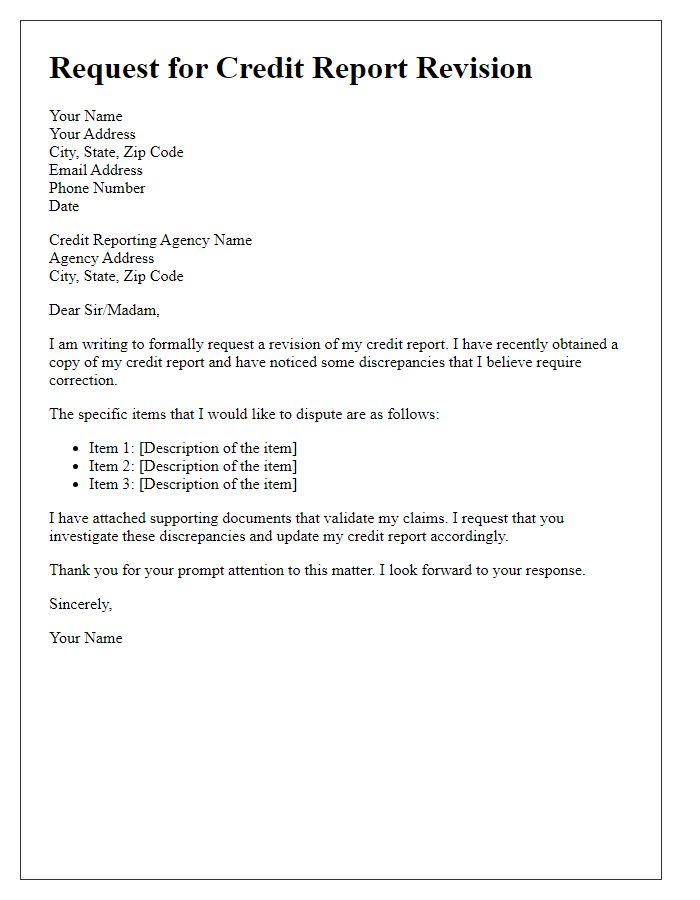

Specific credit account details

A credit report update request requires precise information to ensure accurate processing. The account number, such as 123456789, is essential for identification of the specific credit account in question. Include the name of the creditor, like Bank of America, to establish the context of the request. Mention the reporting agency, such as Experian, that holds the credit report needing updates. Specify the details of the discrepancy, such as incorrect payment history or outdated personal information, to provide clarity. Additionally, include supporting documentation, such as payment receipts or correspondence, to substantiate the request. Prompt and clear communication can expedite the update process for a more accurate credit profile.

