Are you tired of missing payment deadlines and dealing with overdue bills? Setting up automatic debt deductions can simplify your financial life and ensure you never have to worry about late fees again. With just a little effort, you can set up a seamless process that keeps your accounts in good standing while saving you precious time. Ready to learn how to get started? Read on!

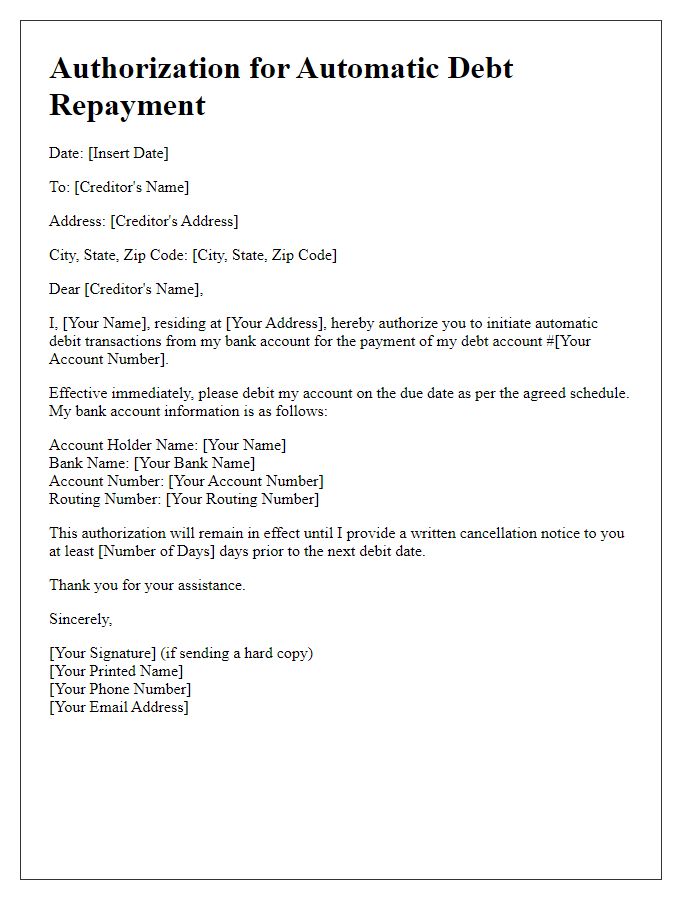

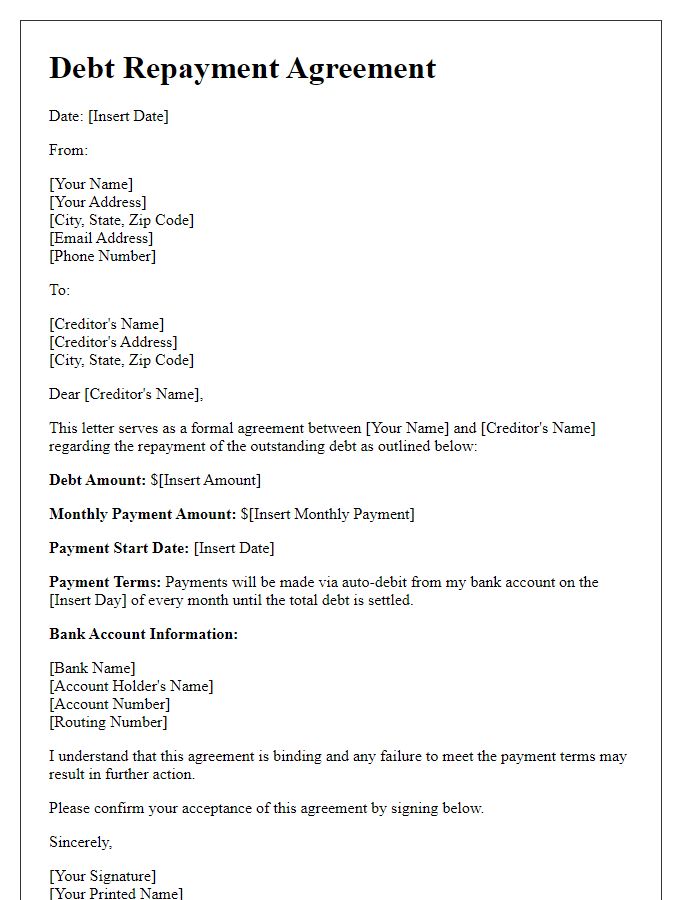

Account holder's personal information

Setting up automatic debt deductions requires accurate account holder personal information to ensure seamless transactions. Essential details include the account holder's full name (as registered with the financial institution), social security number (a unique identification number for individuals in the USA), bank account number (specific to the savings or checking account), routing number (used to identify the financial institution), and contact information (such as phone number and email address for notifications). Additional requirements may include the type of debt (such as mortgage, car loan, or credit card) and the agreed deduction schedule (weekly, bi-weekly, or monthly). Accuracy of this information is crucial to avoid payment delays or miscommunication with the lending institution.

