When you're on an adventure, the last thing you want to worry about is unexpected expenses due to a travel mishap. That's why having a credit card travel insurance can be a lifesaver, but navigating the claims process can sometimes feel overwhelming. In this article, we'll break down how to effectively write a claim letter for your credit card travel insurance, ensuring you have the best chance of a successful outcome. Ready to learn the ins and outs of crafting the perfect claim? Let's dive in!

Policy details and personal information

Travel insurance claims provide crucial financial support during unforeseen events. Policy details, including the insurance provider (such as XYZ Insurance Company), policy number (123456789), and coverage period (from January 1, 2023, to January 31, 2023), serve as essential identifiers for processing requests smoothly. Personal information required generally includes full name (John Doe), address (123 Main St, Springfield, IL 62701), date of birth (March 15, 1985), and contact information (email: john.doe@email.com, phone: (555) 123-4567). Documentation must clearly outline the incident, including dates, expenses incurred (flight cancellation fees of $500), and relevant medical bills (hospital receipts totaling $2,000). These elements ensure a comprehensive and organized claims submission.

Detailed description of the incident or reason for claim

Travel-related incidents can significantly disrupt planned journeys, as experienced during a recent trip to Santorini, Greece. On July 15, 2023, while visiting a popular tourist destination, a sudden and severe thunderstorm, characterized by high winds and heavy rain, forced the cancellation of previously arranged boat tours to nearby islands. This unforeseen weather event, which registered wind speeds of up to 60 kilometers per hour, not only affected the boat service but also caused widespread disruptions in local transportation and accommodations. My pre-paid tour tickets amounting to EUR150 could not be refunded due to the policy of the service provider, leading to financial loss. Additionally, incurred expenses for alternative travel arrangements, totaling EUR200, along with an emergency hotel accommodation fee of EUR120 for an unplanned overnight stay, further contributed to the claim. These unforeseen circumstances necessitated the activation of the travel insurance policy linked to my credit card, designed to provide coverage for such unpredictable events.

Documentation and evidence (e.g., receipts, reports)

When initiating a travel insurance claim for credit card benefits, it's crucial to compile comprehensive documentation. Essential items should include original receipts which detail expenses incurred during the trip, such as medical bills, trip cancellation fees, or emergency accommodation costs. In addition, police reports or medical reports may be needed, especially in situations involving theft or medical emergencies. For travel delays or cancellations, documentation like itineraries, boarding passes, and written notifications from airlines (preferably including date, time, and reason for the delay) establish a timeline of events. Photographic evidence may also bolster claims, providing visual support of damage or theft that occurred during the trip. Collectively, this thorough documentation is vital for a successful claim processing by the insurance provider associated with the credit card.

Contact information and preferred communication method

When submitting a credit card travel insurance claim, including precise contact information is crucial. Personal details such as full name, address (including city, state, and zip code), and telephone number should be clearly stated. Utilize a preferred communication method, whether it be phone calls, emails, or postal mail, to ensure swift correspondence throughout the claims process. Providing an email address should include the domain provider (e.g., Gmail, Yahoo), while indicating best times for contact can improve response efficiency. Each detail enhances the claim's clarity for insurance reviewers, expediting the review process and minimizing potential delays.

Request for specific compensation or reimbursement amount

Credit card travel insurance claims often necessitate clear communication regarding specific compensation amounts. Travelers, experiencing disruptions such as canceled flights or lost luggage, may request reimbursement for expenses incurred due to the event. For instance, if a flight from New York City to Paris is canceled, travelers may seek a compensation amount covering accommodation costs, such as hotel fees averaging around $150 per night, combined with additional transportation expenses, like a taxi fare of approximately $50. Documentation, including receipts and booking confirmations, enhances the legitimacy of the claim, expediting the review process. It is crucial to reference the precise policy and the coverage limits outlined in the credit card agreement, which may dictate reimbursement eligibility for various travel-related incidents.