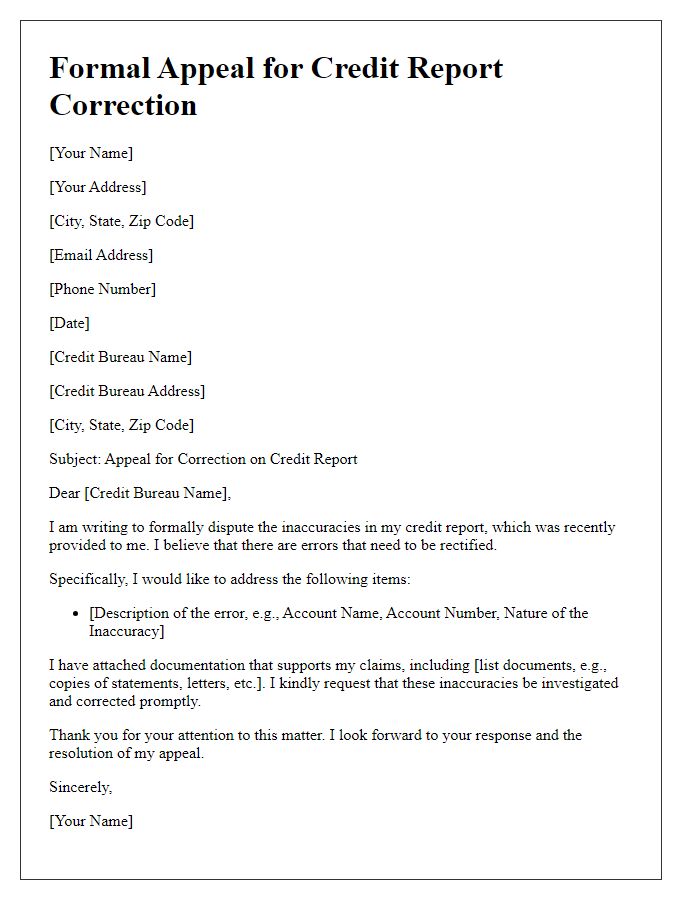

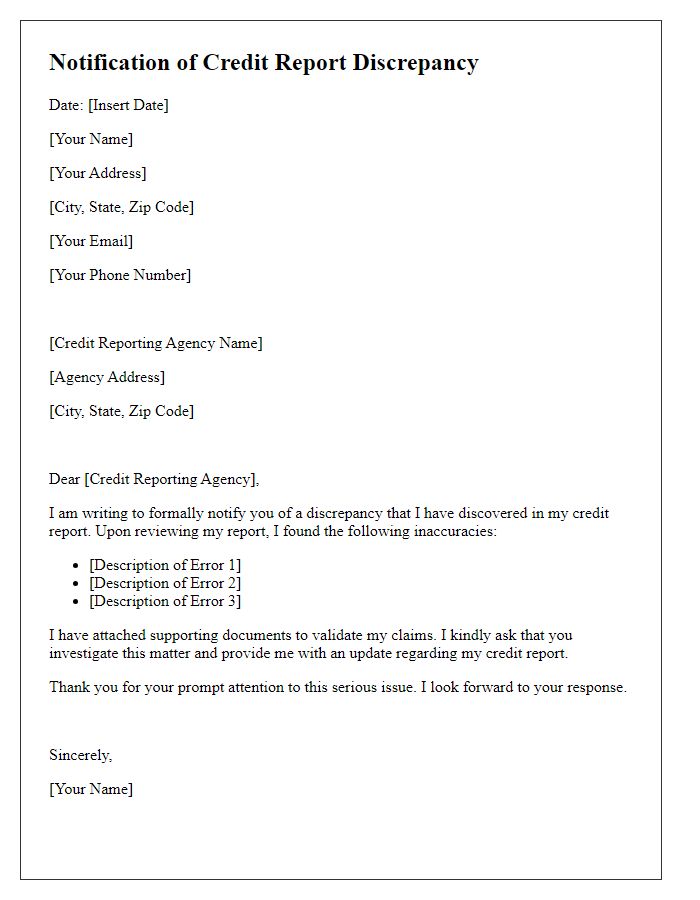

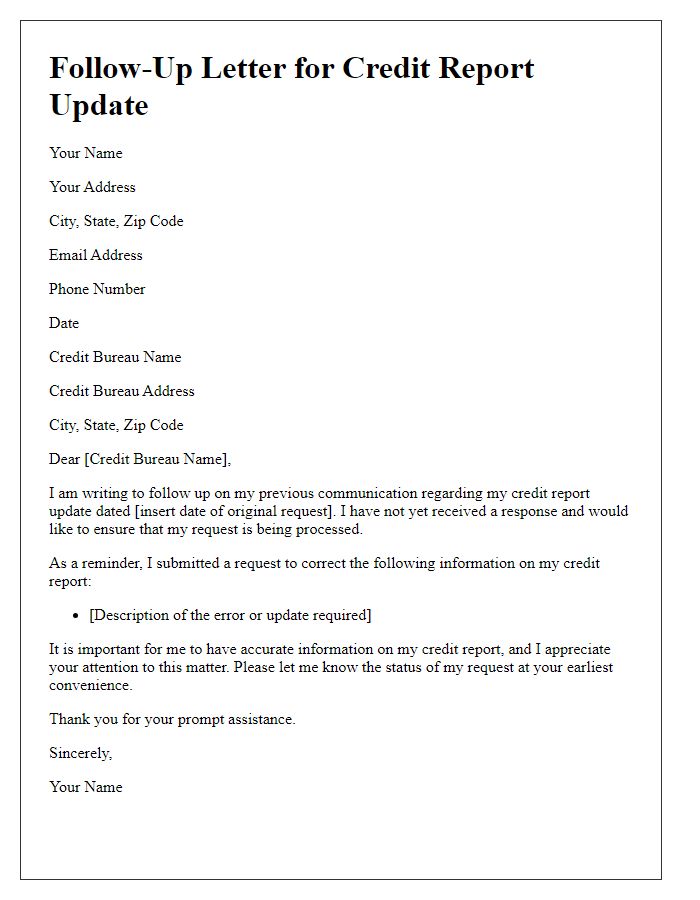

Clear explanation of error

The credit report error on file number 123456789 pertains to inaccurate payment history. The report indicates a late payment reported by XYZ Bank for June 2022, while records confirm timely payments. Late payments can negatively impact credit scores, affecting loan eligibility. Documentation including bank statements and payment confirmations supports this timely payment claim. Request for correction aligns with the Fair Credit Reporting Act, ensuring consumer rights. Updating this error is essential for maintaining accurate financial records.

Supporting documentation

Submitting a request for a credit report update often requires supporting documentation to validate claims. Identity verification, such as government-issued photo ID (driver's license or passport) should accompany the request. Financial statements, for instance, bank statements or loan agreements that reflect recent payments or account status may also be included. Additionally, dispute documents detailing inaccuracies with specific credit entries, like previous creditor notifications or billing statements highlighting errors, strengthen the case for updates. Clear and organized presentation of these documents enhances credibility and ensures timely processing by credit reporting agencies.

