Navigating the world of debt disputes can feel overwhelming, but having the right tools can make all the difference. A well-crafted letter template can help you articulate your concerns and present your case effectively. With the proper format and persuasive language, you can address discrepancies and potentially resolve issues amicably. Ready to learn how to create a compelling letter for your debt dispute?

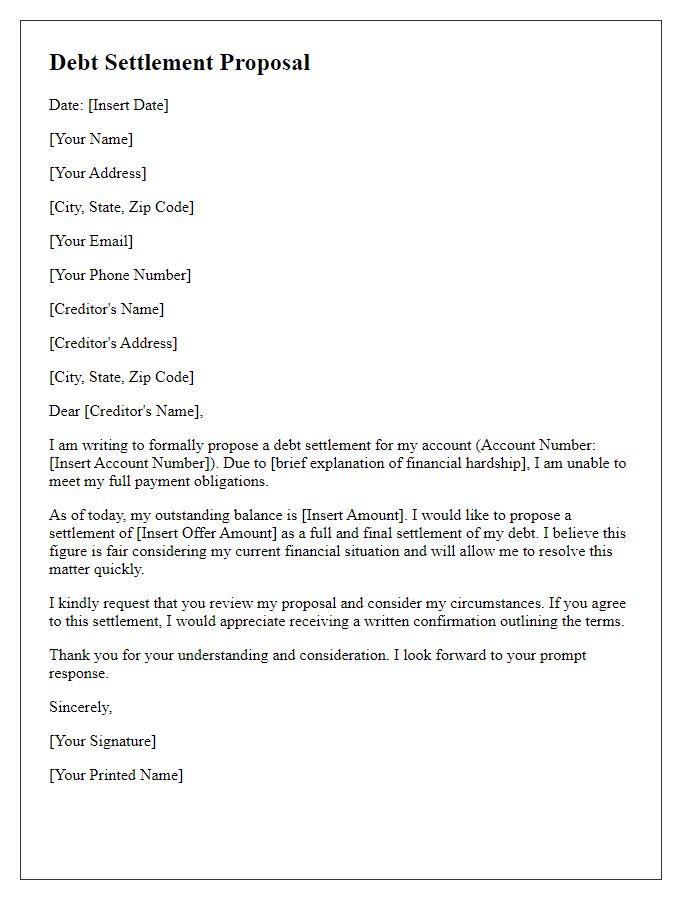

Accurate Account Details

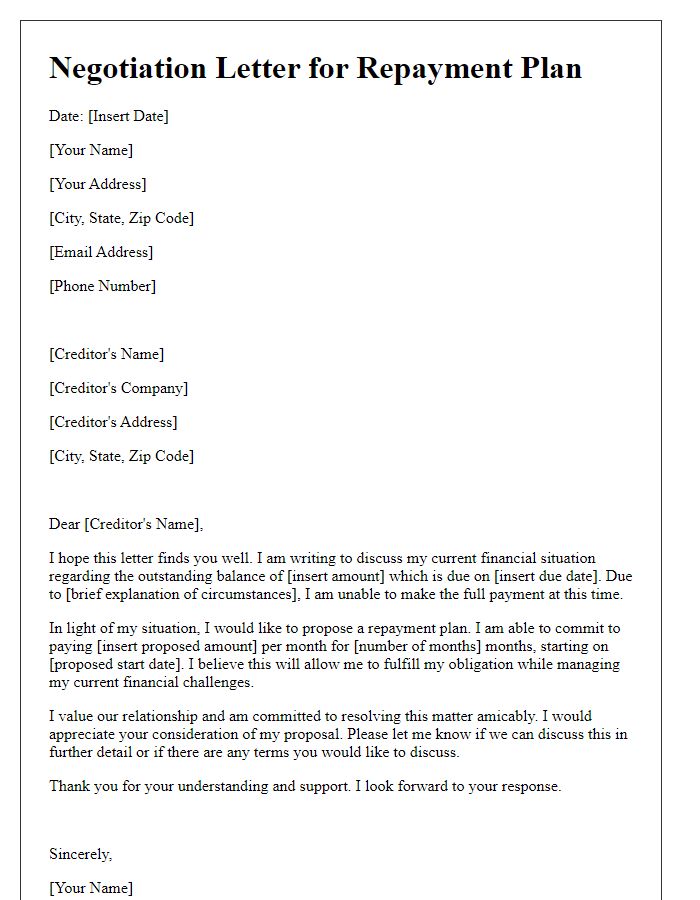

Accurate account details are crucial for resolving debt disputes efficiently and effectively. The account number, often a combination of alphanumeric characters, uniquely identifies the debtor's account within the creditor's financial system. Including the creditor's name, such as Capital One or American Express, alongside the contact information ensures clarity when communicating. Detailed transaction history offers transparency, showcasing dates, amounts, and descriptions of all debits, credits, or fees that have been applied to the account. Discrepancies in balances must be outlined, referring to specific dates and transactions to substantiate claims. Accompanying documentation, such as payment receipts or correspondence, supports the debtor's position and adds credibility to the dispute process.