Letter Template For Credit Card Travel Insurance Claim Samples

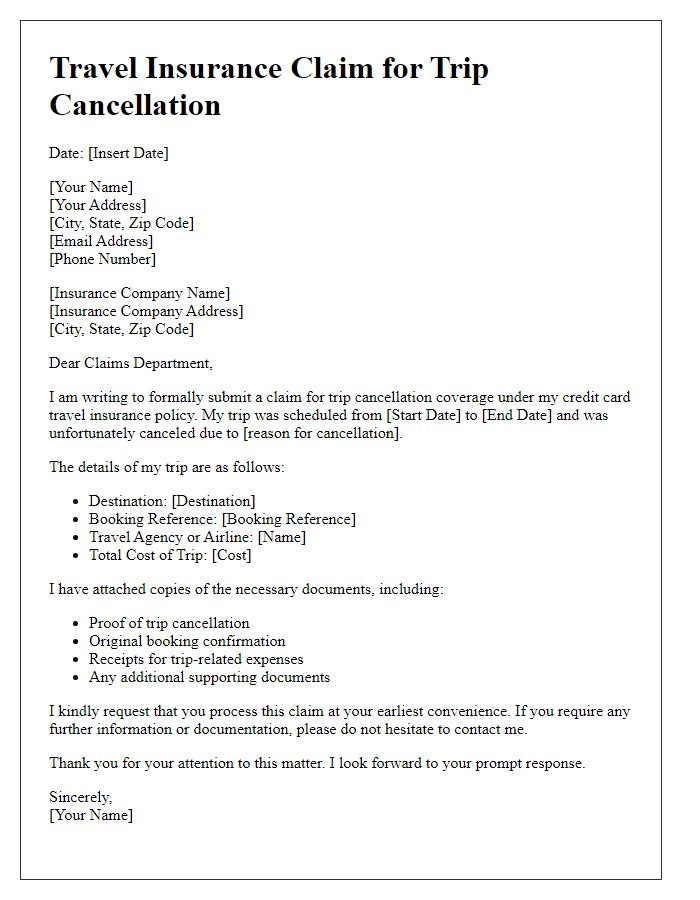

Letter template of credit card travel insurance claim for trip cancellation.

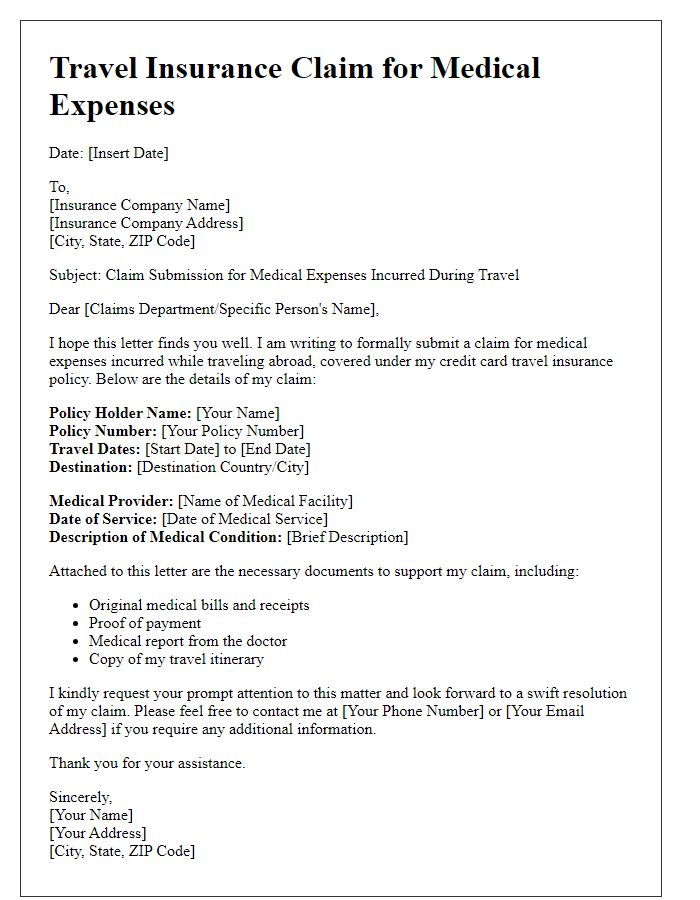

Letter template of credit card travel insurance claim for medical expenses abroad.

