In today's challenging financial landscape, it's common for individuals and businesses to face unexpected hardships. If you're navigating the difficult waters of debt, a cooperative stance can significantly ease the pressure for both you and your creditors. By fostering open communication and understanding, you can work towards finding manageable solutions that benefit everyone involved. Curious to learn how to craft the perfect letter for your situation? Read on!

Clear Identification of Debtor and Creditor

The debtor, John Smith (Identification Number: 123-45-6789), has outstanding obligations to the creditor, XYZ Financial Services LLC, located in New York City. The total debt amount is $25,000, originating from a personal loan issued on March 15, 2022, with a maturity date set for March 15, 2024. Communication regarding repayment schedules indicates that John's monthly payments of $500 are due on the first of each month. Records show that the debtor has made timely payments until December 2022 when unforeseen medical expenses impacted his financial stability. The impetus for seeking a cooperative stance includes John's proposal for a revised payment plan, aiming to ensure consistent payments while managing existing obligations without incurring further financial strain.

Explanation of Financial Hardship or Situation

Financial hardship often results from unforeseen circumstances, such as job loss, medical emergencies, or unexpected expenses. Individuals may face difficulty in meeting financial obligations, struggling to pay debts in a timely manner. A comprehensive assessment of income, monthly expenses, and other financial commitments is crucial for understanding the overall situation. For example, reduced income levels may lead to insufficient funds to cover essential living costs, including housing, utilities, and groceries, forcing individuals to seek assistance. Cooperative negotiations could provide opportunities for modified repayment plans or temporary relief, enabling individuals to stabilize their finances and eventually meet their obligations without further exacerbating their situation. Professional financial counseling may also aid in formulating a realistic budget and establishing a sustainable path toward financial recovery.

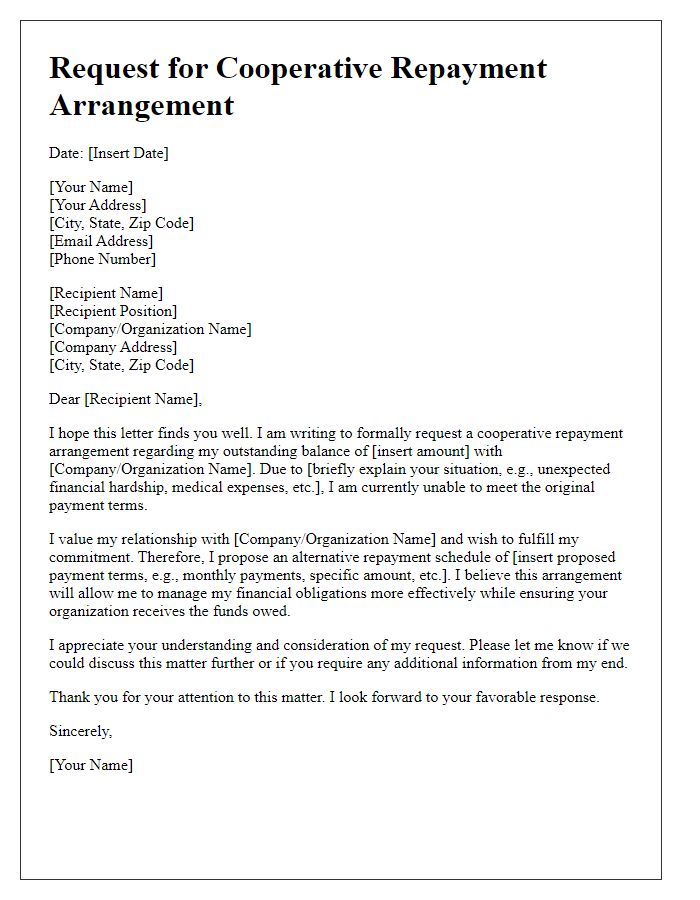

Proposal for a Payment Plan or Settlement

Debtors facing financial difficulties can seek a cooperative stance by proposing a structured payment plan or settlement to creditors. Developing a feasible repayment strategy can foster positive relationships and ensure compliance with obligations. A realistic proposal may include monthly payments reflecting the debtor's financial capacity, timelines for completion, and specific amounts owed. Transparency in disclosing financial circumstances such as income, expenses, and other debts can reinforce credibility. Additionally, offering a lump-sum settlement option, often at a reduced figure, can attract creditor acceptance while resolving outstanding balances efficiently. This approach promotes collaboration between parties, aiming for a mutually beneficial resolution.

