Are you tired of missing payment deadlines and incurring late fees on your credit card? Setting up a direct debit can be a game changer, allowing you to enjoy peace of mind knowing your bills are paid on time, every time. In this article, we'll guide you through a simple letter template to authorize direct debit payments for your credit card, making financial management easier than ever. Keep reading to discover how you can streamline your payment process and take control of your finances!

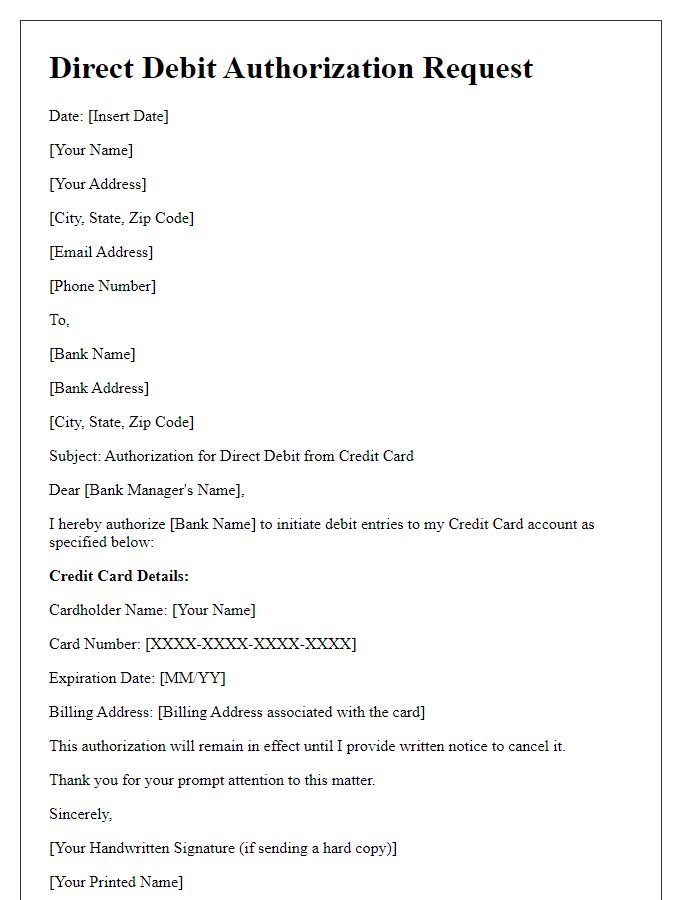

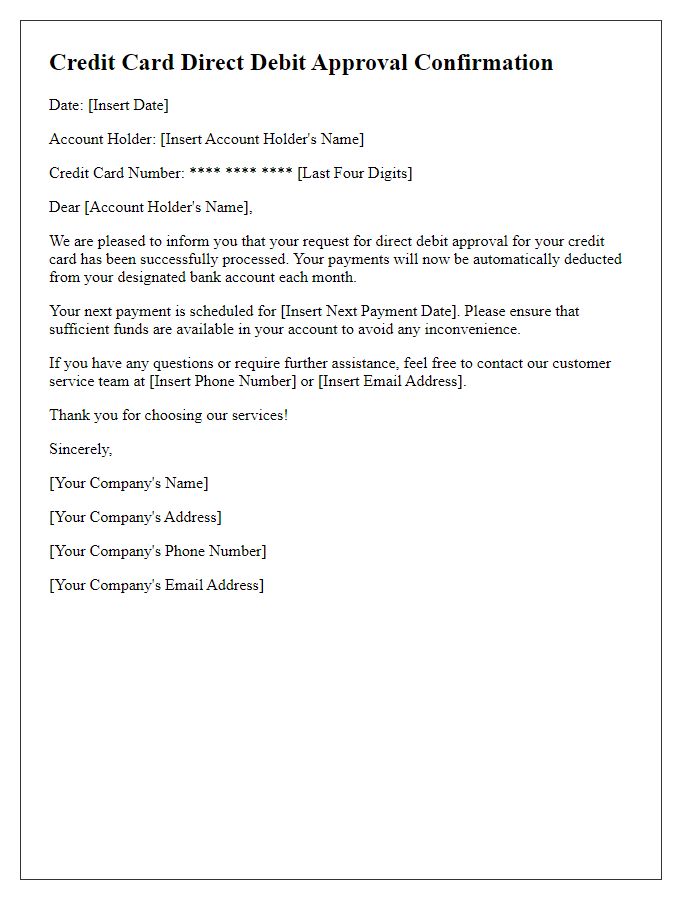

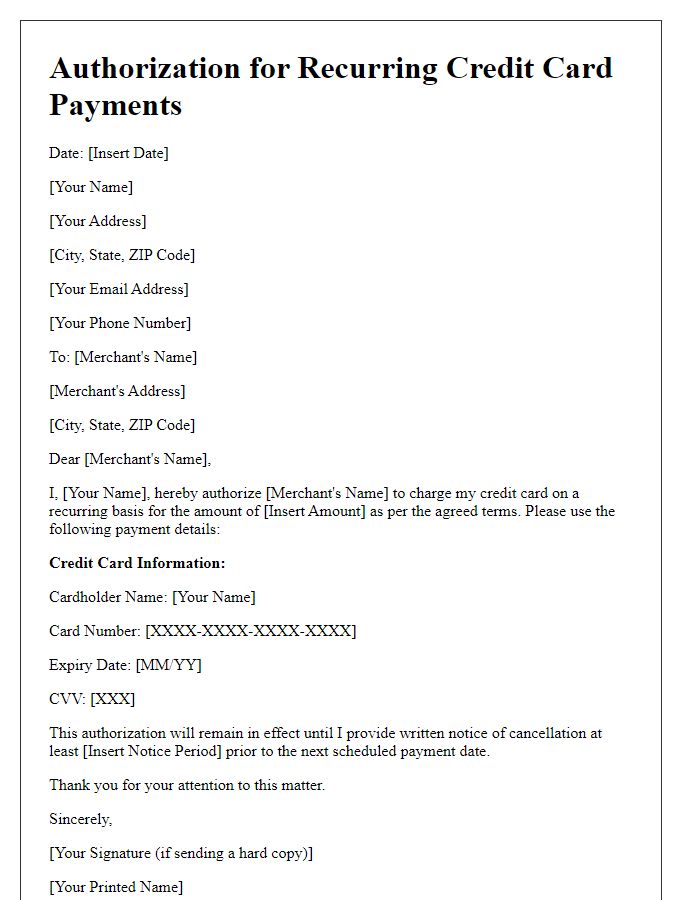

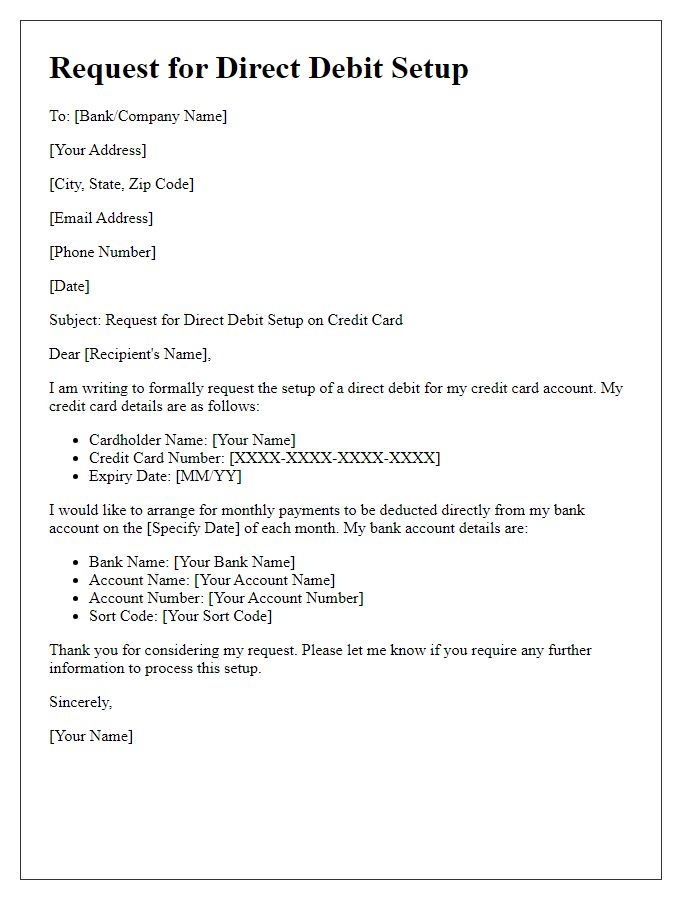

Account Holder's Full Name and Contact Information

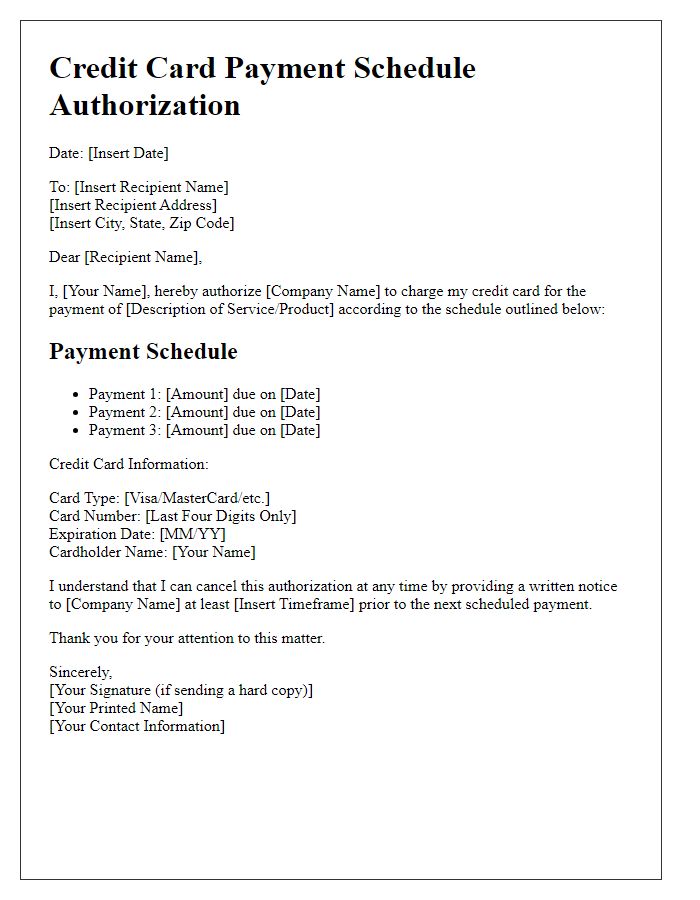

Credit card direct debit authorization is a crucial process for managing recurring payments efficiently. An account holder's full name (as it appears on the card), such as John Smith, along with contact information including a phone number (e.g., +1-555-123-4567) and email address (e.g., john.smith@example.com) is essential for establishing clear communication. This information facilitates confirmation of transactions, notification of any issues, and updates regarding payment schedules. Additionally, incorporating the billing address associated with the credit card, like 123 Main Street, Springfield, IL, enhances security and ensures that debits are processed accurately in accordance with the agreement established between the account holder and the service provider.

