Have you ever found yourself anxious about your credit card points expiring? It's a common dilemma for many cardholders who want to make the most of their rewards. In this article, we'll delve into the crucial details about how and when these points can vanish, along with tips on keeping your hard-earned rewards intact. So, if you want to ensure your points don't go to waste, read on to uncover essential strategies!

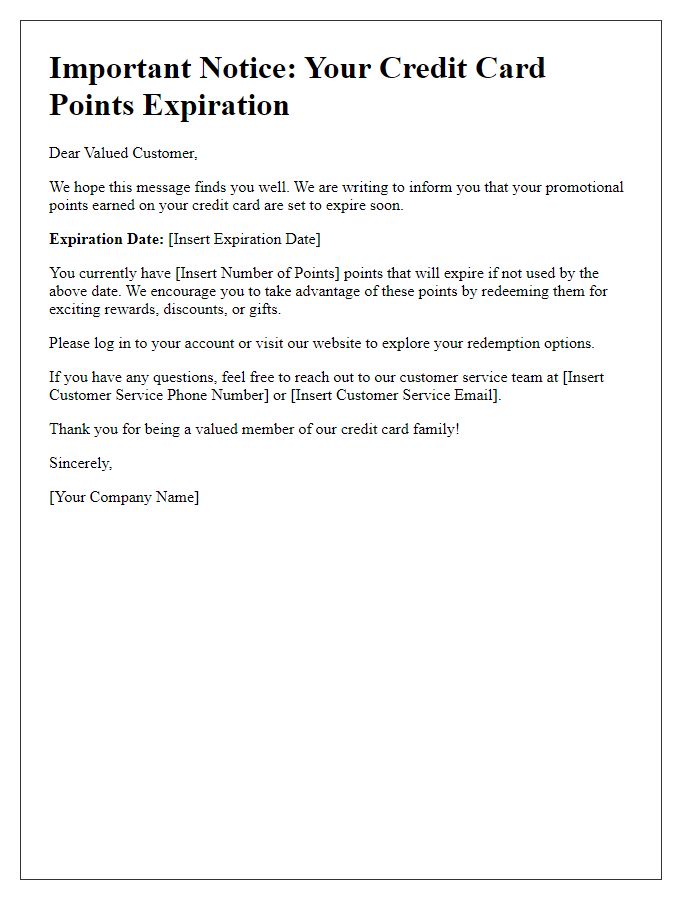

Cardholder Information

Credit card promotional points can significantly enhance the value of your card membership, incentivizing cardholders to engage in regular spending. Typically, promotional points accumulate through various transactions like purchases or sign-ups, often expiring after a set period (usually 12 to 24 months). Cardholders must be aware of their current point balance, which can often be viewed via online banking platforms or mobile apps, ensuring they redeem points before the expiration date set by the bank or financial institution. Failure to redeem these points before expiration results in a loss of value, emphasizing the importance of tracking point validity for maximizing rewards.

Expiry Date of Promotional Points

Promotional points associated with credit cards often come with an expiration date, which is crucial for cardholders to monitor. Typically, these promotional points, earned through specific purchases or promotional events, might expire after a predetermined period, such as 12 months from the date of issue. For instance, points awarded during a promotional campaign in January 2023 may become unavailable for redemption as of January 2024, prompting users to take advantage of their rewards before the deadline. Different credit card issuers may have varying policies regarding points expiration, so it's essential for users to check their account statements or the terms and conditions related to their credit card to remain informed about any changes. Failing to redeem points before the expiration date may result in a loss of potential savings or perks.

