Are you feeling overwhelmed by your debt payments and considering a deferral? You're not aloneâmany individuals and businesses face this dilemma when financial strains arise unexpectedly. A deferred debt payment engagement can be a viable solution, allowing you the necessary time to regroup without the extra pressure of immediate payments. Curious about how to navigate this process effectively? Read on to discover insightful tips and helpful templates!

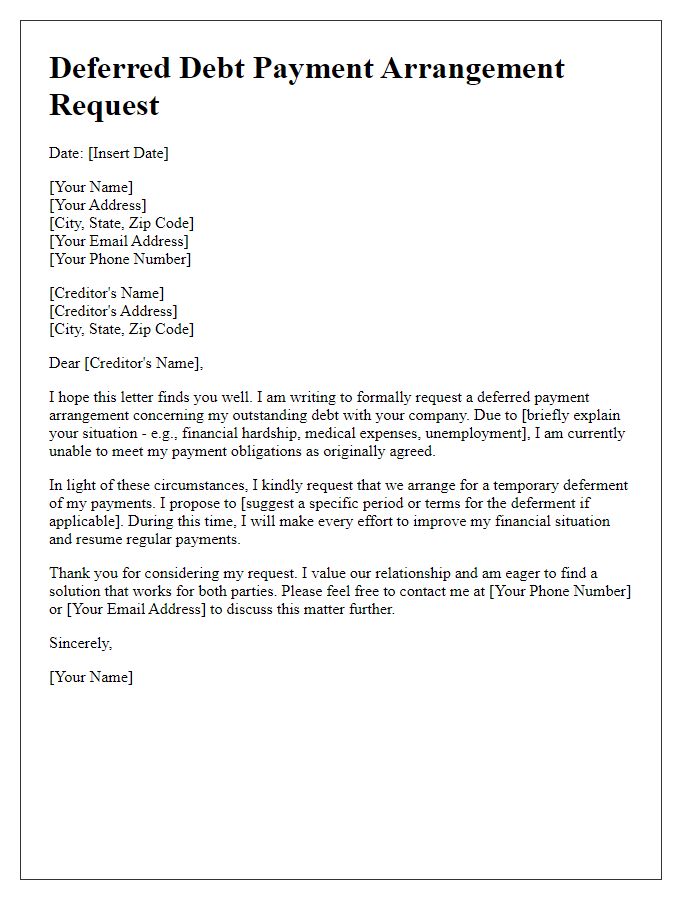

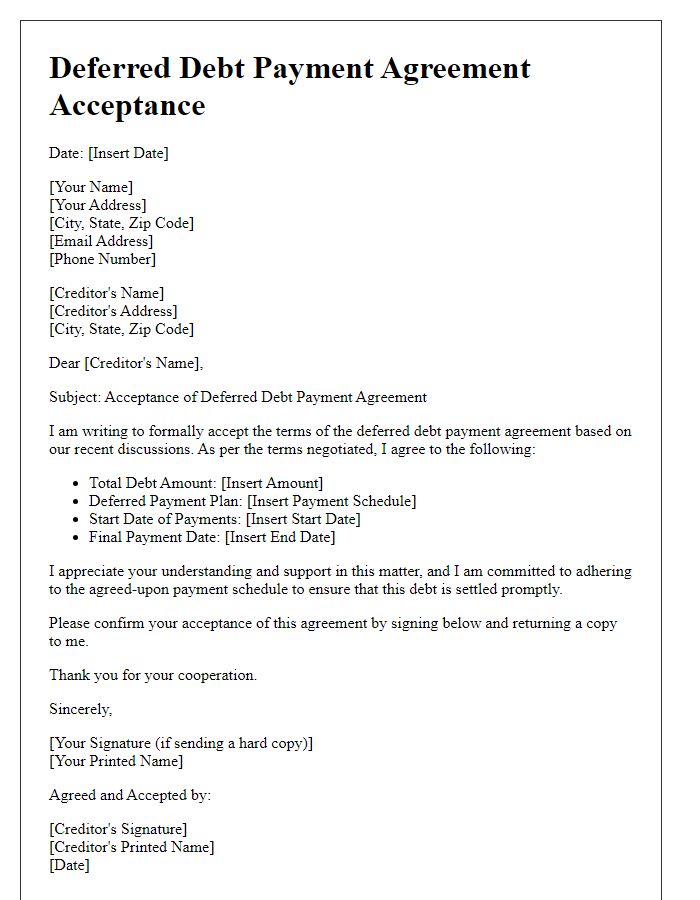

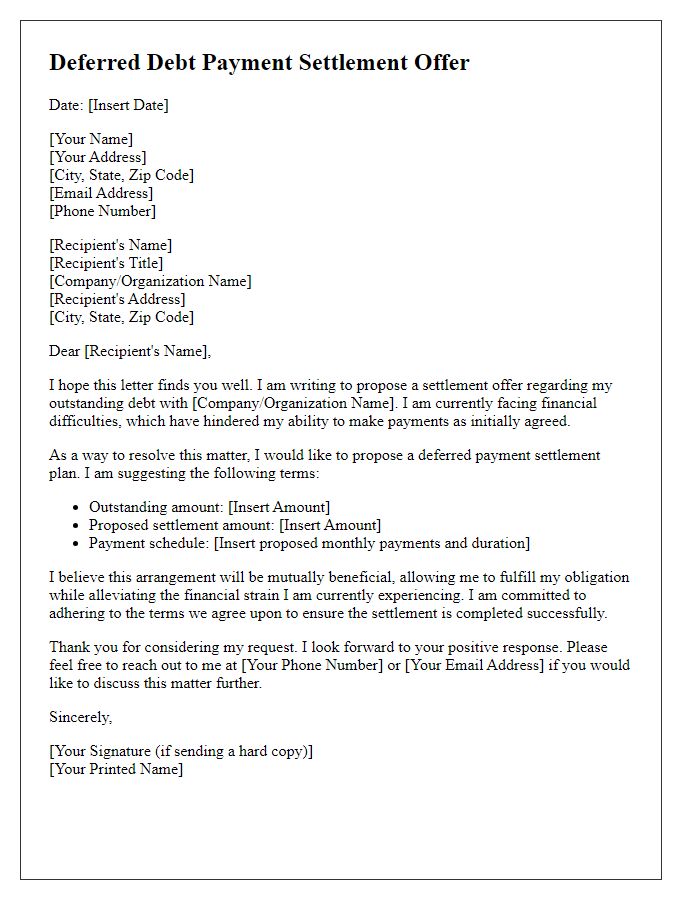

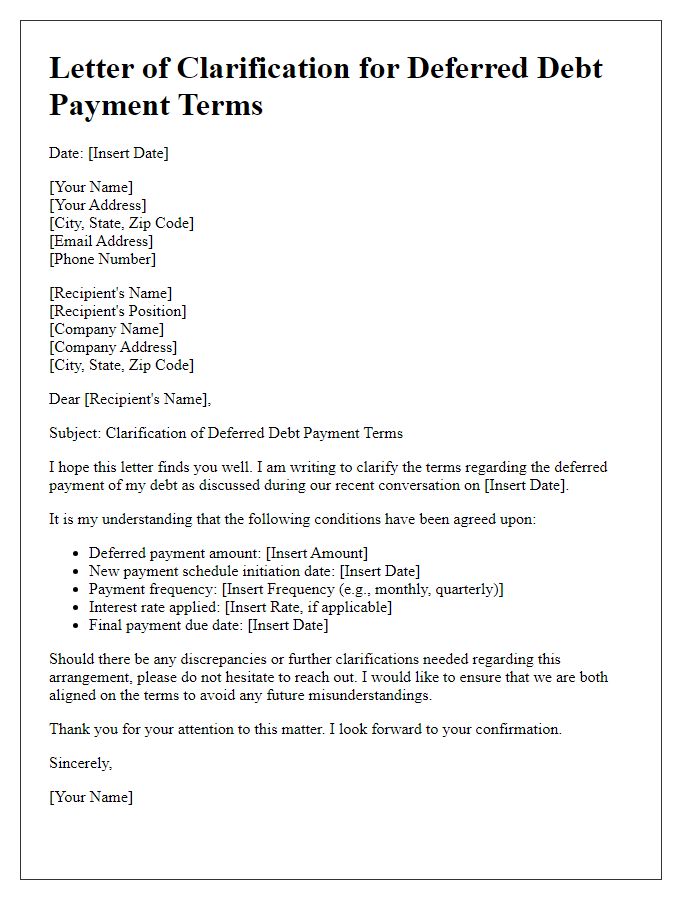

Clarity of Payment Terms

Clarity in payment terms is essential for effective debt management and maintaining healthy financial relationships. Specific parameters such as due dates, installment amounts, and interest rates should be clearly defined to avoid misunderstandings. For example, a deferred payment agreement typically outlines a schedule that could range from six months to two years, allowing borrowers flexibility in repayment. Furthermore, late payment penalties should be explicitly stated to encourage timely payments and prevent additional financial burdens. Transparency regarding changes in payment terms due to unforeseen circumstances, such as job loss or medical emergencies, can also foster goodwill between parties. By ensuring that these elements are unambiguous, both lenders and borrowers can navigate their obligations with confidence.

