Are you feeling overwhelmed by your debt and unsure of how to communicate with creditors? You're not alone, as many people find it challenging to navigate these conversations. In this article, we'll break down the essentials of crafting an informative debt interaction summary that keeps you organized and informed. So, grab a cup of coffee and dive in with us for tips that can make your financial discussions clearer and more effective!

Debtor Identification

Debtor identification is crucial in financial management within various sectors, including banking, credit services, and collections agencies. This involves collecting key personal information such as full name, date of birth, and social security number to verify identity against credit records. The unique identification number plays a vital role in tracking an individual's credit history and managing outstanding obligations. Additionally, addresses are significant for establishing geographical jurisdiction and communicating effectively regarding debt recovery activities. Historical payment behavior, including patterns of default, can provide insights into risk assessment, influencing decisions on future credit extensions or recovery strategies. Understanding the debtor's financial background enhances the ability to develop tailored repayment plans and strategies that promote financial stability for both parties involved.

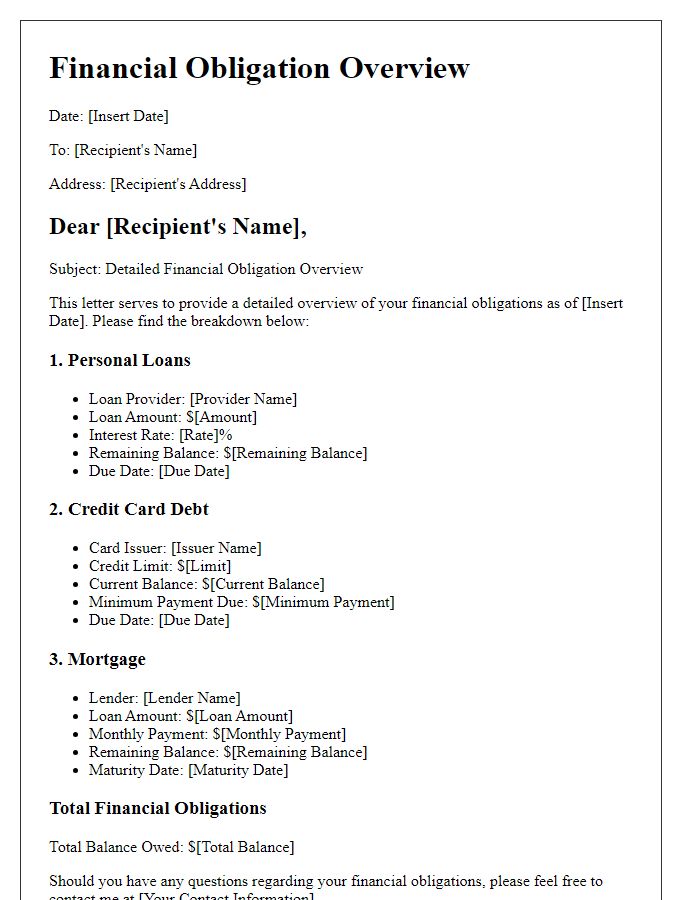

Debt Details and Amount

A detailed summary of the informative debt interaction highlights critical aspects of debt management. Debt amounts can vary significantly, with personal loans averaging around $16,000 in the United States. Credit card debts remain a prominent concern, with the average American household carrying approximately $6,000 in credit card debt. Notably, student loan debt is a staggering $1.7 trillion nationally, impacting millions of borrowers, primarily in their 20s and 30s. Understanding these figures aids in addressing repayment strategies, negotiating settlements, or exploring consolidation options. Regular monitoring of debt balances and payment schedules is essential for effective financial planning and improved credit scores.

