Are you feeling overwhelmed by your credit card payments and unsure about what to do next? Many people find themselves in similar situations, and it's completely normal to seek a little extra time to manage those bills. One potential solution is requesting a grace period extension from your credit card issuer, which can provide you with the breathing room you need. Curious about how to effectively draft that request? Let's explore this useful letter template together!

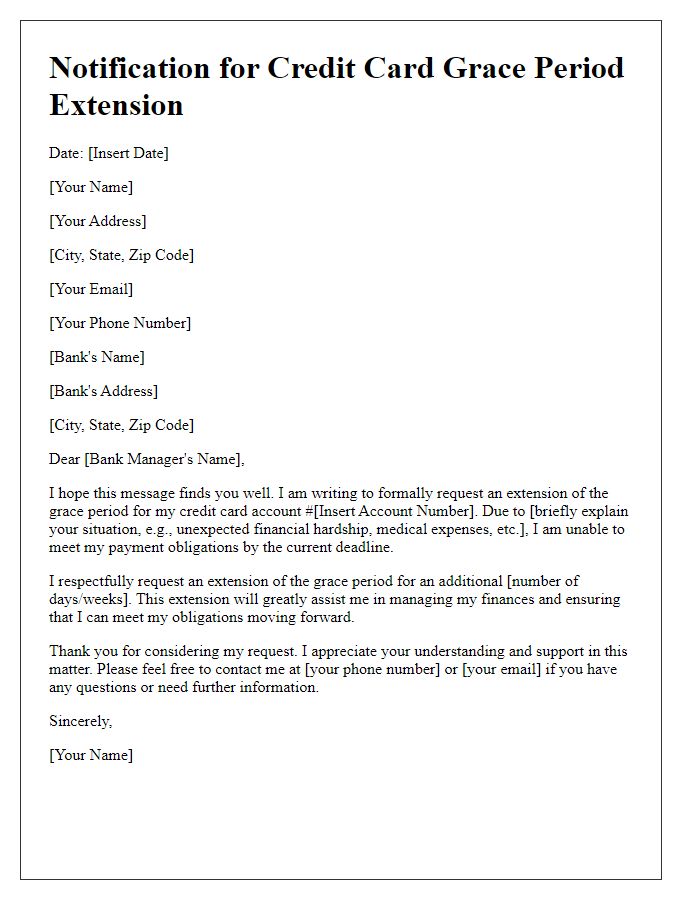

Account Holder Information

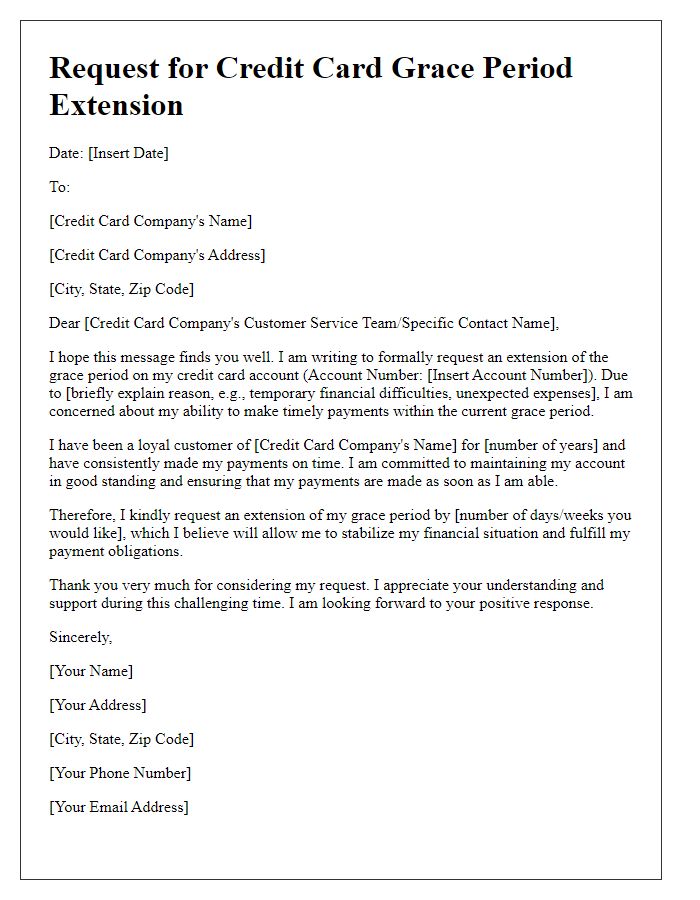

A credit card grace period extension can be vital for account holders facing financial challenges or unexpected expenses. The typical grace period allows users to avoid interest charges on new purchases if the previous balance is paid in full by the due date, usually around 21 days. However, certain situations, like medical emergencies or job loss, may necessitate a request for extension. Account holders seeking this extension should include essential information such as their full name, account number, and contact details, enabling the credit card issuer to efficiently process the request. Supporting documentation, like proof of income loss or medical bills, can enhance the likelihood of approval, ensuring clear communication regarding one's financial situation and rationale behind the request.