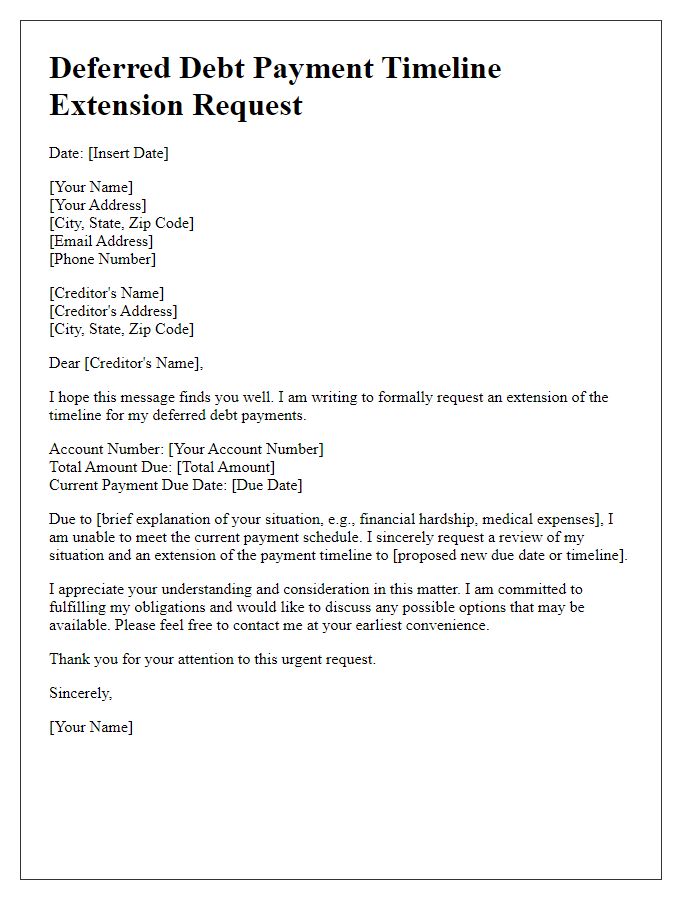

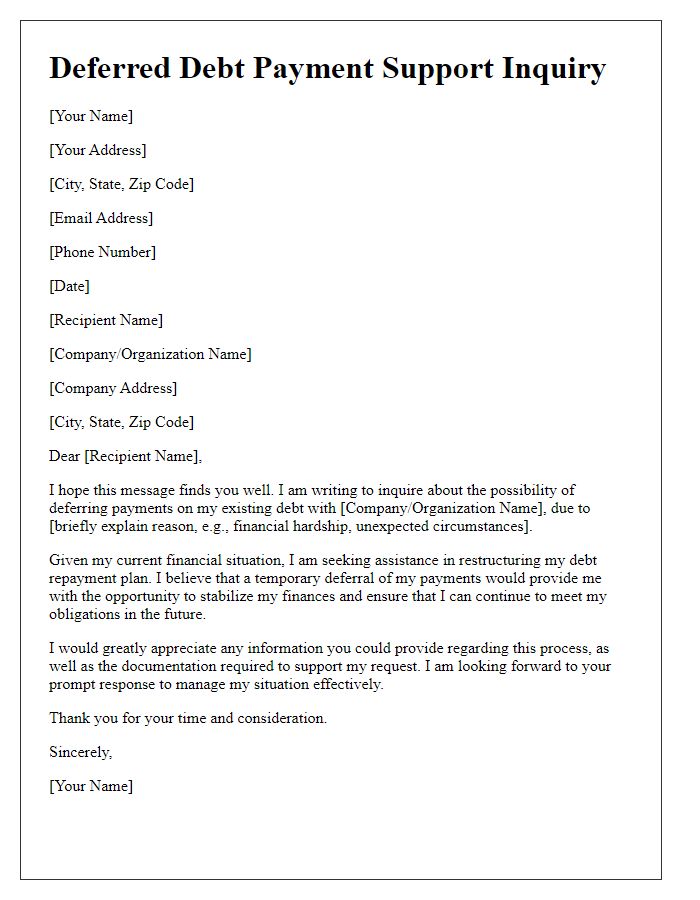

Reason for Deferral Request

Requesting a deferred debt payment can be an essential step for individuals facing financial difficulties. Situations such as unexpected medical expenses, job loss, or economic downturns can create temporary cash flow challenges. For example, during the COVID-19 pandemic, millions of Americans experienced sudden job losses (over 20 million in April 2020), illustrating the need for flexible payment arrangements. Specific debts, such as credit card bills or student loans, often have significant interest rates which can exacerbate financial strain if not managed effectively. Engaging with creditors to discuss deferrals can help individuals regain stability during tough times, ensuring they avoid default while planning for future payments.