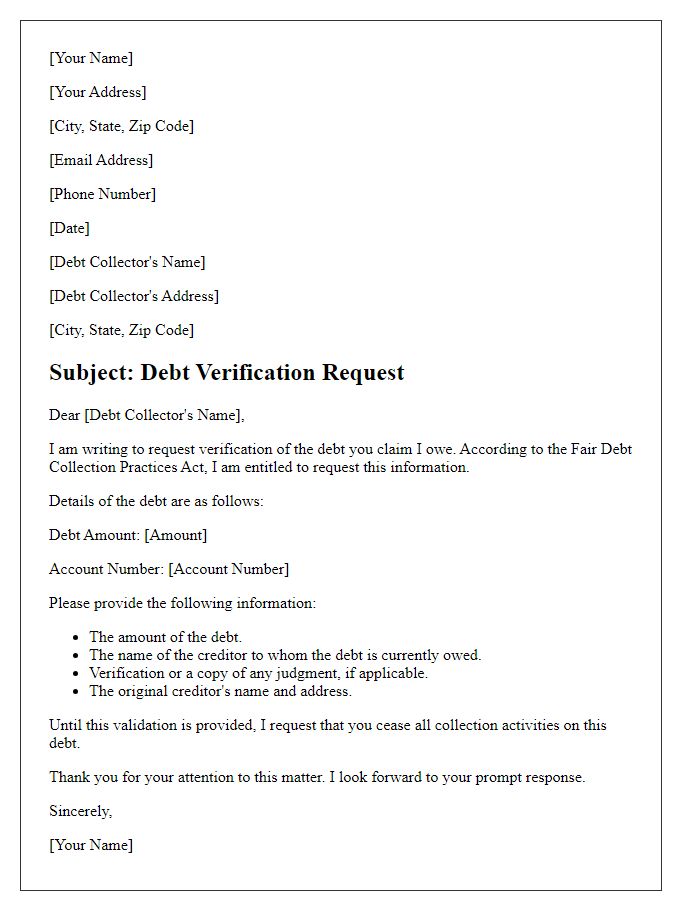

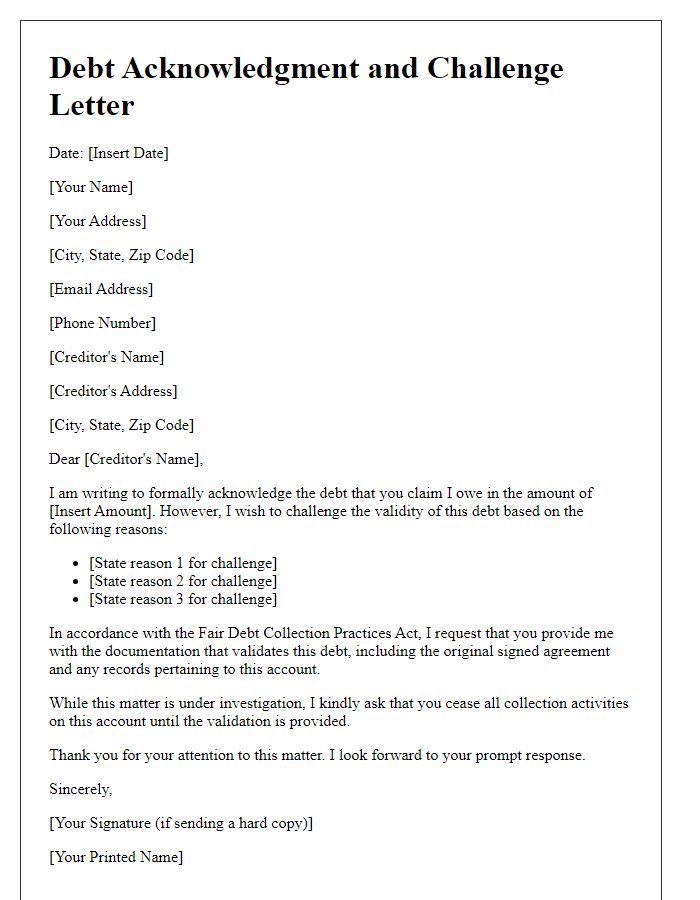

Clear Dispute Explanation

Debt disputes can arise from discrepancies in amounts owed, unclear terms, or errors in billing. Documenting the dispute is crucial; begin by identifying the creditor's name, account number, and specific details of the disputed amount. Providing context is essential; for example, include the original loan or credit agreement date, payment history, and any past communication regarding the dispute. Supporting evidence, such as bank statements or correspondence, strengthens the argument and facilitates resolution. Clearly outline the reasons for the dispute, referencing any legal obligations or consumer protection laws that apply, such as the Fair Debt Collection Practices Act (FDCPA). Aim for a well-structured presentation to encourage prompt investigation and resolution by the creditor.

