Have you ever found yourself feeling overwhelmed by debt and unsure of how to tackle it? A sequenced debt payment plan can be a game-changer, helping you prioritize your payments and regain control of your finances. By breaking down your debts into manageable steps, you can create a roadmap that leads to financial freedom. Curious to learn how to implement this strategy effectively? Keep reading!

Account Information and Reference Number

The sequenced debt payment document provides essential details for managing financial responsibilities effectively. Account information, including the account number (a unique identifier assigned by the financial institution) and reference number (specific to the outstanding balance), ensures clarity in tracking payment progress. Timely payments, scheduled according to the agreed-upon timeframe, help customers avoid late fees and potential penalties while improving credit scores. Maintaining accurate records of these transactions reinforces responsible financial habits, promoting informed decision-making for individuals seeking to achieve debt reduction goals. Regularly updating this document allows for monitoring adjustments in payment amounts and maintaining awareness of total outstanding debts.

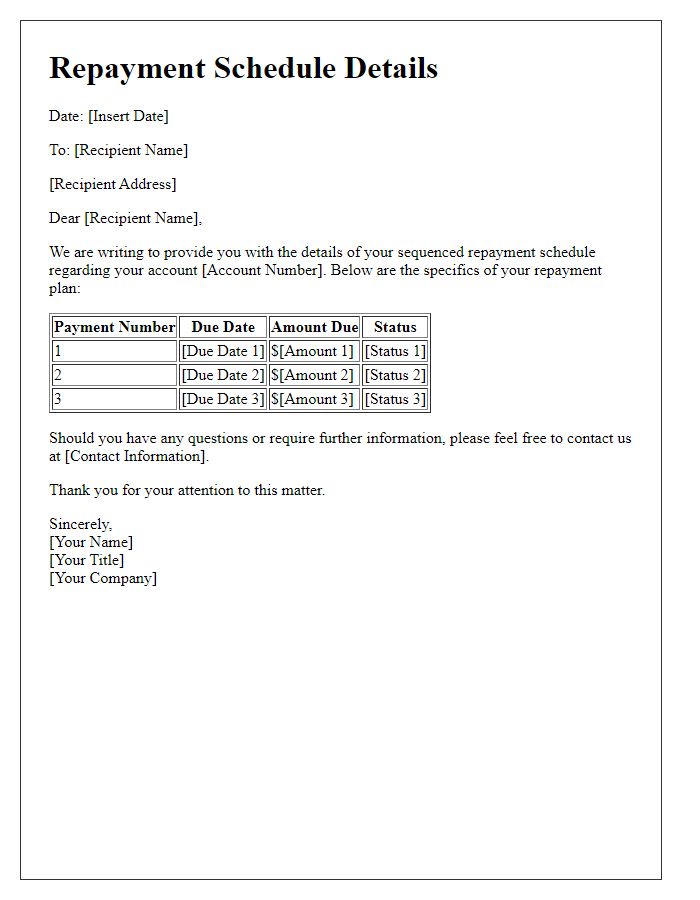

Payment Schedule with Dates and Amounts

A payment schedule is crucial for managing debt effectively, detailing the timeline and specific amounts due. The schedule typically includes multiple entries, often spanning monthly intervals, indicating exact payment dates. For instance, on March 1, 2024, a payment of $200 might be due, followed by another payment of $250 on April 1, 2024. Each entry provides clarity on remaining balance, interest rates (e.g., 5% annual interest), and total outstanding debt (e.g., $5,000 initially). A well-structured payment schedule helps in tracking progress, ensuring timely payments, and minimizing late fees associated with missed deadlines.

Interest Rate and Fees Details

Interest rates for debt payments typically vary depending on factors such as loan type, lender, and borrower creditworthiness. For example, unsecured personal loans may have interest rates ranging from 5% to 36%, while secured loans like mortgages may offer lower rates, often between 3% to 5%. Fees associated with debt repayment can include origination fees (typically 1% to 5% of the loan amount), late payment fees (often $25 to $50), and prepayment penalties (which may be a percentage of the remaining balance). It is crucial for borrowers to understand the terms and conditions specified in the lending agreement to manage repayment effectively and avoid potential financial pitfalls.

Penalty Clauses for Late Payments

In the context of sequenced debt payment documents, penalty clauses for late payments serve as significant contractual provisions. These clauses specify the financial repercussions for failing to meet established payment deadlines, often including late fees ranging from 5% to 15% of the overdue amount. Such penalties may escalate if payments are delayed beyond a specified grace period, typically outlined as 30 days from the original due date. Additionally, consistent late payments could lead to further actions, such as the acceleration of the remaining balance, which may require immediate repayment of the total outstanding debt. This framework is intended to encourage timely payments and mitigate the risk for creditors, thereby necessitating clear communication regarding obligations and potential repercussions.

Contact Information for Queries and Support

For individuals seeking assistance regarding their sequenced debt payment plans, contacting customer support is crucial. Reach out to the dedicated helpline at 1-800-555-0199, operational from 8 AM to 8 PM EST, Monday through Friday. Alternatively, you may email support@debtassistance.com for inquiries requiring detailed responses, with a typical response time of 24 to 48 hours. For live chat support, visit the official website www.debtassistance.com, where trained agents are available from 9 AM to 5 PM EST, ready to address any concerns about payment schedules, account statuses, or general financial advice. These resources ensure individuals receive timely help and guidance throughout their debt repayment journey.

Comments