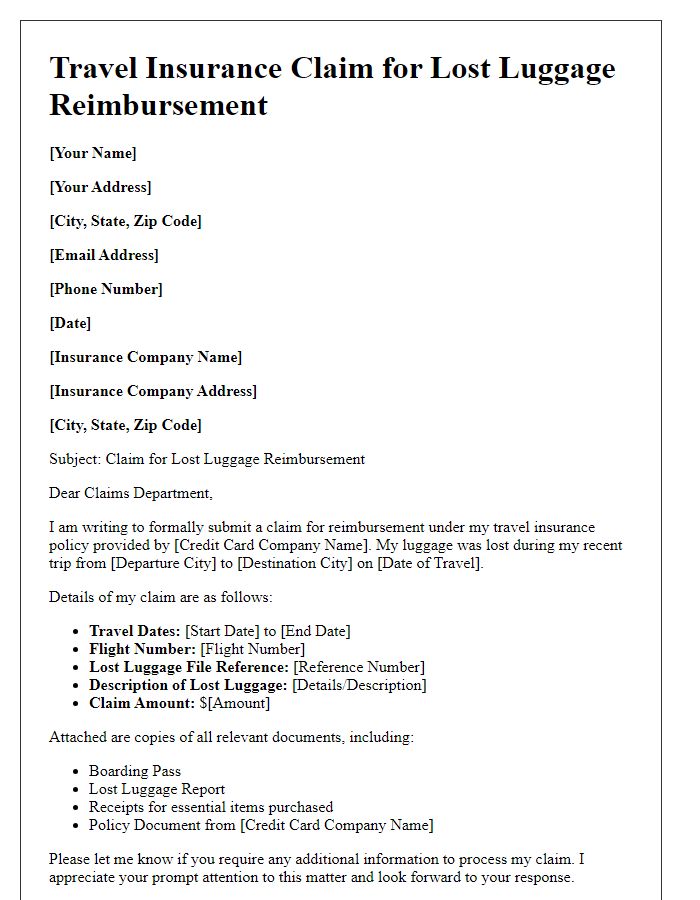

Letter template of credit card travel insurance claim for lost luggage reimbursement.

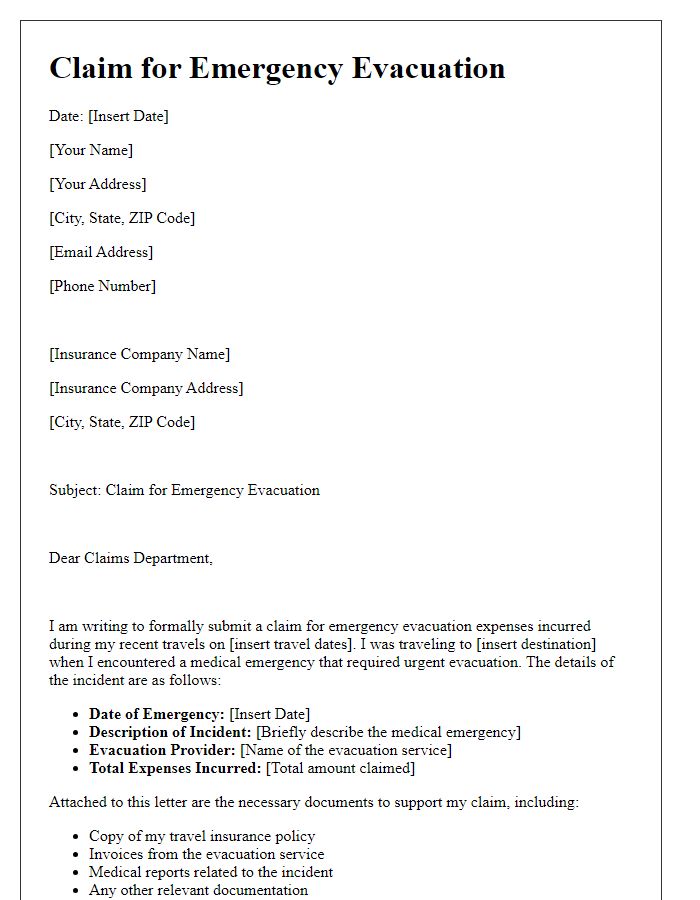

Letter template of credit card travel insurance claim for emergency evacuation.

