Are you considering enrolling in a credit card cashback program? Understanding the rules and benefits can help you maximize your rewards and make the most of your spending. With various offers and categories, it's essential to navigate through the specifics to ensure you're getting the best deals. Keep reading to uncover the details that will empower you to boost your cashback earnings!

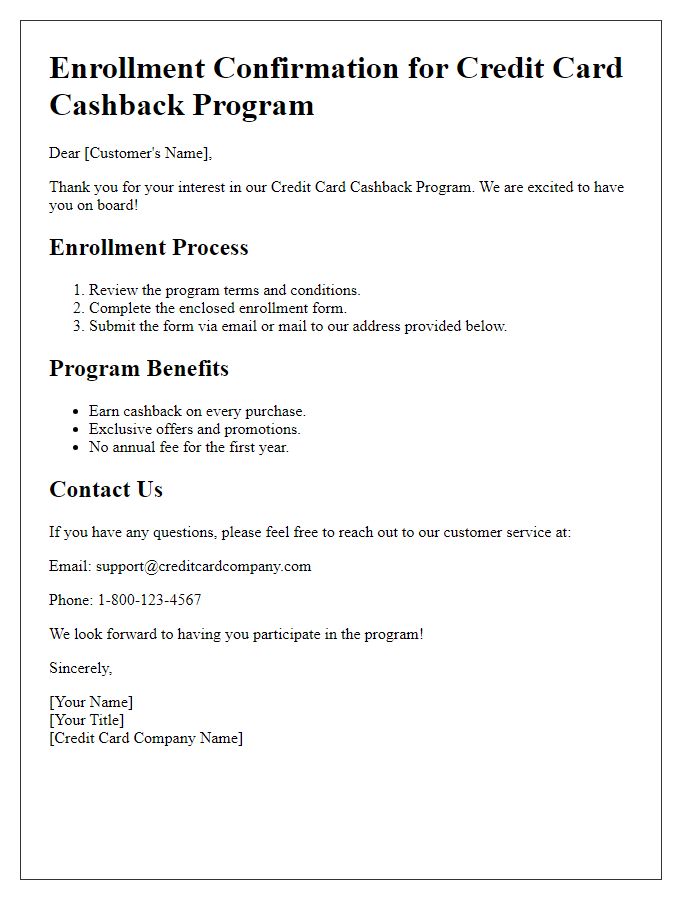

Eligibility Criteria

The eligibility criteria for the credit card cashback program include age requirements, such as applicants must be at least 18 years old, and residency requirements, specifically that applicants must be permanent residents or citizens of the country where the card is issued. Additionally, applicants may need to demonstrate a minimum annual income, often set at $25,000 or higher, to qualify. Regular credit evaluation processes, including credit score checks, are also part of eligibility evaluations, where scores typically need to exceed 650 to be eligible. Applicants should also be aware that existing account status matters; individuals with delinquent accounts or recent bankruptcies may be disqualified. Furthermore, only primary cardholders, not authorized users, can earn cashback rewards, emphasizing the need for the account to be in good standing for a certain duration, generally three months, before cashback rewards are credited.