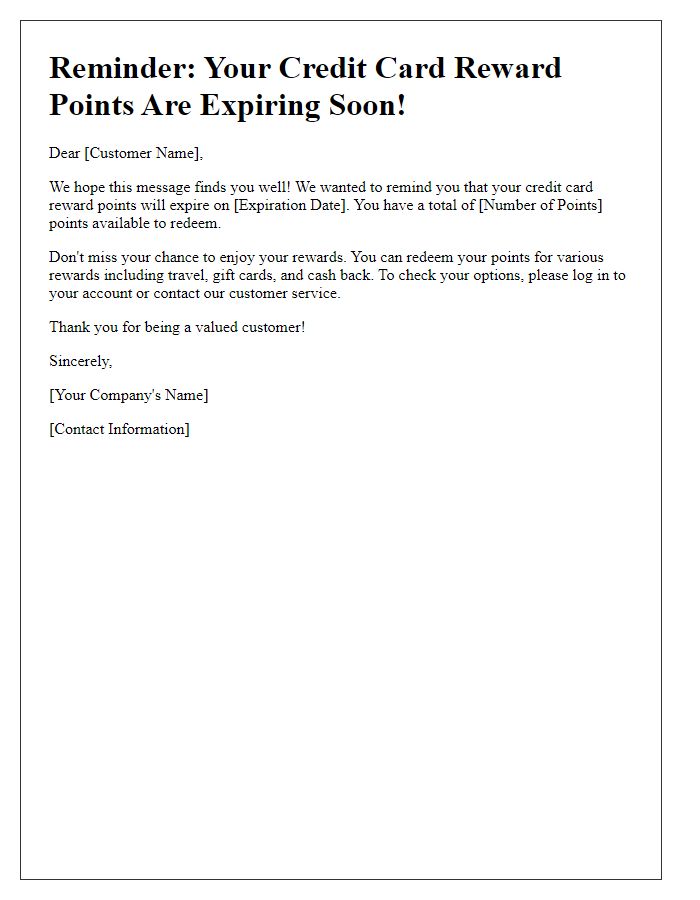

Redemption Instructions

Credit card promotional points are often time-sensitive, with a specific expiration date set by the issuing bank, such as Chase or American Express. Typically, points earned through spending may expire within 36 months after earning, depending on account status and activity. To redeem points, cardholders must navigate to the rewards section of the issuing bank's website, where they can view available offers, including travel rewards, cashback options, or merchandise purchases. It is advisable to check redemption values, as some offers provide higher value per point than others, such as booking flights through the bank's travel portal. Cardholders should also ensure they perform the redemption before the expiration date, as unused points may disappear, leading to lost potential benefits.

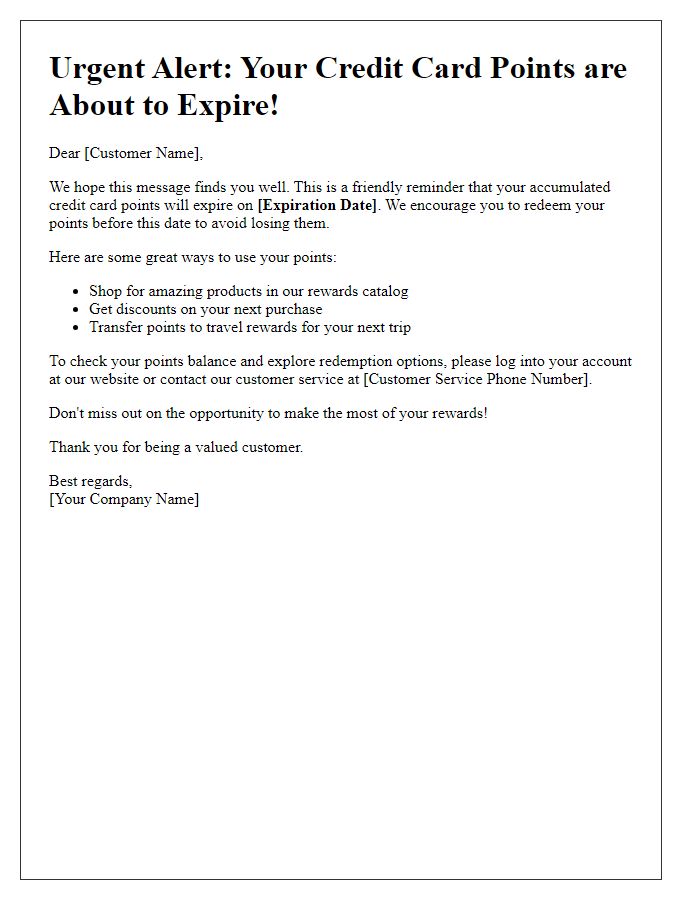

Urgency and Importance

Promotional credit card points can have an expiration date, emphasizing urgency and importance for cardholders to redeem their benefits. Many financial institutions, like Chase and American Express, implement a 24-month expiration policy on unused rewards points. Consumers need to be aware of their current point balance to avoid losing potential savings or travel rewards. Moreover, timely redemption can unlock exclusive offers, such as bonus points on specific categories like groceries or travel, which typically range from 2x to 5x points. Regular reminders from banks help encourage engagement, ensuring families and individuals maximize the value of their credit card rewards before expiration occurs.

Contact Information for Assistance

Credit card promotional points expiration can significantly impact cardholders' ability to maximize rewards earned through spending. Many cardholders, particularly those engaged in travel or frequent shopping, value points accrued from promotions. Points typically have an expiration period ranging from 12 to 24 months, depending on the issuing bank's policy. To avoid losing valuable points, cardholders should monitor their account regularly, ensuring eligible activities like making purchases, paying bills, or engaging in promotional offers. If assistance is needed, contacting customer service, typically available via the bank's website or through the mobile app, can provide guidance on extending point validity or understanding specific promotional terms and conditions. Prominent credit cards such as those from Visa, Mastercard, or American Express often have dedicated support lines for inquiries related to points expiration.

Comments