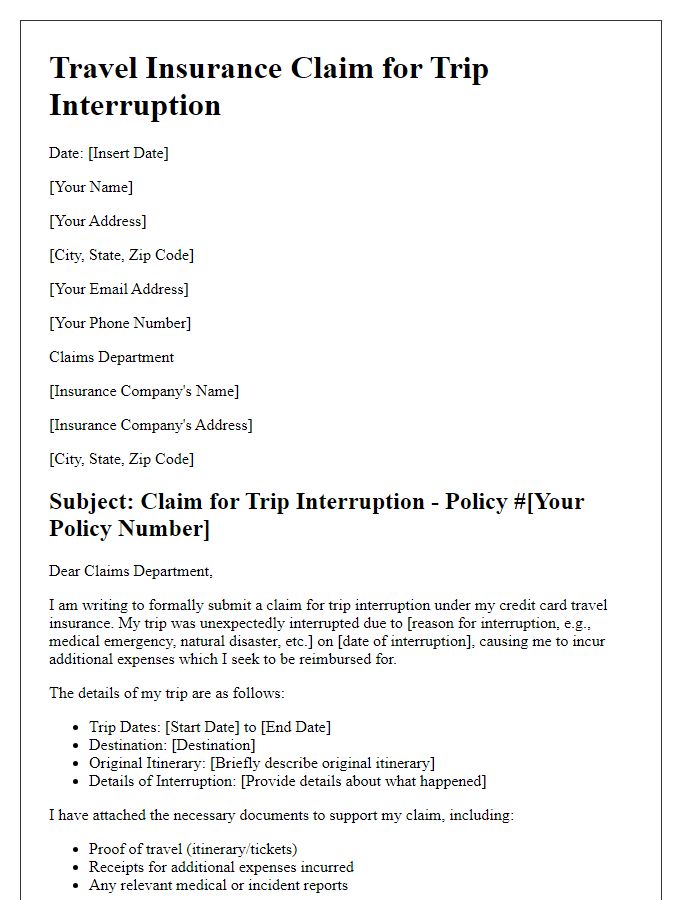

Letter template of credit card travel insurance claim for trip interruption.

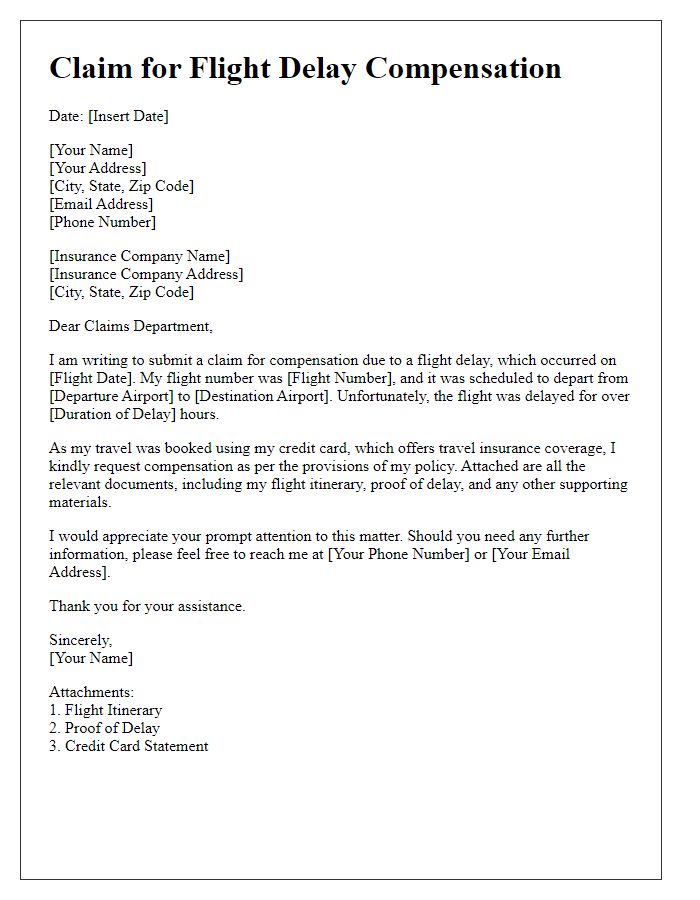

Letter template of credit card travel insurance claim for flight delay compensation.

