When it comes to managing your financial health, keeping a close eye on your credit report is essential. One often overlooked aspect is verifying any inquiries made on your report, which can impact your credit score. Whether you're looking to challenge inaccuracies or simply understand what's been reported, taking the time to address these inquiries can make a significant difference. Interested in learning how to effectively verify your credit report inquiries? Read on!

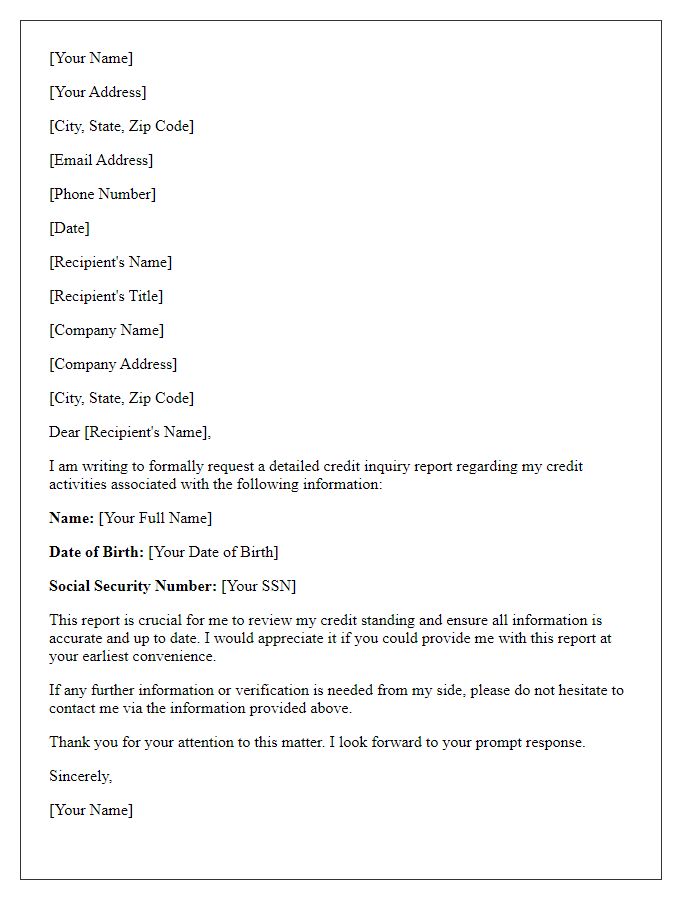

Accurate personal information verification.

Accurate personal information verification is essential in maintaining a reliable credit report, as errors can lead to misleading financial assessments. A recent study by the Consumer Financial Protection Bureau (CFPB) reported that approximately 20% of consumers had errors on at least one of their credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. In order to verify personal information, consumers must check details such as their name, address, Social Security number, and date of birth against official records. The Fair Credit Reporting Act (FCRA) mandates that consumers are entitled to request corrections for inaccuracies, which may include inquiries from lenders or creditors that do not match their known financial activities. To facilitate this process, individuals should provide supporting documentation, such as utility bills or bank statements, that confirm their identity and current residence when contacting credit bureaus for corrections. Accurate verification not only helps improve credit scores but also fosters trust with potential lenders and financial institutions.

