Are credit card interest rates weighing heavily on your wallet? You're not alone; many consumers are finding these rates increasingly challenging to manage. Fortunately, negotiating a lower rate is not only possible but can also lead to significant savings in the long run. If you're curious about how to effectively approach this negotiation, read on for some practical tips and templates!

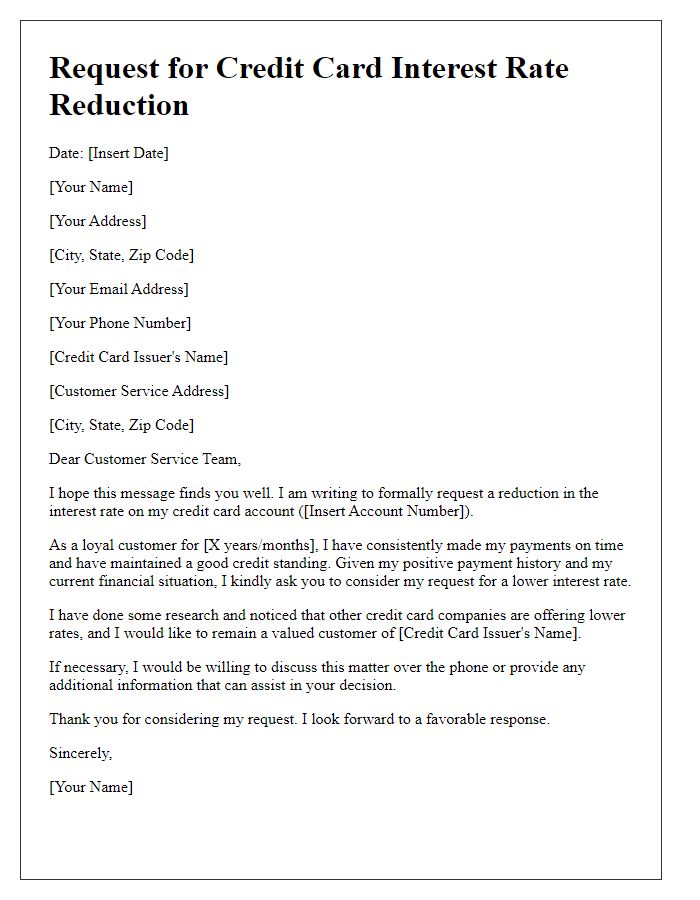

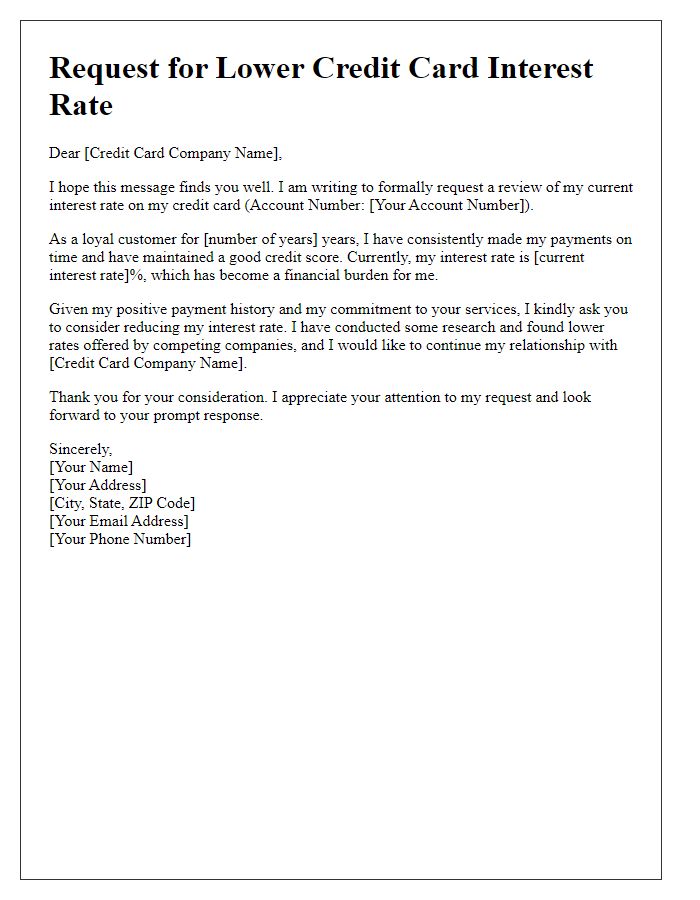

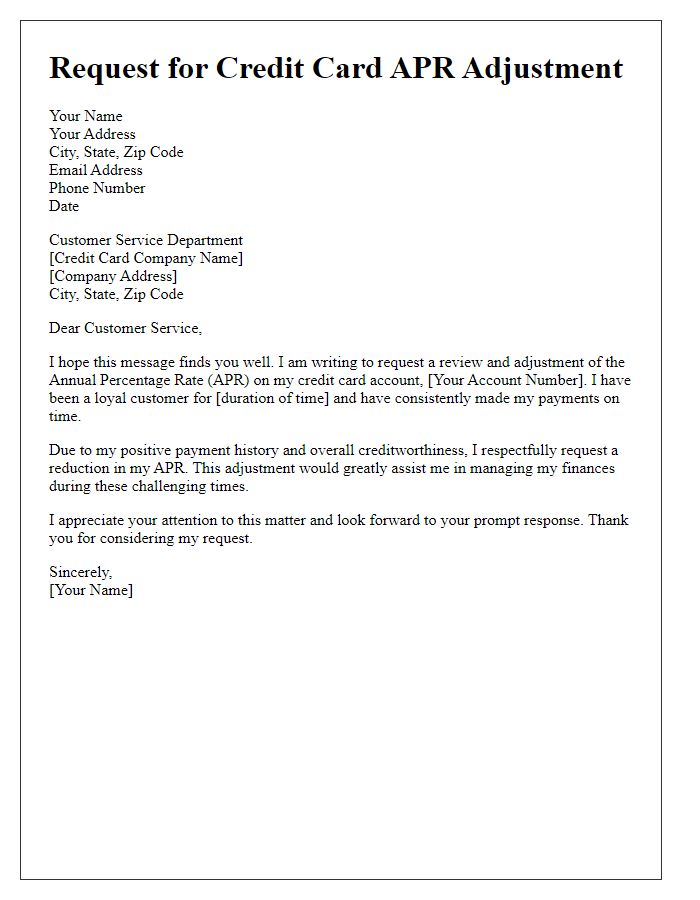

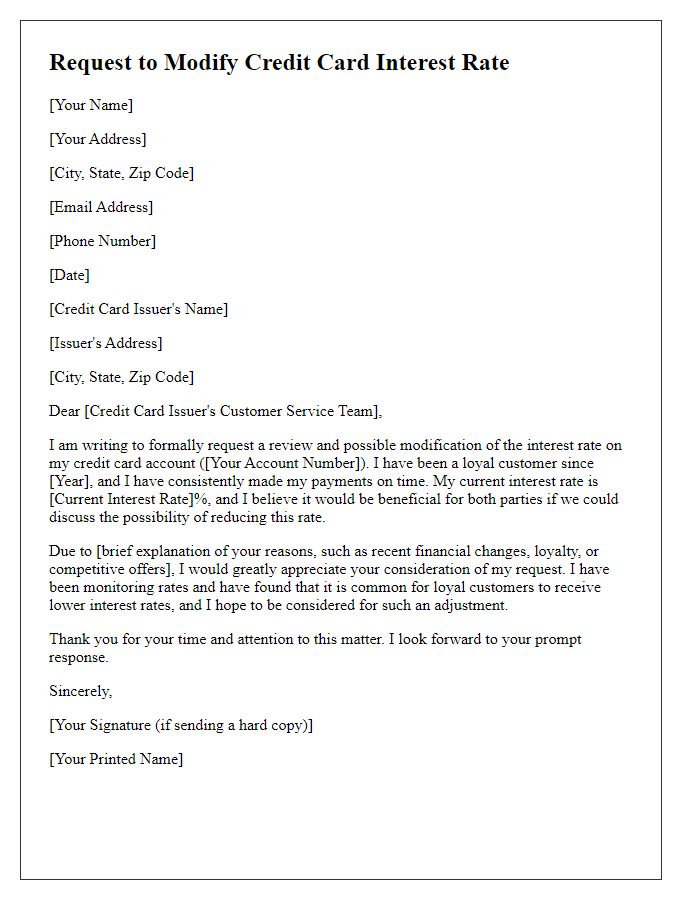

Personal Account Information

Negotiating credit card interest rates can significantly impact financial management. Credit card interest rates, typically ranging from 10% to 29% APR, play a crucial role in determining monthly payments. For instance, a $5,000 balance at a 20% APR could result in over $1,000 in interest payments annually. Maintaining a positive payment history by making on-time payments for over six months can enhance negotiation leverage. Issuers such as Visa, MasterCard, or American Express may be more willing to accommodate requests from long-term customers, especially if the request is made after market rate changes or promotional offers become available. In addition, exploring alternative credit options, such as personal loans with lower rates, can provide a clear rationale when negotiating.

