Are you looking for a credible way to build or rebuild your credit? A secured credit card could be your ideal solution, combining the benefits of standard credit cards with a safety net for lenders. By making a small cash deposit as collateral, you gain the opportunity to establish positive credit history while enjoying the convenience of plastic. Curious to learn how a secured credit card can enhance your financial journey? Read on!

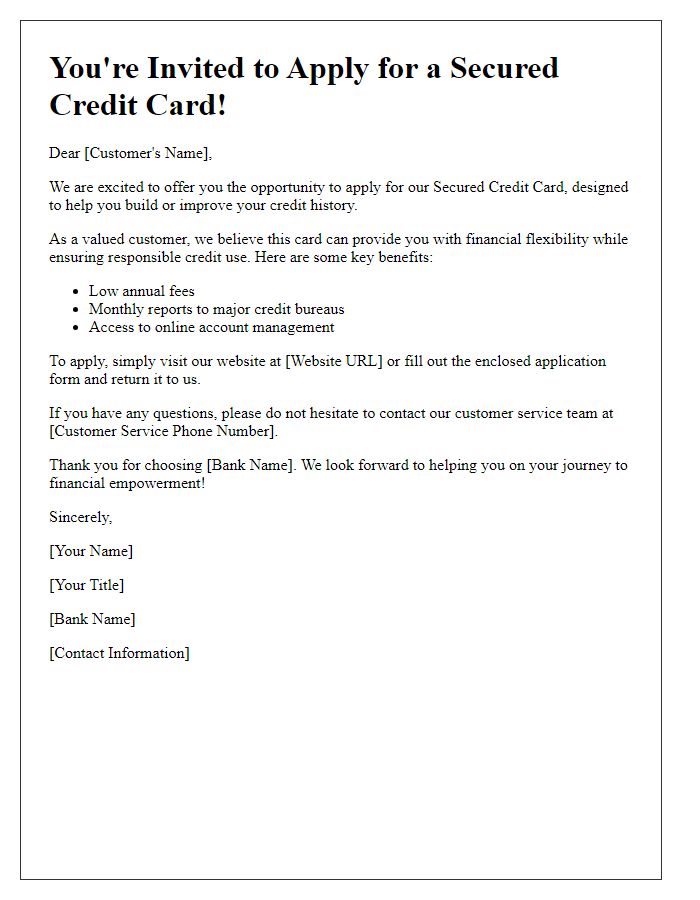

Personalization and recipient's details

A credit card secured offer presents an excellent opportunity for individuals looking to build or rebuild their credit history. Typically, these secured cards require a cash deposit, which serves as the credit limit; often starting from $200 to $500, depending on the issuing bank. Institutions like Discover and Capital One provide these cards to applicants with limited credit histories. Users can benefit from regular reporting to major credit bureaus, such as Experian and TransUnion, allowing them to establish a positive credit profile over time. To enhance this process, on-time payments and responsible usage play a crucial role, with many providers offering rewards programs or cash back benefits once a good credit score is established. Security features like EMV chip technology further safeguard against fraud, making these cards both beneficial and secure for consumers.

Clear offer explanation and benefits

A secured credit card, such as the Capital One Secured Mastercard, allows individuals to establish or rebuild credit effectively. Candidates must provide a security deposit, usually ranging from $49 to $200, which serves as collateral and determines the credit limit. The card offers benefits like the potential for credit limit increases, regular reporting to major credit bureaus such as Experian and TransUnion, and no annual fee options. Users can also earn cash back on eligible purchases, alongside access to online account management tools. Furthermore, responsible usage and timely payments can ultimately lead to an unsecured card offer in the future, enhancing credit scores and financial opportunities.