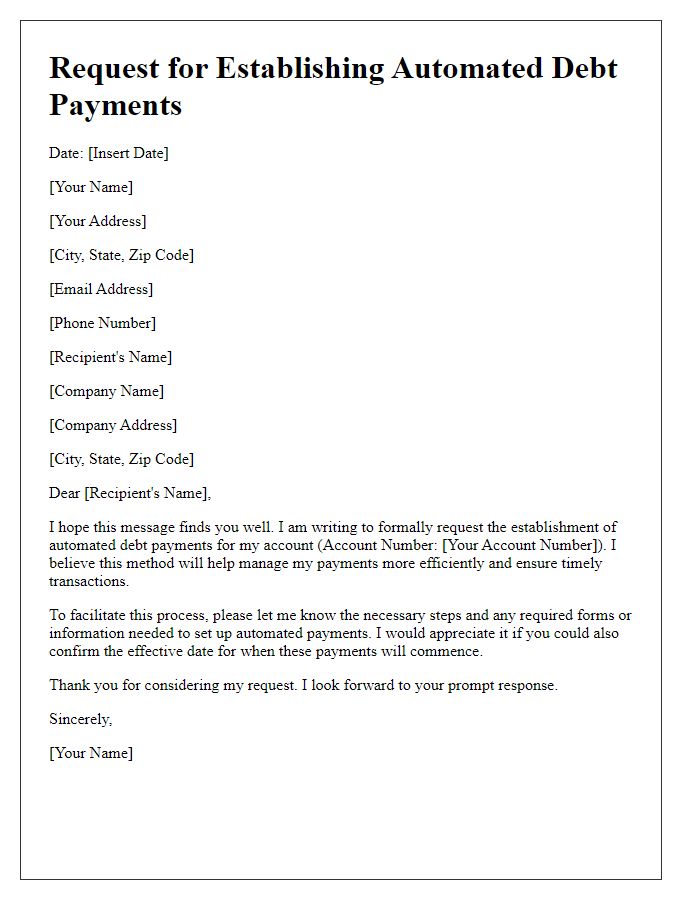

Financial institution details

Setting up automatic debt deductions requires precise attention to financial institution details. Account name represents the holder of the account, typically a full name or business name. Account number, a unique identifier, often consists of 10 to 12 digits, varies between financial institutions. Routing number, essential for directing funds correctly, usually contains 9 digits, indicating the bank's location and identity. Institution name denotes the specific bank or credit union, such as Bank of America or Chase. Address may include street number, street name, city, and ZIP code, providing geographical identification. Payment frequency specifies intervals such as monthly, bi-weekly, or weekly, establishing a schedule for automated withdrawals. Amount indicates the dollar figure to be deducted, ensuring consistent repayment of debts. Authorization signature may be required to provide consent for the setup, often requiring verification to enhance security.