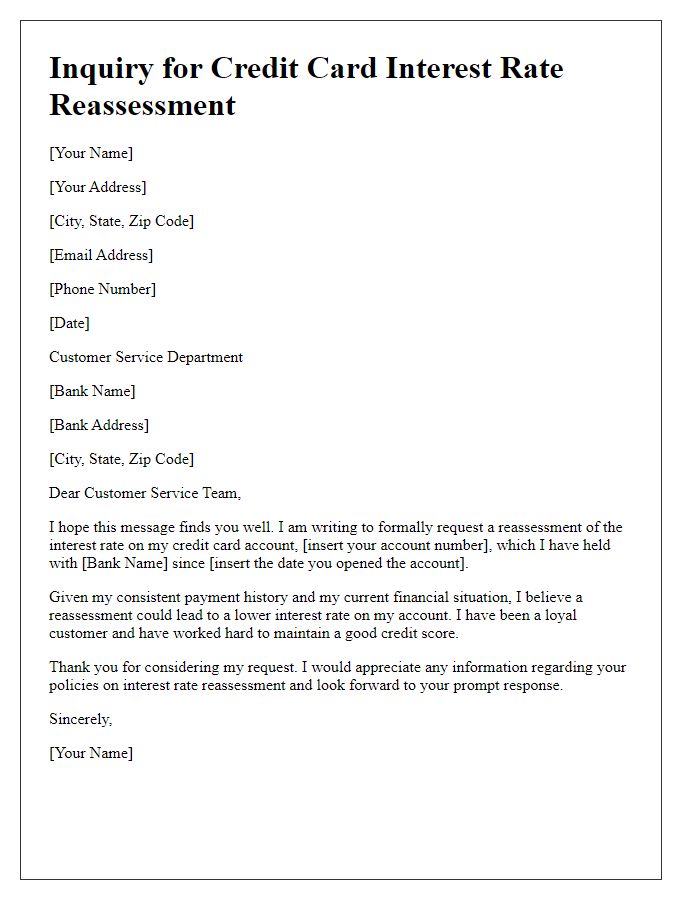

Current Interest Rate Details

Current interest rates on credit cards can significantly impact overall financial management and budget planning. For example, a typical annual percentage rate (APR) ranges between 14% and 25% depending on the lender, creditworthiness, and prevailing market conditions. Many consumers encounter interest rates above 20% on cards issued by major banks like Chase or Citibank. Negotiating a lower interest rate may be beneficial, especially for individuals carrying a balance; even a reduction of just a couple of percentage points can lead to savings of hundreds of dollars annually. Identifying competitive offers from other financial institutions, such as 0% introductory APRs from Discover or American Express, can provide leverage in discussions with current credit card providers. Keeping excellent credit scores (typically above 700) can enhance negotiation success and improve chances of obtaining a more favorable rate.