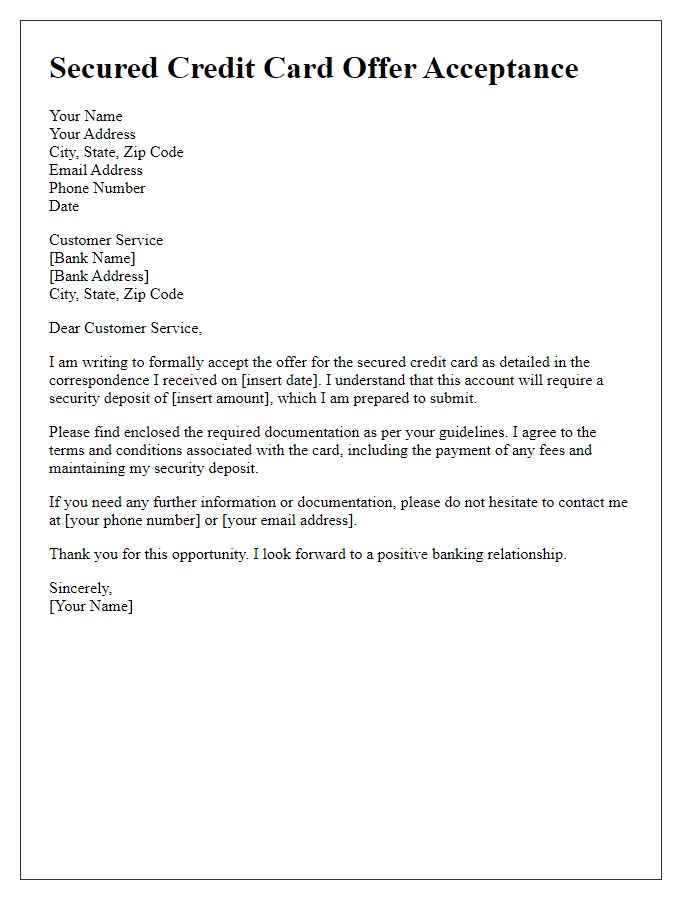

Secured card requirements and terms

A secured credit card offer typically requires specific eligibility criteria and terms for potential applicants. Applicants must generally possess a valid government-issued photo ID, such as a driver's license or passport, to verify identity. A minimum refundable security deposit is often required, usually ranging from $200 to $500, which serves as collateral against credit risk. Clients may encounter an annual fee, which can vary from $25 to $49, depending on the issuing bank's policies. Furthermore, the interest rate, expressed as an Annual Percentage Rate (APR), can range from 15% to 30%, contingent upon the applicant's creditworthiness. Payment due dates occur monthly, and late fees may apply if the payment is not received on time, typically around $35. Cardholders should understand that this secured card can be instrumental for building or improving credit scores when managed responsibly.

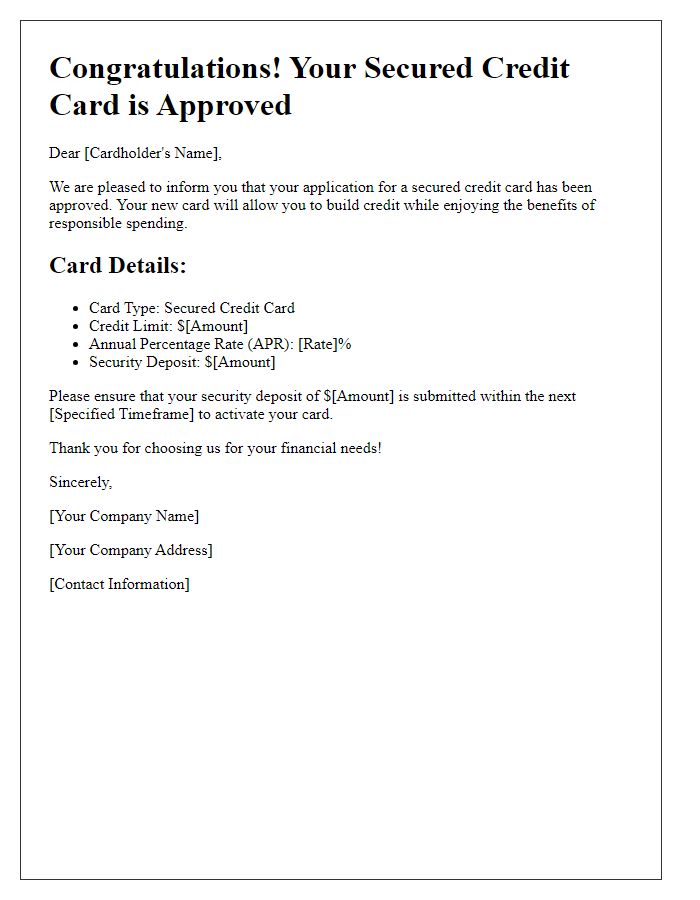

Application process instructions

A secured credit card application typically involves a few key steps that ensure applicants understand the process. First, prospective applicants need to gather necessary documents, such as proof of income, identification (driver's license or passport), and social security number. Next, applicants may visit the bank's website or local branch to complete the application form. The minimum deposit amount for securing the card is usually stated, often ranging from $200 to $500. This deposit acts as collateral for the credit limit. After submitting the application form and deposit, the bank may conduct a credit check, although approval often does not require a perfect credit history. Finally, once approved, the secured credit card will be mailed to the applicant's address, enabling them to start building or rebuilding their credit score responsibly.

Contact information and support options

A secured credit card offers individuals a pathway to rebuild their credit history and improve their financial standing. This type of card requires a cash deposit (often ranging from $200 to $5,000) as collateral, which serves as the card's credit limit, enabling responsible usage while minimizing risk to the lender. Support options typically include a dedicated customer service hotline (often available 24/7) for account inquiries or troubleshooting, as well as an online chat feature through the bank's website for real-time assistance. Furthermore, many issuers provide email support for non-urgent matters and detailed FAQs, enhancing user experience and ensuring access to necessary information.

Comments