If you've ever felt uneasy about a charge on your credit card, you're not alone! Many people find themselves in situations where they need to dispute an unexpected transaction, and that's where a chargeback request comes into play. Navigating the process can be daunting, but with the right template, you can articulate your concerns clearly and effectively. Ready to learn how to protect your finances? Let's dive in!

Cardholder information

Cardholder information forms the foundation of a credit card chargeback request, encompassing essential details such as the cardholder's name, account number, and billing address. Accurate identification is crucial; incorrect or missing information can delay the chargeback process or lead to rejection. The cardholder's phone number (preferably a direct line for prompt communication) ensures responsive dialogue with customer service. Additionally, providing an email address facilitates quick exchanges of information or documentation related to the dispute. All details must align with the records held by the issuing bank, typically accessed through banking apps or websites, to streamline the chargeback process.

Transaction details

A credit card chargeback request requires clear transaction details to facilitate the process. Key transaction details include the transaction date, typically formatted as mm/dd/yyyy, the merchant's name where the charge occurred, and the specific amount charged, which may include cents (e.g., $123.45). The transaction ID, often provided in the transaction confirmation email, serves as a unique identifier for reference during disputes. Additionally, any relevant receipts or invoices related to the purchase can support claims against unauthorized charges or fraudulent transactions, significantly enhancing the likelihood of a successful chargeback. Furthermore, including a brief description of the reason for the chargeback, such as undelivered goods or services not rendered, helps clarify the context for the financial institution processing the request.

Reason for dispute

A credit card chargeback request may arise from various reasons, including unauthorized transactions, product not received, or defective products. The Chargeback process allows consumers to dispute charges on their credit card bills, typically as governed by the Fair Credit Billing Act (FCBA) in the United States. For unauthorized transactions, evidence must demonstrate the lack of consent, representing a clear case of fraud. If a product is not received, documentation like tracking numbers or communication with the seller serves to strengthen the claim. Disputes over defective products hinge on clear proof of the defect, such as photos or expert opinions, and may require an attempt to resolve the issue with the merchant before proceeding. Customers must submit their chargeback requests to their credit card issuer within 60 days from the statement date reflecting the disputed charge for timely processing.

Supporting documentation

A credit card chargeback request requires precise supporting documentation to establish the legitimacy of the dispute. Essential documents include the original transaction receipt, typically reflecting the purchase date, amount, and merchant details, while also illustrating the service or goods purchased. Additionally, any correspondence with the merchant, such as emails or chat logs, should be included to highlight attempts at resolution before the chargeback was initiated. Relevant evidence may also consist of photographs of defective products or service failures. Bank statements showing the transaction can further substantiate the claim, illustrating the date and amount charged. Gathering this comprehensive documentation, organized chronologically, strengthens the chargeback case, ensuring all critical information is readily accessible for review by the financial institution.

Request for resolution

Initiating a credit card chargeback request requires precise documentation to ensure a successful resolution. The transaction in question, dated [specific date] for [specific amount] at [merchant name/location], pertains to a disputed charge due to [briefly specify reason: unauthorized transaction, service not rendered, defective product]. Credit card provider policies typically require substantive proof, such as receipts, correspondence with the merchant, and any relevant screenshots. Submitting the chargeback request within the mandated dispute timeframe--often within 60 days of the transaction--is crucial for consideration. Ensure inclusion of your account details and a clear description of the circumstances surrounding the charge to facilitate prompt investigation by the credit card issuer.