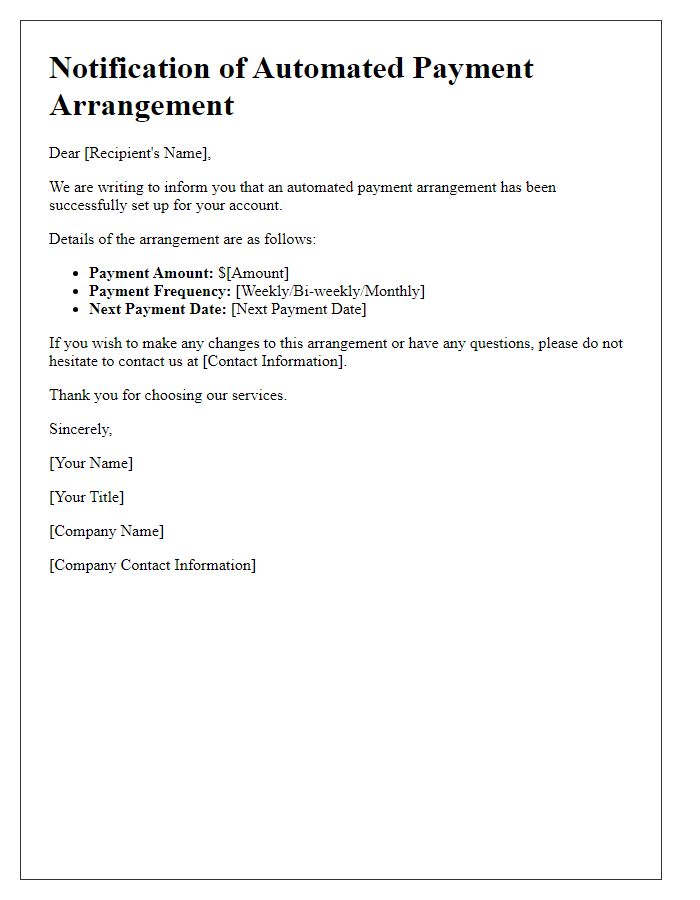

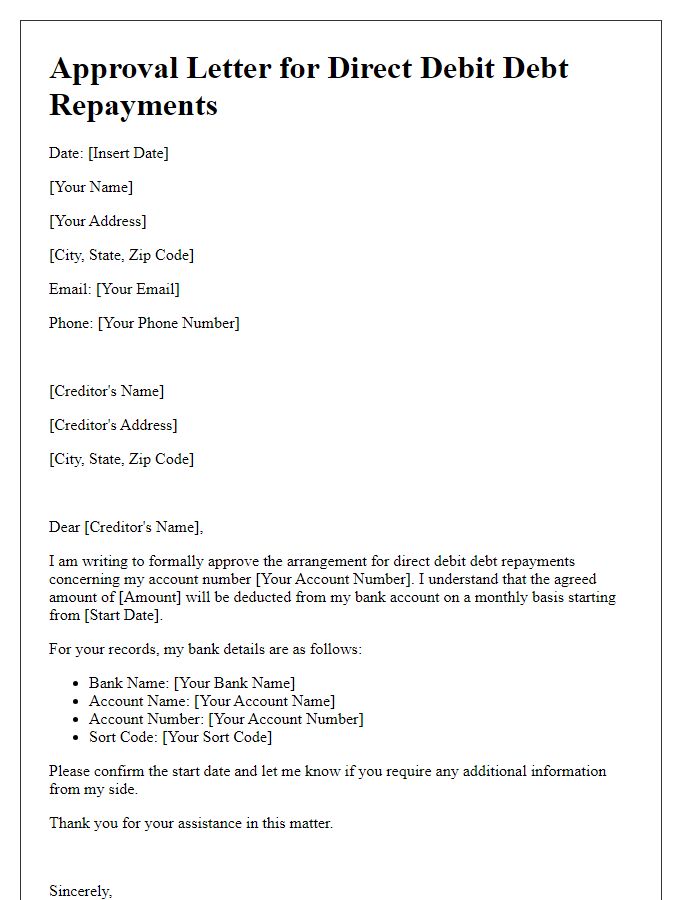

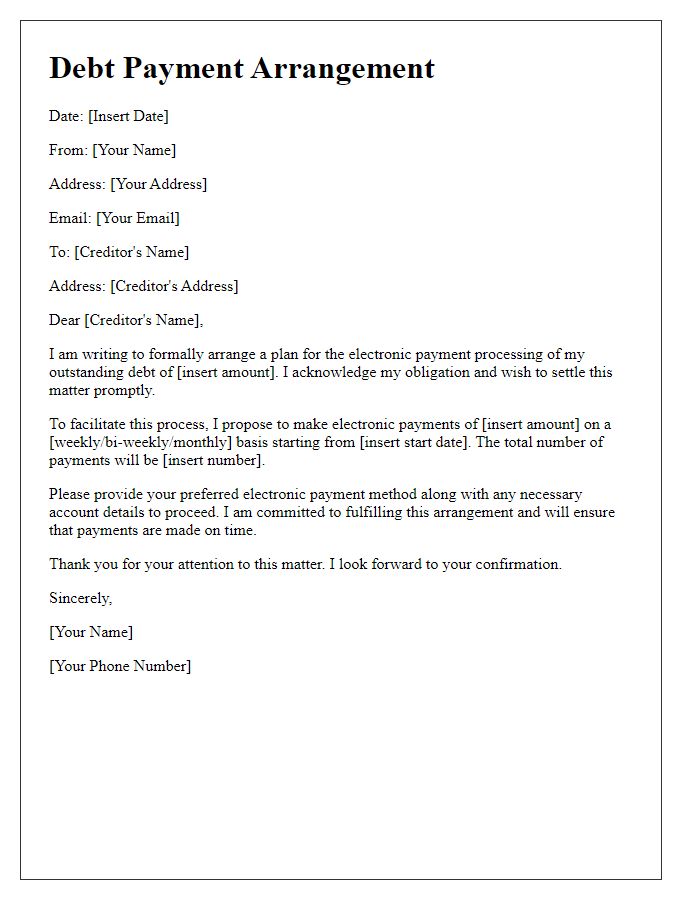

Authorization for automatic deductions

Setting up automatic debt deductions involves a formal authorization process. Individuals must provide their banking details, including account number and routing number, to facilitate these transactions. The authorization form should clearly outline the amount to be deducted regularly, the frequency (weekly, bi-weekly, monthly), and the duration of the deductions (ongoing until canceled, specific number of payments). It is crucial to include the company or lender's name, address, and contact information for transparency. Additionally, terms regarding cancellation policies and notification procedures must be included to comply with financial regulations and protect consumer rights. Always ensure that the signatory confirms their consent with a signature and date.