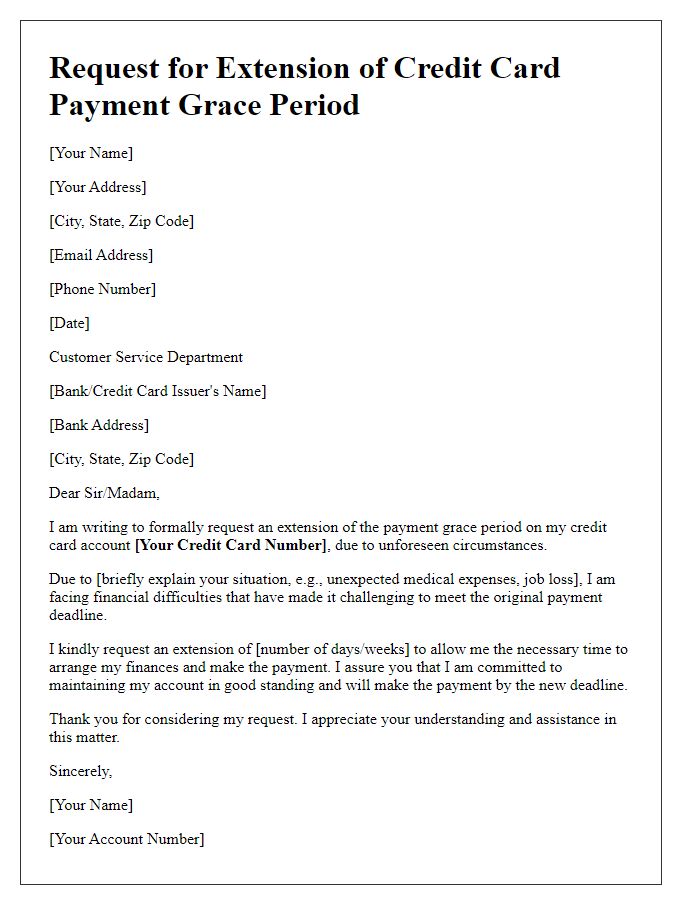

Credit Card Account Details

A credit card grace period extension allows cardholders to avoid interest on new purchases during a specified time frame. Major credit card issuers like Visa and MasterCard typically offer a grace period of up to 21 days from the billing statement date. For example, if the statement is issued on the 1st of the month, payments must be made by the 22nd to avoid interest fees. Each issuer's policy may vary, so checking terms specific to the account is essential. Account details, including the account number and statement balance, must be provided in any request for an extension to ensure proper handling. Additionally, submitting such requests promptly before the end of the current billing cycle may increase the chances of favorable consideration.

Specific Extension Request Reason

Consumers experiencing financial strain often seek a credit card grace period extension to manage their payments effectively. A grace period typically lasts 21 to 25 days, allowing card users to pay off new purchases without incurring interest. Unexpected events such as job loss, medical emergencies, or major home repairs frequently prompt requests for extensions. Financial institutions may consider these requests based on the cardholder's history, payment patterns, and current circumstances. For instance, consistent on-time payments prior to financial hardships may strengthen the case for an extended grace period, providing relief and allowing cardholders to avoid late fees and increased interest rates during tough times.

Requested Extension Duration

A credit card grace period extension allows cardholders additional time to pay their balances without incurring interest or late fees. Typically, standard grace periods last between 21 to 25 days from the end of the billing cycle, depending on the credit card issuer. In circumstances such as financial hardship or unexpected expenses, cardholders may request an extension of this grace period to better manage their payments. Issuers often consider the cardholder's payment history, credit utilization ratios, and overall relationship with the bank before granting an extension. Providing clear documentation, such as proof of income changes or medical expenses, may increase the likelihood of approval. Extension requests are usually handled through the issuer's customer service channels, including phone and secure online messaging, ensuring that the cardholder receives timely assistance.

Contact Information for Follow-up

Credit card grace period extension requests can significantly impact personal finances, especially in times of economic uncertainty. Effective communication with the credit card issuer is crucial. Providing accurate contact information such as a phone number (e.g., (555) 123-4567) and email address (e.g., example@email.com) ensures prompt responses. Including a brief summary of the request, highlighting specific events that prompted the need for an extension, like unexpected medical bills or loss of employment, adds context. Keeping records of all communications holds importance; therefore, date-stamped correspondence may provide essential references for future discussions with customer service representatives.

