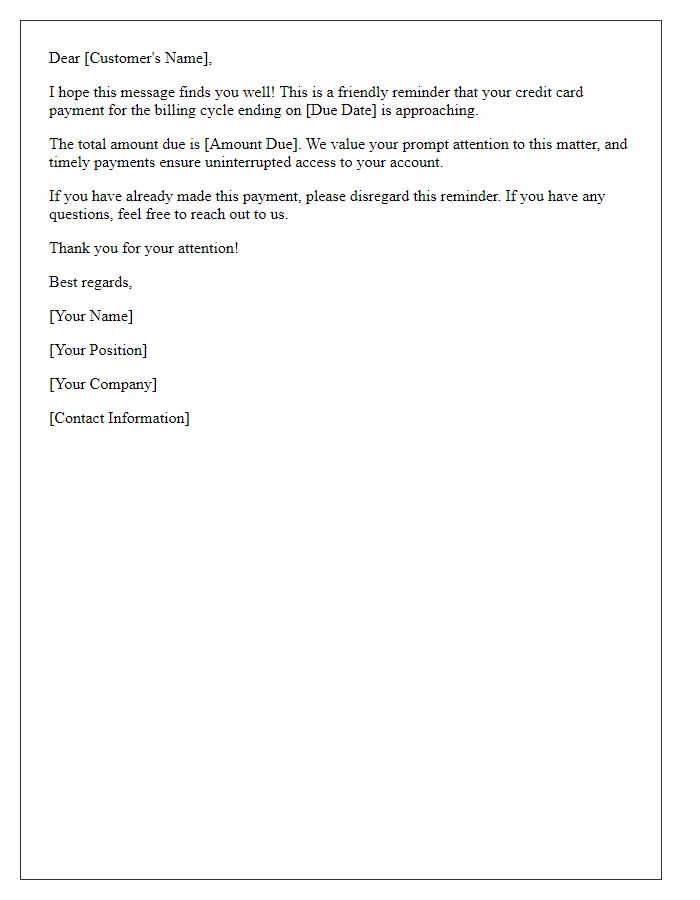

Hey there! We all know how easy it is to lose track of time, especially with our busy lives. That's why a friendly reminder about your upcoming credit card payment is so important; it helps keep your credit in top shape and avoid any late fees. So, if you want to learn more tips on managing your finances effectively, keep reading!