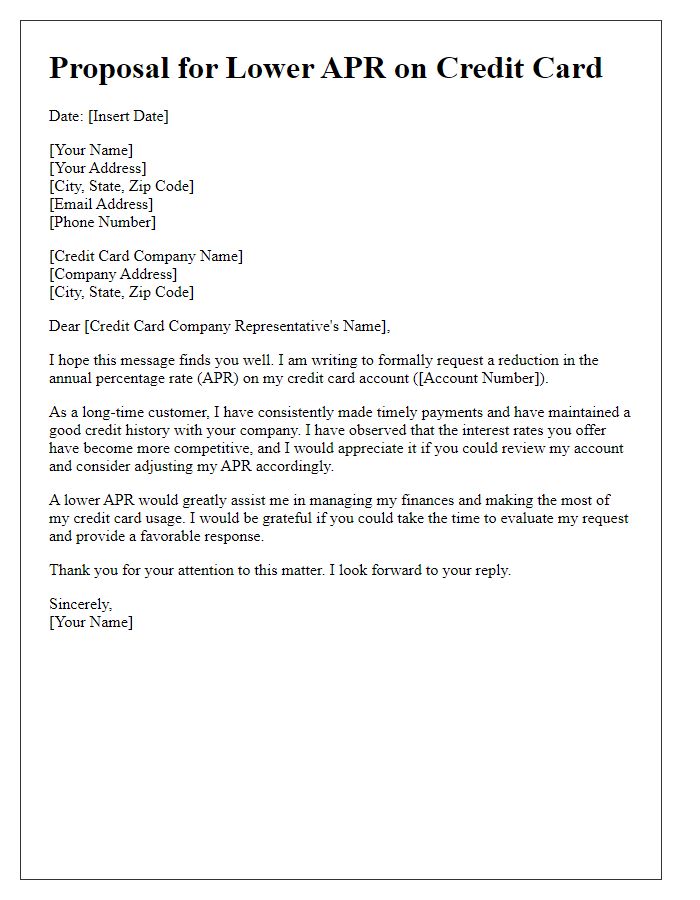

Reason for Negotiation Request

Consumers often seek credit card interest rate negotiation for various reasons, such as financial hardship, improved credit scores, or competitive offers from other financial institutions. High-interest rates, typically ranging from 15% to 25%, can significantly impact monthly payments and overall debt repayment timelines. For example, a $5,000 balance at 20% APR results in approximately $1,000 in interest over a year. Demonstrating a consistent payment history and a good faith effort to manage debt can strengthen negotiation positions. Additionally, alternative offers from competitors, like a zero-percent introductory rate for the first 12 months, can leverage negotiation discussions with current credit card issuers.

Comparison with Competitor Rates

Many credit card holders face varying interest rates, especially when compared to competitive offers from other financial institutions. For example, Bank A offers a standard variable interest rate of 14.99% APR, while Bank B provides a promotional rate of 10.99% for the first twelve months on similar credit cards. This discrepancy creates substantial financial implications for consumers, as a lower interest rate can mean significant savings on interest payments over time. Additionally, rewards and cashback programs offered by competitors further enhance the appeal of switching cards. For instance, competing offers may include 2% cash back on all purchases, whereas other cards might offer limited benefits. Therefore, negotiating with your credit card issuer is crucial for securing a more favorable rate aligned with market standards.

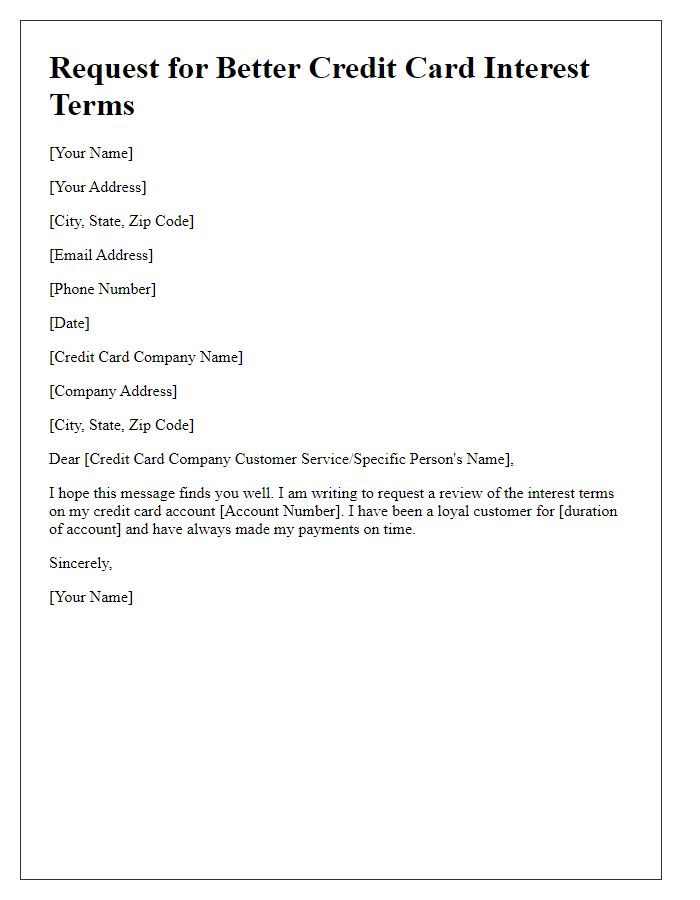

Financial Hardship Circumstances

Financial hardships can lead to significant challenges in managing credit, particularly for individuals reliant on credit cards. Circumstances such as unexpected medical expenses exceeding $10,000, sudden job loss affecting monthly income by over 50%, or natural disasters causing property damage can severely impact financial stability. Borrowers experiencing these difficulties may seek to negotiate lower interest rates with their credit card companies to reduce monthly payments and prevent default. A successful negotiation may involve presenting documentation, such as bank statements, medical bills, or termination letters, to illustrate the financial strain. Lowering the interest rate from an average of 18% to 12% could provide substantial relief, enabling a more manageable repayment plan during tough financial periods.

Comments