Have you ever found yourself in the frustrating situation of losing your credit card? It can feel overwhelming, but taking the right steps promptly can help protect your finances. In this article, we'll guide you through the essential steps to report a lost credit card, ensuring that your personal information remains secure and mitigating any potential damage. Ready to learn how to handle this situation smoothly? Let's dive in!

Cardholder information

Cardholders who have lost their credit cards must act quickly to prevent unauthorized transactions. Immediately reporting the loss can minimize financial risk. Cardholder information, including full name, contact number, and account number, is essential for the bank's verification process. Banks usually require specific details such as the last transaction date and amount to authenticate the report. Promptly canceling the lost card and requesting a new card is critical for security. Many banks provide online services or mobile apps that facilitate the reporting process, allowing cardholders to secure their accounts efficiently.

Date of loss or theft

Reporting a lost or stolen credit card is crucial to protect your financial information. If a credit card goes missing, especially after the date of loss or theft (notable events such as December 15, 2023), immediate action is essential. The cardholder should contact their financial institution promptly, detailing the last known location (such as a restaurant in downtown Chicago) and circumstances of the loss (like leaving it on the table). This ensures the bank can deactivate the card to prevent unauthorized transactions. Following the report, the bank typically issues a replacement card, often taking 5 to 7 business days for processing and delivery.

Card details (if known)

A lost credit card can lead to unauthorized transactions and identity theft. It's essential to report a lost card immediately to the issuing bank or credit card company, which can vary by institution but typically requires providing personal identification details and the card number (if known). For instance, major providers like Visa and MasterCard recommend reporting losses within 24 hours to mitigate potential fraud. In 2021, over 1.4 million cases of unauthorized use of credit cards were reported in the United States alone, highlighting the urgency of prompt reporting. Furthermore, the Federal Trade Commission (FTC) advises vigilance by monitoring bank statements and setting up account alerts for suspicious activity.

Contact information for follow-up

Reporting a lost credit card requires immediate action to secure financial accounts. Customers should provide essential details such as full name, address, and phone number for follow-up communication. Include the credit card number (if available) or the last four digits for identification. It is crucial to report the incident to the issuing bank using the designated customer service number, typically found on the bank's website, and to monitor account statements for unauthorized transactions. Follow-up steps may involve confirming the cancellation of the lost card and issuing a new card, ensuring account security against potential fraud.

Request for card cancellation and replacement

Lost credit cards pose significant security risks to consumers. Reporting a lost card immediately is crucial to prevent unauthorized transactions. Customers should contact their credit card issuer, often via a dedicated customer service line, to initiate the cancellation process. Cardholders typically provide identification details, including the last four digits of the card number and personal information, to verify identity. Issuers may issue a replacement card, usually taking 7 to 10 business days for delivery. During this period, customers can monitor account activity for fraud, while temporary digital cards may be available for online purchases.

