Are you feeling the weight of overdue debt? It's a tough situation, but understanding your options can make all the difference. In this article, we'll discuss the importance of addressing your financial obligations and the steps you can take to prevent further complications. So, let's dive in and explore what you need to know to navigate this challenging time effectively!

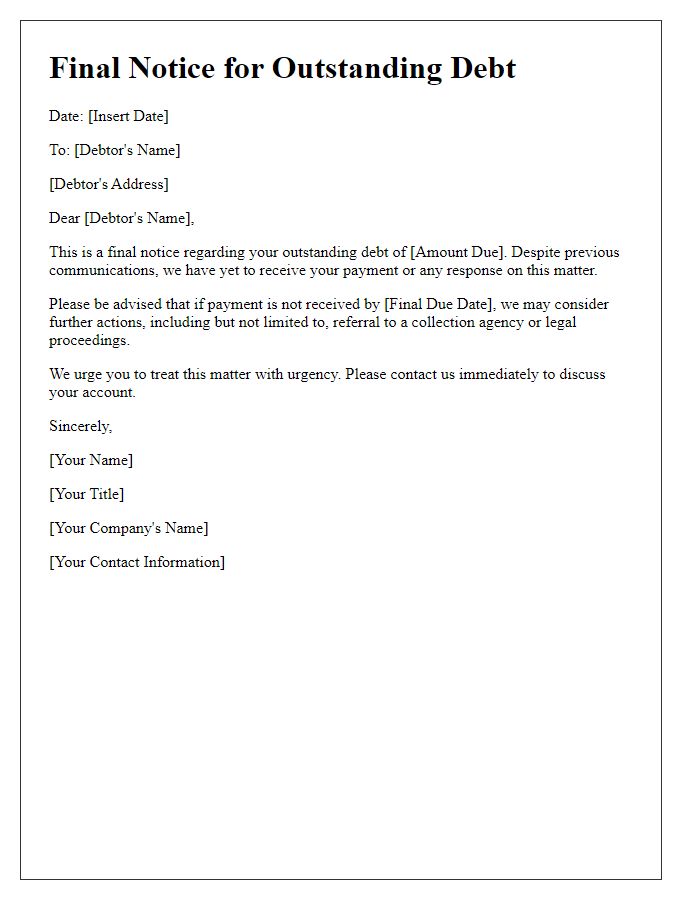

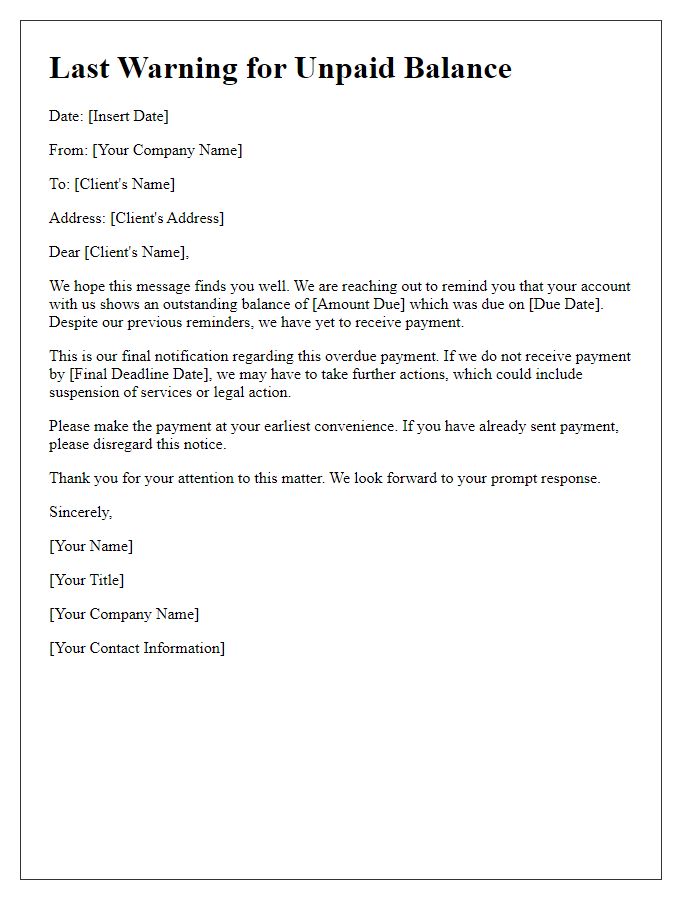

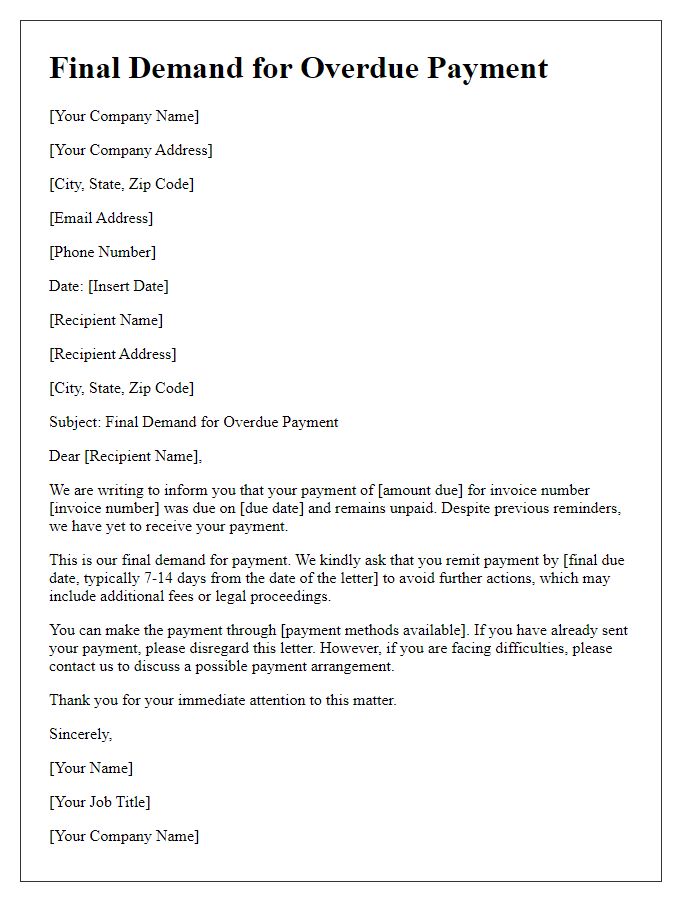

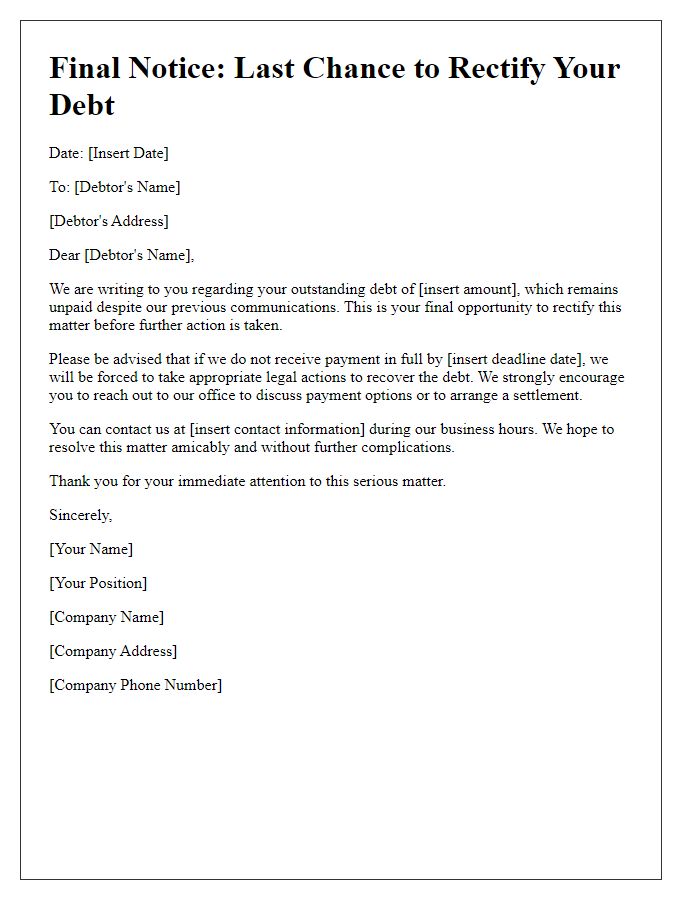

Creditor's Contact Information

