Updating your credit card information can feel like a tedious task, but it's crucial for maintaining uninterrupted access to your accounts and services. Whether you're changing your card because of a lost one or simply upgrading, ensuring your details are current can save you from potential headaches in the future. Don't worryâit's a straightforward process, and we're here to guide you through each step. Ready to learn how to easily update your credit card information? Let's dive in!

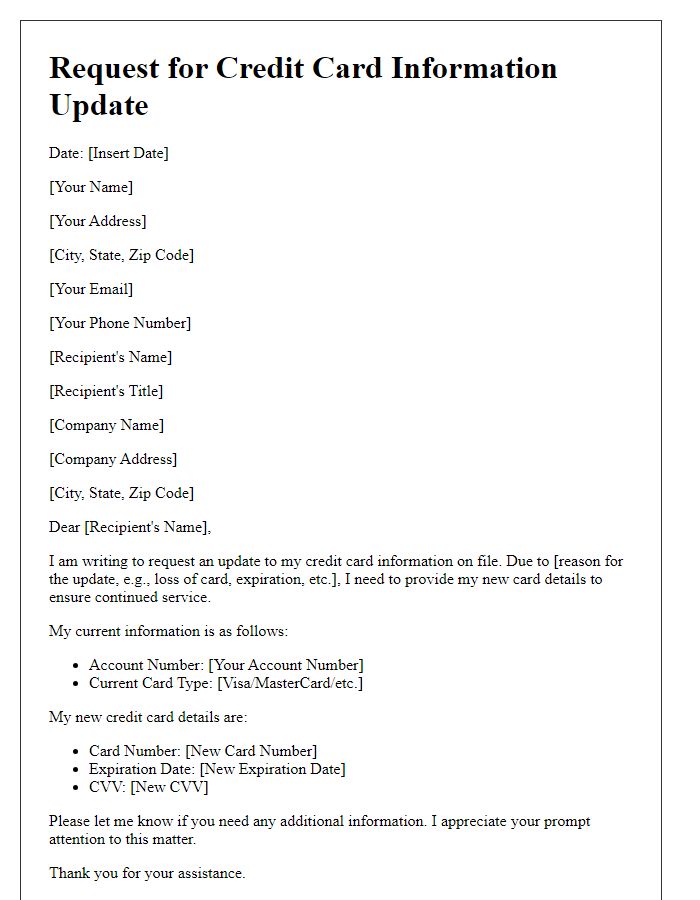

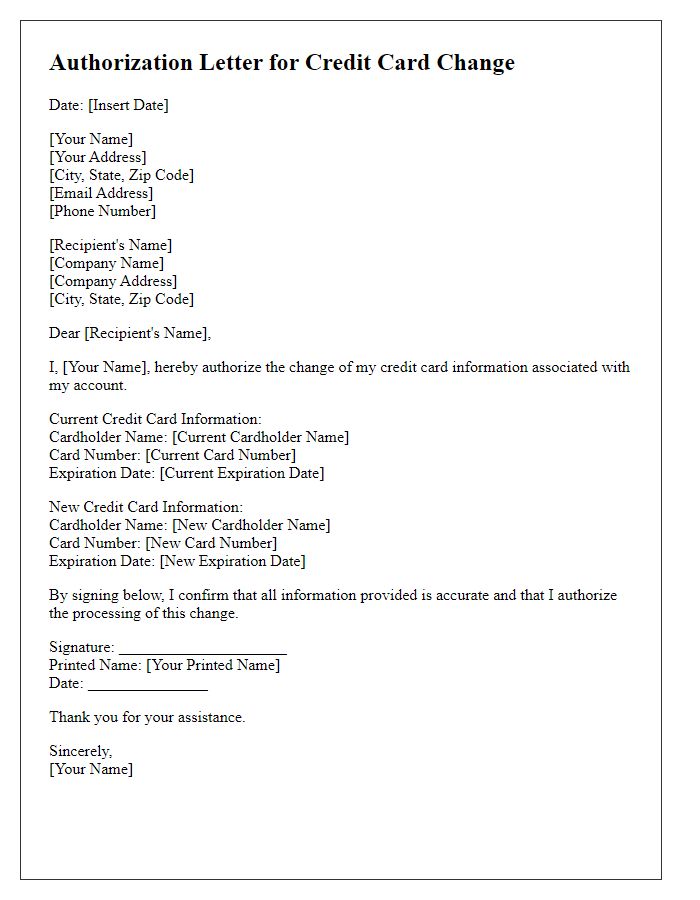

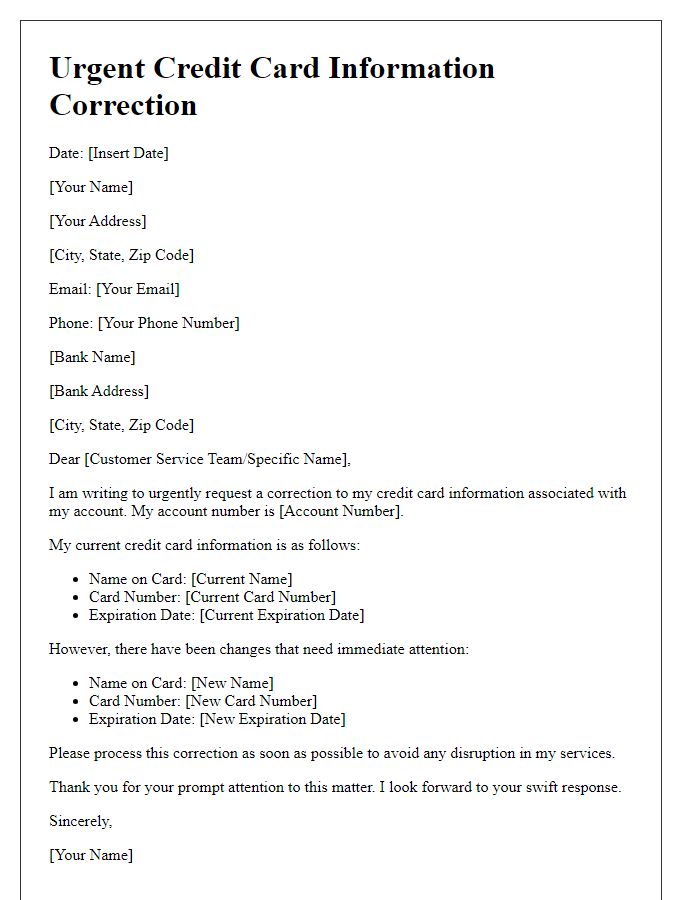

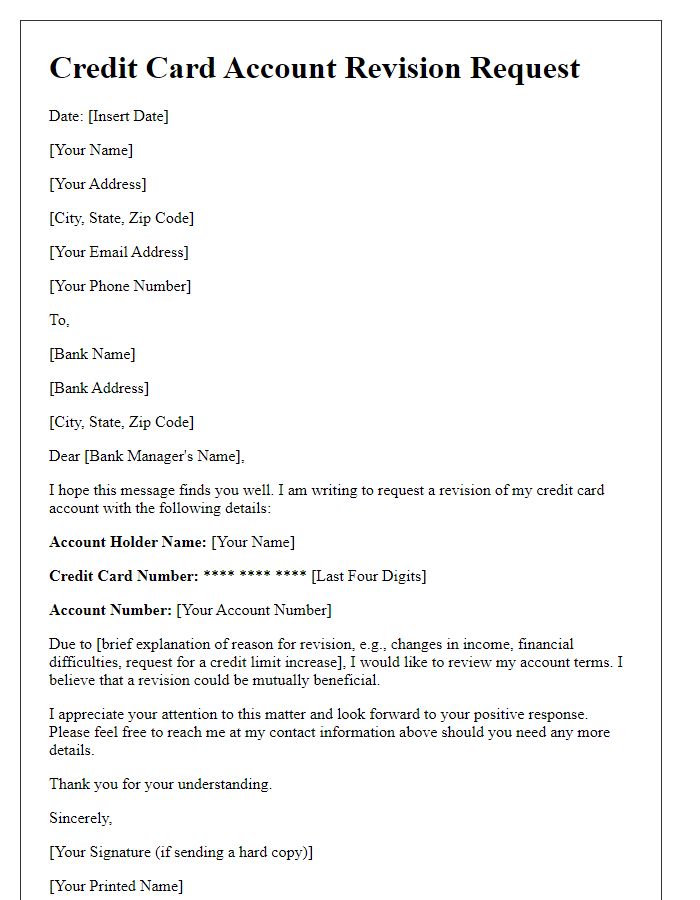

Cardholder's name

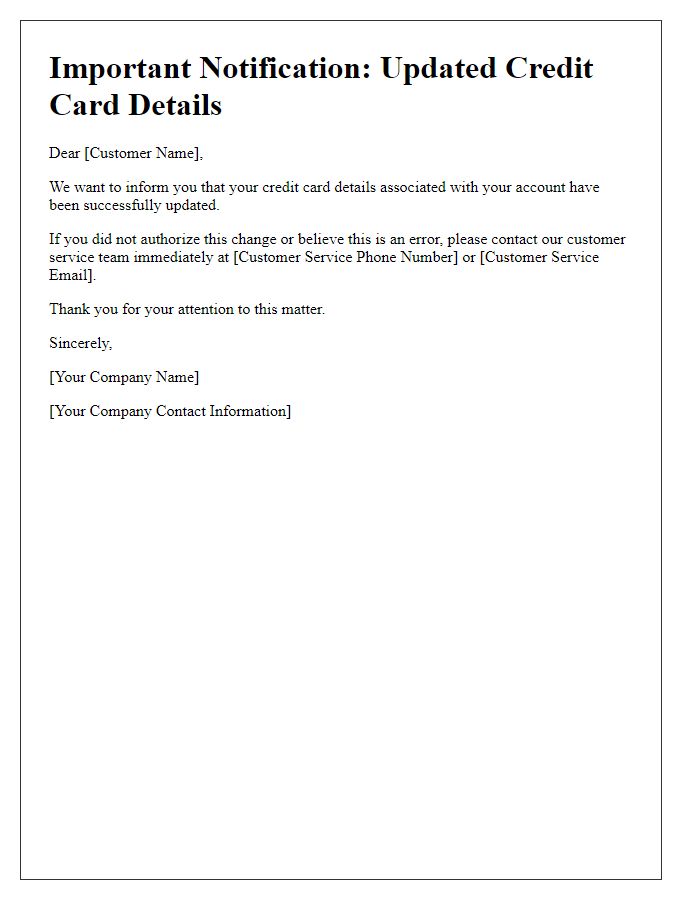

Credit card updates are essential to maintain security and uninterrupted service. Various institutions such as banks and credit unions require up-to-date information on cardholders, including the cardholder's name, expiration date, and billing address. In the case of a name change, such as due to marriage or legal alteration, documentation proving the change may be required, like a marriage certificate or court order. Having accurate information prevents issues like transaction declines or fraudulent activities, ensuring that cardholders can use their accounts smoothly. Additionally, keeping contact details current aids in receiving important notifications related to account security.

Credit card number (last four digits)