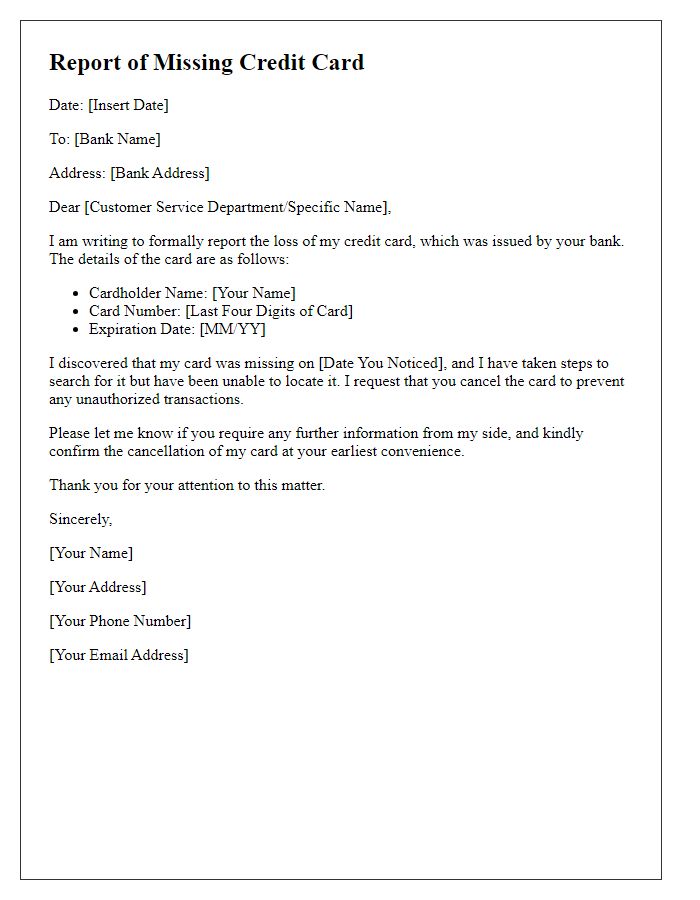

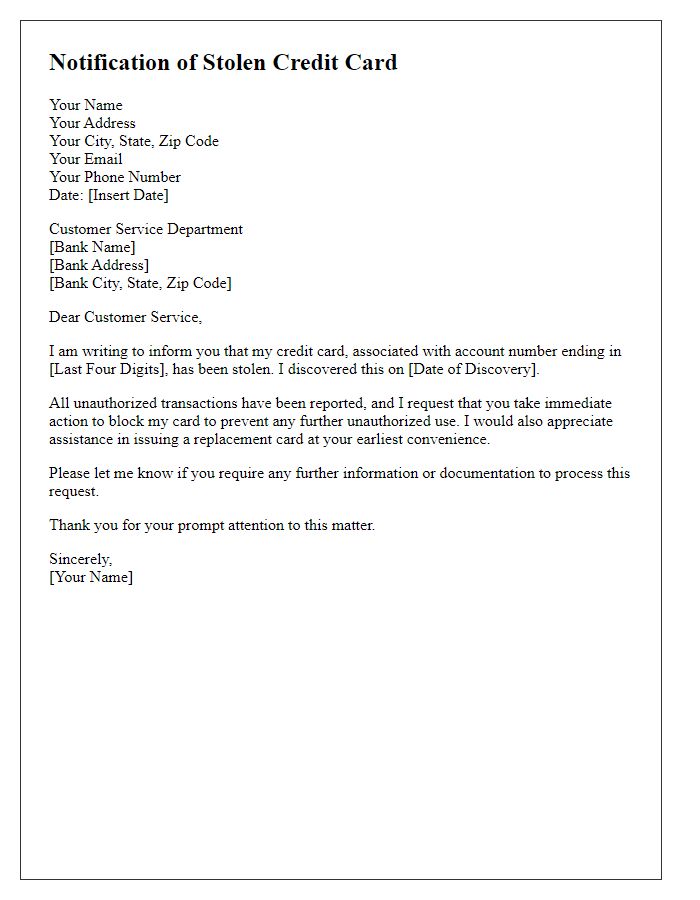

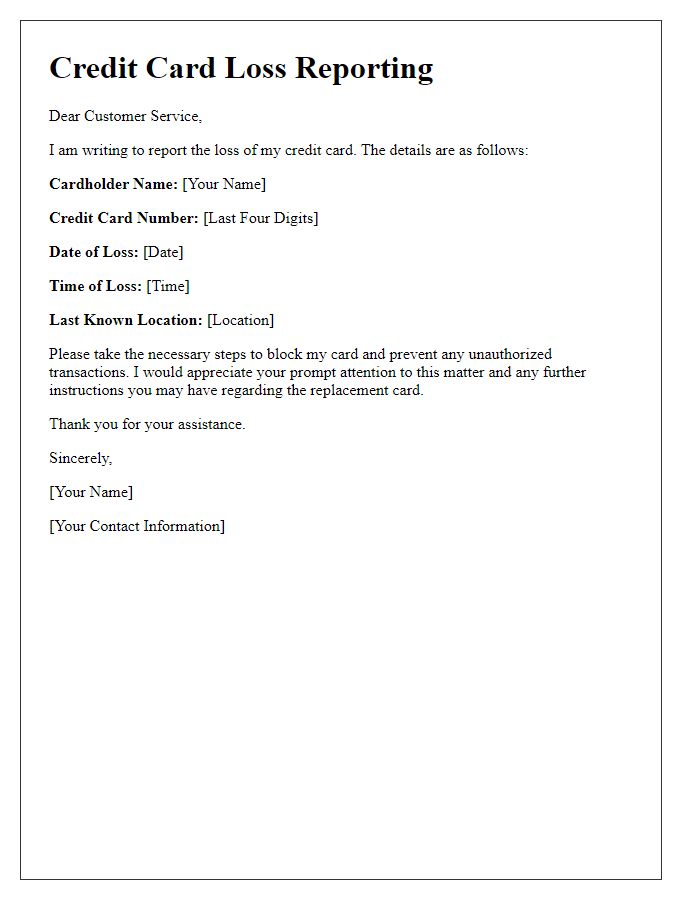

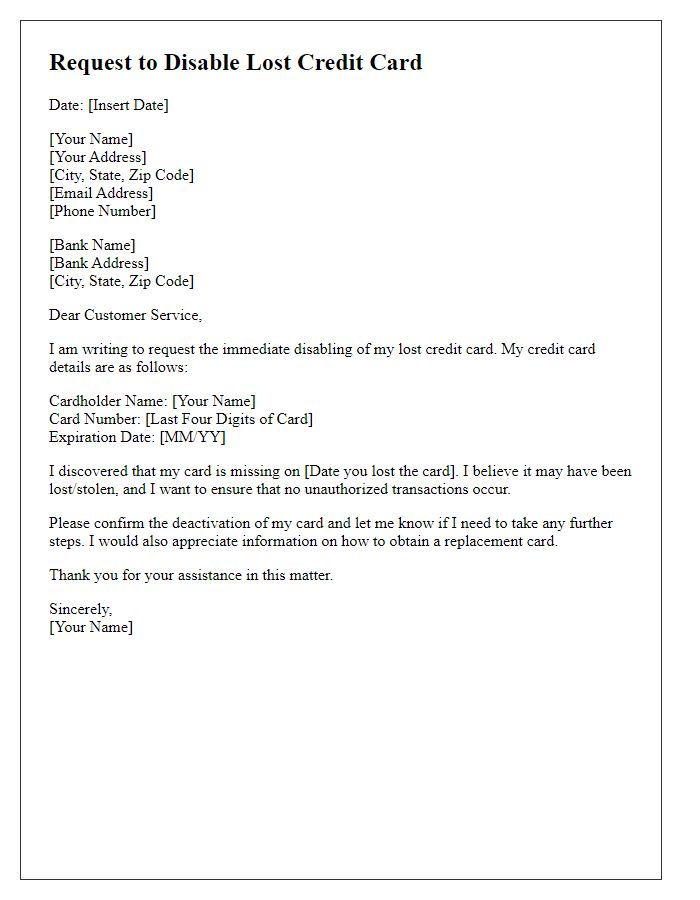