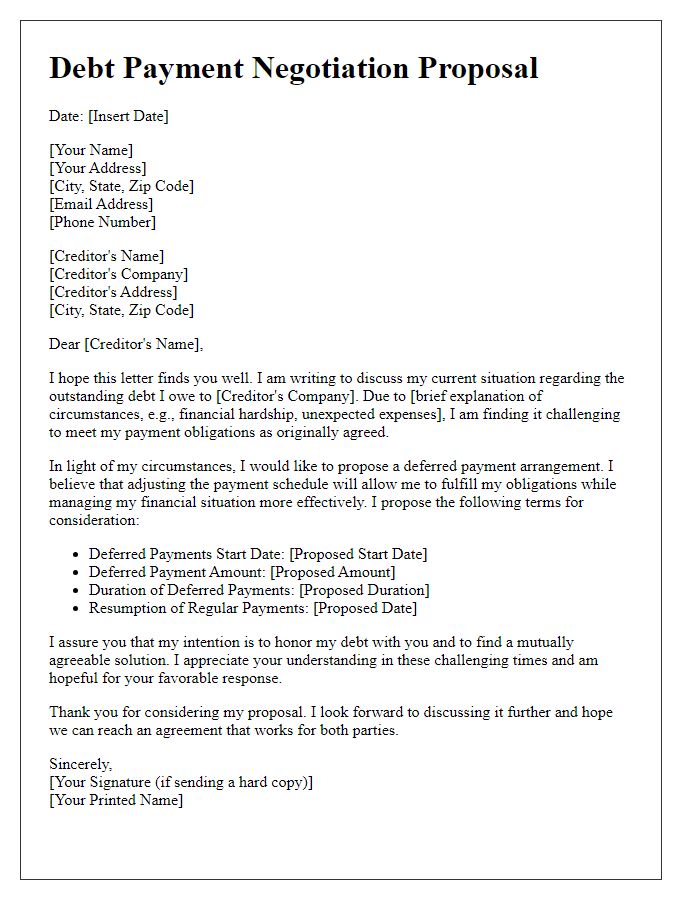

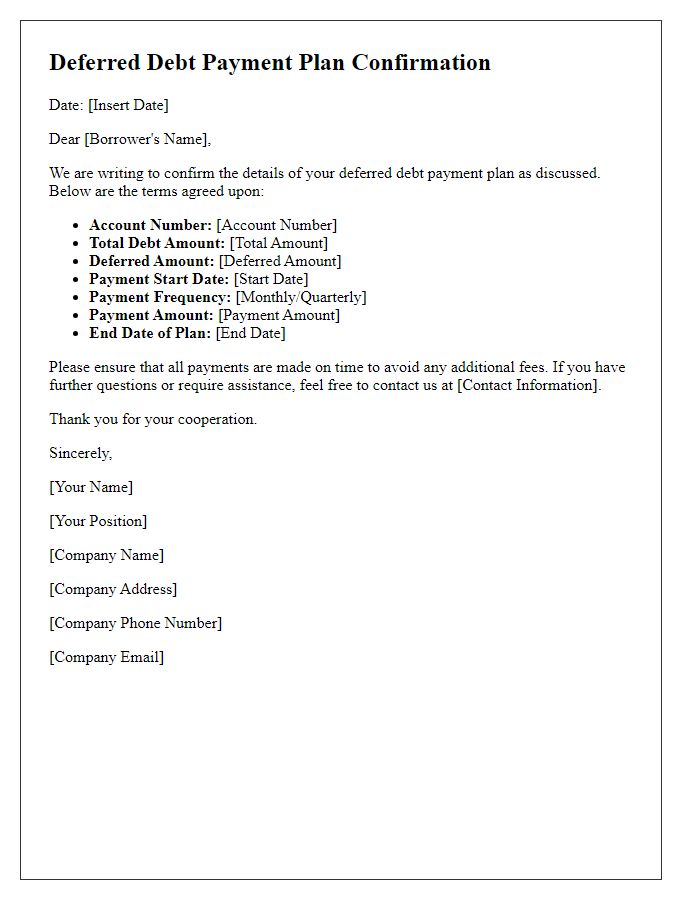

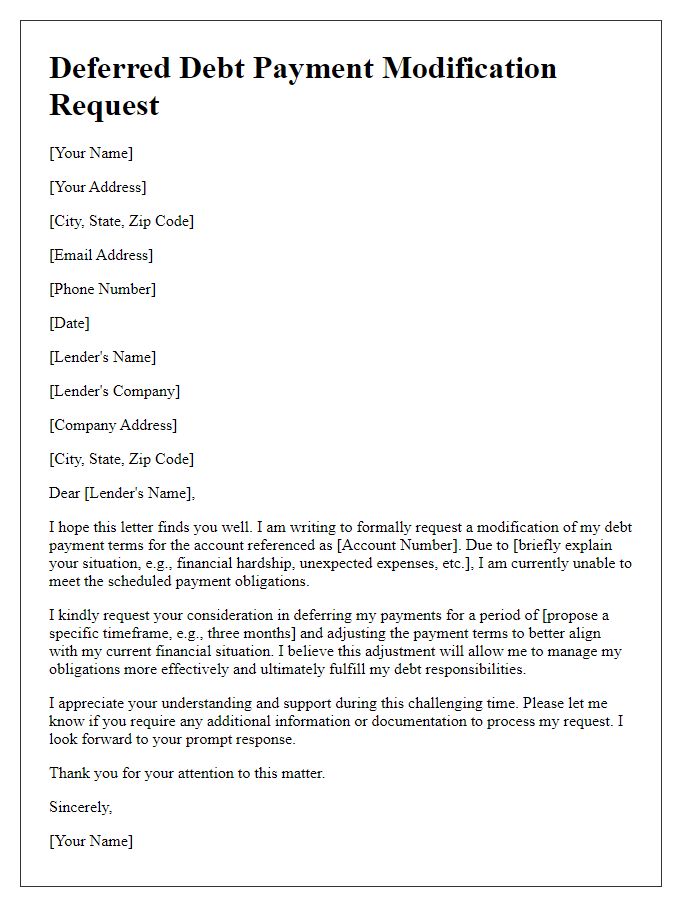

Proposed New Payment Timeline

A deferred debt payment engagement outlines a structured approach to manage outstanding financial obligations. The new payment timeline can extend repayment periods, allowing debtors more flexibility in meeting their financial responsibilities. For example, a plan might propose monthly payments adjusted based on current income, with reduced amounts during periods of financial hardship. Key entities include the debtor (individual or organization), creditors (lending institutions or service providers), and any regulatory bodies overseeing debt agreements. Additional aspects such as interest rates, penalties for late payments, and the impact on credit scores are crucial in constructing an effective and legally binding payment