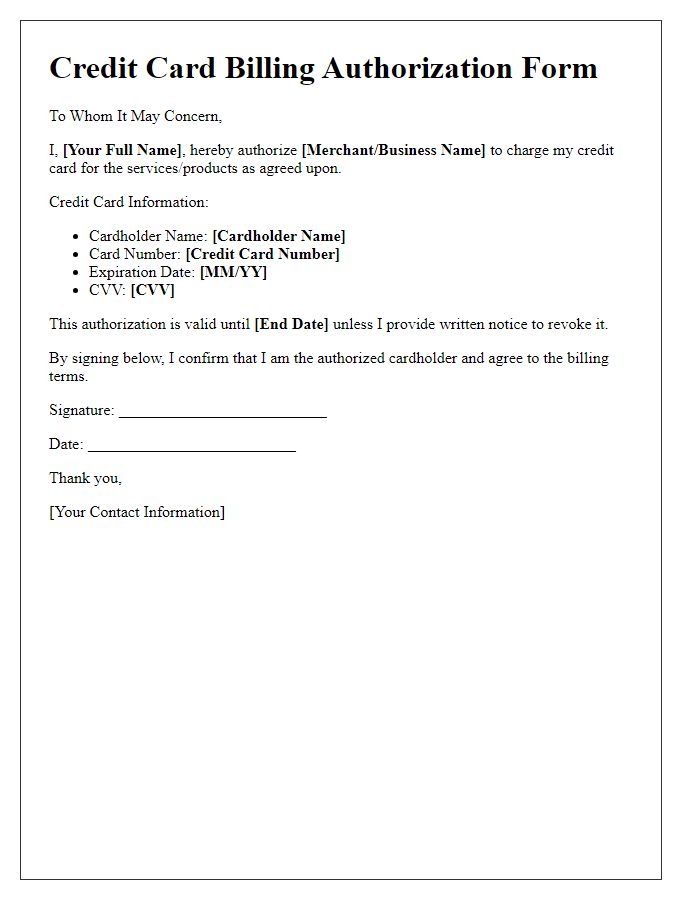

Credit Card Details (Issuer, Card Number, Expiry Date)

Credit card direct debit authorization enables automated payment processing for recurring expenses linked to a specific financial institution. The issuer refers to the bank or financial service responsible for managing the credit card, such as Visa or MasterCard, affecting transaction fees and user benefits. The card number, a unique 16-digit identifier assigned to each cardholder, is crucial for identifying the account within the issuer's system. The expiry date, typically displayed as a month and year (MM/YY), signifies the validity period of the card, ensuring that transactions are processed only when the card is active. Maintaining accurate credit card details is essential for uninterrupted service payment, preventing declined transactions due to outdated information.

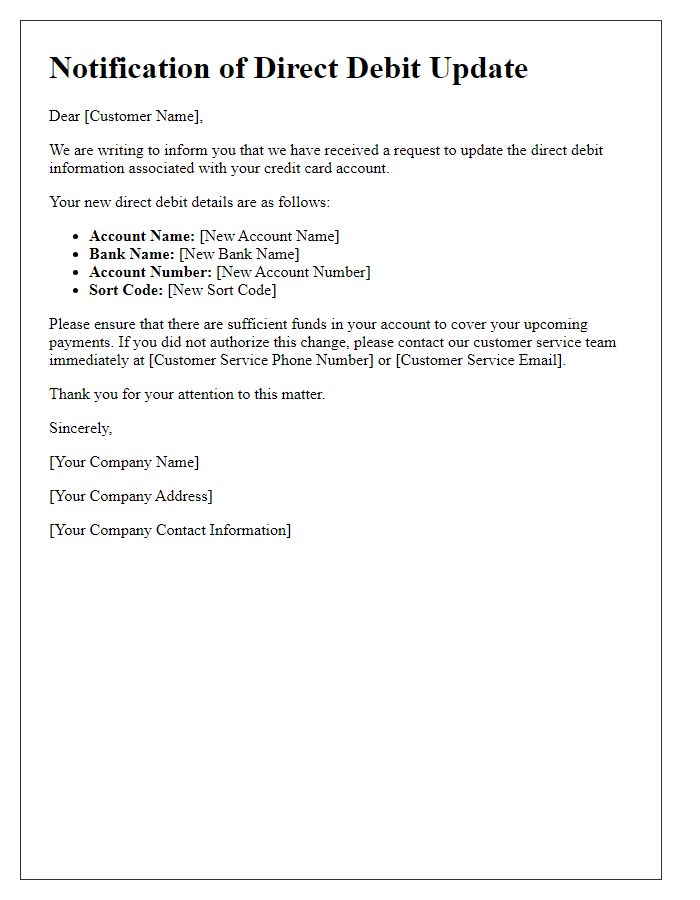

Bank Details (Bank Name, Account Number, Routing Number)