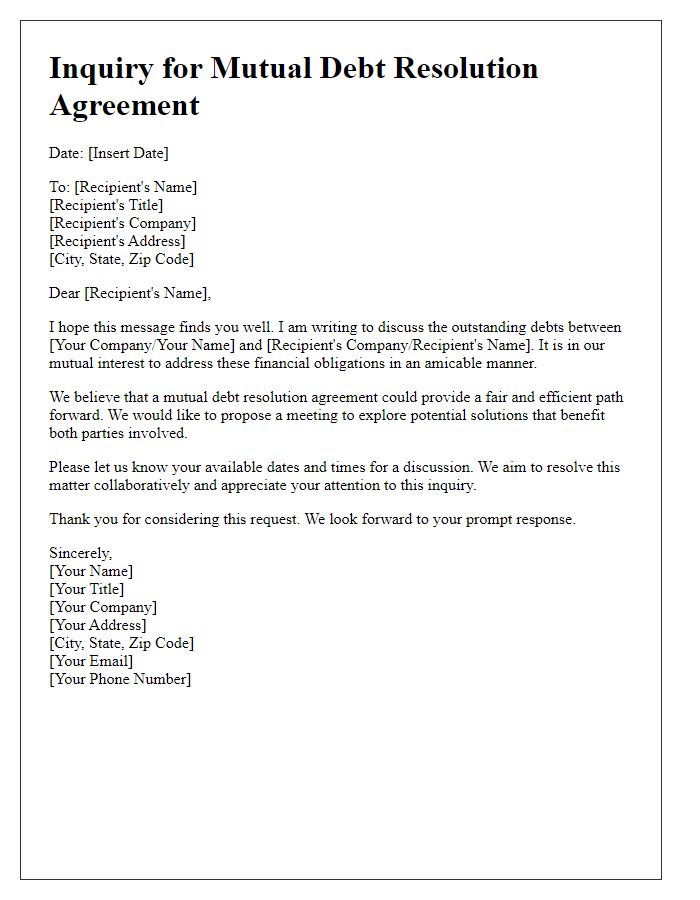

Request for Goodwill and Cooperation

Debtor's cooperation is essential in maintaining favorable relationships with creditors. Open communication fosters goodwill, which can lead to flexible repayment options. Establishing a clear repayment plan (such as a timeline or specified amounts) can alleviate financial stress. In financial crises, acknowledging challenges and proactively seeking help from cooperative organizations, like non-profit credit counseling services, can be beneficial. This openness allows for exploration of potential debt relief options, such as restructuring agreements or reduced interest rates, ensuring sustainable financial health while maintaining trust and accountability in financial dealings.

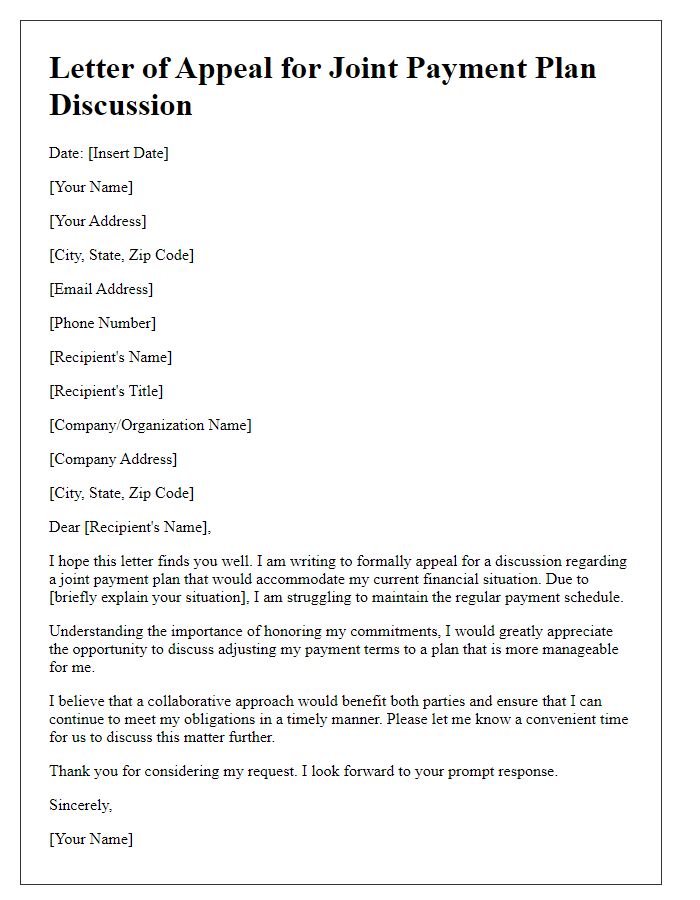

Assurance of Future Compliance and Communication

Debt relationships often hinge on mutual trust and transparency. Assurance for future compliance can greatly enhance the cooperative stance between debtors and creditors. Establishing a clear communication channel is crucial, particularly regarding potential payments, repayment schedules, and financial difficulties. The debtor should provide detailed records of past transactions, highlighting instances of timely payments and commitment to honoring agreements. In addition, outlining a proactive approach to communication, such as monthly status updates or dedicated contact points, can foster goodwill. This cooperation not only strengthens relationships but also builds a foundation for resolving disputes amicably, ensuring compliance with financial agreements moving forward.

Comments