Are you feeling frustrated about a recent charge on your credit card that just doesn't seem right? You're not aloneâmany people encounter unexpected expenses and sometimes need to navigate the process of requesting a refund. In this article, we'll explore a straightforward letter template that can help you articulate your request clearly and effectively. So, if you're ready to reclaim your funds, keep reading for some valuable insights!

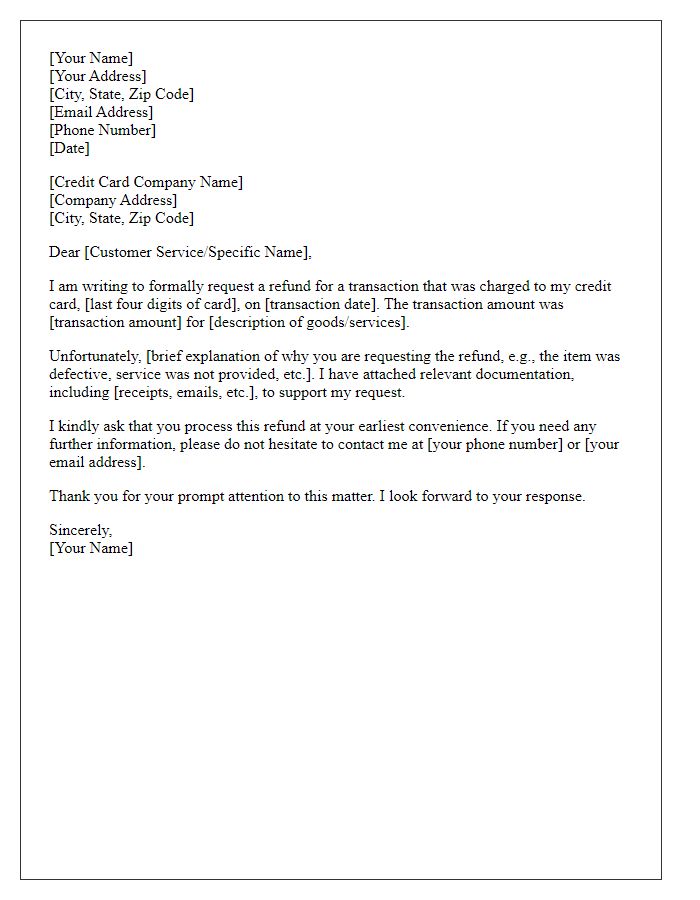

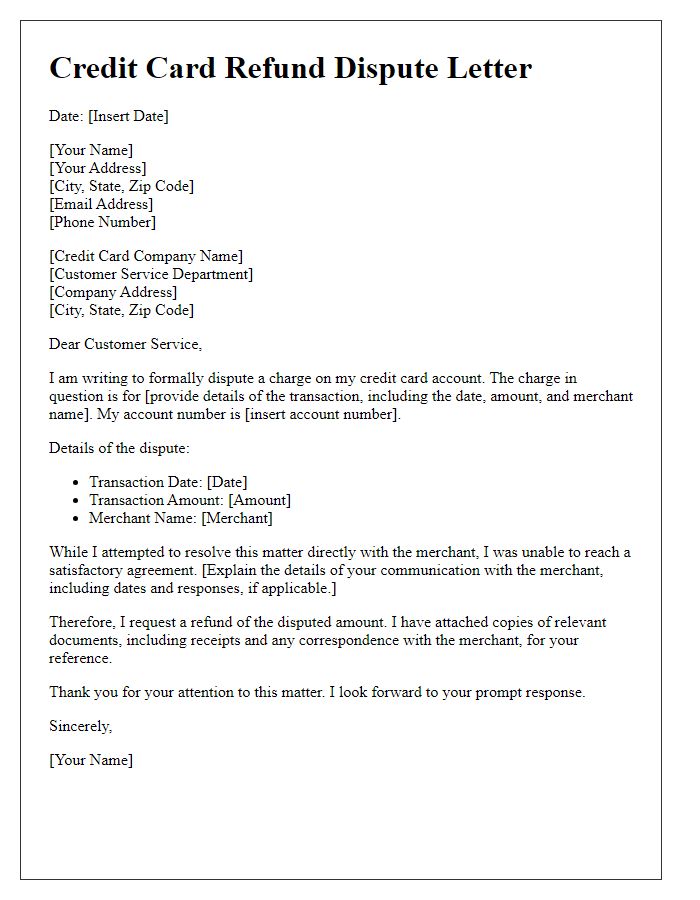

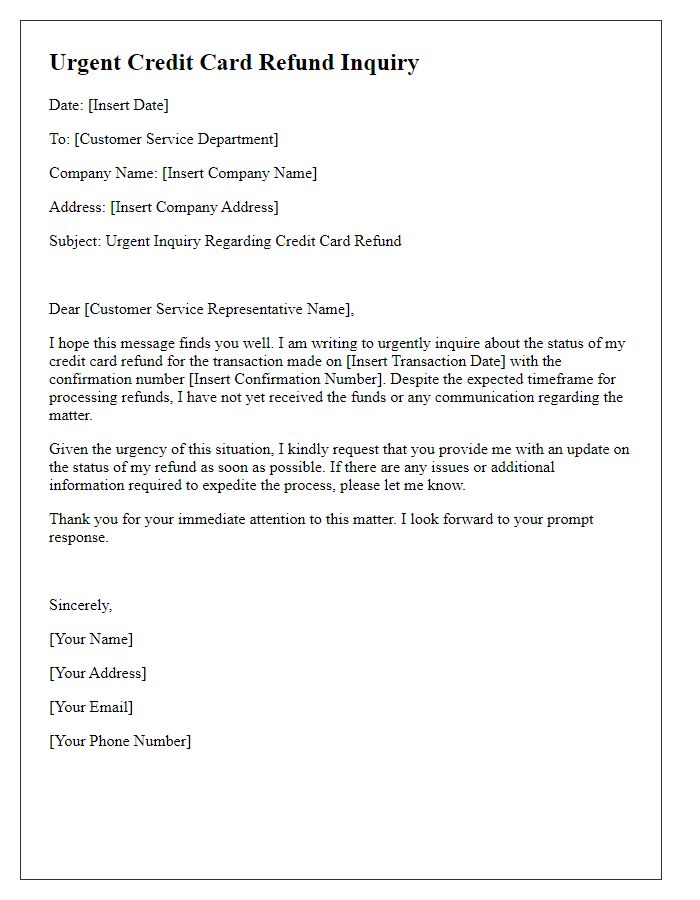

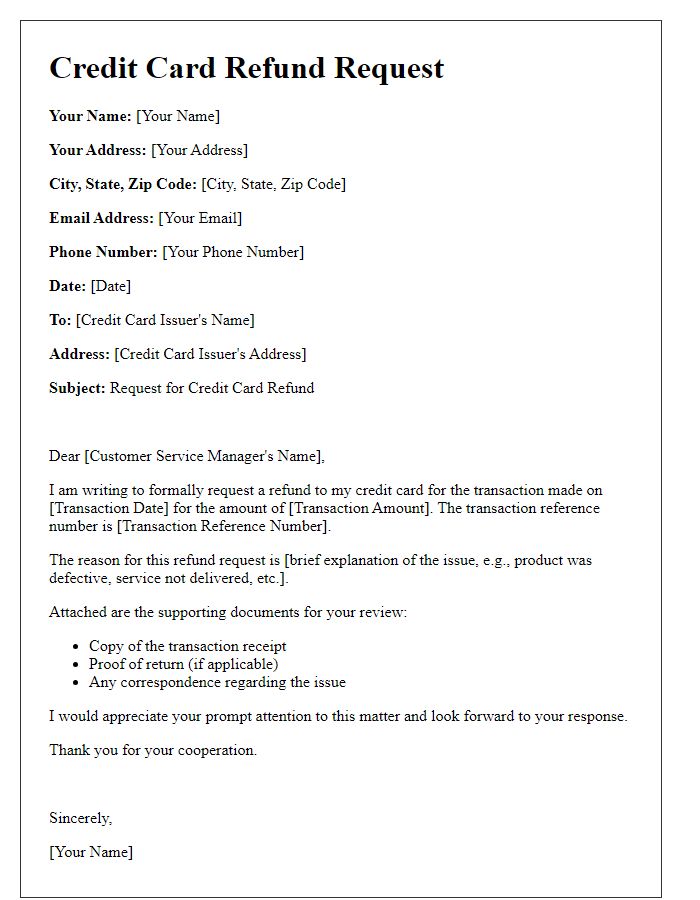

Clear Subject Line

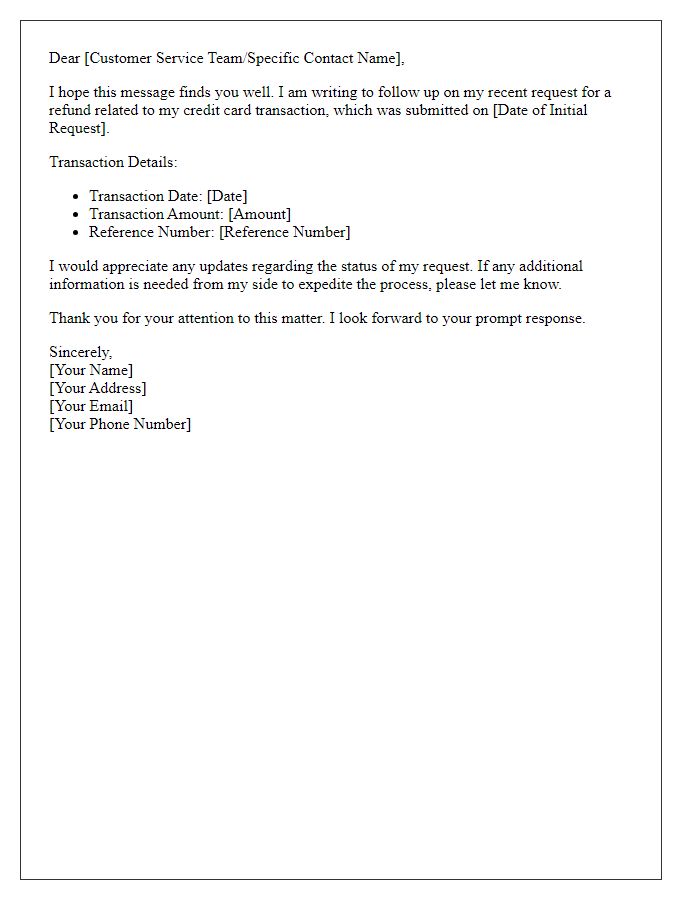

When customers dispute charges on their credit cards, they often seek refunds due to unauthorized transactions. A clear subject line, such as "Request for Credit Card Refund - [Transaction Date/Reference Number]" can help ensure swift processing. Key details include the transaction amount ($XX.XX), merchant name (e.g., Online Retailer), and the reason for the refund request (e.g., product not received). Providing supporting documents, such as receipts or email correspondence, facilitates quicker resolution. Customers typically expect responses within 7-10 business days from the bank's customer service department.