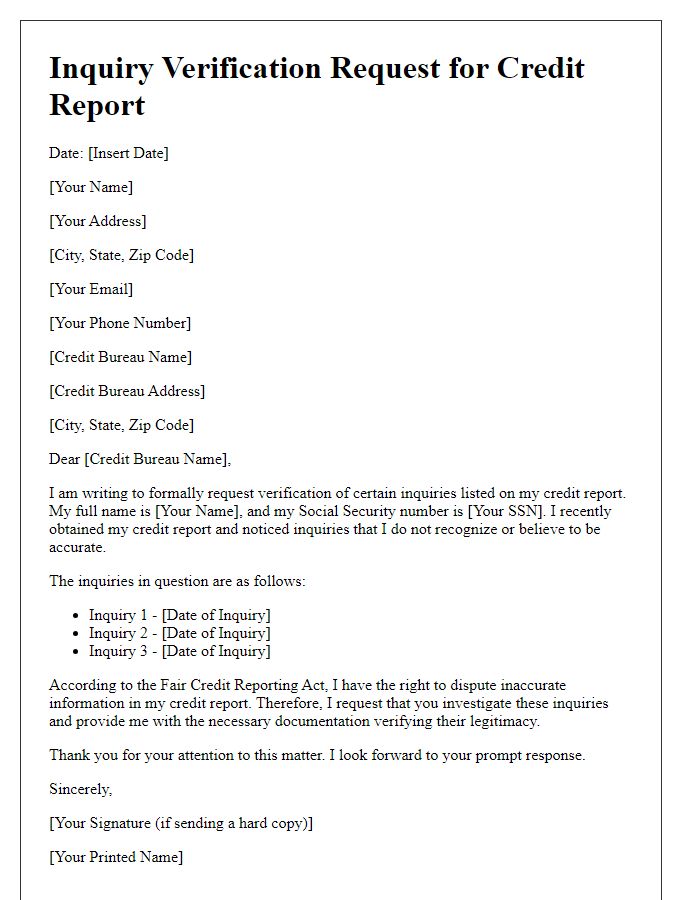

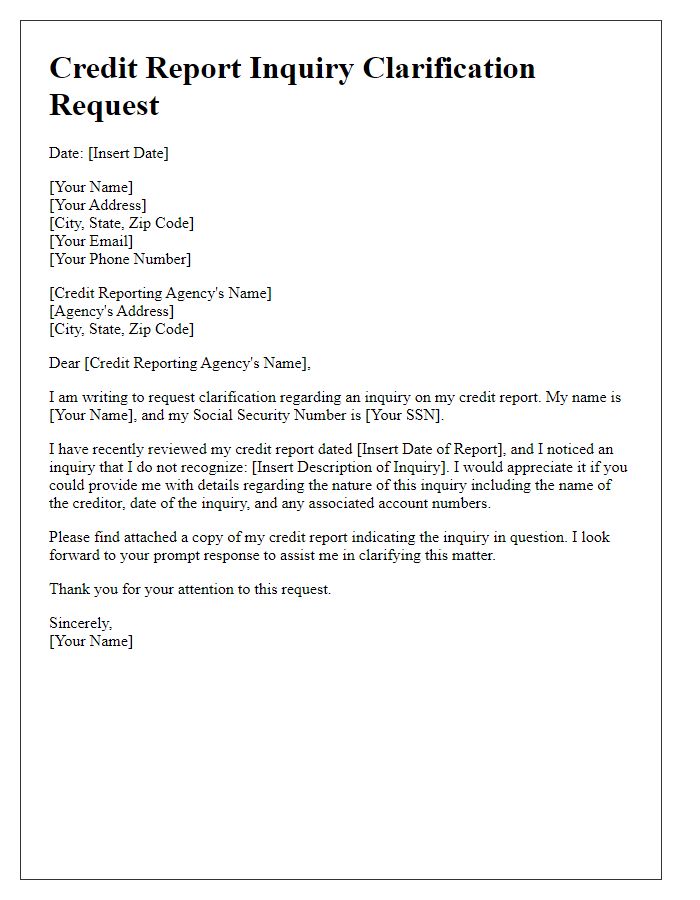

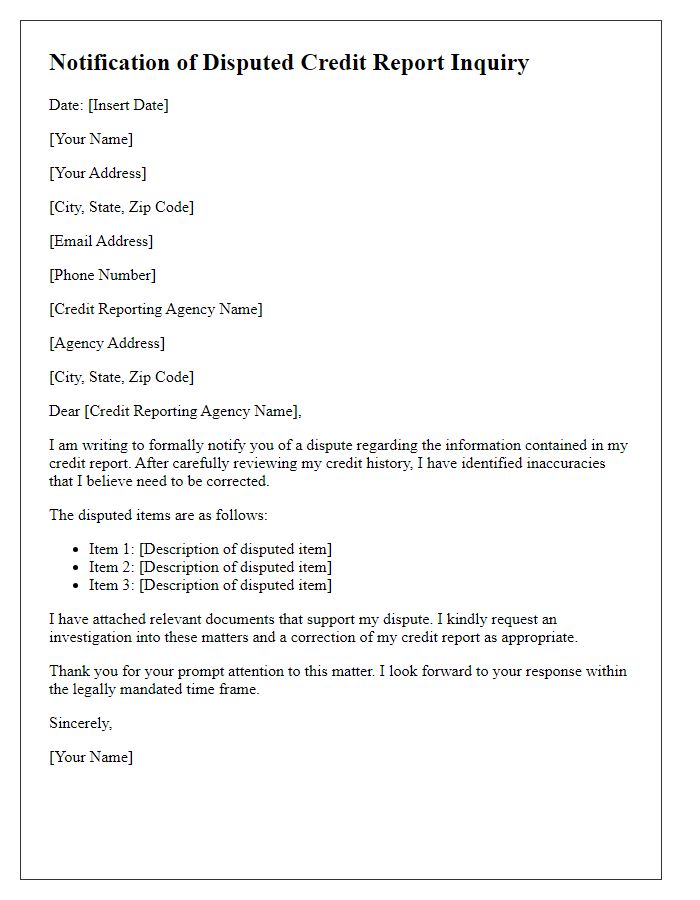

Clear identification of inquiries to dispute.

A credit report inquiry dispute requires a specific identification of the inaccurate inquiries. Details such as the inquiry date, the name of the creditor (e.g., XYZ Bank), and the type of inquiry (hard or soft) need to be systematically listed. For instance, an inquiry dated January 15, 2023, generated by XYZ Bank should be clearly marked if it was a hard inquiry that was not authorized by the consumer. Additionally, receipts or correspondence that demonstrate the lack of consent (such as emails from the creditor) can strengthen the dispute. The Federal Trade Commission outlines consumers' rights to dispute inaccuracies, empowering individuals to ensure that their credit reports reflect truthful information. Accurate documentation is essential for successfully resolving these disputes and improving overall credit scores.