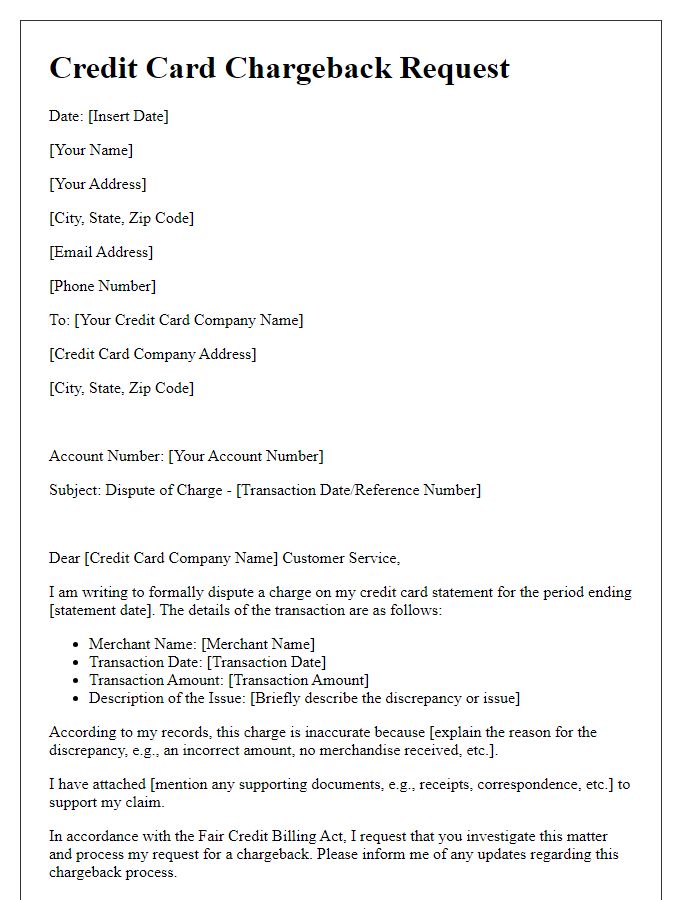

Letter Template For Credit Card Chargeback Request Samples

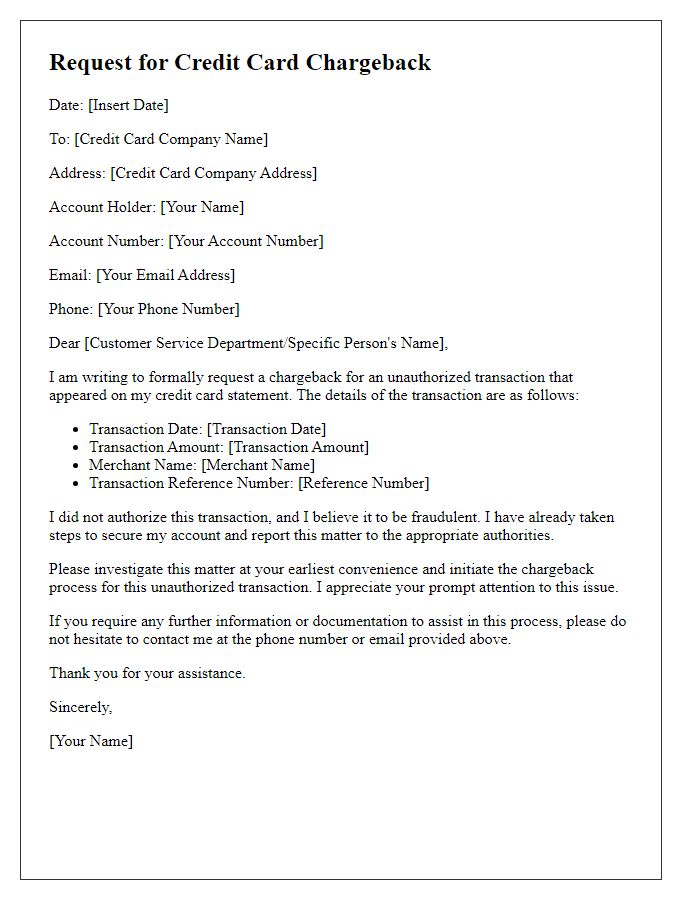

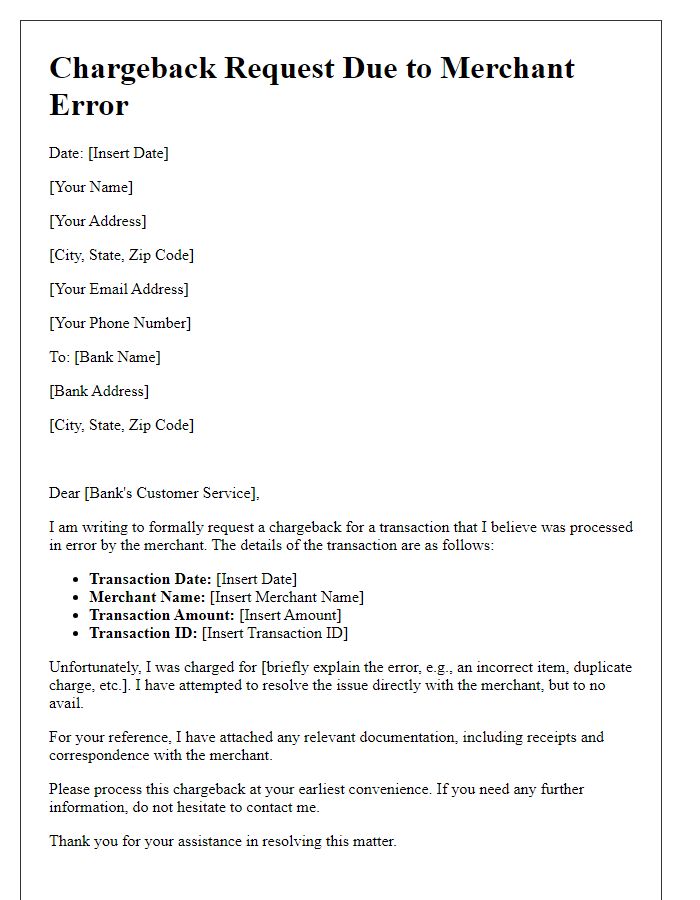

