Are you curious about how to effectively manage your credit card account and understand your financial standing? In today's fast-paced world, keeping track of your spending habits and payment due dates can be overwhelming. Our comprehensive credit card account summary statement template is designed to simplify this process and provide you with a clear overview of your financial health. Dive in to explore how this tool can help you stay on top of your finances and make informed decisions!

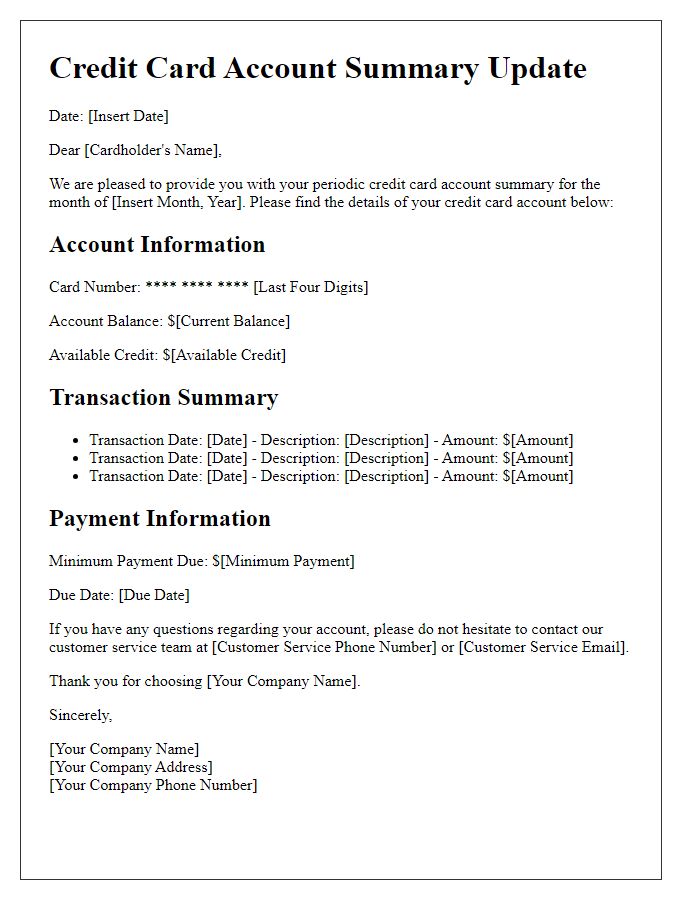

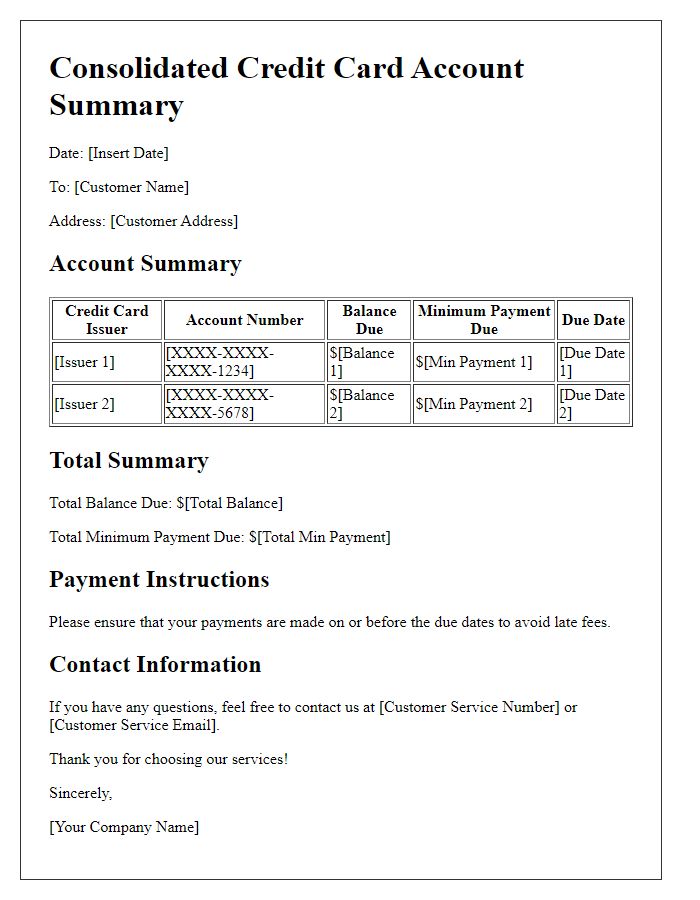

Account Information Summary

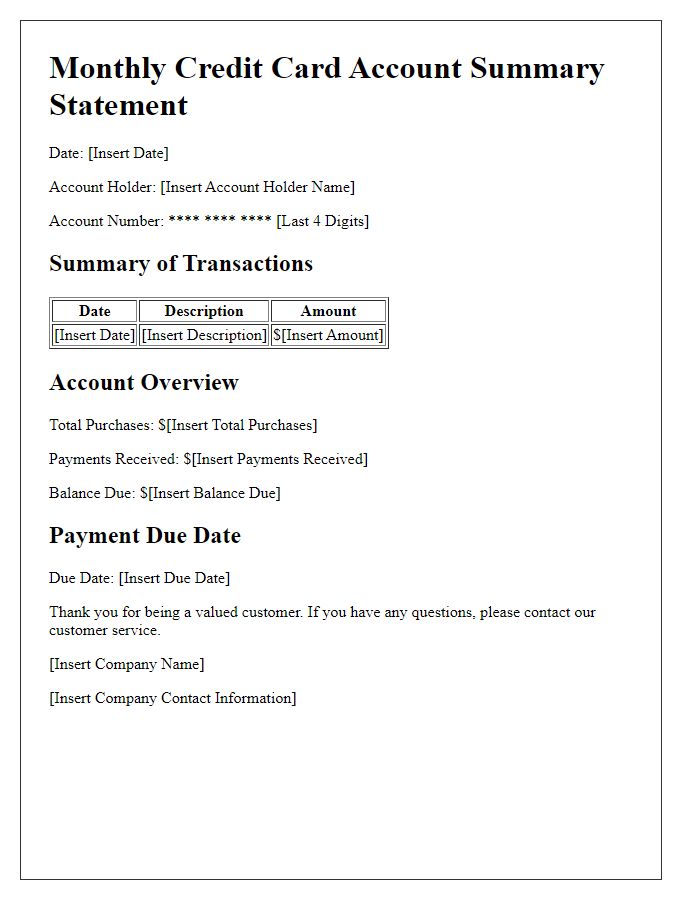

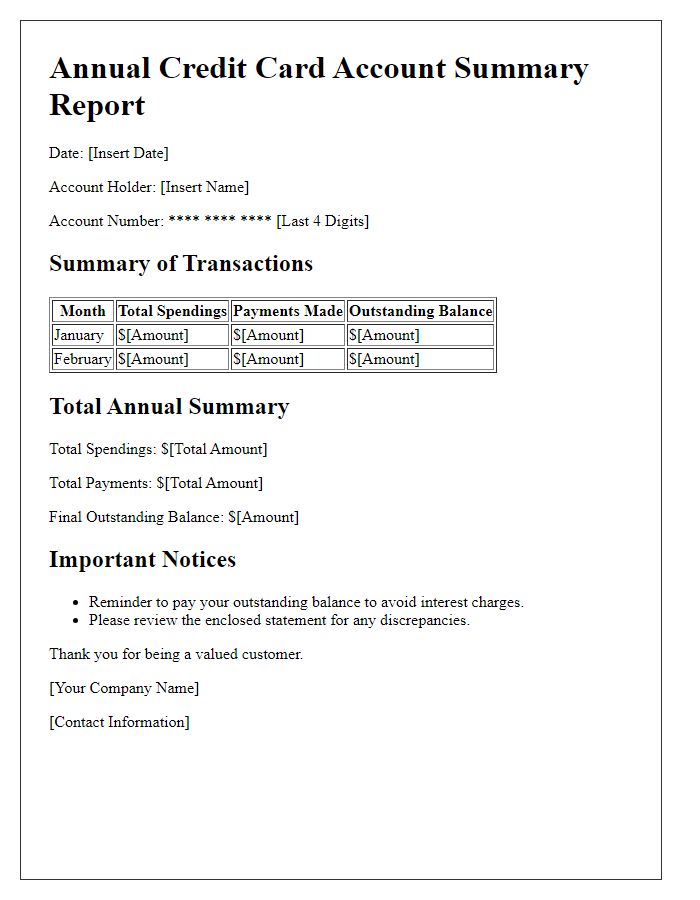

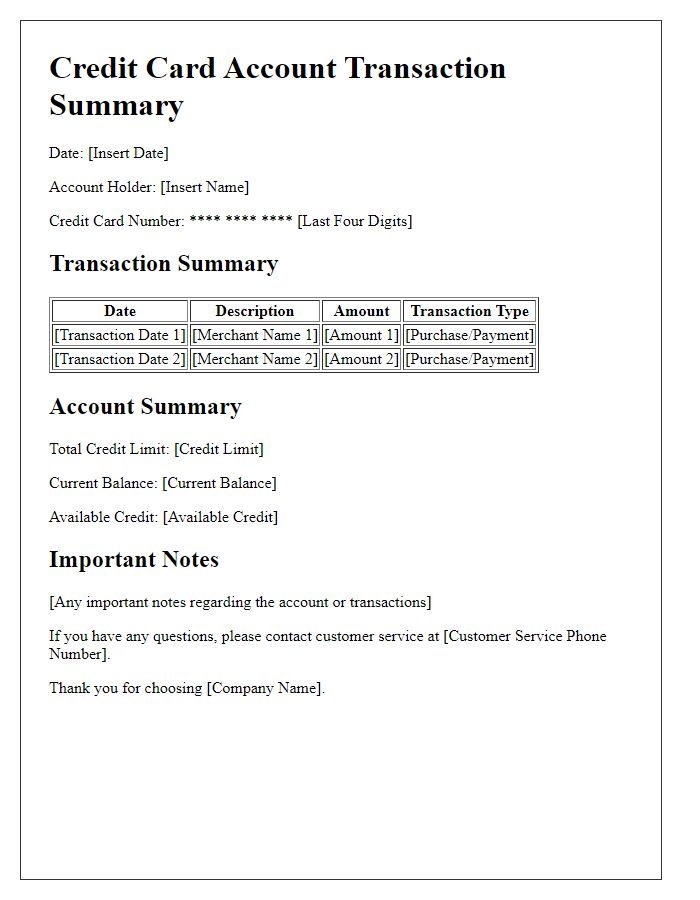

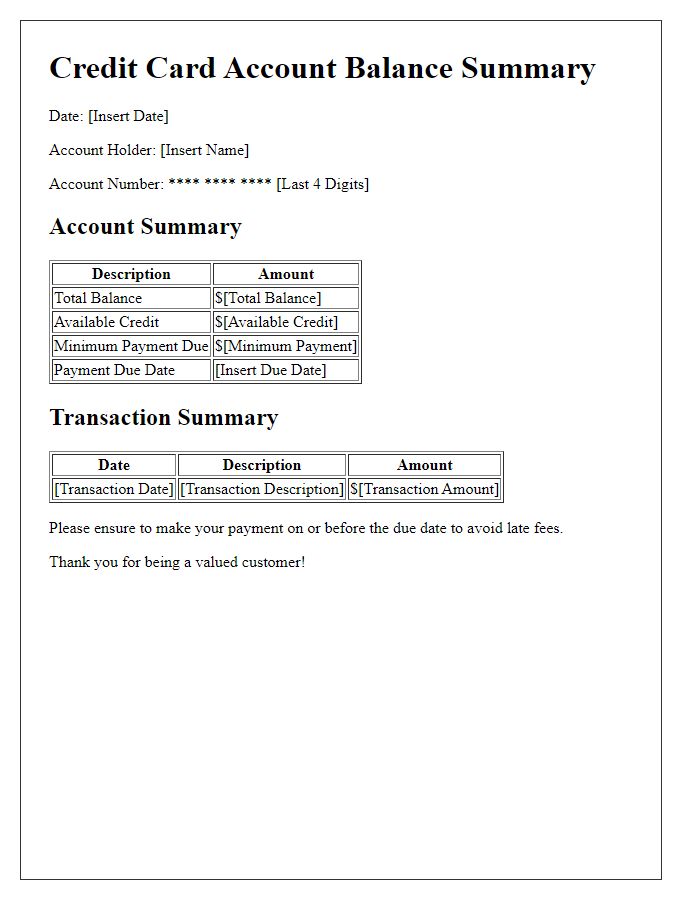

The credit card account summary statement provides a detailed overview of account information, including the total balance outstanding, minimum payment due, due date, and transaction history for the billing cycle. The account number, which is a unique identifier for the card, allows for easy reference. A breakdown of transactions might include purchases made at various retailers, interest charges calculated based on the annual percentage rate (APR), fees such as late payment or over-limit charges, and rewards points earned through spending habits. Understanding these details assists cardholders in managing credit responsibly and avoiding additional fees.