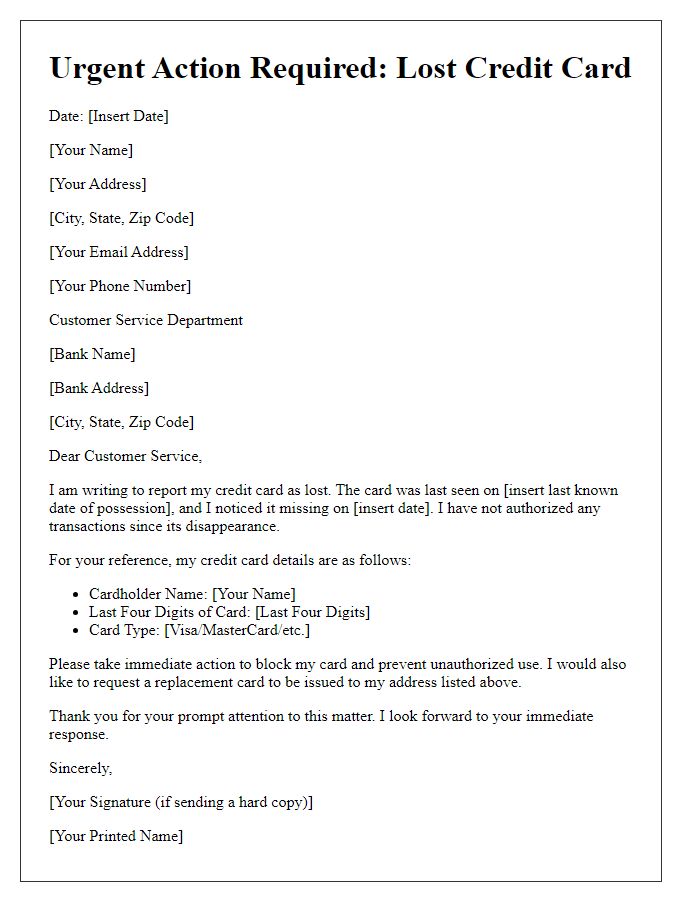

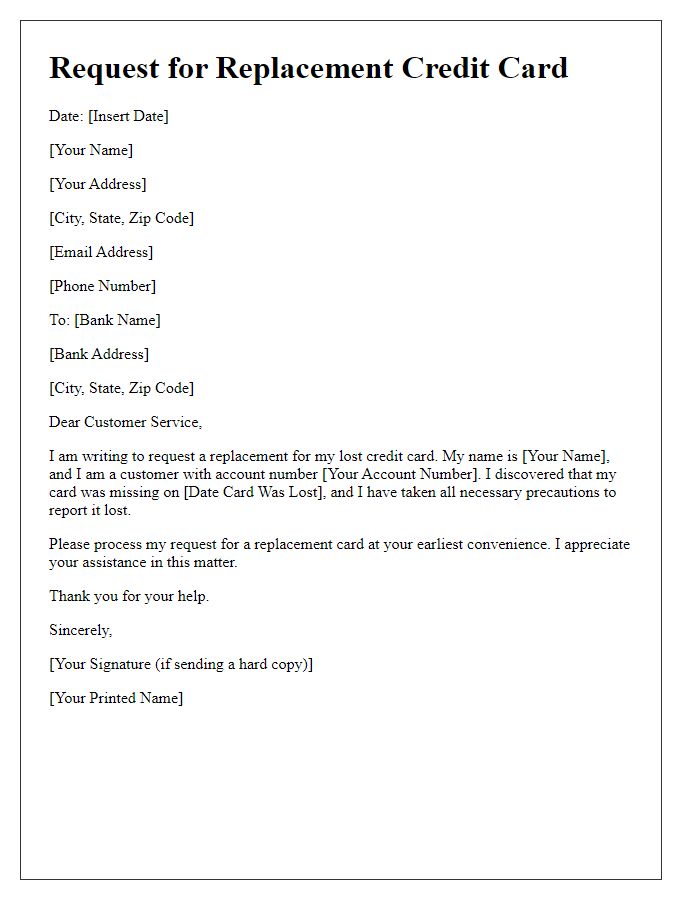

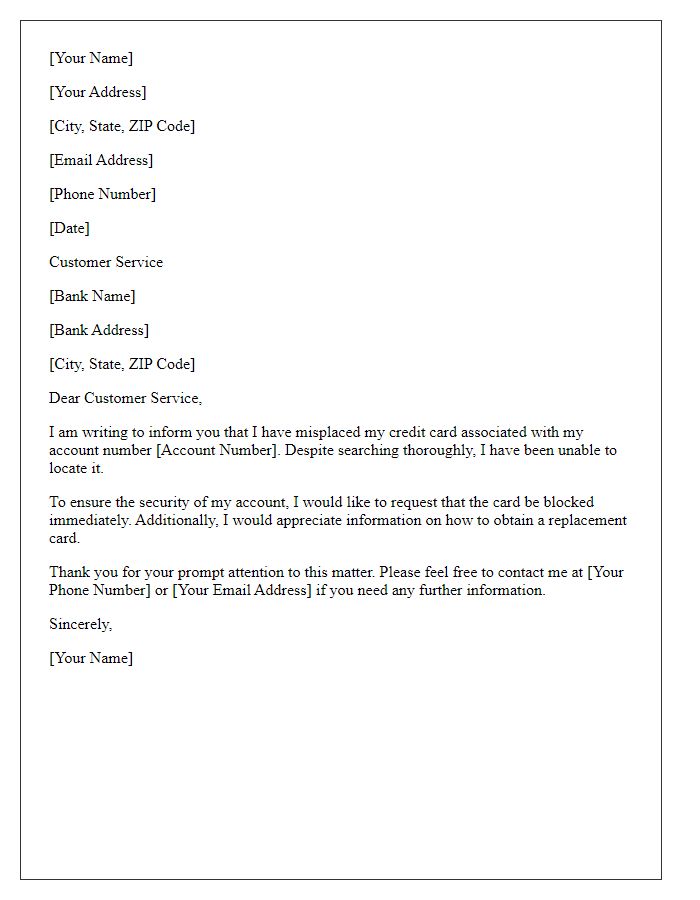