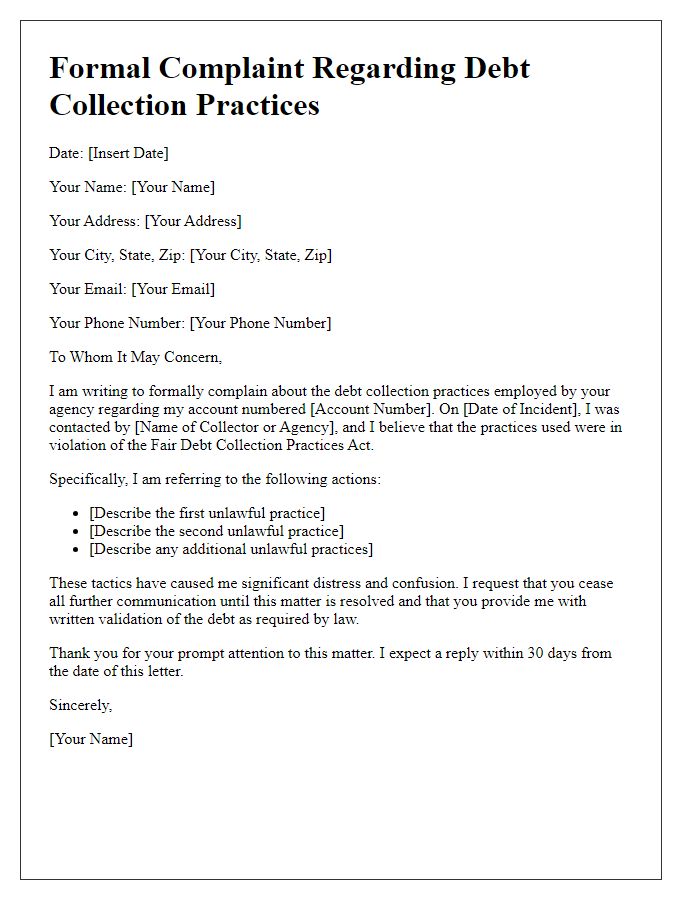

Supporting Documentation

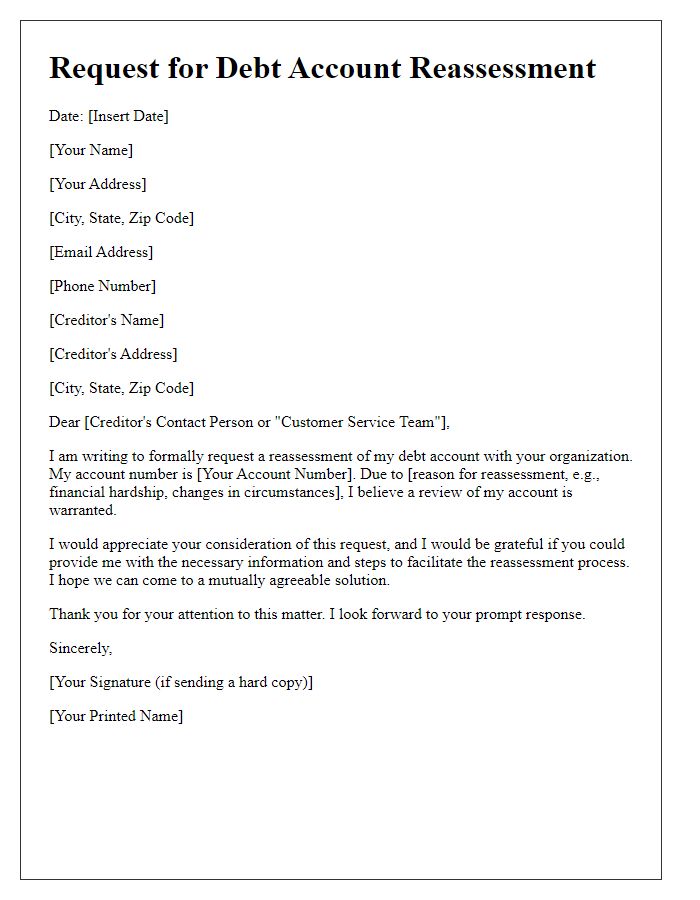

Supporting documentation is essential for resolving debt disputes efficiently and effectively. Clear records such as account statements, payment history, and communication logs play a crucial role in substantiating claims. For instance, itemized billing statements from the creditor, dated within the last three months, can provide evidence of disputed charges. Additionally, copies of prior correspondences, including emails or letters sent to the creditor regarding discrepancies, show efforts made to resolve issues amicably. Documentation of any previous payment receipts or agreements made can further support the dispute, highlighting the timeline and efforts of the debtor. Legal documents, such as notices of validation under the Fair Debt Collection Practices Act, can also strengthen the case, ensuring compliance from the creditor's side. Comprehensive and organized documentation facilitates a smoother negotiation process, enhancing the likelihood of a favorable resolution for both parties involved.