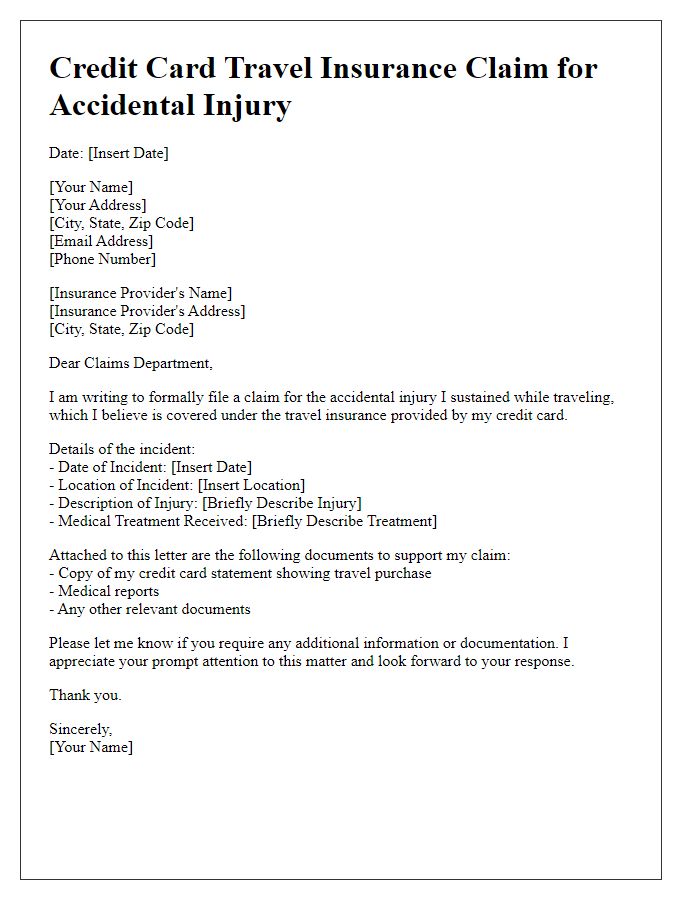

Letter template of credit card travel insurance claim for accidental injury.

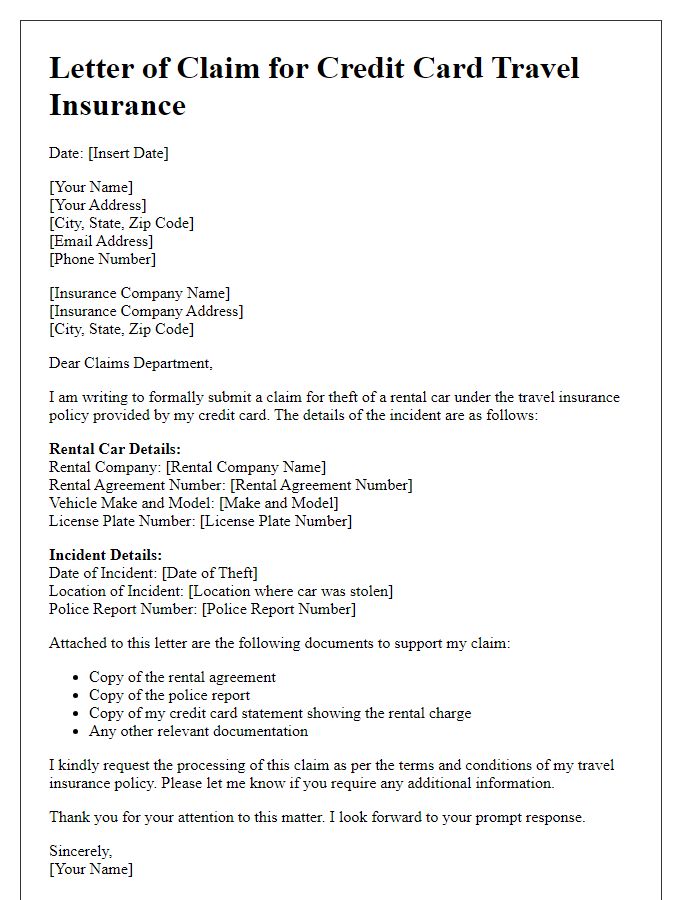

Letter template of credit card travel insurance claim for rental car theft.

