Have you ever found yourself with a credit card you rarely use? It's easy to forget about those plastic companions, but ignoring them can come with consequences. In this article, we'll discuss the importance of staying on top of your credit card usage and the potential impacts on your credit score. So, grab a cup of coffee and join me as we explore why it's vital to keep your credit cards active!

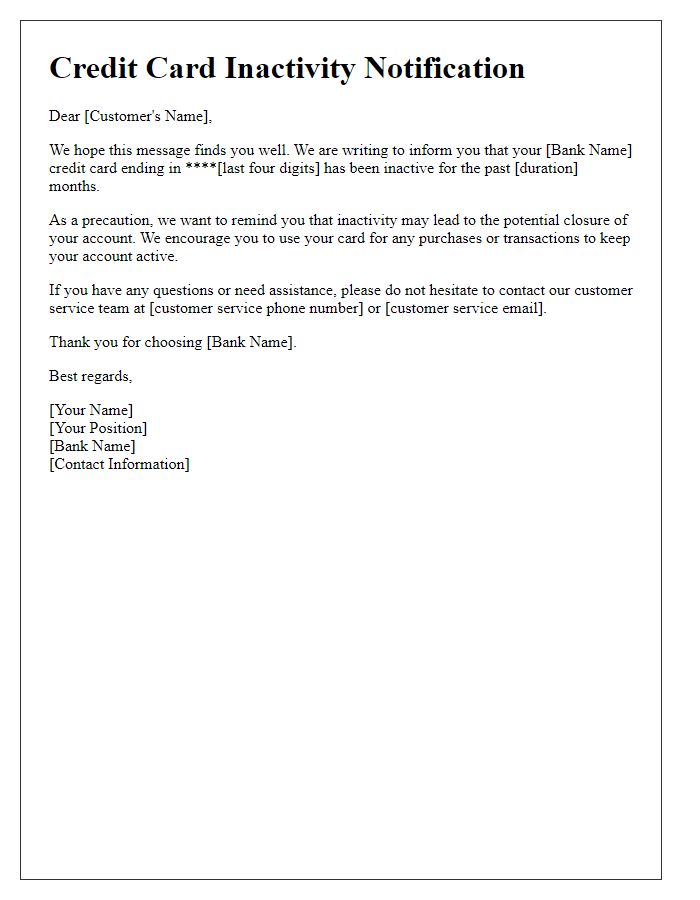

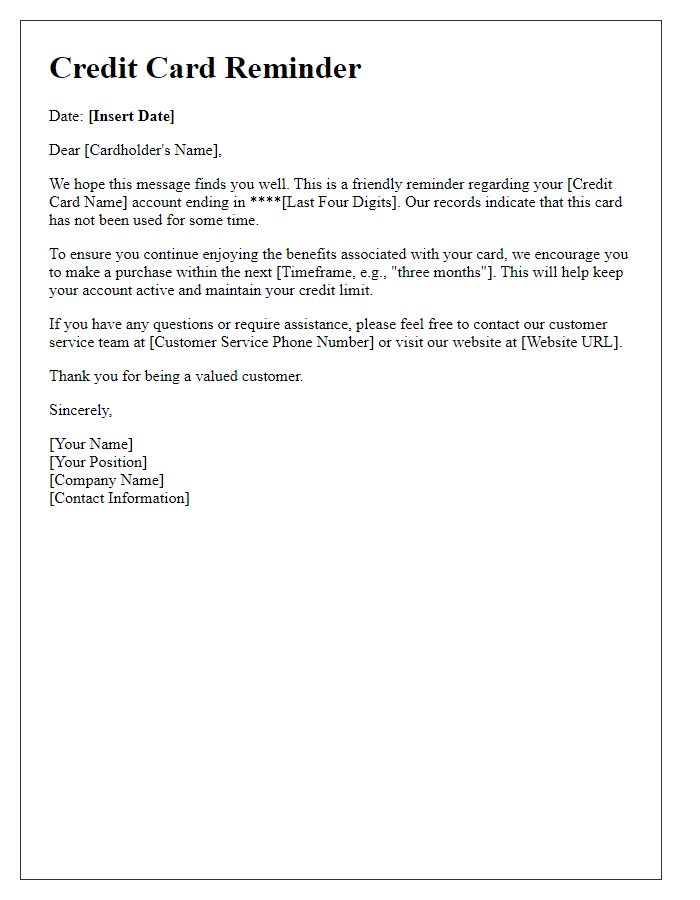

Personalized greeting

Credit card non-usage can lead to inactivity fees and impact credit scores adversely. Many financial institutions, such as major banks, often send reminders to customers after six months of non-usage, encouraging them to use the card at least once to keep the account active. Failure to use the card may result in closure of the account, a decision influenced by factors like credit utilization ratio and overall account activity. In addition, an inactive credit card may reduce available