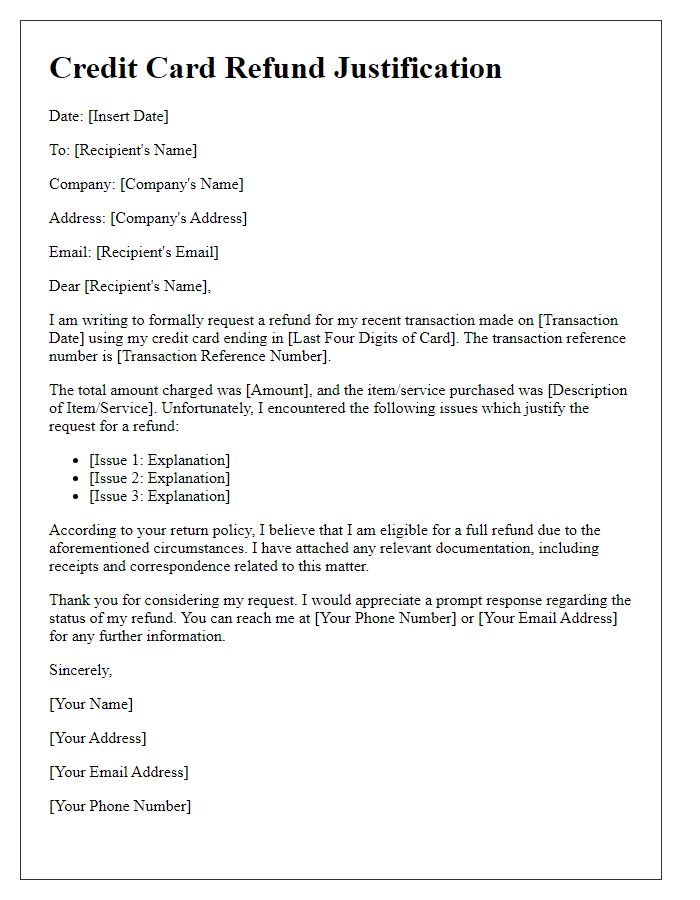

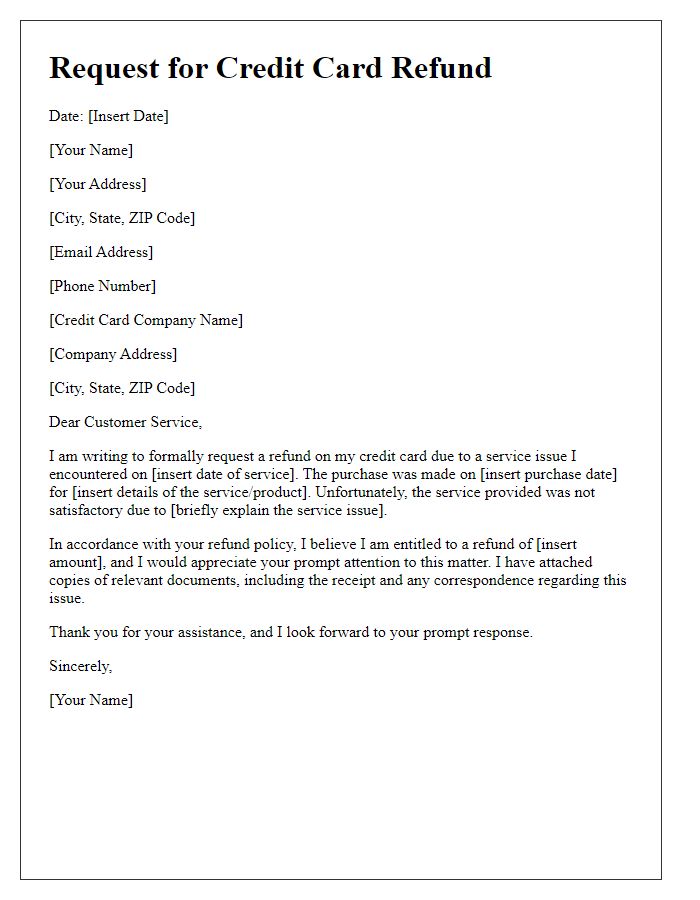

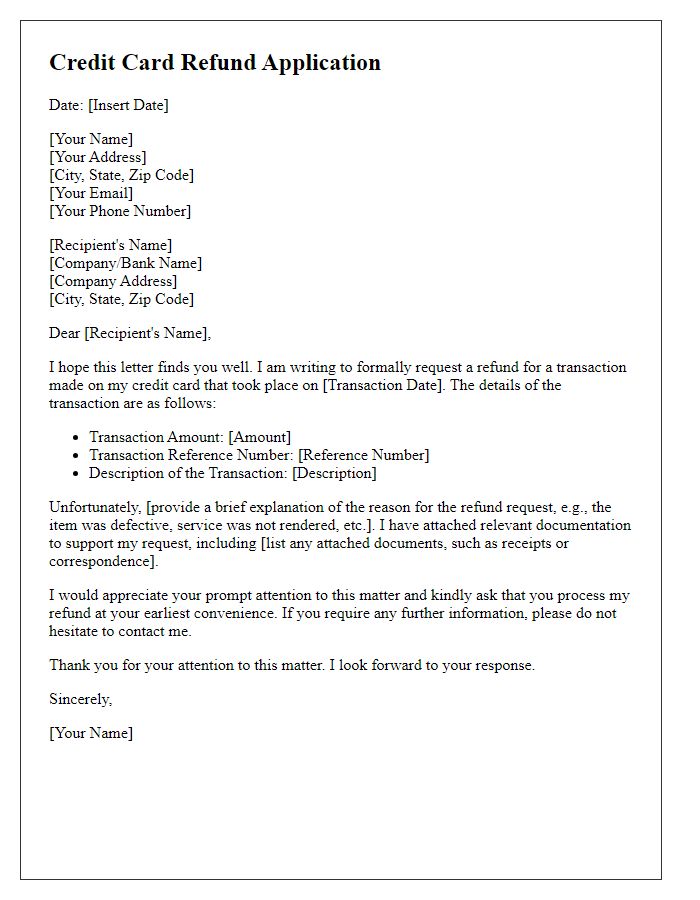

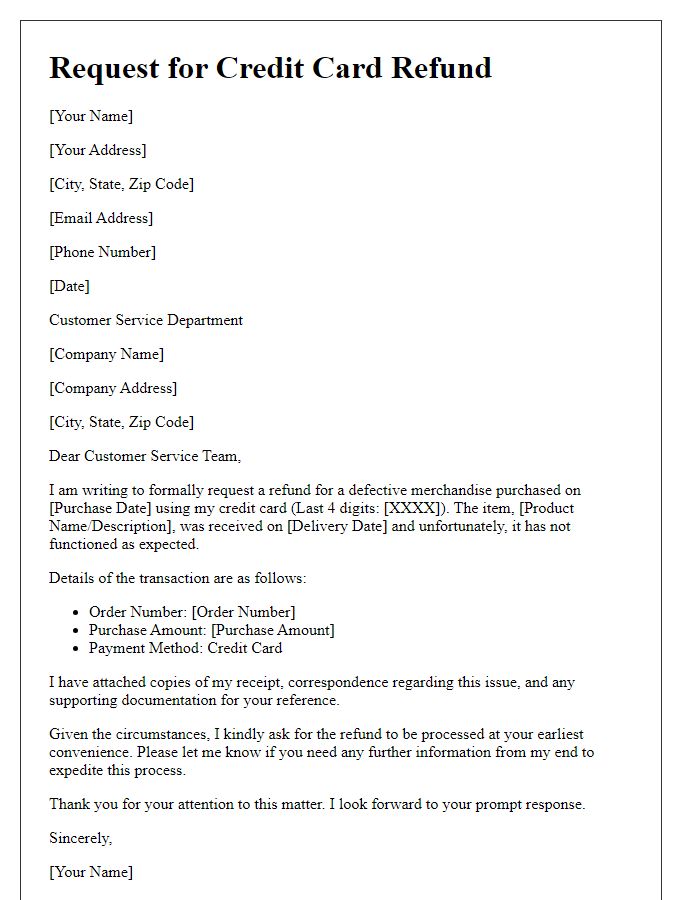

Detailed Transaction Information

When requesting a credit card refund, it is essential to provide detailed transaction information to facilitate a smooth process. Include the transaction date, which indicates the exact day the purchase was made, such as March 15, 2023, and the merchant's name (for example, Amazon, Walmart, or an online retailer). Specify the amount charged, such as $49.99, which makes it easier for the financial institution to locate the correct transaction. Add any transaction reference number or order number, often found on receipts or confirmation emails, to streamline their search. Highlight the reason for the refund request, whether it's due to an incorrect charge, returned merchandise, or unsatisfactory service, while providing supporting evidence such as receipts or correspondence related to the transaction. Lastly, include your credit card number's last four digits for identification purposes, ensuring the security of your sensitive information.