Payment Due Date

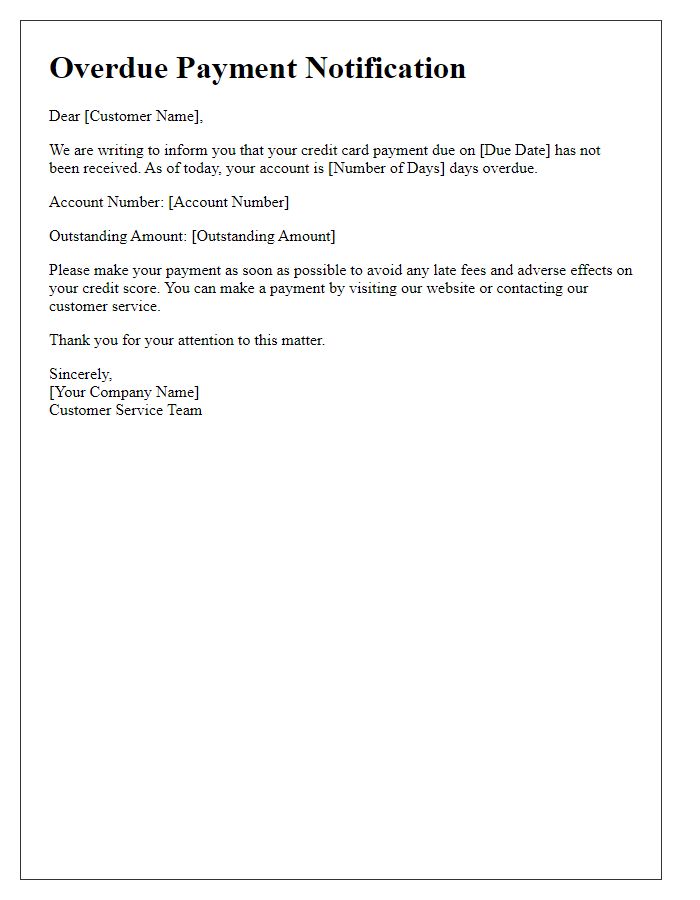

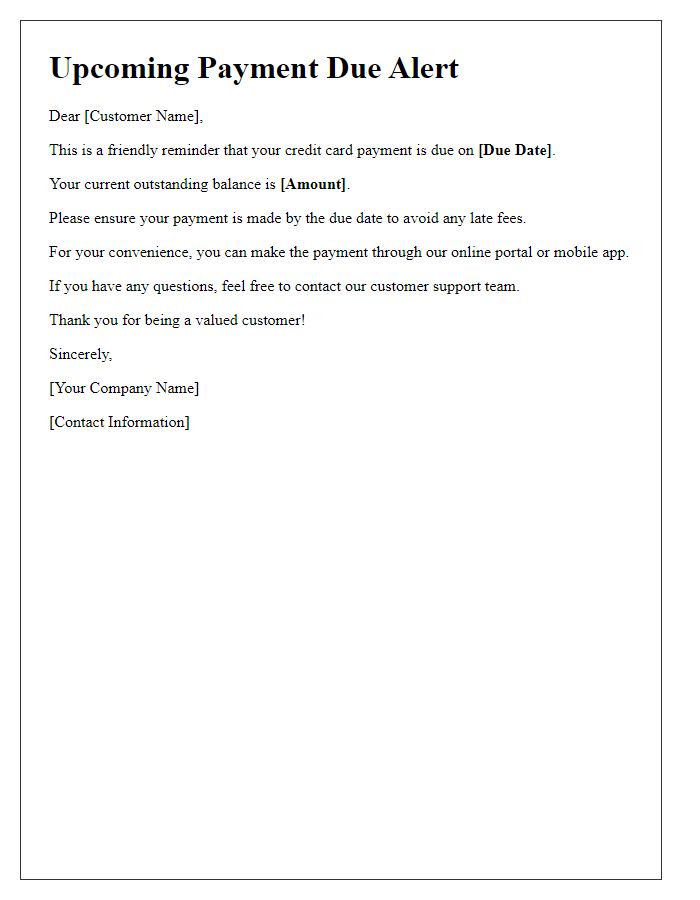

Credit card payment reminders are essential for maintaining good financial standing. A typical reminder highlights the payment due date, often the 15th of the month, which is crucial for avoiding late fees. Cardholders should be aware of the minimum payment amount, typically around $25 or a percentage of the total balance, to ensure timely payments. Additionally, reminders may include the total outstanding balance, which can vary widely depending on recent transactions. Missing the due date can lead to increased interest rates, often exceeding 20%, and negative impacts on credit scores, which can drop significantly if payments are missed consistently.

Outstanding Balance Amount

Outstanding credit card balances can accrue significant interest charges if not addressed promptly. For instance, a balance of $1,000 on a credit card with an annual percentage rate (APR) of 18% can lead to over $180 in interest within one year if only minimum payments are made. Missing payment deadlines can also result in late fees, typically around $35, and damage to credit scores, which relies on timely payments. It's crucial to monitor due dates, often set monthly, to avert these financial repercussions.

Payment Methods Available

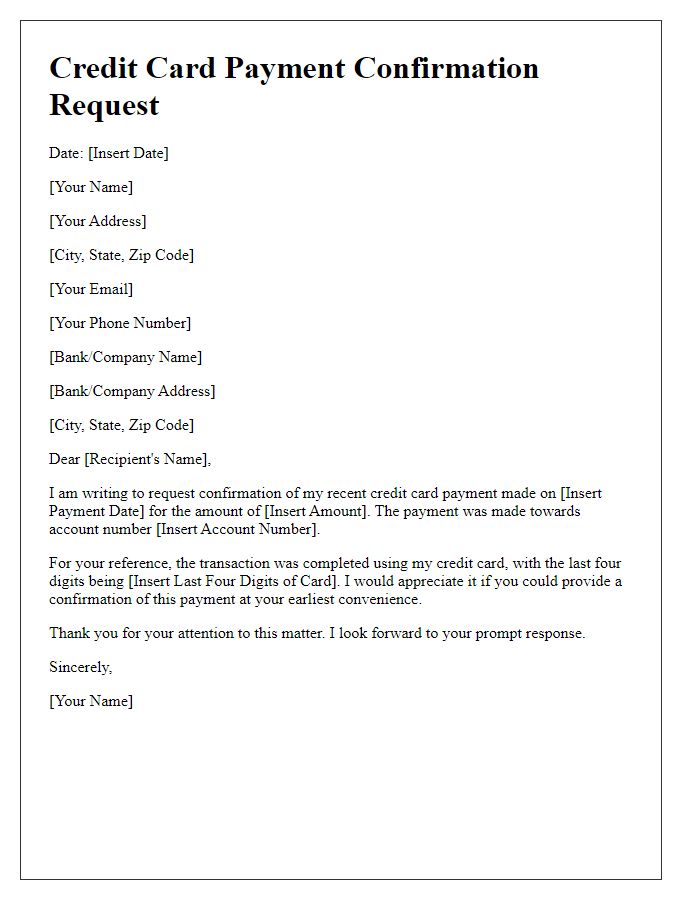

Many financial institutions offer various payment methods for credit card holders to ensure timely payments. Online banking platforms (accessible through both desktop and mobile applications) allow users to transfer funds directly to their credit card accounts from checking or savings accounts. Automatic recurring payments enable customers to set predetermined amounts to be deducted on specific dates, ensuring consistency. Additionally, payment via third-party services (like PayPal or Venmo) can provide flexibility for making credit card payments. Physical locations such as bank branches or authorized merchants also accept in-person payments, often allowing cash or check options. Awareness of due dates and payment methods can significantly reduce the risk of late fees and adverse effects on credit scores.

Late Payment Consequences

Credit card payments must be made on time to avoid late fees and damage to credit scores. Late payments can incur penalties, typically an additional fee of up to $40. Furthermore, payment history constitutes 35% of credit scores, with one late payment potentially decreasing scores by up to 100 points. In addition, persistent late payments may lead to increased interest rates, elevating the overall cost of borrowing. Card issuers often report late payments to credit bureaus, impacting future credit applications. Therefore, staying aware of payment due dates is crucial for maintaining financial health and creditworthiness.

Customer Service Contact Information

Credit card payment reminders serve as essential notifications for cardholders to maintain good financial health and avoid late fees. A typical reminder includes details such as the due date (often the 15th of each month) and the minimum payment amount, which is usually a percentage of the total balance, such as 2%. Additionally, contact information for customer service is crucial, providing assistance through toll-free numbers like 1-800-123-4567 and online chat options available on the issuing bank's website. Such reminders aim to reinforce responsible credit usage and ensure timely payments, thereby enhancing credit scores and customer satisfaction.

Comments