Updating credit card information involves ensuring accuracy and security. For financial accounts, only the last four digits (e.g., 1234) of the new credit card number should be provided to help verify transactions without exposing sensitive data. Typically, this information is submitted via secure forms or customer service channels to protect against identity theft. Banks and financial institutions often require this update for ongoing transactions, subscriptions, or services associated with the account, emphasizing the importance of maintaining current payment information. Regular updates can prevent service interruptions and ensure seamless financial operations.

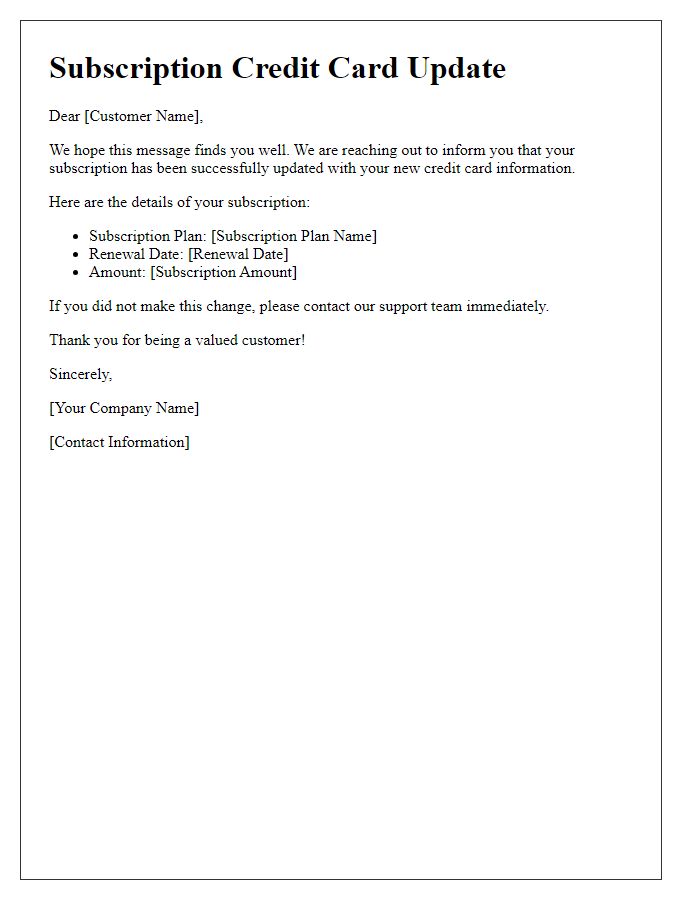

Expiration date

Credit card expiration dates play a crucial role in ensuring uninterrupted service for subscriptions and recurring payments. Typically, expiration dates are formatted as MM/YY, indicating the month and year the card becomes invalid. A card's expiration typically lasts for three to five years from the date of issuance, varying by financial institution. It is crucial to update this information promptly to prevent transaction declines. For example, a major retailer's payment adjustment system may automatically process payments on the first of each month, requiring accurate card details beforehand to avoid service interruptions. In addition, proactive updates can help protect against fraud, as expired cards often become vulnerable to breaches if not replaced timely.

Updated contact information

To ensure secure transactions, maintaining accurate credit card information is crucial. Updated contact information, including a valid mailing address, email, and phone number, facilitates effective communication regarding account activity. The card issuer, often a prominent bank like Chase or Bank of America, uses this data to send alerts about suspicious transactions or changes in terms. Confirming this information helps avoid declines during payments (issues arising from outdated data) when shopping online or at retail locations. Regular verification of contact details also supports timely notifications related to billing cycles, ultimately enhancing user experience and security.

Authorization for processing the update

When updating credit card information, authorization must be clearly stated to ensure secure processing. Detail the credit card number (last four digits for security), expiration date, and cardholder's name. The new payment method might also include the issuing bank's name for verification. It's crucial to include a consent statement, indicating the cardholder permits the entity to update payment data in accordance with privacy regulations. If applicable, specify the effective date of the changes and any reference number associated with the prior authorization, ensuring a streamlined transition between old and new cards while maintaining data integrity and security.

Comments