Are you navigating the complexities of debt service subsidies and seeking clarity on how they can work for you? Understanding the ins and outs of these financial tools can seem daunting, but with the right guidance, they can offer significant relief. In this article, we'll break down the essential elements of debt service subsidies and explore how they may be beneficial for your situation. So, stick around as we dive deeper into this topic and invite you to discover more!

Clear Purpose Statement

The Debt Service Subsidy Consultation aims to provide financial assistance to eligible borrowers, such as small businesses or low-income homeowners, facing challenges in meeting debt obligations. This initiative focuses on alleviating economic pressure through tailored subsidies that cover a portion of monthly payments, reducing the financial strain on families and enterprises. The consultation process will gather necessary documents, assess eligibility criteria, including income thresholds and loan types, and facilitate direct communication with financial institutions to structure manageable repayment plans. This program ultimately enhances long-term sustainability for participants, promoting economic resilience in communities.

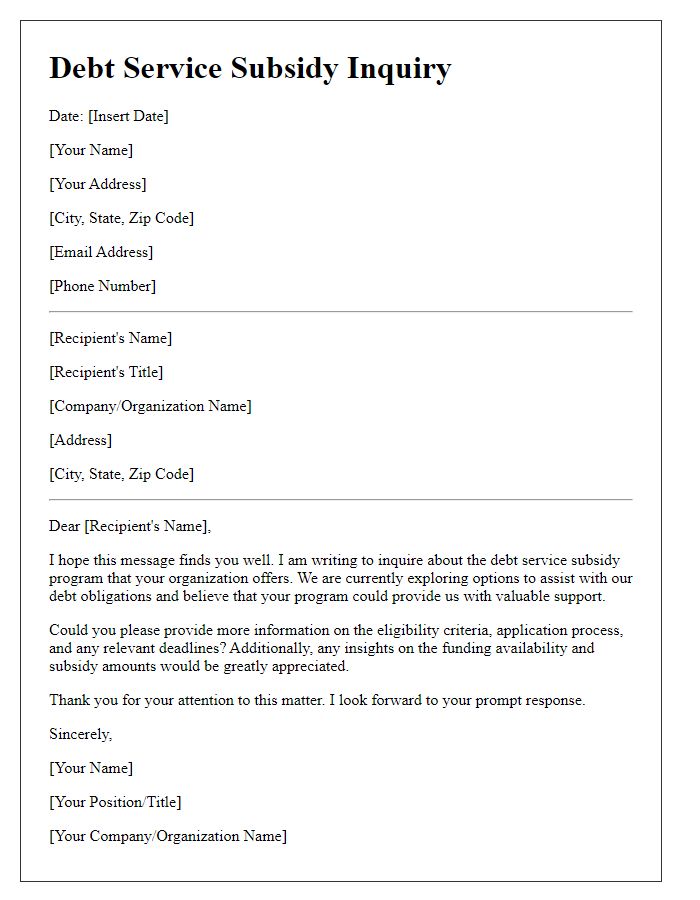

Recipient's Details

A debt service subsidy consultation letter, designed for financial institutions, outlines essential recipient details to facilitate proper communication. Key details include the recipient's full name, a critical identifier for correspondence, and their official title, denoting their position within the organization. The organization's name holds significance, as it represents the legal entity involved in the debt service discussions. The address, comprising the street name and number, city, state, and ZIP code, ensures accurate delivery of correspondence, reflecting professionalism in business communication. Finally, including contact information such as phone numbers and email addresses allows for effective follow-up, fostering a clear channel for consultation regarding financial matters such as debt service adjustments or subsidies.