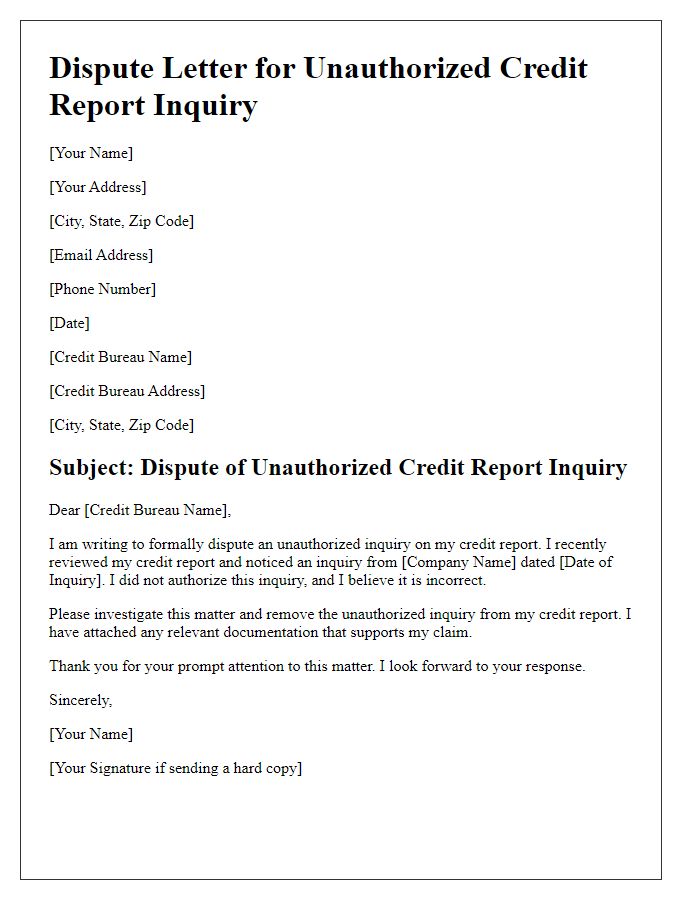

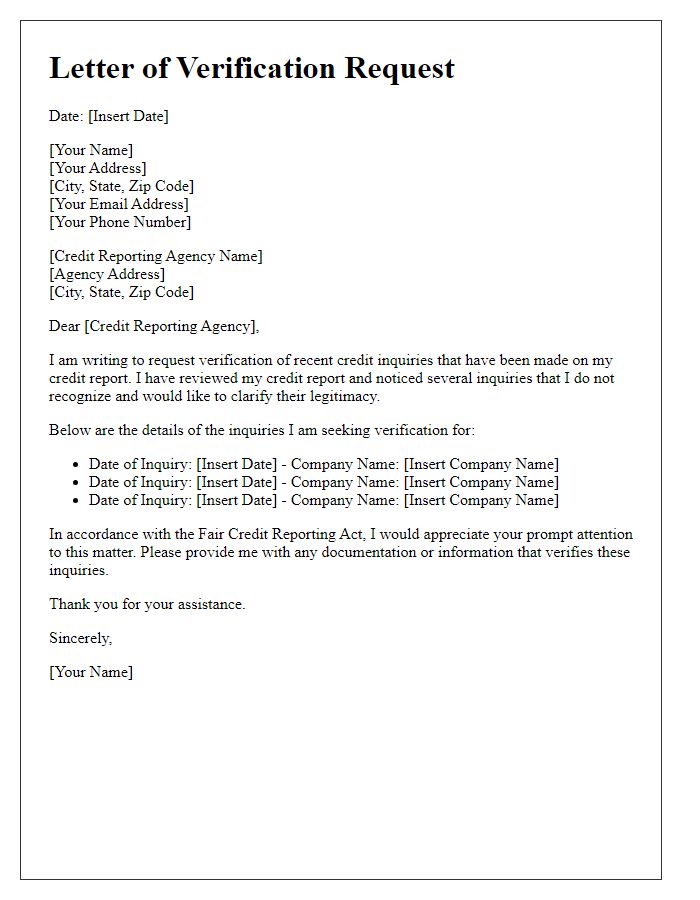

Reason for disputing inquiries.

Credit report inquiries can significantly impact credit scores, affecting financial opportunities such as loan approvals and interest rates. Inquiries are categorized as either hard or soft. Hard inquiries, usually resulting from loan applications or credit card requests, can remain on credit reports for up to two years, potentially lowering credit scores by a few points. Disputes occur when individuals identify unauthorized inquiries, such as those from companies not contacted or known to them. These inaccuracies can arise from identity theft (when someone uses another person's identity to open accounts) or simple clerical errors. Consumers must address these inaccuracies promptly to maintain creditworthiness and ensure accurate credit assessments in lending processes, particularly with major credit bureaus like Experian, TransUnion, and Equifax.