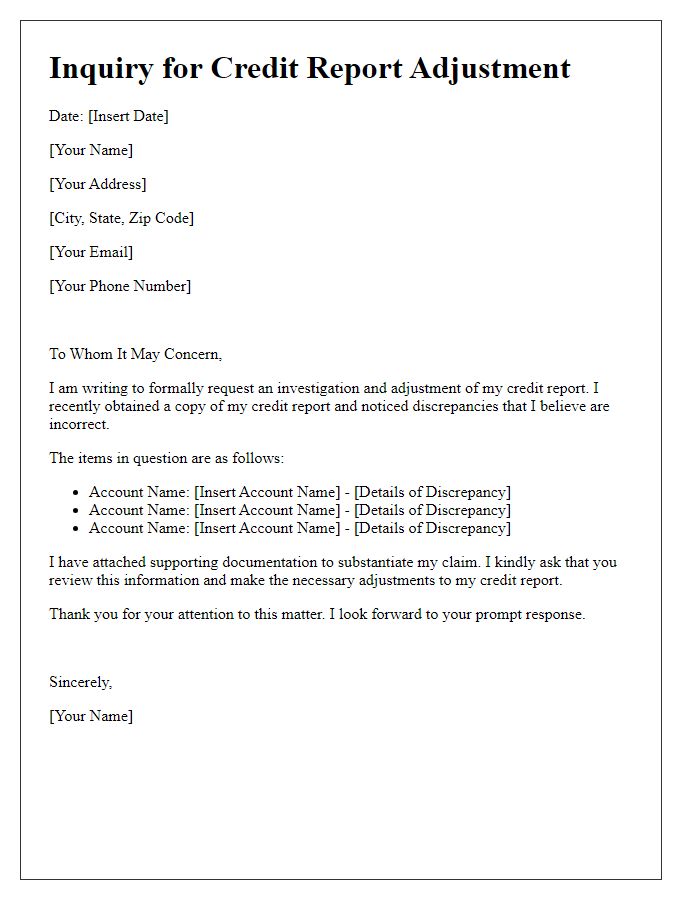

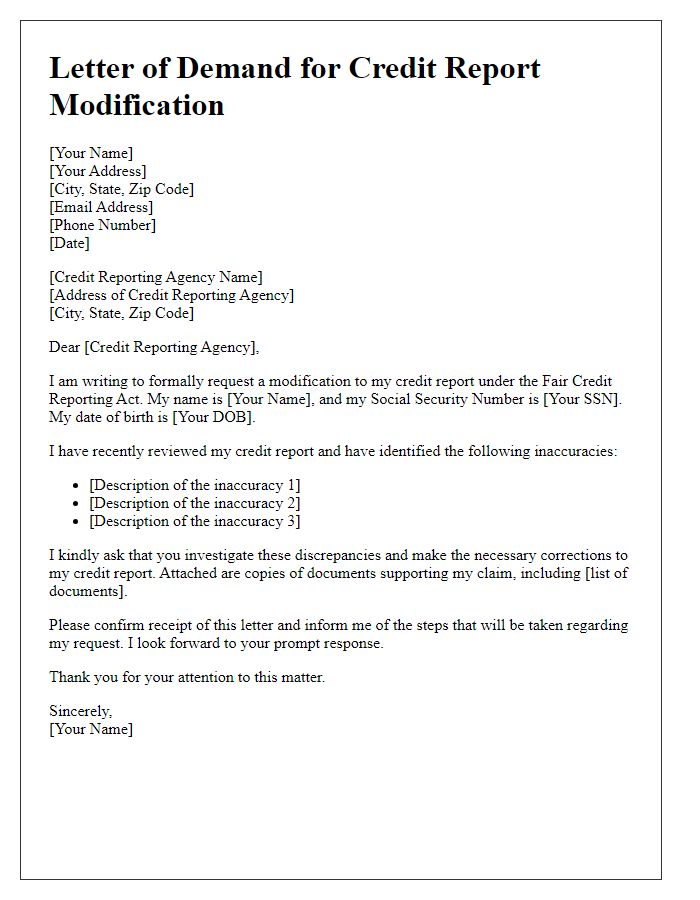

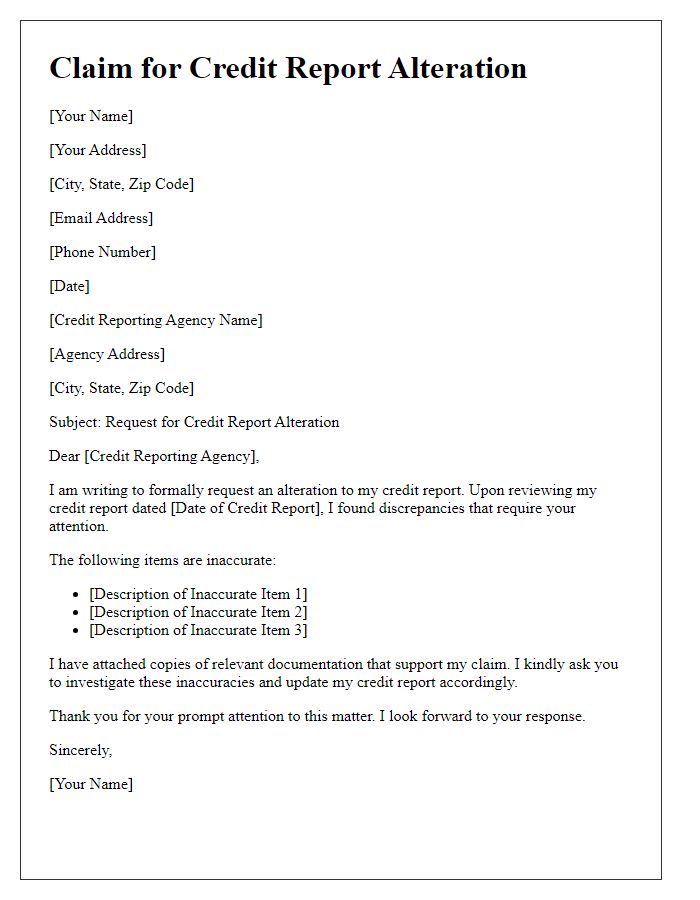

Contact information and signature

Contact information must include full name, current address (including city, state, and zip code), phone number, and email address (if applicable). Signature should be a handwritten mark that authenticates the request. A credit report update request needs to specify the identification details such as Social Security number, necessary for confirming identity, and the specific updates required, like addressing inaccuracies or missing information. Providing a detailed description of the discrepancies, including dates and amounts, enhances the clarity of the request. This structured format aids in ensuring timely processing of the update.

Comments