Are you perplexed by the minimum payment details on your credit card statement? You're not alone; many individuals find this concept a bit confusing, especially when trying to manage their finances effectively. Understanding how minimum payments work can help you make more informed decisions about your spending and repayment strategy. So, let's dive deeper into what it really means and how you can leverage this knowledge to benefit your financial health!

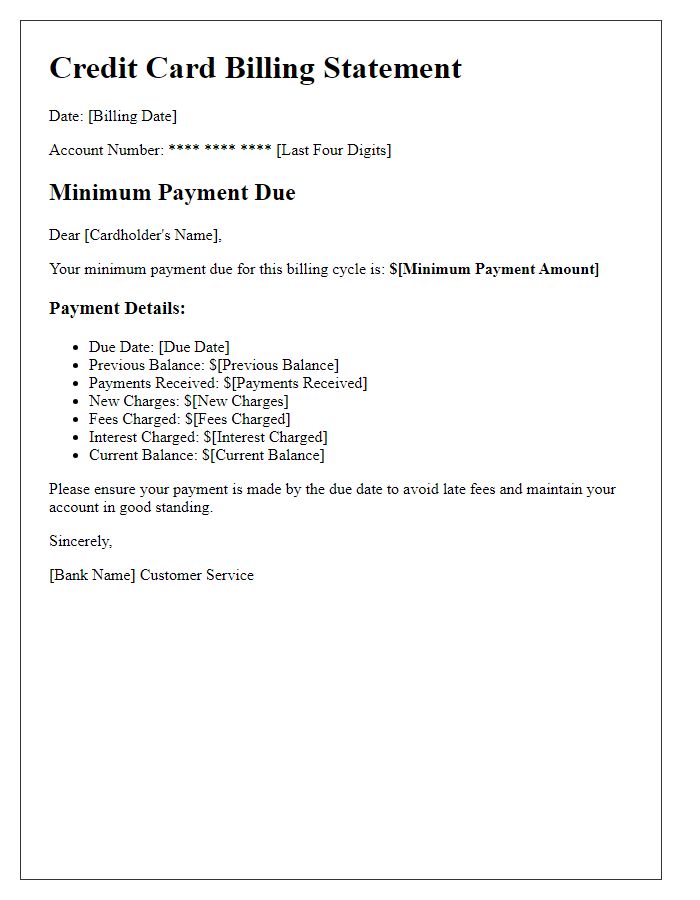

Clear account identification

Credit card accounts require specific identification to facilitate accurate payment processing. Account numbers, typically a 16-digit series, uniquely identify each credit card holder's financial obligation. The payment amount due, often highlighted in monthly statements, signifies the minimum required payment to maintain good standing. Payment due dates, usually set on a specific day of the month, ensure timely compliance and avoid late fees. Statements, generated monthly by financial institutions such as Visa or Mastercard, outline transaction history, outstanding balances, and can offer insights on interest rates applied to outstanding amounts. Understanding these elements is essential for effective account management.

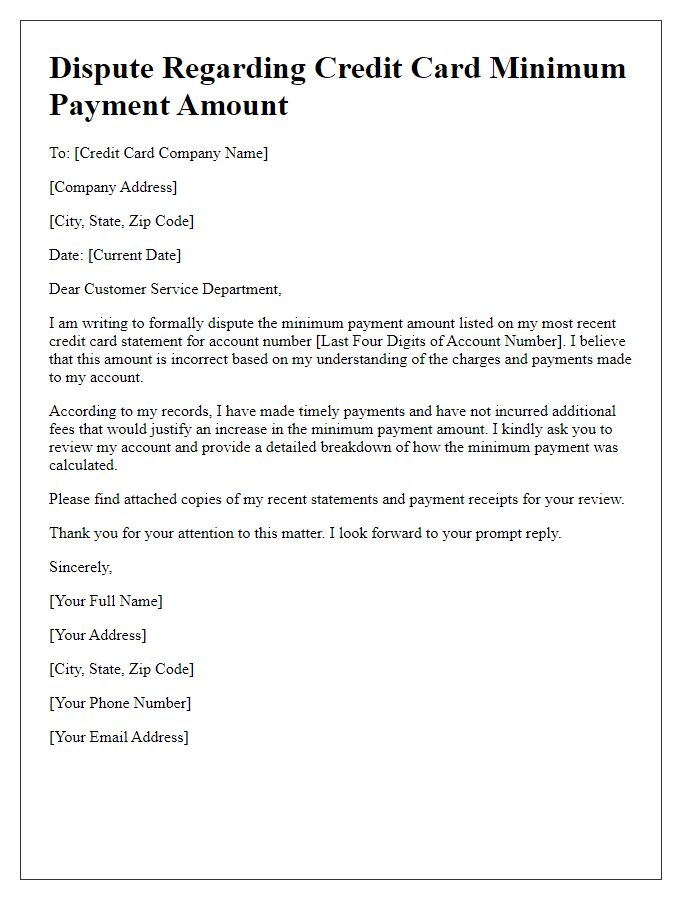

Detailed payment breakdown

Minimum payment requirements on credit cards, like Visa or Mastercard, typically comprise a fixed percentage of the outstanding balance, often around 2% to 3%, plus any late fees or over-limit fees from previous billing cycles. Monthly payments must include any accrued interest charges calculated based on the average daily balance, which might fluctuate depending on spending habits and interest rates, potentially reaching rates between 15% and 25%. A detailed statement will reflect the total balance due, minimum payment due date, and payment allocation towards principal versus interest, creating transparency regarding financial obligations. Staying informed on payment structures is crucial for maintaining healthy credit scores and avoiding additional charges.

