Are you curious about the benefits of a credit card's zero liability policy? This powerful feature protects you from unauthorized transactions, ensuring that your hard-earned money stays secure. Understanding how this policy works could save you from financial headaches and give you peace of mind while shopping. So, let's dive into the details and explore what this means for youâread on to discover more!

Concise Introduction

The credit card zero liability policy protects cardholders against unauthorized transactions, offering peace of mind while using their cards. Under this policy, consumers are not held liable for charges made without their consent, provided they report the fraud within a specified time frame, typically 60 days. This ensures that any fraudulent activity is swiftly addressed, safeguarding both personal finances and credit scores. Institutions emphasize the importance of monitoring account statements regularly to catch potential fraud early, strengthening the security measures for users.

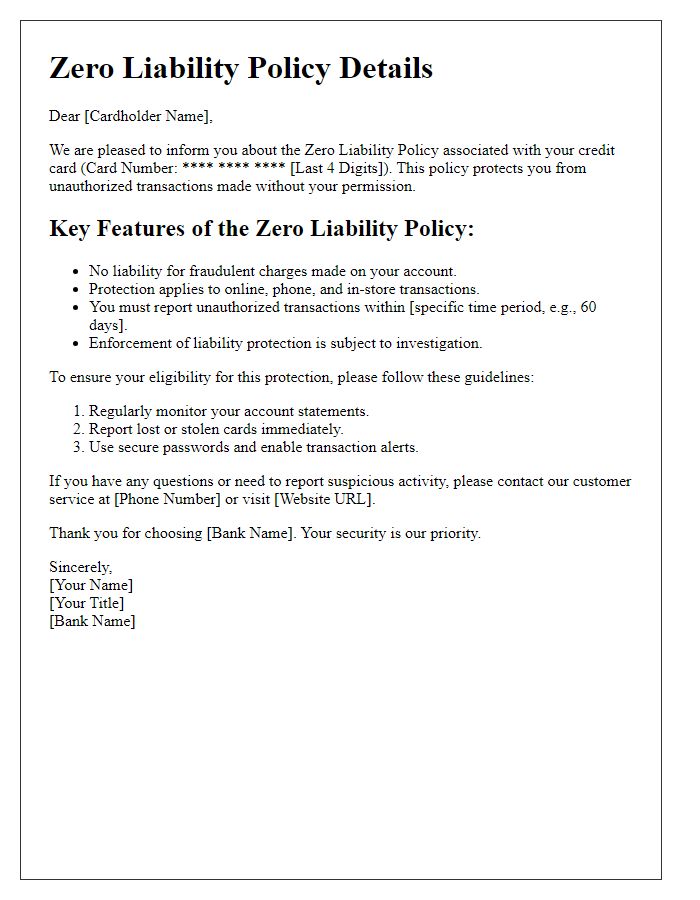

Explanation of Zero Liability Policy

The Zero Liability Policy is designed to protect credit card holders from unauthorized transactions, offering peace of mind and financial security. Under this policy, customers are not held responsible for any fraudulent charges made on their credit cards, provided they report the unauthorized use within a specified timeframe, typically ranging from 30 to 60 days. Major credit card companies such as Visa and MasterCard provide this protection, which underscores the importance of monitoring account activity regularly. In the event of theft, loss, or online fraud, quick reporting to the issuer can safeguard consumers from financial loss, ensuring they only pay for transactions they authorized. This policy is vital for safeguarding personal financial information in today's digital age, where cyber threats are increasingly common.

Customer Guidance on Reporting Theft or Fraud

Credit card zero liability policies allow consumers to report unauthorized transactions without facing financial loss. Immediate reporting is crucial, especially for incidents involving theft or fraud. Consumers should contact their credit card issuer, such as Visa or MasterCard, through dedicated customer service numbers within 24 hours of discovering suspicious activity. Detailed documentation, including transaction dates, amounts, and merchant names, aids in the investigation process. Additionally, monitoring account statements regularly helps identify irregularities early. Cardholders must ensure their contact information remains current to receive alerts and updates regarding their accounts. Understanding these protocols enhances consumer protection against financial risks.

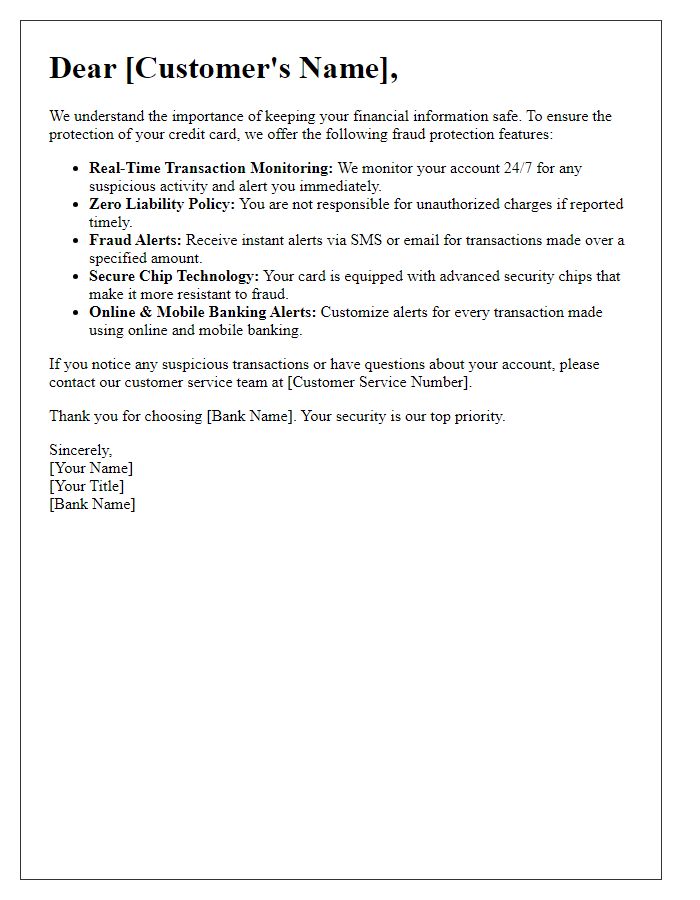

Assurance of Security Measures

Credit card companies implement a zero liability policy to safeguard consumers from unauthorized transactions, providing reassurance against fraud. Cardholders are protected for unauthorized charges, ensuring financial security up to the total amount of the transaction--typically thousands of dollars--without personal loss. This policy is governed by provisions outlined in the Fair Credit Billing Act (FCBA), which mandates prompt reporting of fraudulent activity, usually within 60 days from the statement date. Additionally, security measures, such as EMV chip technology and two-factor authentication, enhance protection for transactions, particularly in physical retail locations across various regions. Consumer education initiatives also highlight the importance of safeguarding personal information to prevent theft. Major providers like Visa and Mastercard continue to advance their cybersecurity protocols to maintain customer trust and confidence in their services.

Contact Information for Support

Zero liability policies protect consumers, such as those issued by major credit card companies like Visa and MasterCard, from unauthorized transactions. When a cardholder reports fraudulent activity promptly, typically within 60 days, they are not responsible for the incurred charges. Consumer protection laws, such as the Fair Credit Billing Act (FCBA), reinforce these policies, offering additional safeguards. Contacting customer support is crucial for resolving issues; support can typically be reached through dedicated phone numbers or online chat features provided on official websites. It is essential to document any communications, including the dates and representatives spoken with, to ensure a smooth claims process. Important details such as transaction dates, amounts, and merchant names must be prepared for reporting potential fraud.

Comments