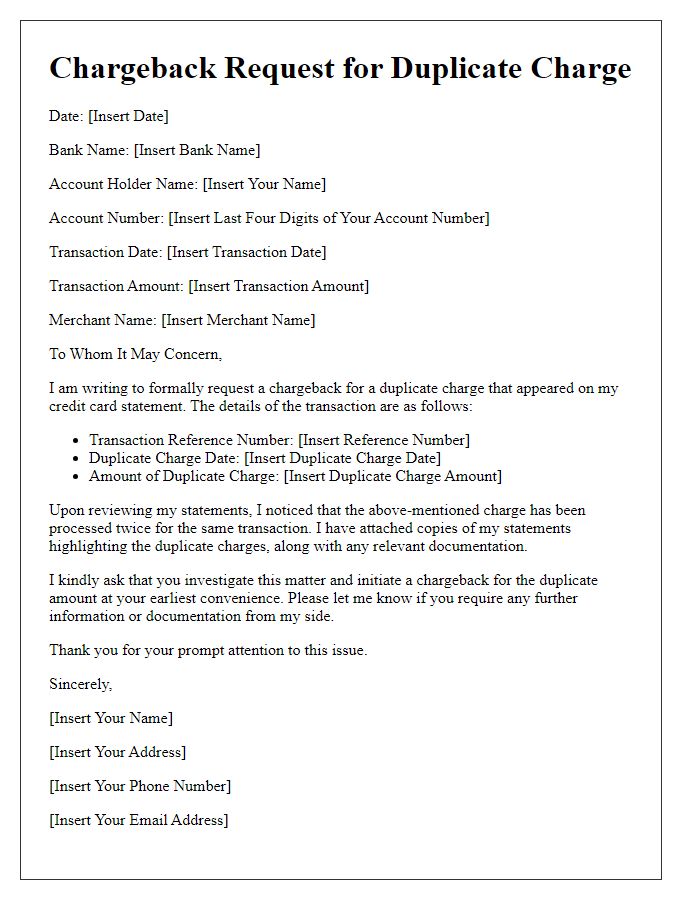

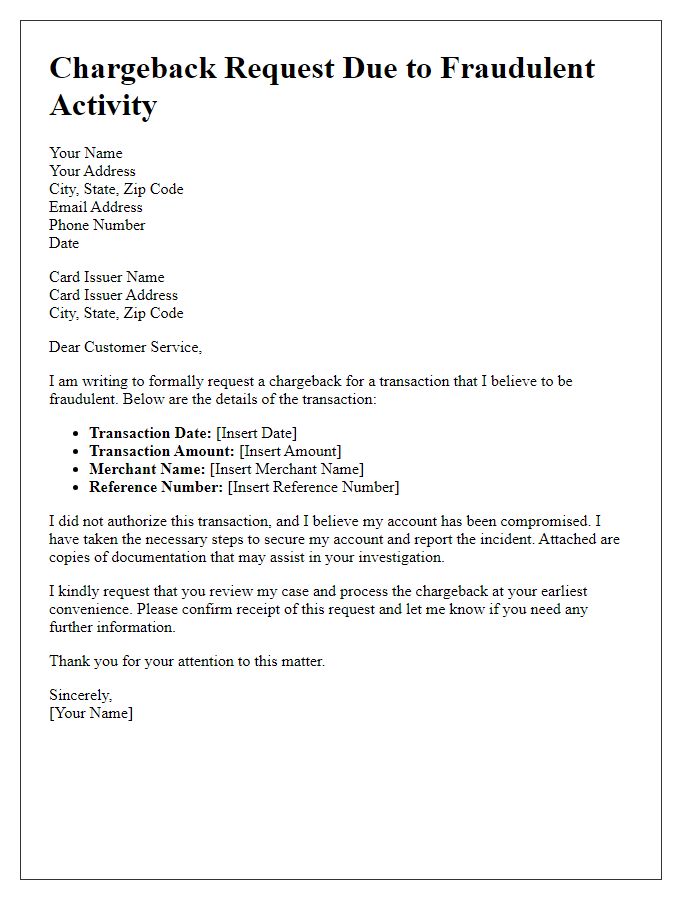

Letter template of request for credit card chargeback due to unauthorized transaction