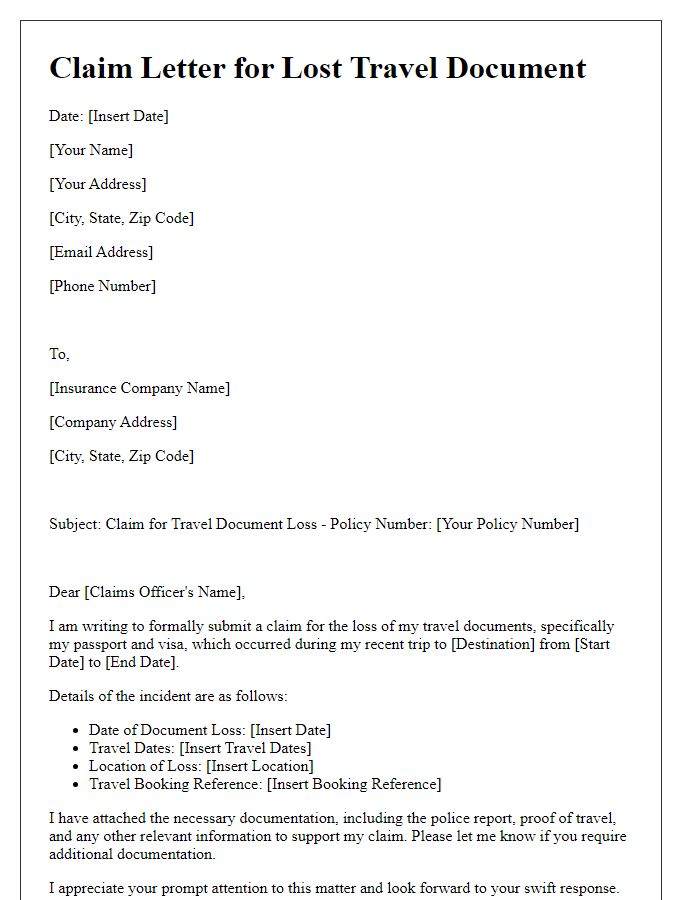

Letter template of credit card travel insurance claim for travel document loss.

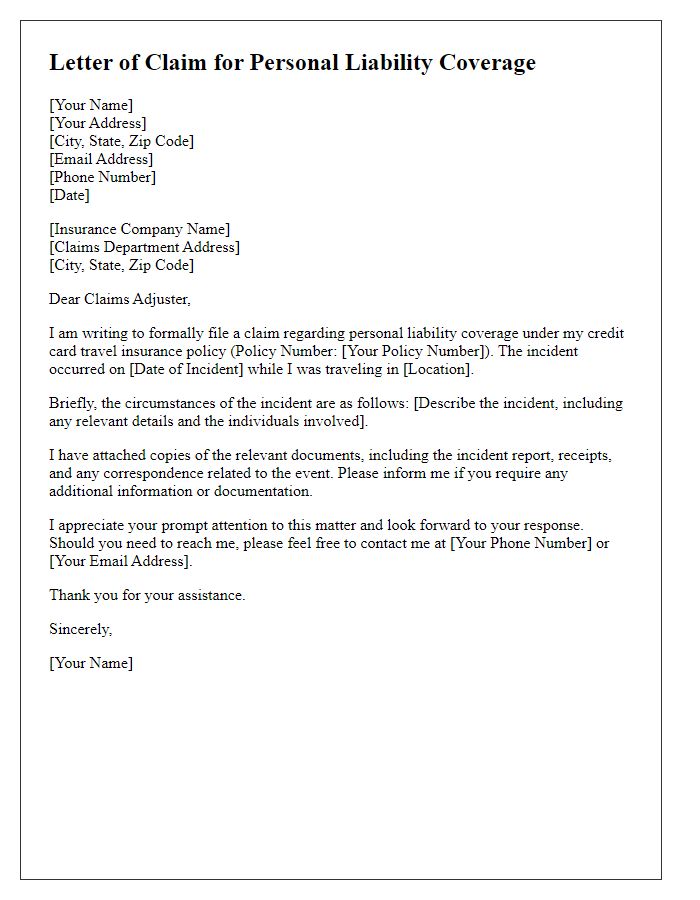

Comments