credit, affecting financial flexibility. Customers should be aware of these potential consequences and consider making small purchases regularly to maintain account status.

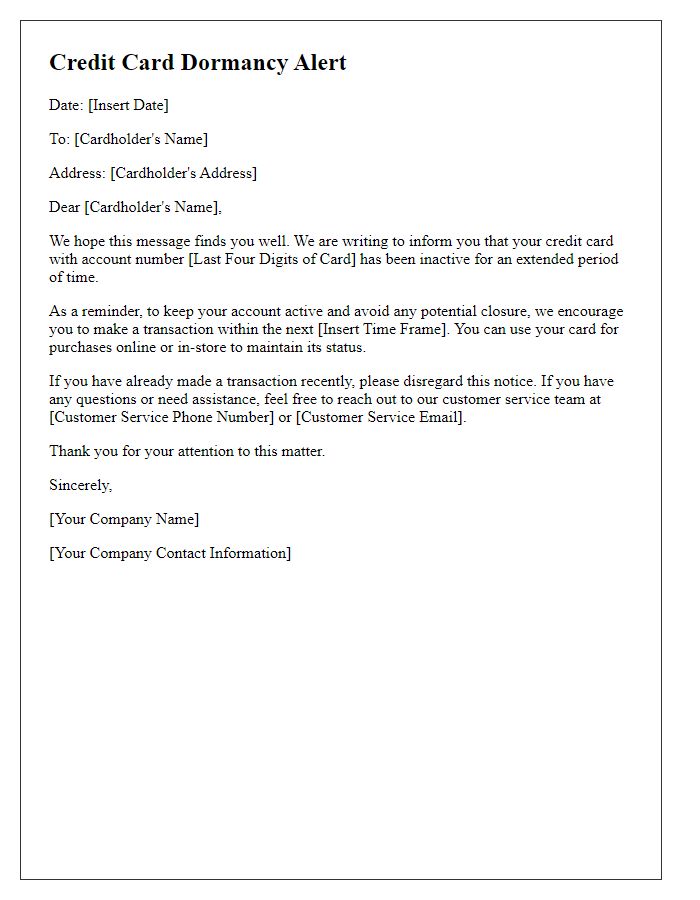

Account inactivity notice

A credit card account inactivity notice serves to remind cardholders about their credit card status and the potential consequences of not using the card. Inactive periods of six months or more may trigger fees, such as inactivity fees, or even result in the account being closed. Financial institutions, such as Bank of America or Chase, typically advise users to make at least one purchase within a designated timeframe to maintain account activity. Additionally, some credit card issuers may offer promotional incentives to encourage usage, thereby maintaining a healthy credit utilization ratio which is beneficial for credit scores. Frequent reviews of account statements can aid awareness of any impending changes regarding inactive accounts.