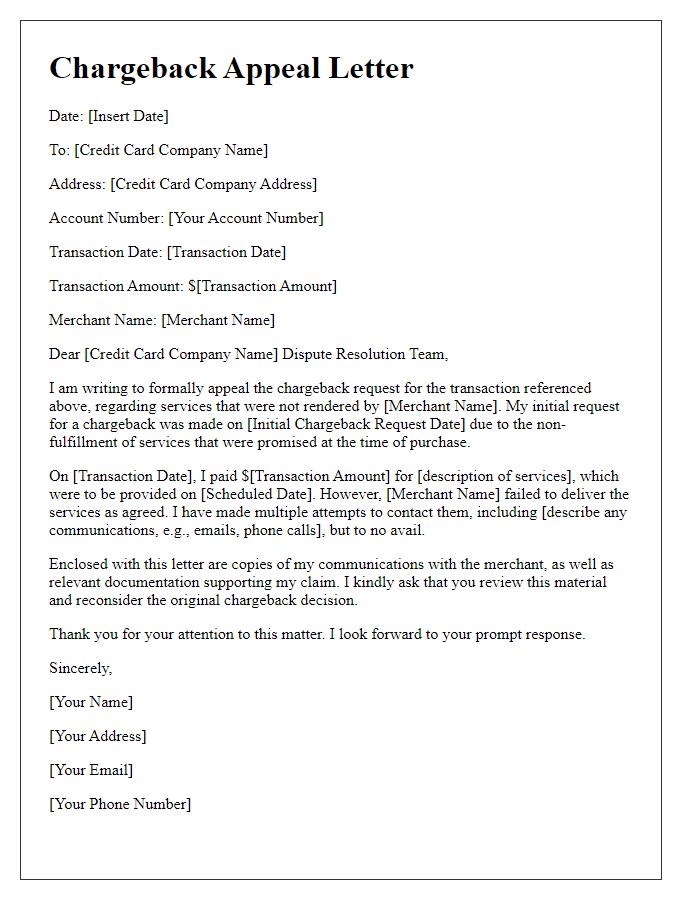

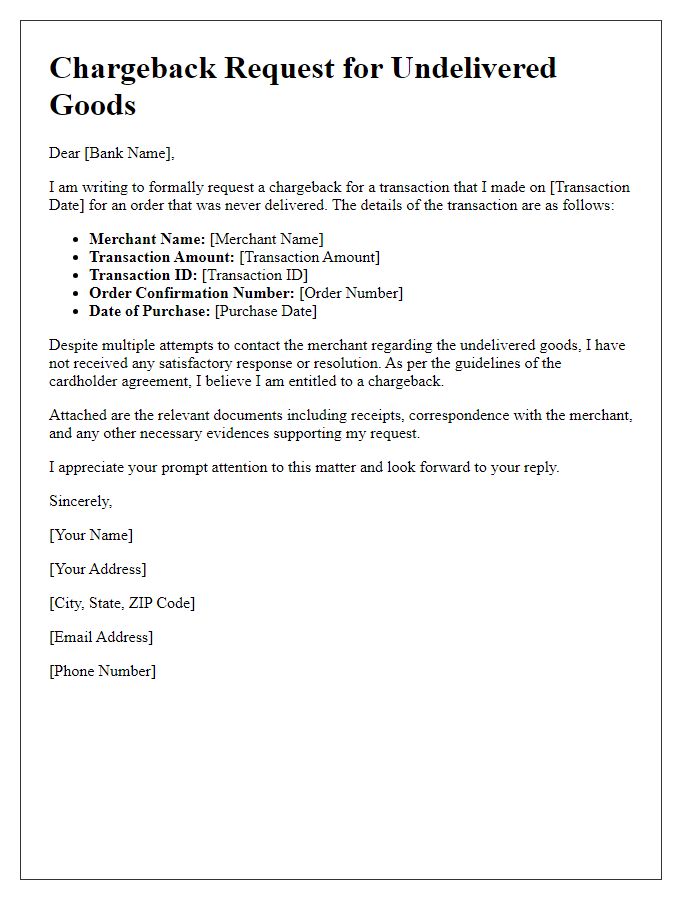

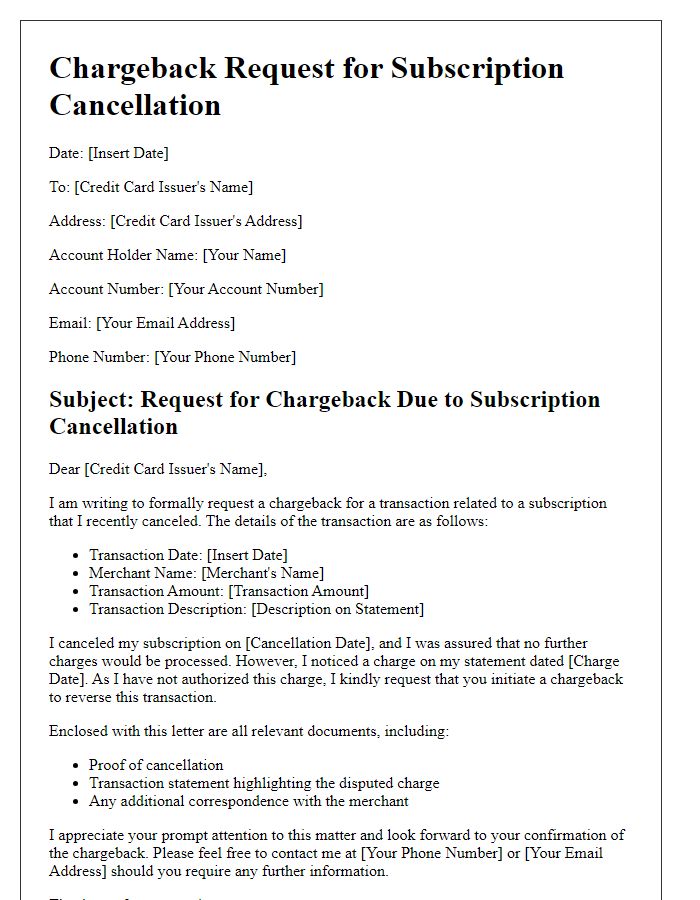