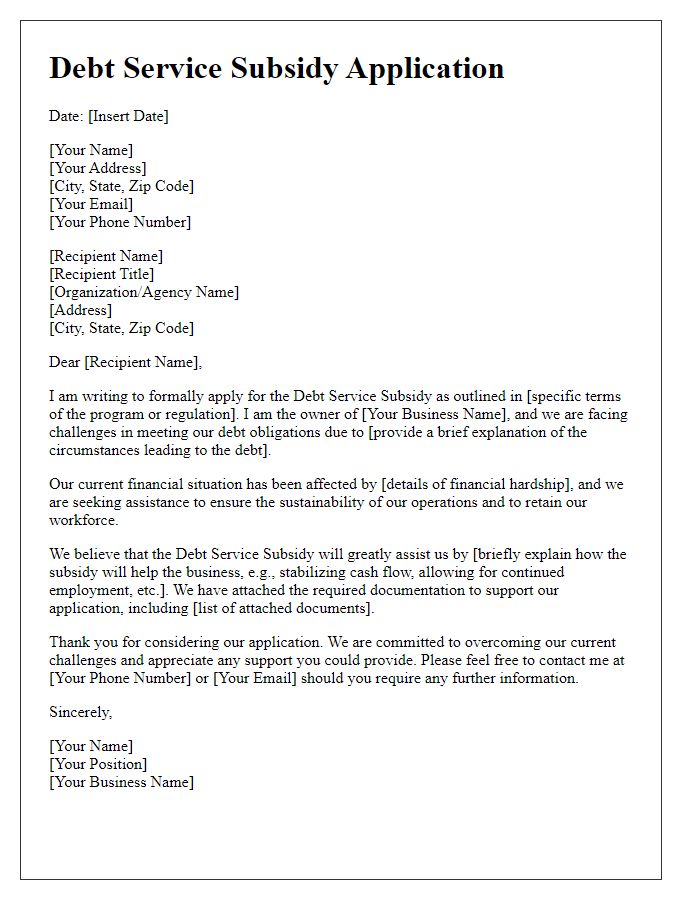

Details of Subsidy Program

The Debt Service Subsidy Program, established to alleviate financial burdens for eligible borrowers, provides assistance to individuals and businesses struggling with loan repayments. This program typically covers a percentage of monthly loan payments, allowing participants to maintain cash flow and financial stability. Eligibility criteria often include income limitations (usually set at 80% of the Area Median Income), types of debt (such as mortgages, personal loans, or student loans), and a demonstrated history of on-time payments prior to financial distress. Geographic restrictions may be imposed, focusing on economically disadvantaged regions or communities. Application processes involve submitting personal financial information, documentation of current loans, and proof of financial hardships. Successful applicants receive monthly subsidies directly applied to their outstanding debt, effectively reducing their financial obligations and fostering long-term fiscal health.