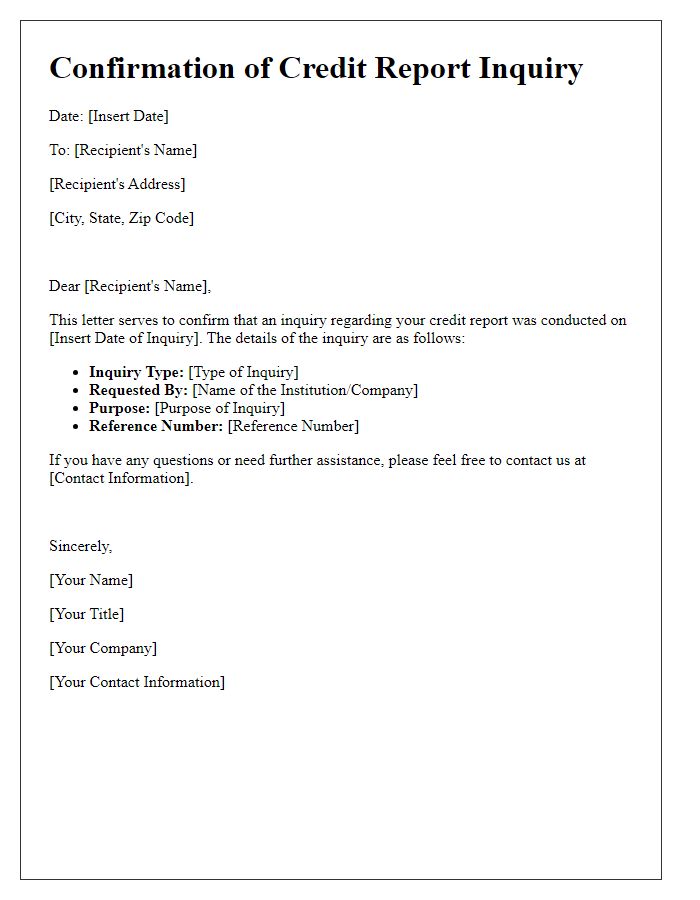

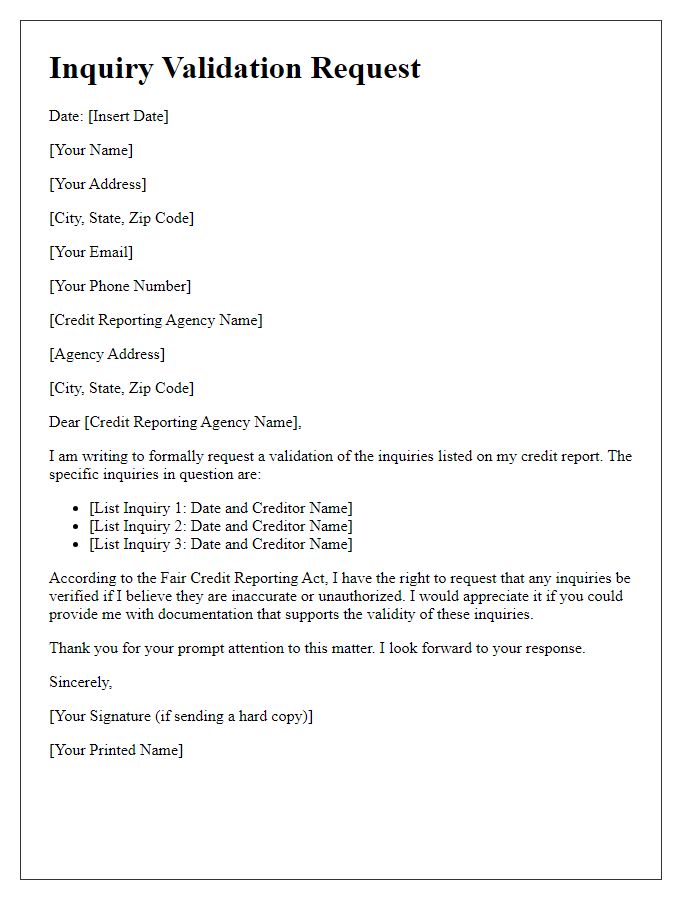

Request for investigation and resolution.

Credit report inquiries can significantly impact credit scores, especially from agencies like Experian, TransUnion, and Equifax. Frequent hard inquiries, typically stemming from applications for credit cards or loans, may reduce scores by up to five points each, potentially affecting future approvals. Accurate record-keeping of inquiries is crucial, as fraudulent inquiries might indicate identity theft, detrimentally impacting financial health. A formal request for investigation, clearly stating specific inquiries in question, should be sent to credit bureaus for clarity and resolution. Following guidelines set by the Fair Credit Reporting Act ensures rights are preserved and inaccuracies are addressed promptly.