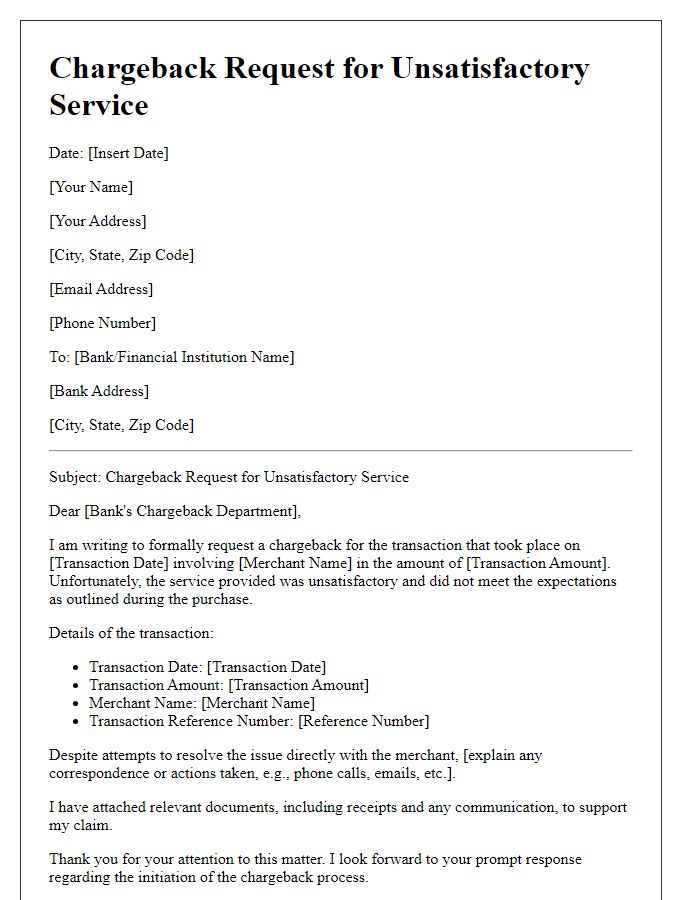

Letter template of credit card chargeback appeal for service not rendered

Comments