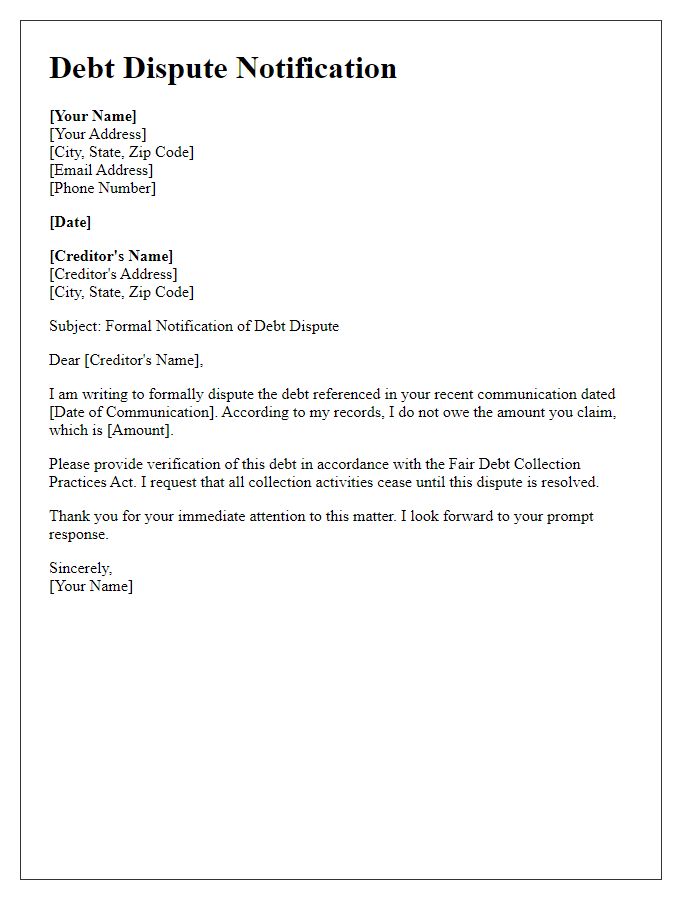

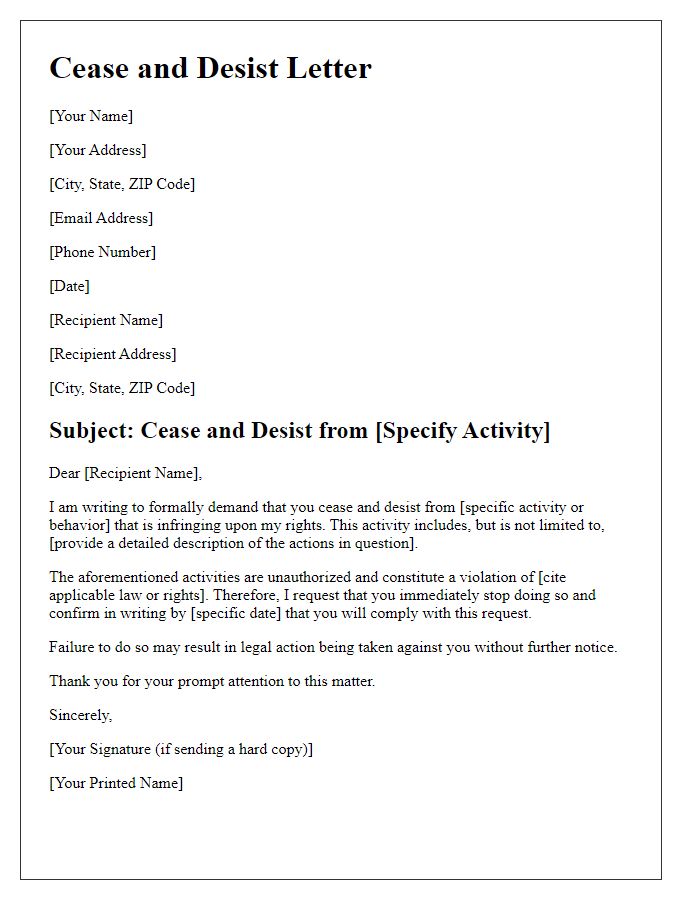

Formal Tone and Language

A debt dispute resolution process often involves various steps aimed at addressing and resolving discrepancies regarding debt amounts or obligations. Initiating the process typically requires the debtor to formally communicate their concerns to the creditor, detailing specific claims or inaccuracies in the statements received. Documentation such as account statements, agreements, and correspondence will play a crucial role in substantiating the dispute, ensuring clarity around the points of contention. Regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB) in the United States, may provide guidelines on formal dispute methods. Timeframes, often dictated by local laws, dictate how long creditors have to respond to disputes, which is critical in establishing timelines for resolution. Mediation sessions or formal hearings might follow, depending on the complexity and nature of the dispute, ensuring both parties have the opportunity to present their cases effectively.