Consequences of minimum payment

Making only the minimum payment on credit card balances can lead to significant financial consequences. For instance, if a cardholder owes $1,000 with an annual percentage rate (APR) of 18%, paying just the minimum (often 2% of the balance or $25, whichever is higher) can extend the payoff period to nearly 6 years. During this time, the cardholder would pay approximately $600 in interest alone. This scenario illustrates the danger of accumulating debt, as higher outstanding balances can negatively impact credit scores, which typically range from 300 to 850, affecting future borrowing ability. Moreover, relying on minimum payments can create a cycle of debt, leading to financial strain, increased stress, and potentially default (failure to pay) repercussions such as late fees or increased interest rates, further complicating one's financial health.

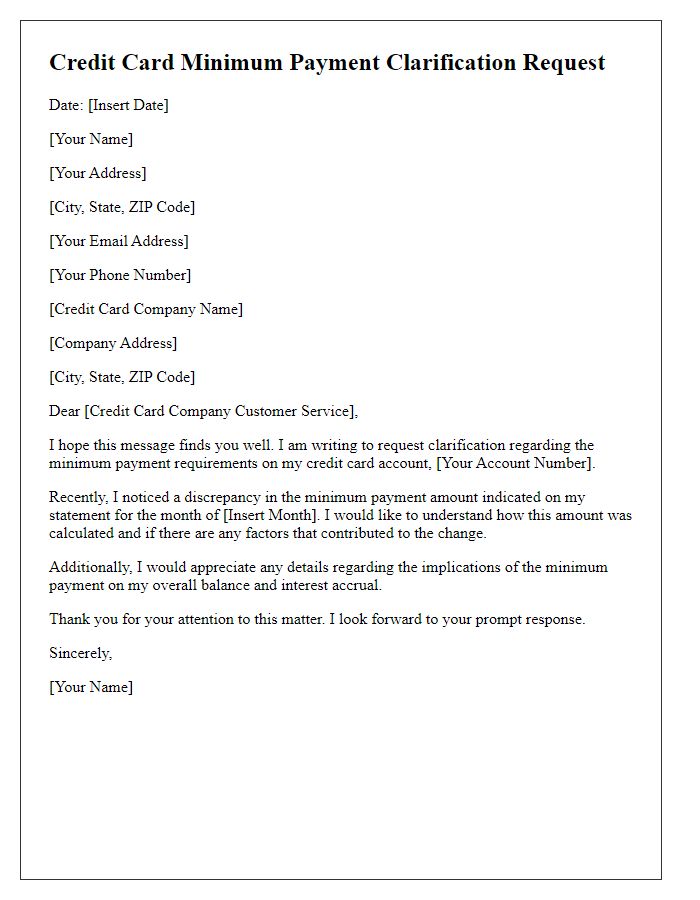

Contact information for inquiries

Understanding credit card minimum payments is crucial for financial management. Minimum payment is the smallest amount a cardholder must pay by the due date to avoid late fees and potential damage to credit score. Typically, the minimum payment is calculated as a percentage (often around 1% to 3%) of the total outstanding balance plus any fees. For example, with a $1,000 balance, the minimum payment could range from $10 to $30, depending on the card issuer's terms. Failing to meet this minimum can lead to penalties, including late fees (often $25 to $35) and increased interest rates. For inquiries regarding payment options or account details, customers are encouraged to contact the card issuer's customer service at the phone number listed on the back of the card or via the official website for assistance.

Encouragement for full payment

Credit card minimum payments can often create confusion and financial strain for consumers. The minimum payment, typically a small percentage of the outstanding balance (usually around 1% to 3%), may seem manageable; however, carrying a balance can lead to accumulating interest charges that increase total debt significantly. Making only the minimum payment could result in prolonged repayment periods, extending for several years, depending on the balance. For instance, a $1,000 balance with an interest rate of 20% might take over five years to repay if only the minimum payment is made. This interest costs can rapidly add up, ultimately far exceeding the original purchase amount. Therefore, making full payments not only eliminates debt faster but also enhances credit scores, providing greater financial flexibility for future purchases or loans. Prioritizing full payments every month is a strategic move toward financial health.

Letter Template For Credit Card Minimum Payment Explanation Samples

Letter template of credit card billing statement minimum payment details.

Letter template of dispute regarding credit card minimum payment amount.

Comments