Letter Template For Credit Card Grace Period Extension Samples

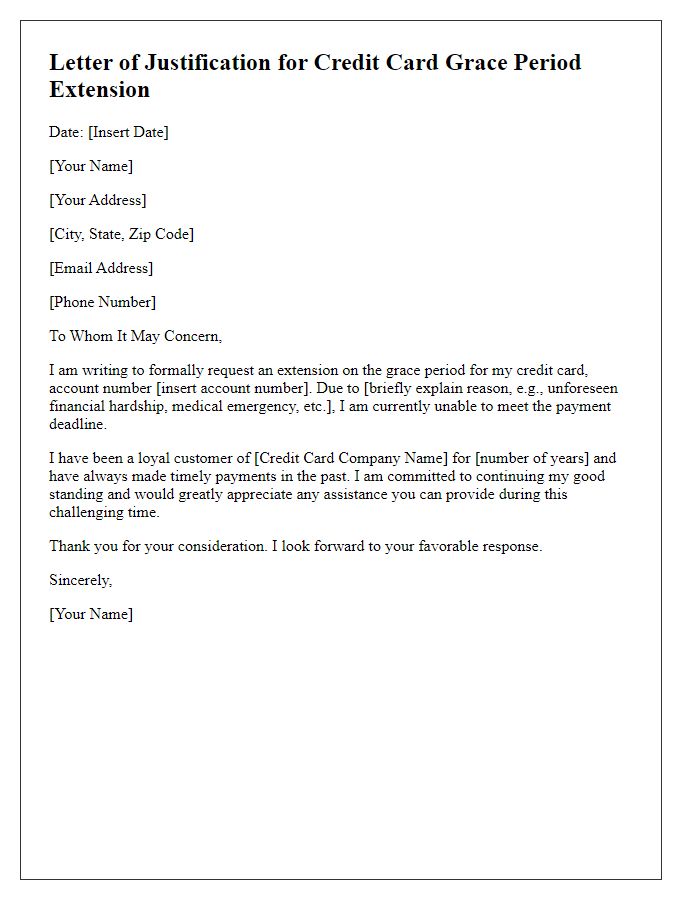

Letter template of notification for need of credit card grace period extension

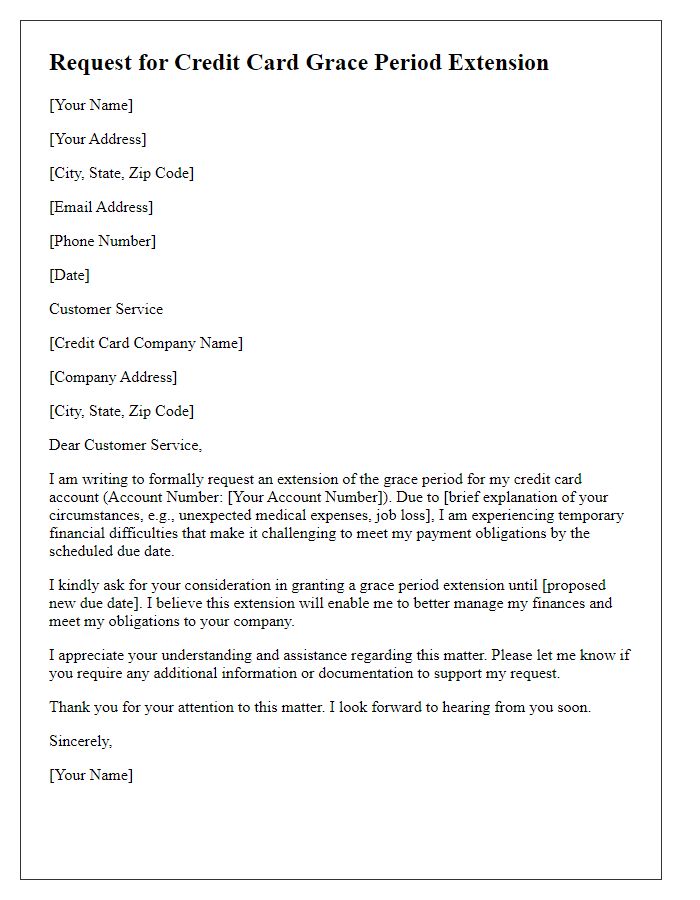

Letter template of formal request for extending credit card payment grace period

Letter template of documentation for credit card grace period extension request

Letter template of follow-up on credit card grace period extension application

Comments