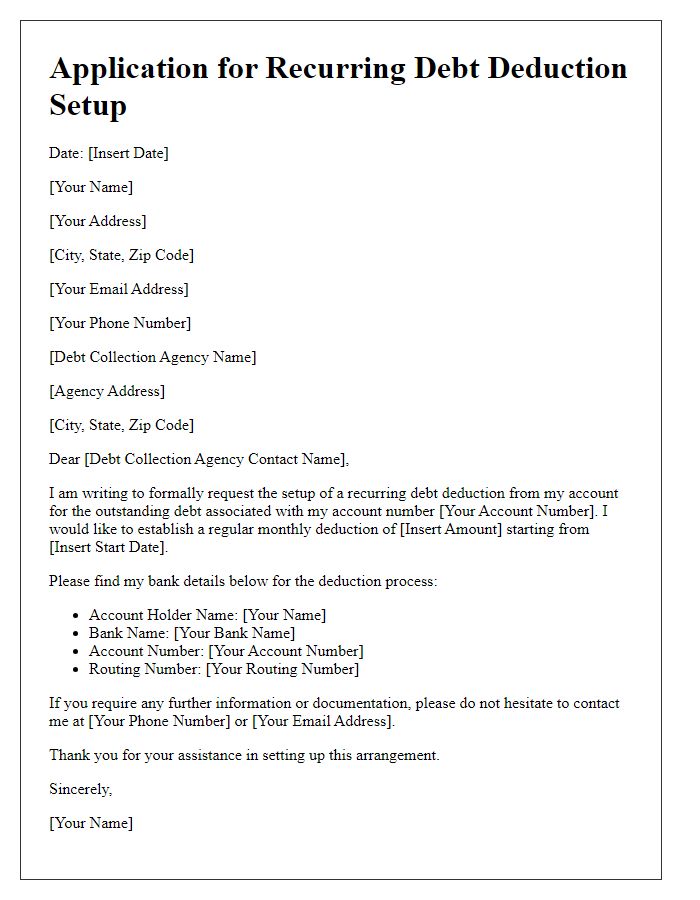

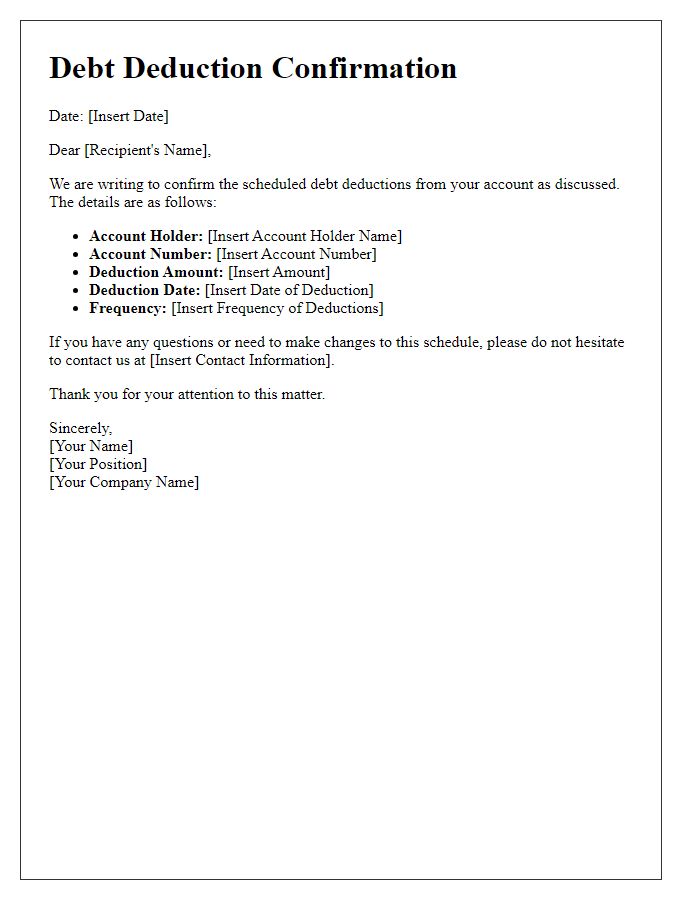

Debt account reference and amount

An automatic debt deduction setup requires careful attention to account details and specific amounts owed. The debt account reference, which uniquely identifies the financial obligation, typically includes a series of alphanumeric characters, such as "DA123456", aligning with bank standards. The amount to be deducted should be clearly stated, specifying currency, for example, "$250.00" for accuracy in transactions. Regular schedules, such as monthly deductions on the fifth day, aid in managing repayment plans effectively, avoiding late fees or interest penalties. Ensuring the banking information is accurate, including the account number and routing number, is essential for successful transfers, providing a seamless experience for both the debtor and the creditor.