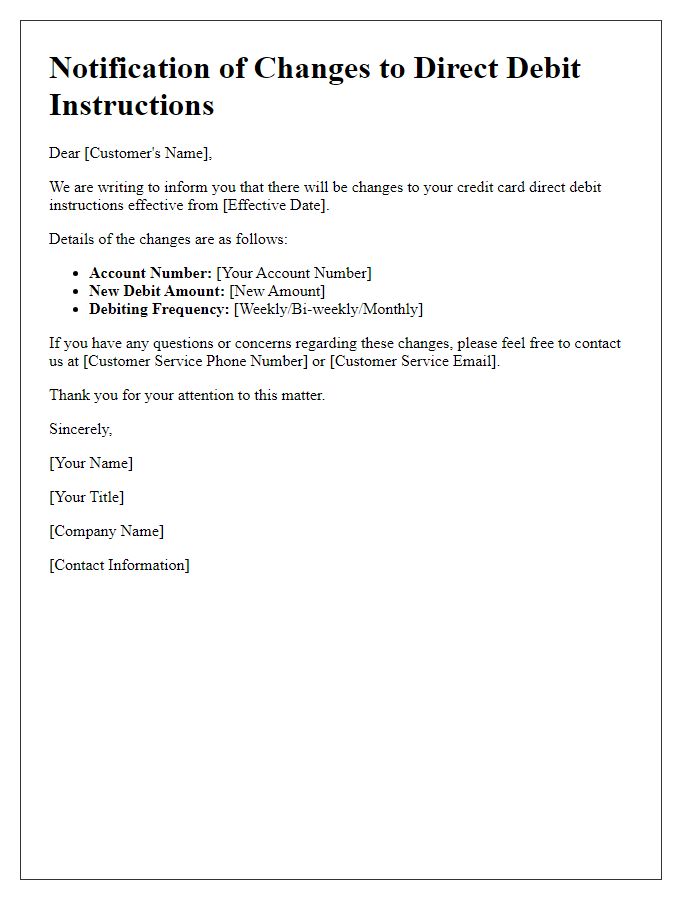

A credit card direct debit authorization is essential for automating payments and ensuring timely transactions. Various banks, such as Bank of America, Chase, or Wells Fargo, require specific information for account registration. For instance, a banking account number, typically 10-12 digits long, acts as a unique identifier for a customer's account, while the routing number, usually 9 digits, directs funds to the correct financial institution. Providing accurate details helps in preventing errors during transactions, safeguarding credit scores, and ensuring smooth service continuity for monthly bills, subscription services, or loan repayments.