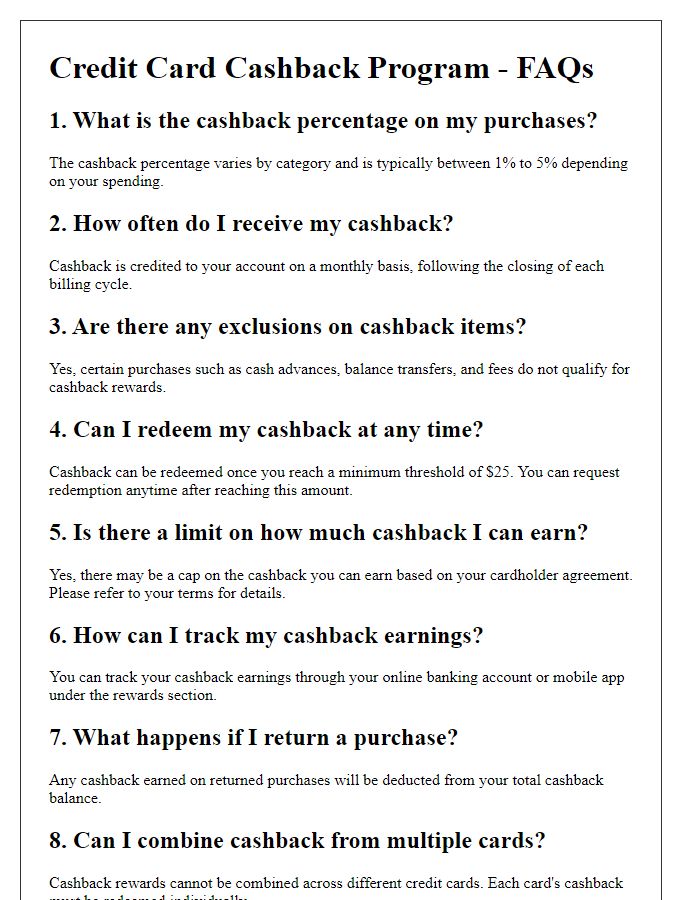

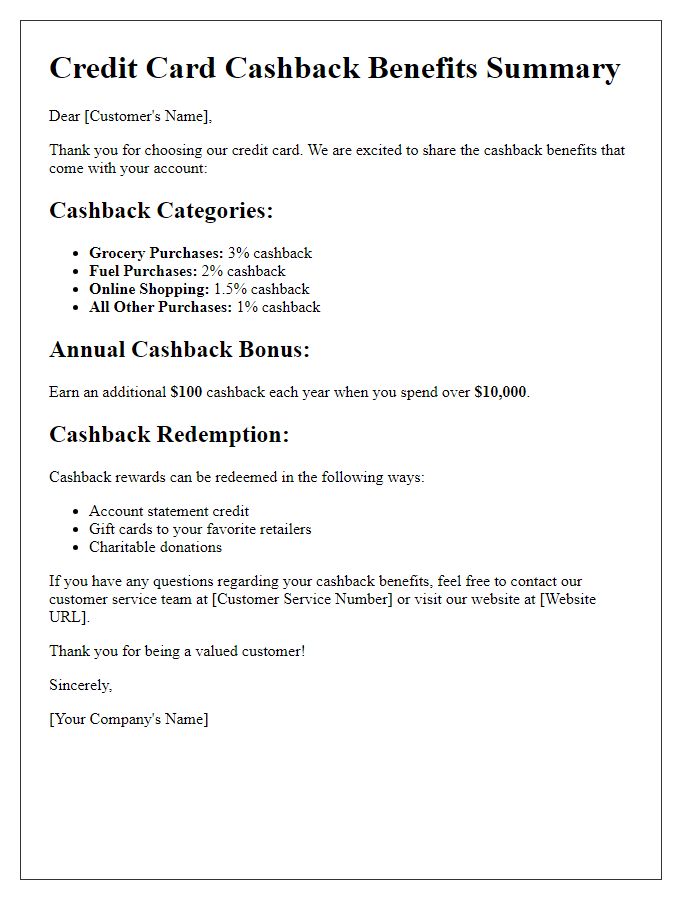

Cashback Earning Rates

Credit card cashback programs often offer various earning rates that can benefit users with different spending habits. On average, cashback rates range between 1% to 5% for eligible purchases, depending on categories such as retail, groceries, dining, or travel. Some credit cards, like the Chase Freedom Flex, offer rotating bonus categories that change quarterly, allowing cardholders to earn up to 5% on specific purchases when activated. Other cards, like the Citi Double Cash, typically provide a flat rate of 2% cashback on all purchases, which appeals to those who prefer simplicity and consistency in earning rewards. Additionally, certain promotional periods may offer increased cashback rates, such as 3% on online shopping during the holiday season, enticing consumers to spend more where it matters most. Understanding these varied cashback earning structures can help cardholders maximize their rewards based on their unique spending patterns.

Redemption Process

To redeem cashback from your credit card program, follow a straightforward process designed for user convenience. First, review the cashback balance available, which is updated monthly after the billing cycle on statements. Next, access your online account, where you will find a dedicated section for cashback rewards. This section provides detailed information about eligible redemption options, including statement credits, gift cards, or merchandise, with some programs offering options redeemable starting at as low as $5. Choose the preferred method and confirm the redemption, noting that the processing time may vary; statement credits typically reflect within 48 hours, while third-party gift cards may take longer. Ensure you maintain updated contact information to receive notifications of redemption status and any changes to program rules that may occur.

Terms and Conditions

Credit card cashback programs provide consumers with rewards on eligible purchases made through their credit cards, such as Visa or Mastercard. Cashback percentages often range from 1% to 5% based on specific categories, like groceries, dining, or travel. Participating merchants include major retailers and online platforms, such as Amazon or Walmart. Program rules typically outline minimum spending requirements, redemption options, and potential expiration dates for cashback rewards. Cardholders should understand limitations, like exclusions on certain transactions or annual caps on cashback earnings. Additionally, maintaining a good credit score is crucial for retention in such programs and ensuring access to promotional bonuses or sign-up rewards, often exceeding $200. Familiarity with these terms enhances the potential for maximizing benefits while minimizing misunderstandings.

Promotional Offers

Promotional offers in credit card cashback programs often feature significant discounts, promotional percentages, and limited-time rewards. These offers can range from 1% to as much as 5% cashback on specific categories like groceries, travel, or dining out, potentially enhancing overall savings on everyday purchases. Some programs may introduce bonus cashback events during holidays or special events such as Black Friday, offering an opportunity for increased returns. Terms usually specify eligibility periods, often lasting from a few weeks to several months, and stipulate minimum spending requirements, which may be set at $300 or more. Consumers should review details carefully, as limitations might apply, including caps on the maximum cashback earned, typically ranging from $200 to $500. Participation often requires activation of the offer through the credit issuer's website or mobile app, ensuring customers are aware and engaged with ongoing promotional opportunities.

Comments