arrangement. This strategic approach aims to facilitate smoother financial recovery while maintaining communications between all parties involved.

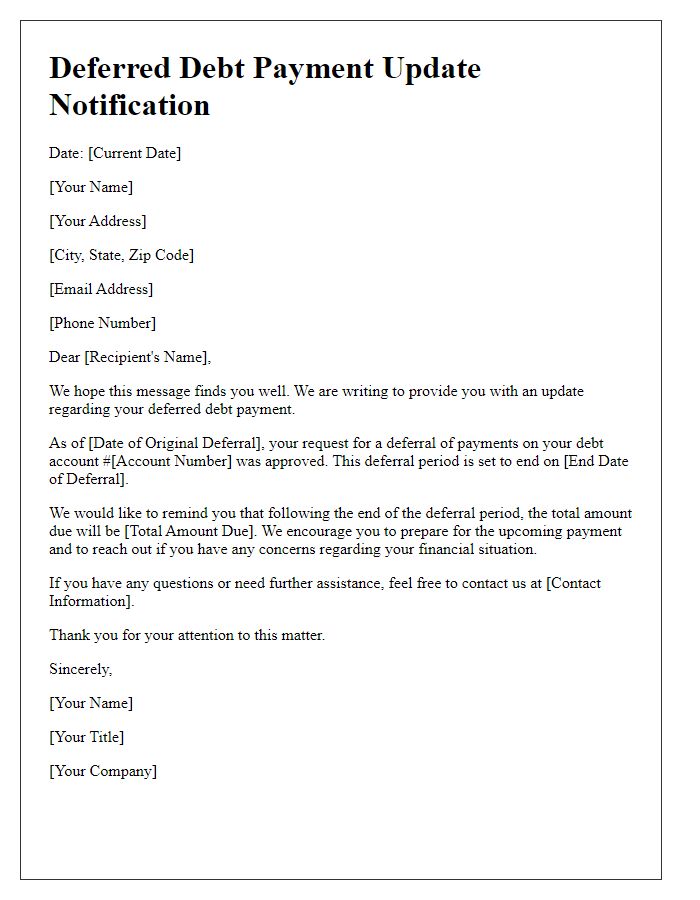

Contact Information for Follow-up

Deferred debt payment engagements often arise during economic hardships, providing borrowers with the opportunity to temporarily postpone payments without penalty. Borrowers must maintain contact with creditors, such as banks or financial institutions, to ensure clarity regarding new payment terms and any interest implications. Timely communication is crucial, enabling both parties to document agreements in writing for future reference. Utilizing contact methods, including email or phone calls, enhances the likelihood of favorable arrangements. It is advisable to have details at hand, including loan numbers and account information, when discussing options with representatives during follow-up conversations.

Formal and Polite Language

A deferred debt payment agreement allows individuals or businesses to postpone their repayment obligations temporarily. This arrangement can be beneficial during financial strains, such as unexpected medical expenses or economic downturns. Essential elements include the total debt amount, interest rates that may apply during the deferral period, and the specific duration before payments resume. A well-documented agreement also features a repayment schedule with clear dates, outlining the expectations for both parties. Understanding local regulations, such as the Fair Debt Collection Practices Act in the U.S., ensures compliance and protects consumer rights during this process. Effective communication with lenders can foster goodwill and potential future collaboration when financial conditions improve.

Comments