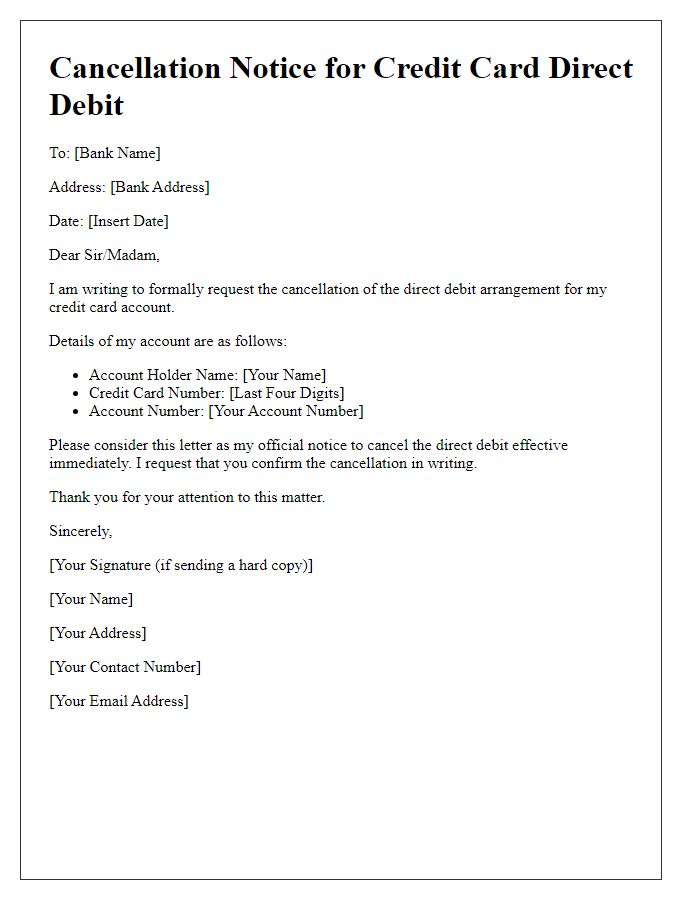

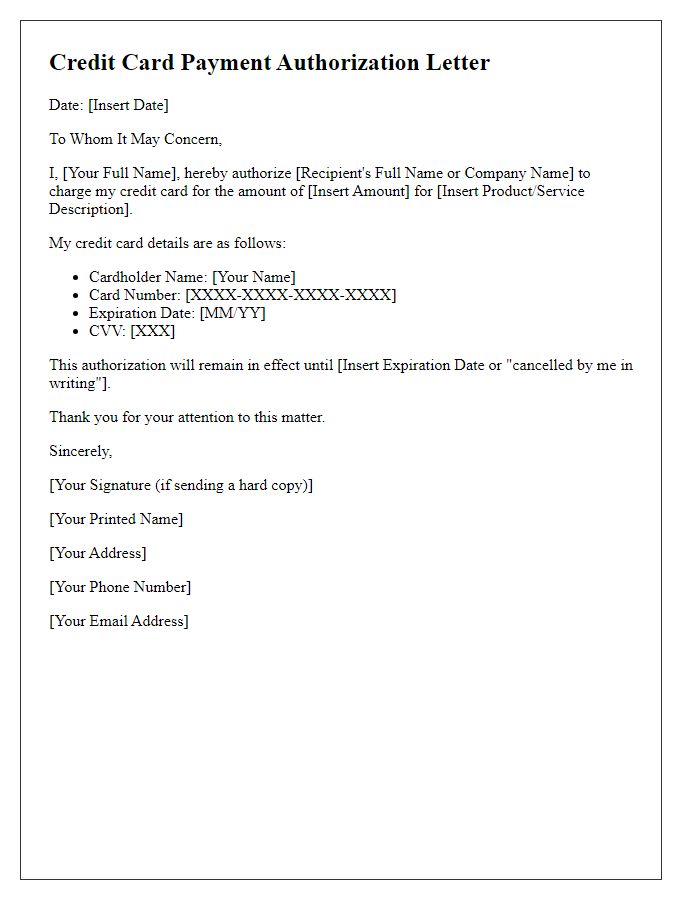

Authorization Statement with Terms and Conditions

A credit card direct debit authorization allows the automatic withdrawal of funds from a cardholder's credit account for recurring payments. This process typically includes an authorization statement where the cardholder grants permission to a specific service provider or company to charge their credit card on agreed-upon dates, often monthly. The terms and conditions detail obligations, including the cardholder's right to revoke authorization, notification of changes in payment amounts or schedules, and responsibilities regarding unauthorized charges. Additionally, companies must ensure compliance with regulations like the Payment Card Industry Data Security Standard (PCI DSS) to protect consumer information during transactions. These authorizations are prevalent in subscription services, utility payments, and membership fees across various industries.

Account Holder's Signature and Date

This template is not applicable as per your request.

Comments