Creditor's contact information should include key details such as the creditor's name, address, and phone number. Identify the creditor's specific department dealing with collections for targeted communication. Include a valid email address to facilitate electronic correspondence if applicable. Document any relevant account number or reference number associated with the debt to ensure clarity in communications. Providing this information accurately enhances the chances of resolving outstanding debts promptly while maintaining an effective line of communication.

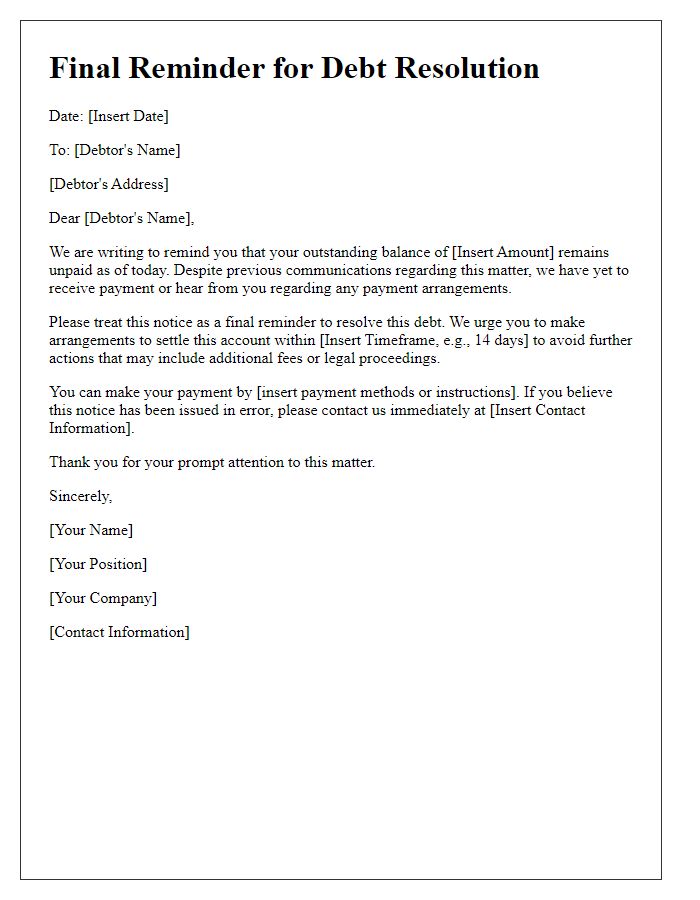

Debtor's Detailed Information

Final debt warnings highlight the urgency of outstanding financial obligations. Key details include debtor's name, which identifies the individual or organization owing money. The amount owed serves as a clear indicator of the financial burden, often including penalties or interest accrued. Specific due dates create a timeline, which emphasizes the deadline for payment. Contact information for collection agencies or legal representatives ensures clear communication channels. The warning may be sent via registered mail, providing proof of delivery and enhancing seriousness. Failure to respond could lead to legal action, resulting in further financial implications for the debtor, including credit score damage and property liens.