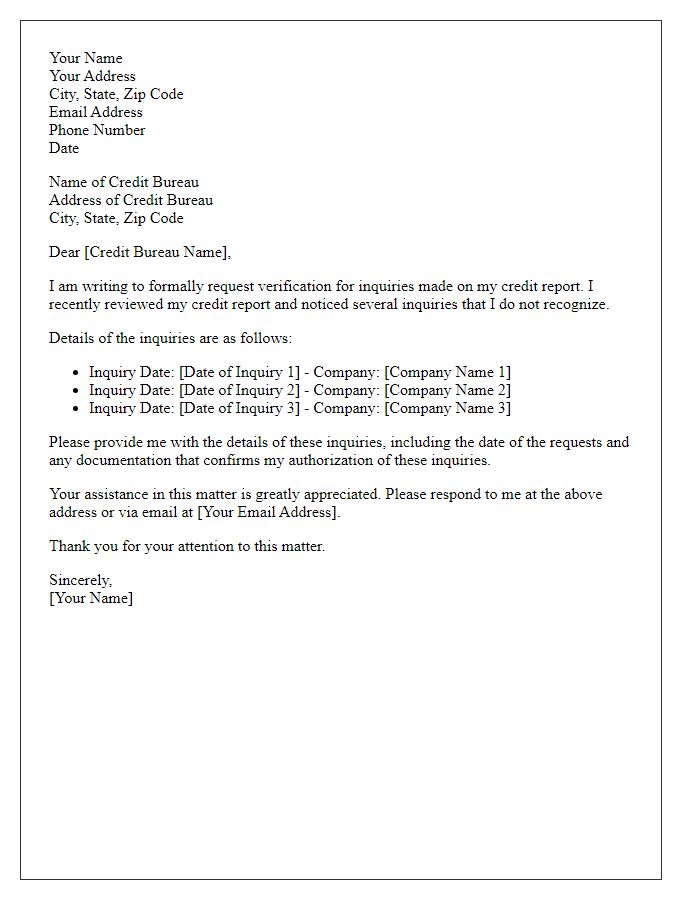

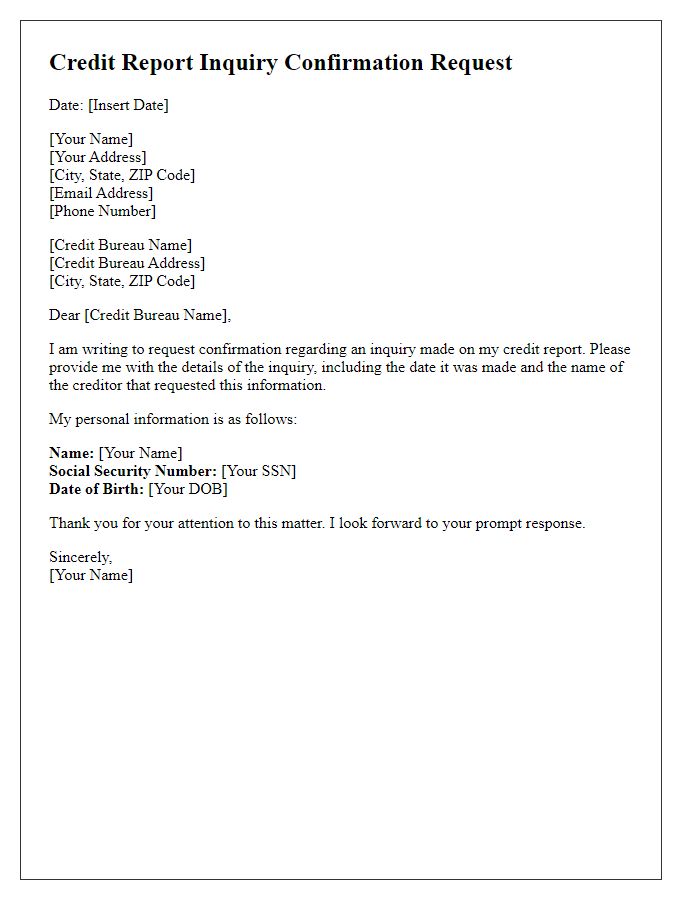

Contact information for follow-up.

Verifying credit report inquiries is essential for maintaining accurate financial records. A recent review indicated multiple unauthorized inquiries, potentially impacting credit scores significantly (potential drop of 5-10 points per inquiry). Credit reporting agencies such as Experian, TransUnion, and Equifax offer annual free reports, allowing consumers to identify discrepancies. Keeping records of all inquiries, including dates and lenders involved, is crucial in disputing inaccuracies. Additionally, consumers should note their rights under the Fair Credit Reporting Act, which provides a platform for correcting errors. Contacting the respective agency's customer service for follow-up, using the specified contact information, ensures timely resolution of these issues.

Comments