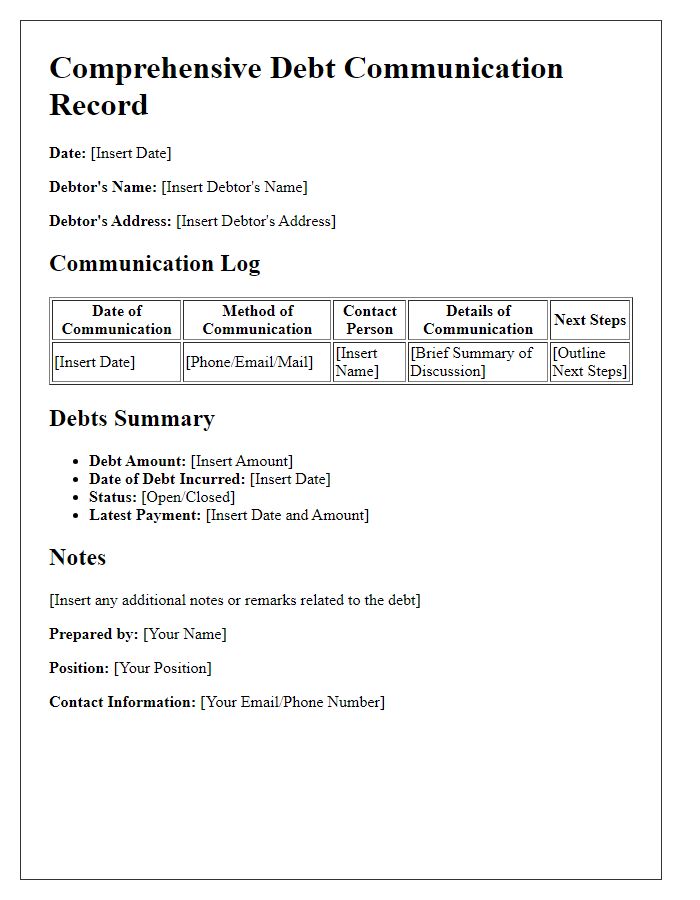

Payment History Overview

An informative debt interaction summary encapsulates a detailed Payment History Overview, highlighting key elements like total outstanding balance, payment dates, and amounts. This document includes specific events such as missed payments (e.g., June 1, 2023) and their resulting late fees (specified as $35), alongside regular payments (e.g., $150 on July 15, 2023). It may also detail the account's inception date, for instance, January 10, 2021, reflecting the overall duration of the borrower-debtor relationship. The history provides insights into trends, like consistent late payments, demonstrating patterns that could affect credit scores (impact assessed by credit agencies such as FICO). Furthermore, it can mention interactions with customer service representatives, including the frequency of calls regarding disputes or issues with transactions, thus giving a comprehensive view of the financial obligations and borrower behavior.

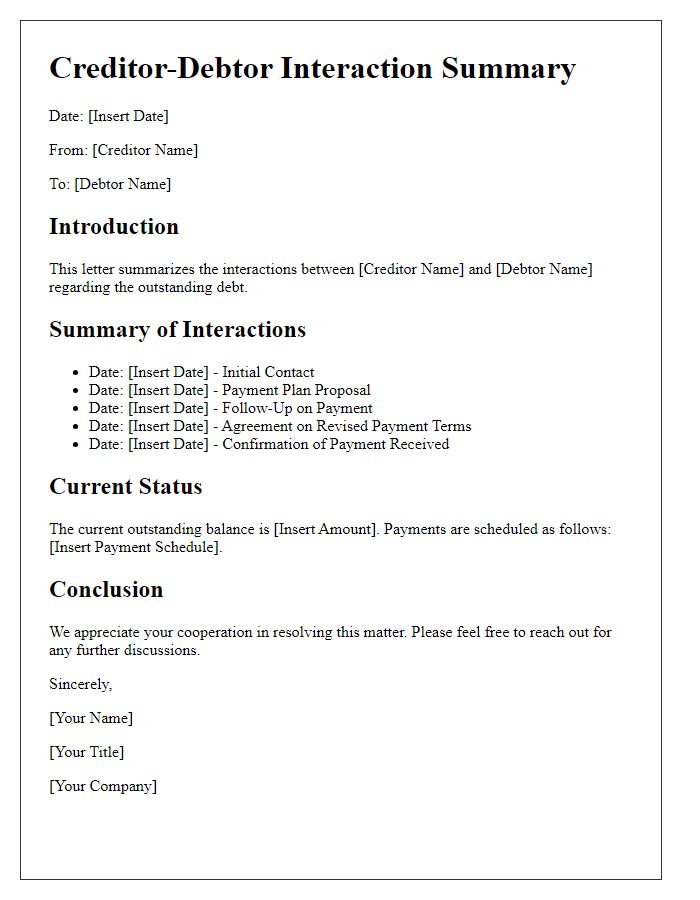

Current Status and Next Steps

The current status of the debt management plan reveals a total outstanding balance of $15,000, primarily consisting of medical bills and credit card debt accumulated over the past two years. Monthly payments of $500 are being made towards the primary debt accounts. An analysis of the account statements from creditors indicates that interest rates vary between 15% to 25%, significantly impacting the overall repayment timeline. The next steps include negotiating with creditors for reduced interest rates and establishing a conditional settlement plan. A follow-up meeting is scheduled for January 15, 2024, to review progress and make necessary adjustments to enhance the repayment strategy. Financial counselors recommend exploring potential budgeting tools or apps to better track expenses and improve financial literacy.

Contact Information and Assistance

Debt interactions can involve various financial institutions, including banks, credit unions, or specialized debt recovery agencies. These entities typically provide contact information, including phone numbers (often toll-free) for customer service inquiries. In many regions, assistance programs exist to help individuals manage debt, such as the Consumer Financial Protection Bureau (CFPB) in the United States or similar organizations worldwide. Maintaining open communication with creditors (like Visa or Mastercard) can facilitate payment plans or negotiate settlements. Keeping detailed records of all interactions, including dates and representative names, is crucial for an accurate summary of debt dialogue. Additionally, utilizing professional services, such as credit counselors or financial advisors, can enhance one's understanding of available options and protections under federal laws like the Fair Debt Collection Practices Act (FDCPA).

Comments