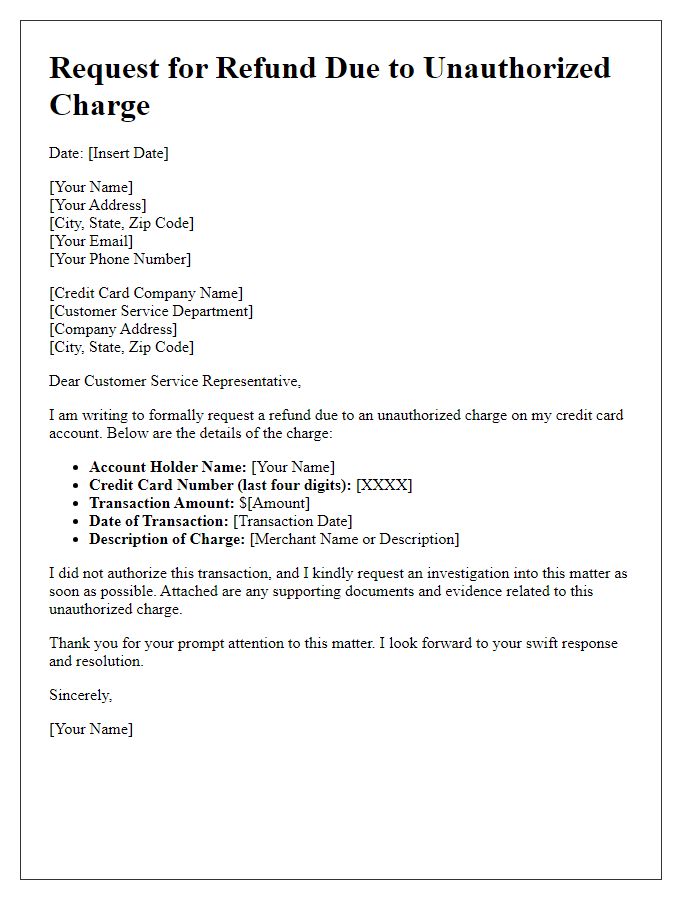

Reason for Refund Request

A refund request on a credit card can arise from various scenarios, including unauthorized transactions, defective merchandise, or canceled services. For example, when a consumer notices fraudulent charges (potentially over $100) on their statement, immediate action is necessary. The Consumer Financial Protection Bureau advises consumers to report such discrepancies within 60 days (after receiving the statement) to maintain consumer protection under the Fair Credit Billing Act. Additionally, for items purchased from online retailers such as Amazon or eBay, if the product arrives damaged or does not match the description, customers can seek refunds based on return policies that typically allow around 30 days for returns. Providing documented evidence, such as receipts or correspondence with the seller, strengthens the request for a refund, increasing the chances of swift resolution.

Supporting Documentation

A credit card refund request requires relevant supporting documentation to substantiate the claim. This can include transaction receipts, proof of return for purchased items, previous correspondence with customer service representatives, and any other related records. Detailed information should be presented, such as itemized lists including product descriptions, purchase dates, and transaction amounts, alongside copies of credit card statements reflecting the charge. These documents help facilitate the refund process, ensuring that the financial institution has all necessary evidence to assess the legitimacy of the claim. Proper organization and clarity in presenting documentation can significantly enhance the resolution speed.

Polite Closing and Contact Information

A credit card refund request is often initiated by customers seeking reimbursement for transactions like erroneous charges or unsatisfactory services. The process typically requires details about the transaction, such as purchase date, amount, and merchant name. Additionally, consumers may provide their contact information for follow-up, which can include a phone number and email address for prompt communication. Maintaining a polite closing, expressing gratitude for the assistance received, can enhance the likelihood of a favorable outcome.

Comments