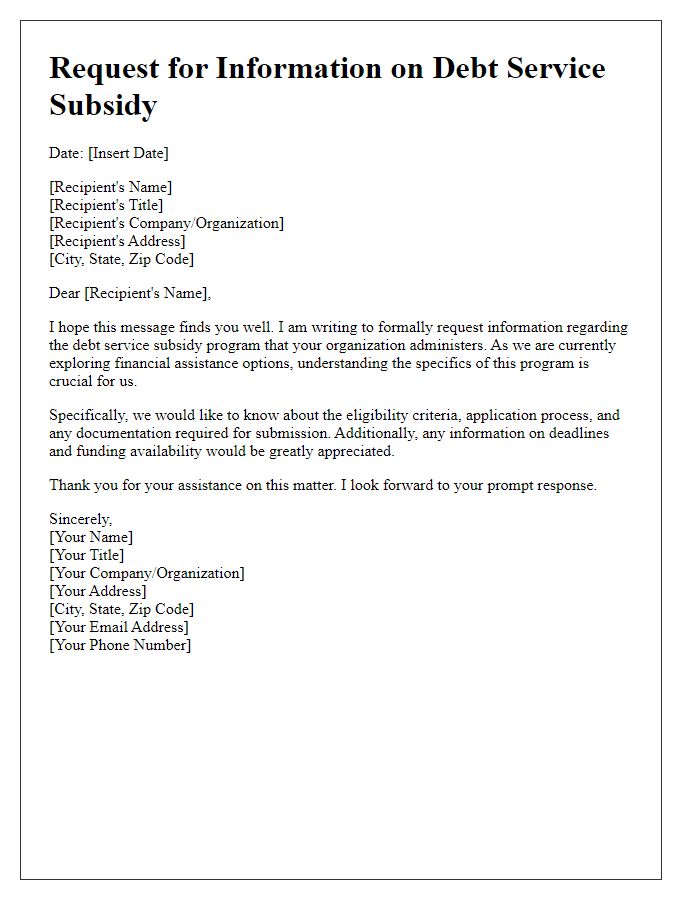

Required Documentation

Debt service subsidy consultations necessitate comprehensive documentation to ensure eligibility and assessment. Essential documents include financial statements, detailing income and expenses, tax returns for the previous three years, and a statement of existing debts, itemizing loan amounts and lenders. Additionally, a clear history of all outstanding debts, including interest rates and repayment schedules, is crucial. Stakeholders must provide proof of income, such as pay stubs or profit and loss statements for self-employed individuals. Finally, a completed application form specific to the subsidy program and any correspondence from the lending institutions may be required for verification and processing.

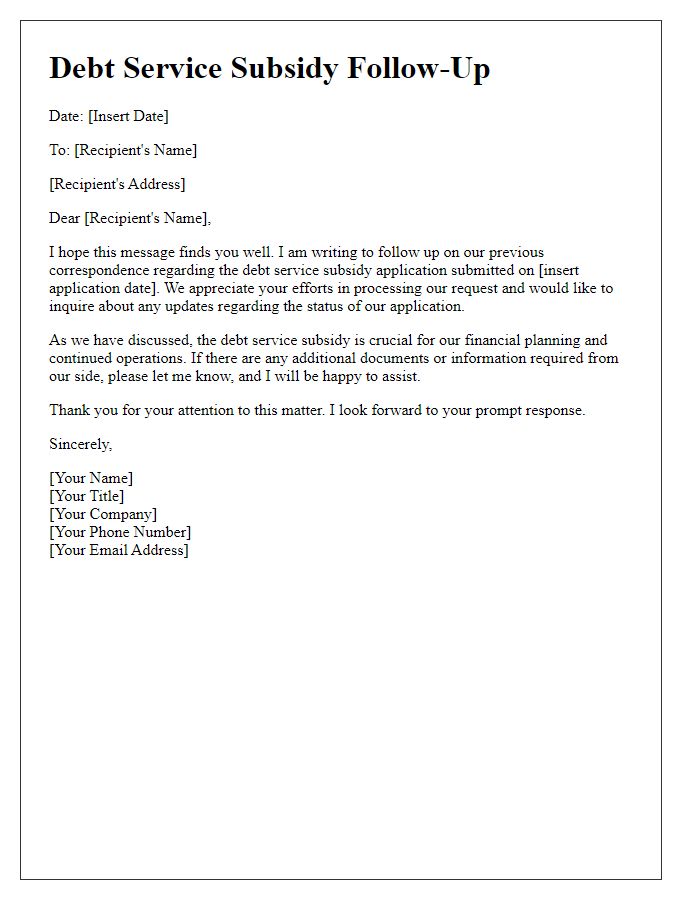

Contact Information for Queries

Debt service subsidies play a crucial role in financial assistance programs, facilitating support for low-income families struggling with housing-related expenses. In the United States, the Federal Housing Administration (FHA) manages various subsidy programs aimed at reducing the cost of mortgage repayments. Individuals seeking assistance must provide necessary documentation, including income verification and housing expenses, to their local housing agency. Local agencies may offer dedicated contact numbers, often operational between 9 AM and 5 PM, to address inquiries about eligibility, application processes, and subsidy amounts. Outreach events frequently occur in communities, providing opportunities for face-to-face consultations on financial literacy and available support resources, ultimately aiming to improve housing stability for vulnerable populations.

Comments