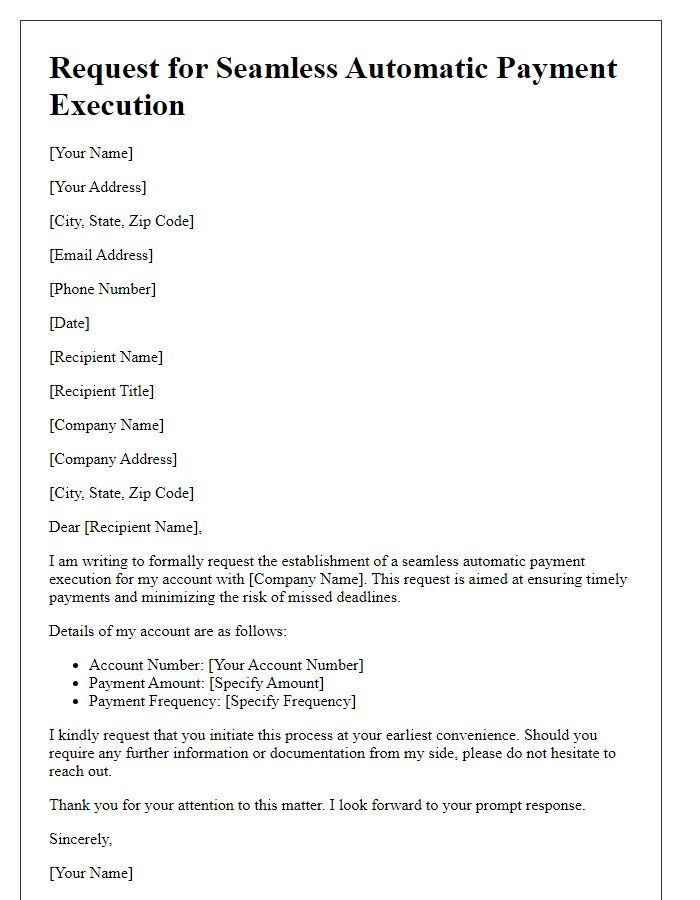

Signatures and date of agreement

Automatic debt deductions, commonly known as direct debit agreements, are essential for ensuring timely payments for loans or recurring bills. Typically, financial institutions or service providers require signatures from the account holder, confirming consent for periodic deductions from a specified bank account (such as a checking or savings account). The date of agreement is crucial as it marks the initiation of the arrangement, assuring both parties of the agreed-upon terms. Specific details such as the amount to be deducted, frequency (weekly, monthly), and duration of the setup may be included to eliminate any confusion. Having a clearly defined structure safeguards both parties against potential disputes regarding payments.

Comments