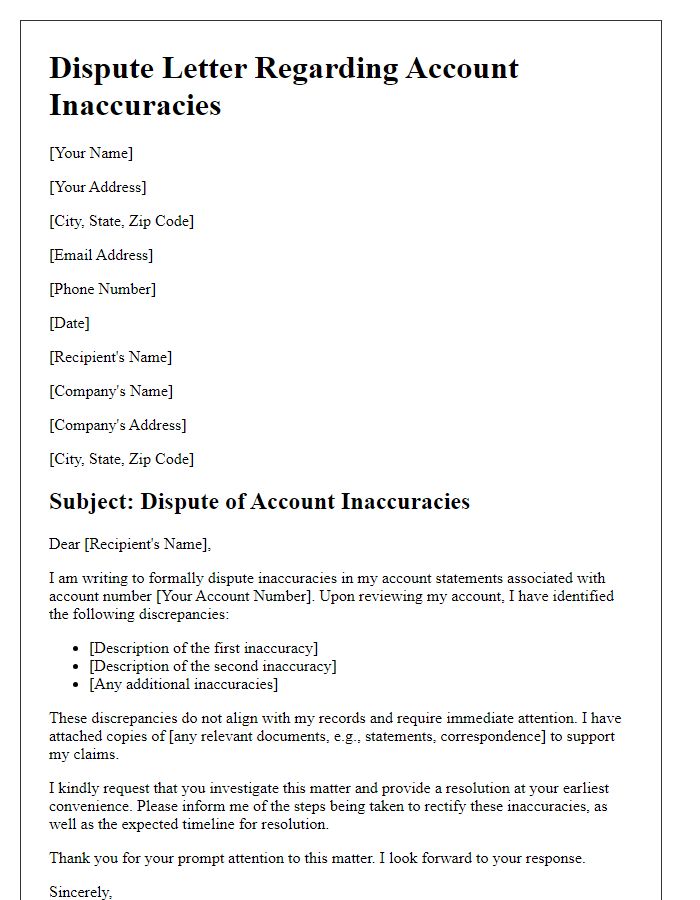

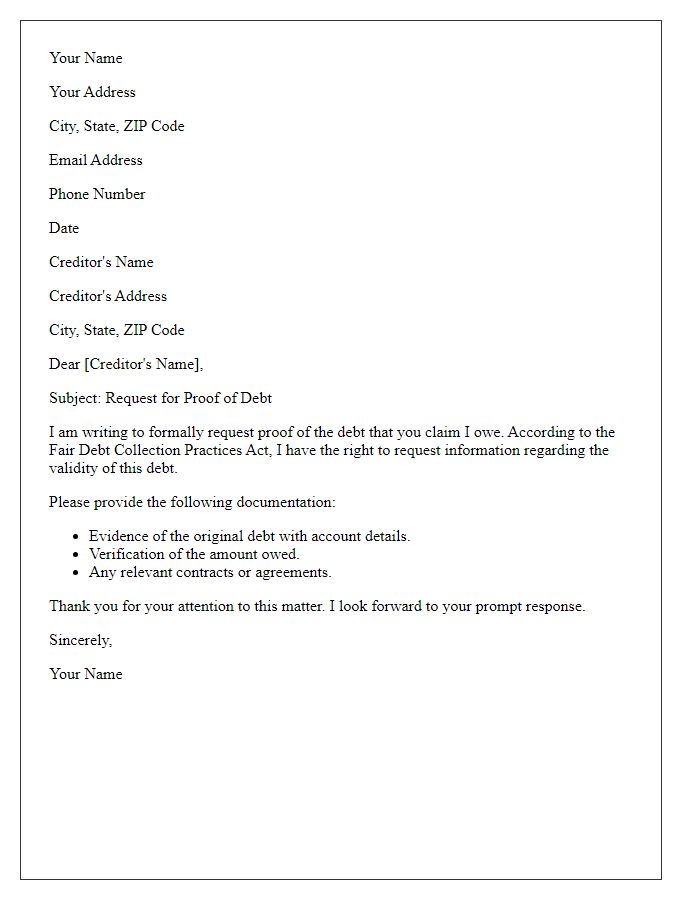

Contact Information

In a debt dispute resolution process, having accurate contact information is crucial for effective communication. The essential components include the debtor's full name, such as John Smith, and his current residential address, for instance, 123 Maple Street, Springfield, IL 62704. Additionally, the creditor's contact details need to be meticulously noted, encompassing their company name, like ABC Collections, along with their business address at 456 Oak Avenue, Suite 200, Chicago, IL 60601. Including phone numbers (e.g., (555) 123-4567 for John Smith, (312) 987-6543 for ABC Collections) and email addresses (john@example.com for the debtor and collections@abc.com for the creditor) further facilitates prompt responses. This foundational step ensures all parties remain promptly informed throughout the dispute resolution process.

Comments