Letter Template For Credit Card Lost Card Report Samples

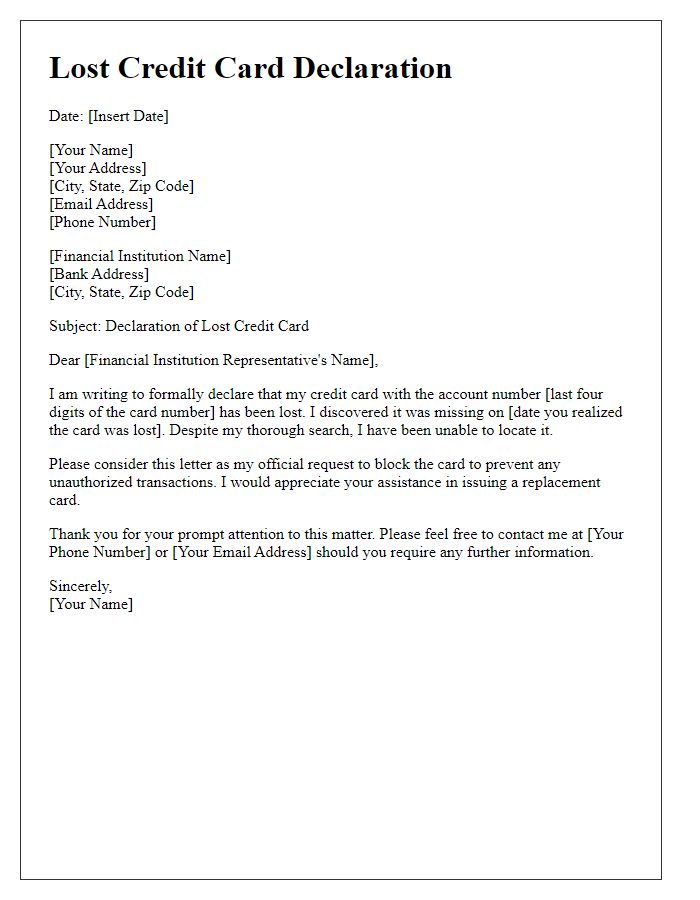

Letter template of lost credit card declaration for financial institution.