Clear Statement of Overdue Amount

Final debt warnings often refer to legal notifications sent to individuals or entities regarding overdue debts. A clear statement of overdue amount can highlight the total outstanding balance, including any accrued interest or fees. This notification typically details critical information such as due dates, payment options, and consequences of non-payment. Legal frameworks may apply, indicating potential for collections or credit report impacts. Important to include contact information for resolution inquiries and payment arrangements to encourage prompt action. Key aspects of the notice may vary based on jurisdiction or financial institution policies.

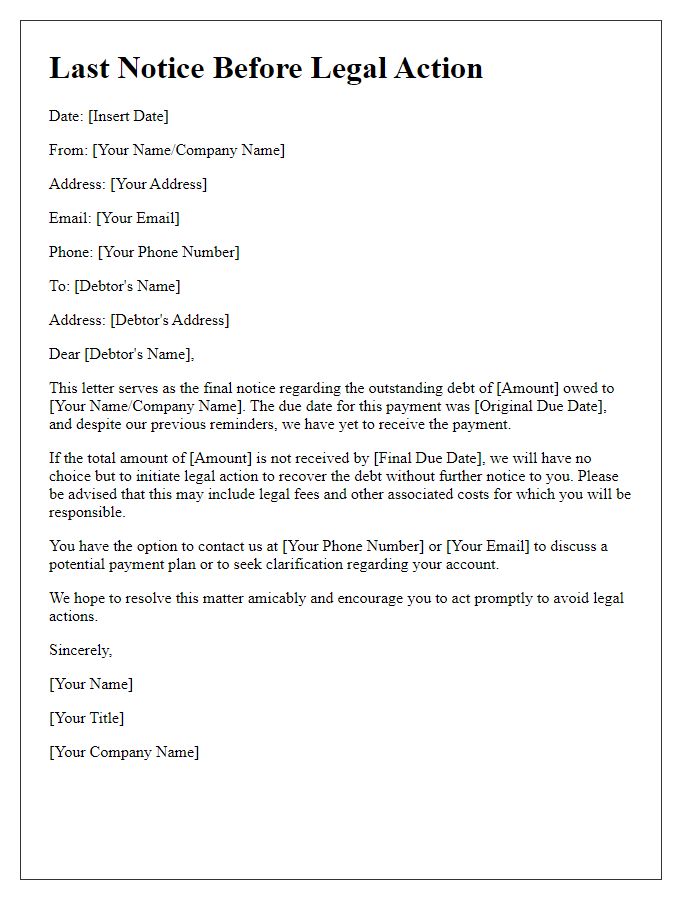

Deadline for Payment

Final debt warning notices serve as a crucial communication regarding outstanding obligations. Recipients, often individuals or businesses, face an urgent deadline for payment, typically set within 7 to 14 days from the date of the notice. The letter usually specifies the total amount owed, including principal and any associated fees or interest rates, which can range from 5% to 20% depending on the creditor's policies. Additionally, the notice may outline potential consequences of non-payment, such as referral to collection agencies or legal action, emphasizing the importance of addressing the debt promptly. Providing clear contact information for debt resolution discussions is also standard practice, enhancing the chance of a positive outcome.

Legal Consequences or Actions

Final debt warning notifications serve as critical reminders for individuals regarding outstanding financial obligations. Failure to address unpaid debts may lead to severe repercussions, such as legal actions initiated by creditors or collection agencies. This could result in court proceedings and judgments that might affect the debtor's credit rating significantly, often dropping it substantially (typically by at least 100 points). Legal consequences may also include wage garnishment, where a portion of earnings is deducted directly from bi-weekly paychecks, and the possibility of asset seizure, depending on local regulations. In extreme cases, bankruptcy filings may become the only recourse, which can remain on financial records for up to a decade. Taking prompt action on unpaid debts can help individuals avoid these distressing legal alternatives and restore financial stability.

Comments