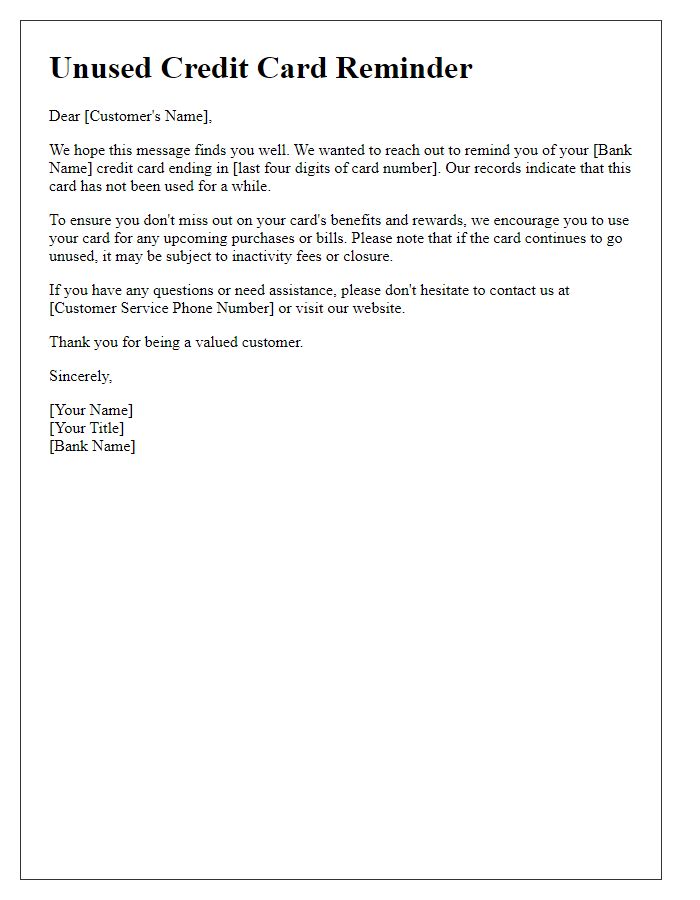

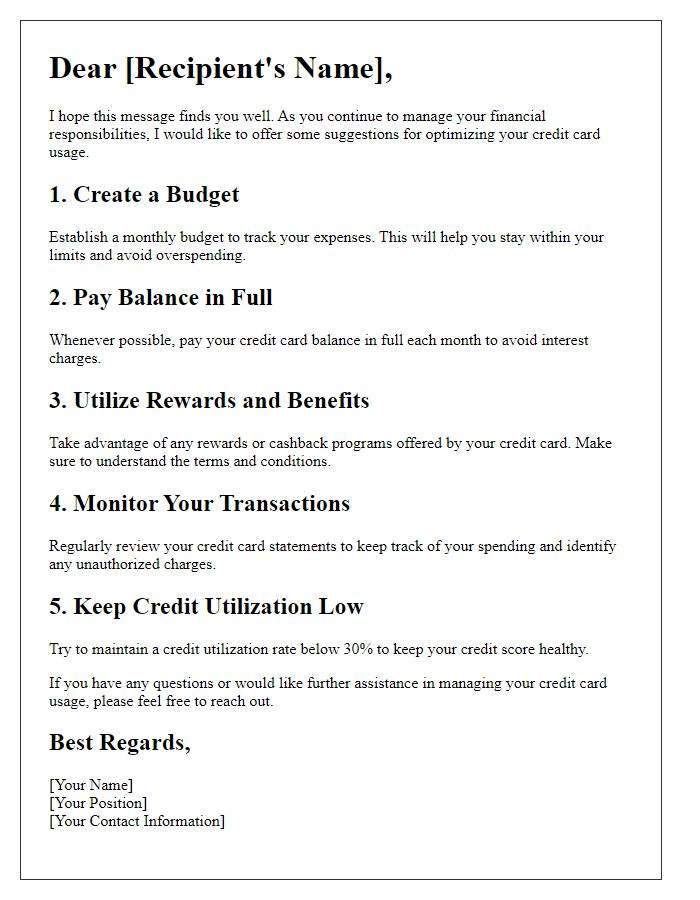

Benefits and rewards highlight

Credit card non-usage can lead to the loss of numerous benefits and rewards associated with the card, such as cashback offers, travel points, and promotional discounts. Many credit cardholders, including those with popular issuers like Chase and American Express, often miss out on exclusive perks that require regular usage to maximize rewards. For instance, accumulating points for travel can significantly enhance vacation experiences, saving hundreds of dollars on flights and accommodations. Furthermore, many credit cards offer incentives such as bonus points for reaching spending thresholds within a specified timeframe. It is essential to remain engaged with your credit card to fully take advantage of these lucrative opportunities, ensuring you gain the most from your financial choices.

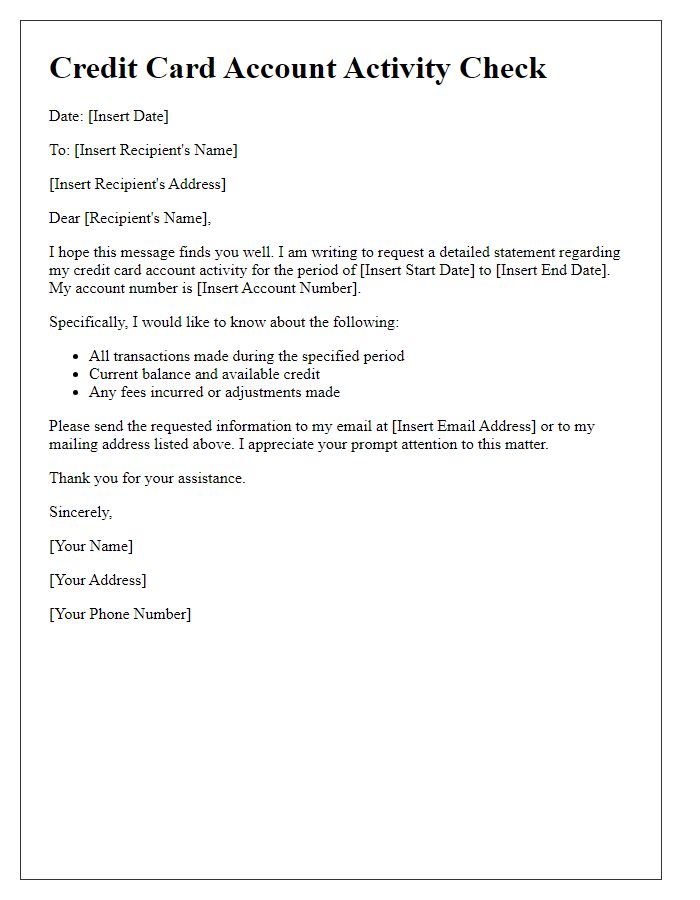

Call-to-action suggestion

Regular non-usage of credit cards can signal financial inactivity or mismanagement, impacting credit scores and potential future credit availability. Many credit card issuers, such as American Express and Visa, monitor account activity closely. Inactive accounts may incur fees or be subject to closure after a specific period, often around 12 months of no transactions. Therefore, maintaining at least minimal usage, like a small purchase each month, can ensure accounts remain open and active. Furthermore, timely payments can help strengthen credit history while reducing the risk of unwanted fees or loss of credit limits.

Contact information for assistance

Many credit card companies send reminders to account holders who have not used their cards recently, often aiming to encourage activity or prevent account closure. For instance, a customer with a Visa card issued by a major bank may receive a letter after six months of inactivity. The reminder typically includes customer service contact information, such as a toll-free phone number (1-800-XXX-XXXX) and an email address (support@bank.com), where customers can reach out for assistance or resolve any inquiries. Additionally, the letter may provide details on any potential fees associated with non-usage, or promotional offers to incentivize card activity.

Comments