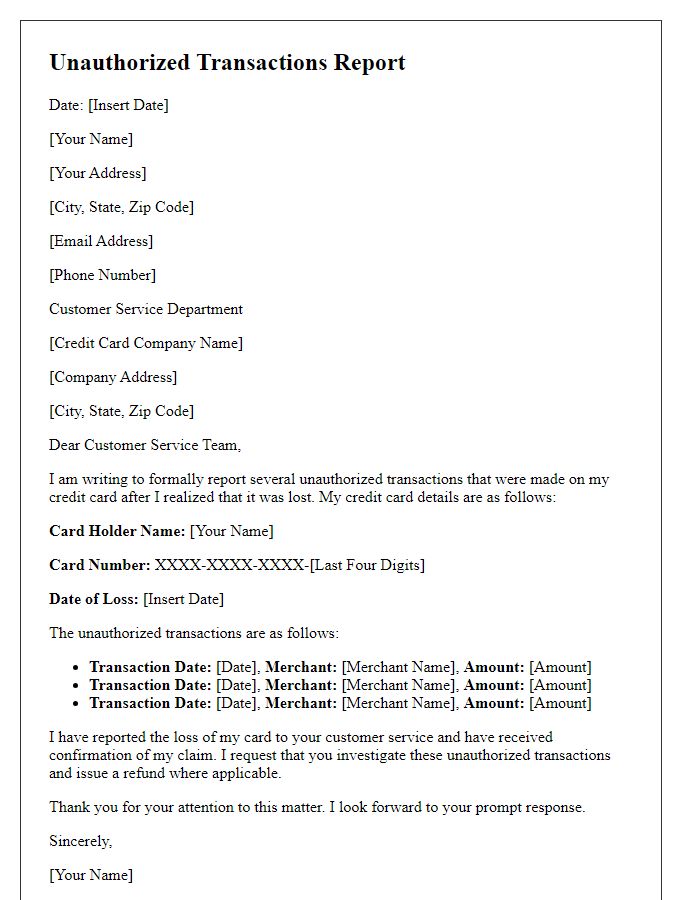

Letter template of reporting unauthorized transactions after credit card loss.

Comments