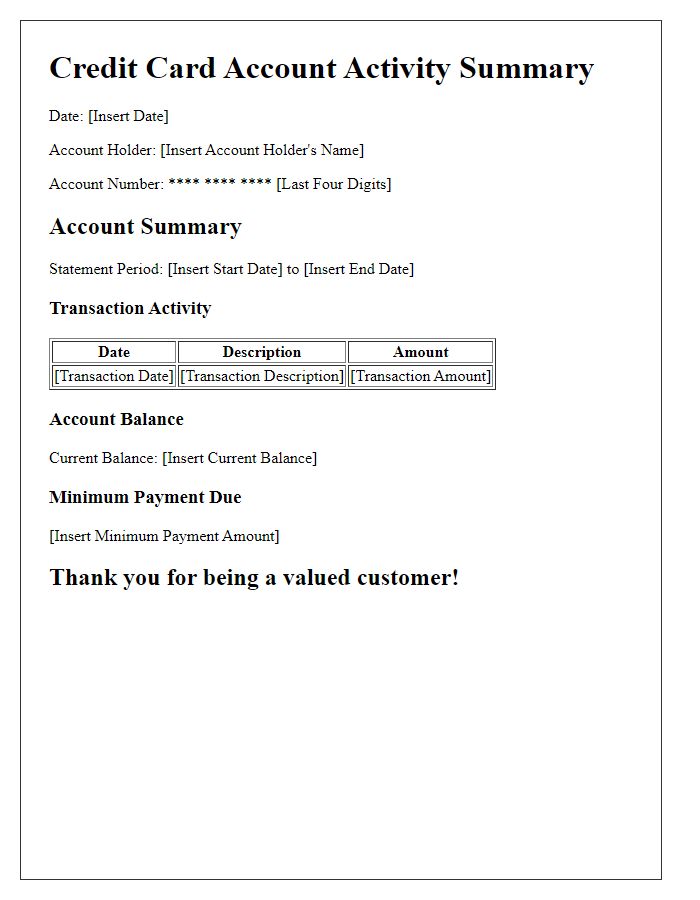

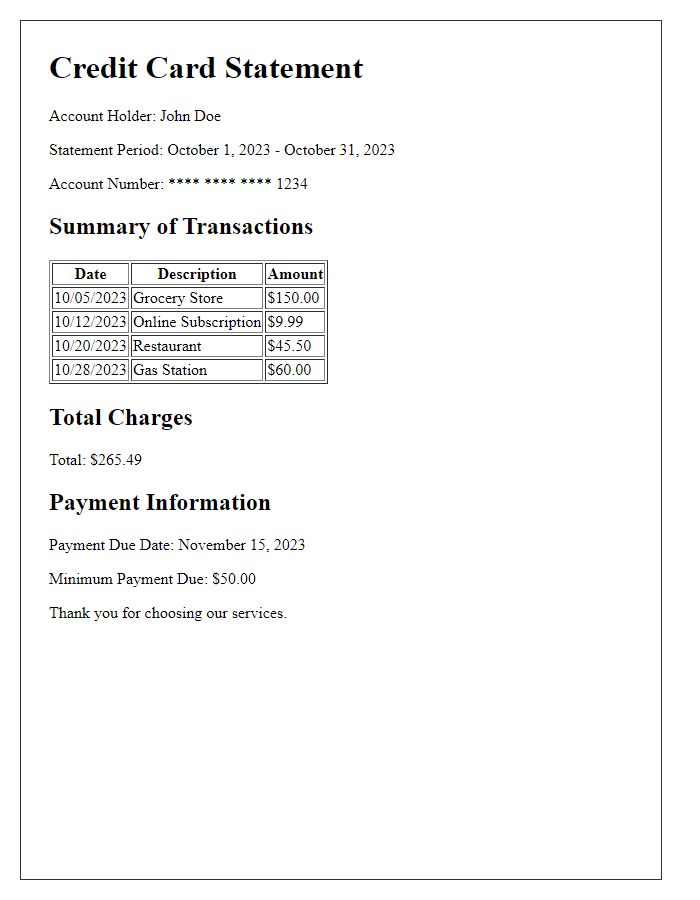

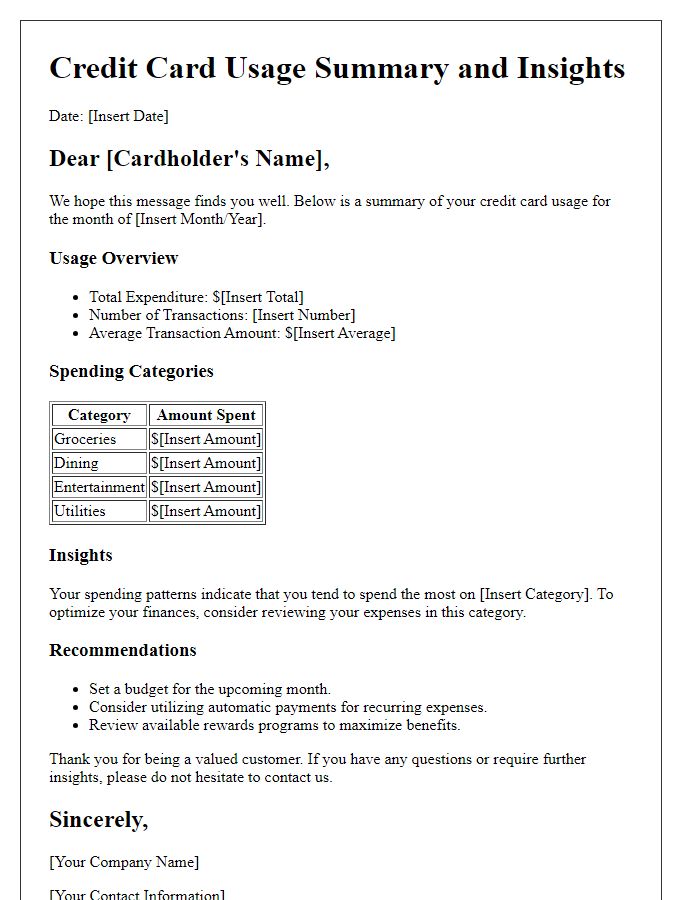

Transaction Details

The credit card account summary statement provides a comprehensive overview of the recent transactions made on the credit card, such as purchases, payments, and fees. Each transaction entry includes key details like transaction date, merchant name, transaction amount, and location (city, state or country) where the purchase was made. For example, a transaction dated September 25, 2023, may show a purchase from "Best Buy" in Los Angeles, California for $250, which highlights consumer electronics. Additionally, payments received may indicate the payment date and the amount, ensuring the account holder can track their payment history effectively. Fees incurred, such as late fees or annual fees, are also documented, providing insight into any additional costs associated with the credit card usage. This summary serves as an essential tool for managing finances and understanding spending habits over time.

Payment Due Date and Amount

Credit card account summary statements provide essential financial information to cardholders. The payment due date is crucial, typically specified at the end of each billing cycle, indicating when the minimum payment should be made to avoid late fees or interest charges. This date can be the same each month, often around 25 days after the statement closing date. The amount due often includes details such as the minimum payment, outstanding balance, and any additional fees incurred during the billing period, ensuring cardholders are well-informed about their financial responsibilities. Failure to pay on or before the due date can result in penalties, affecting credit scores and incurring additional interest.

Rewards and Benefits Overview

The credit card account summary statement reveals a comprehensive overview of rewards and benefits associated with the Visa Signature card. Cardholders can earn 2% cash back on dining expenditures and 1.5% on all other purchases, with an annual bonus of $100 when spending exceeds $10,000. Exclusive travel perks include complimentary access to over 1,000 airport lounges via LoungeKey and travel protection insurance covering delays and cancellations up to $1,500. The rewards program also features double points on selected retailers during promotional events, such as holiday shopping, which increases point accumulation significantly. A detailed breakdown of current points balance, redemption options, and expiration dates are provided for effective planning and management of benefits.

Customer Service Contact Information

Credit card account summary statements provide vital details regarding account activity, payment history, and outstanding balances. These documents typically include a prominent section dedicated to customer service contact information, essential for account inquiries. This section may feature multi-channel options such as a toll-free phone number (often starting with 1-800), an email address for digital communication, and a postal address for written correspondence. Additionally, many statements include hours of operation for customer service representatives, ensuring users know the best times to seek assistance. Some institutions may also offer live chat support through their websites or mobile applications, reflecting a commitment to customer convenience.

Comments