If you've ever worried about identity theft or want to take control of your financial security, a credit freeze might be just what you need. This simple yet powerful tool allows you to restrict access to your credit report, making it nearly impossible for identity thieves to open new accounts in your name. In this article, we'll explore how to initiate a credit freeze, what to expect during the process, and the benefits it can bring to your peace of mind. Intrigued? Let's dive in and learn more about keeping your financial identity safe!

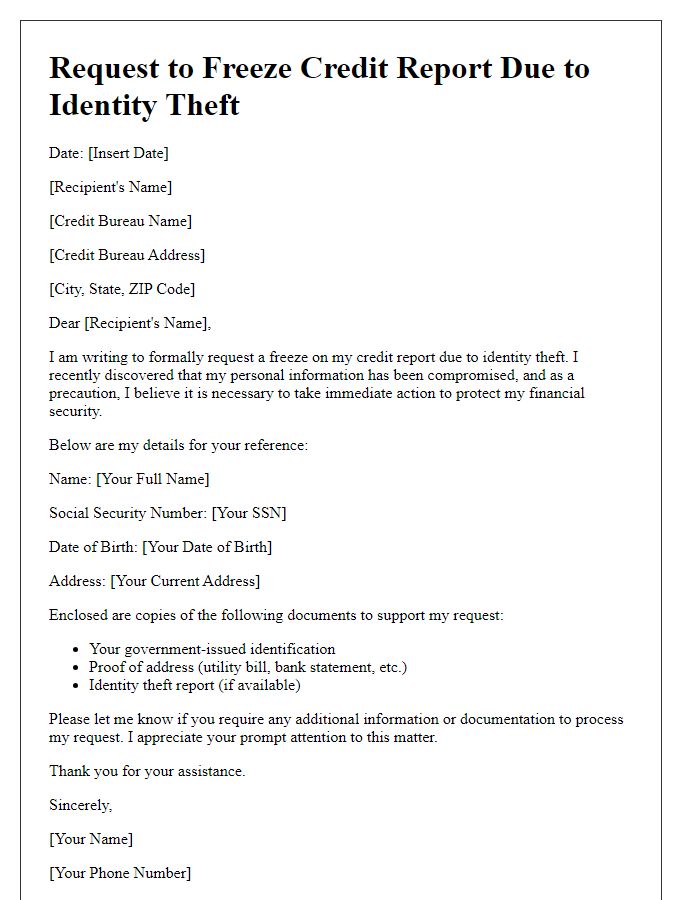

Personal Information: Full name, address, Social Security Number, and date of birth.

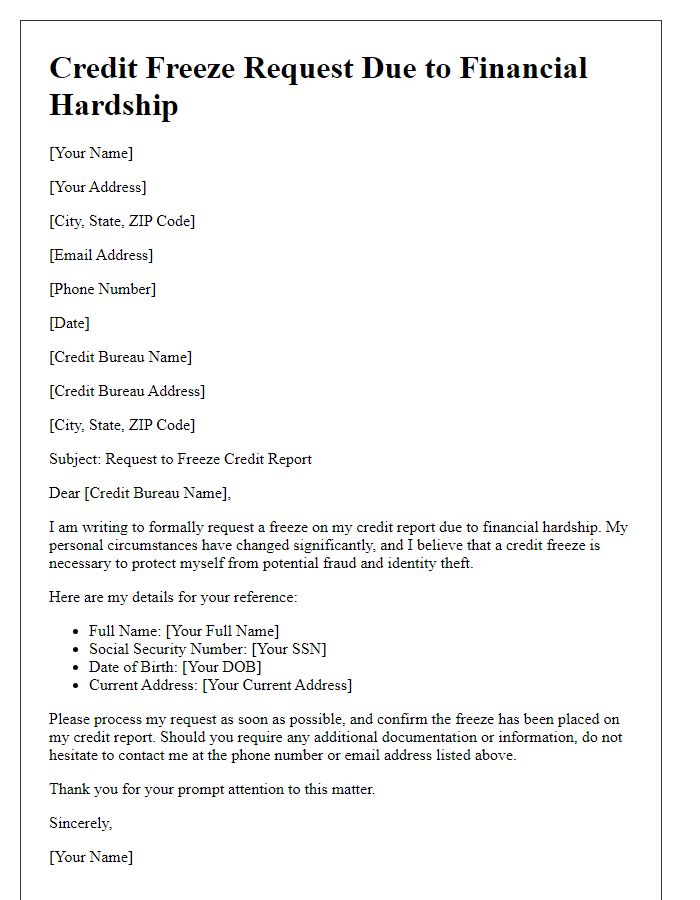

Freezing a credit report is a crucial step in protecting personal information from identity theft. To initiate this process, individuals must provide essential personal information, including their full name, which serves as the primary identifier in credit reporting systems. The address, usually including street name, city name, state abbreviation, and zip code, helps verify residency and links the individual to a specific credit file. The Social Security Number (SSN), a unique nine-digit number assigned by the U.S. government, is vital for accurately identifying credit history, and the date of birth confirms the identity, ensuring that the request is legitimate. Providing this detailed information helps credit bureaus efficiently process the freeze and safeguard against unauthorized access to financial records.

Request Statement: Clear request to freeze the credit report.

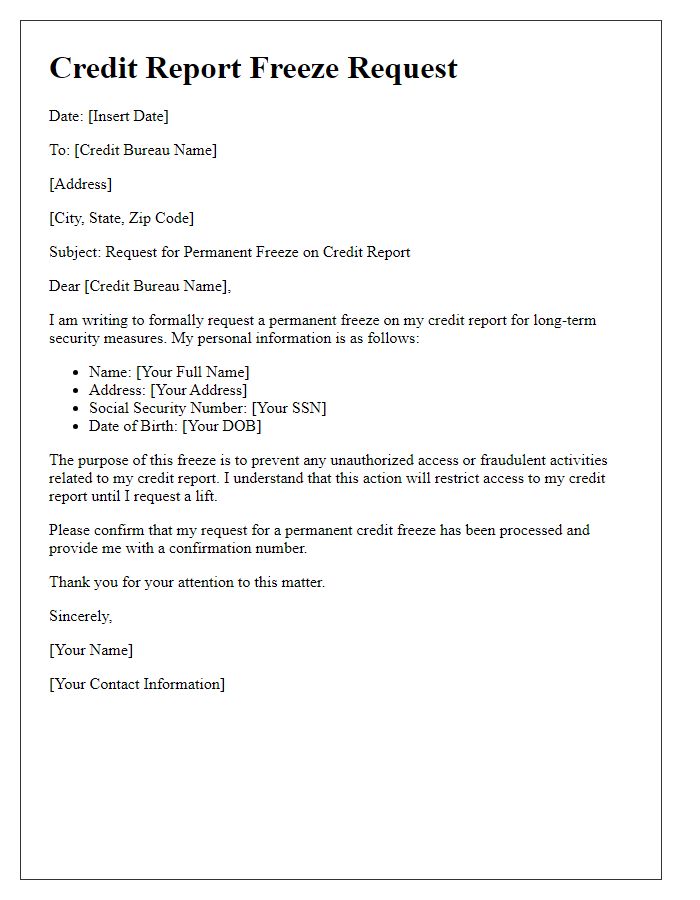

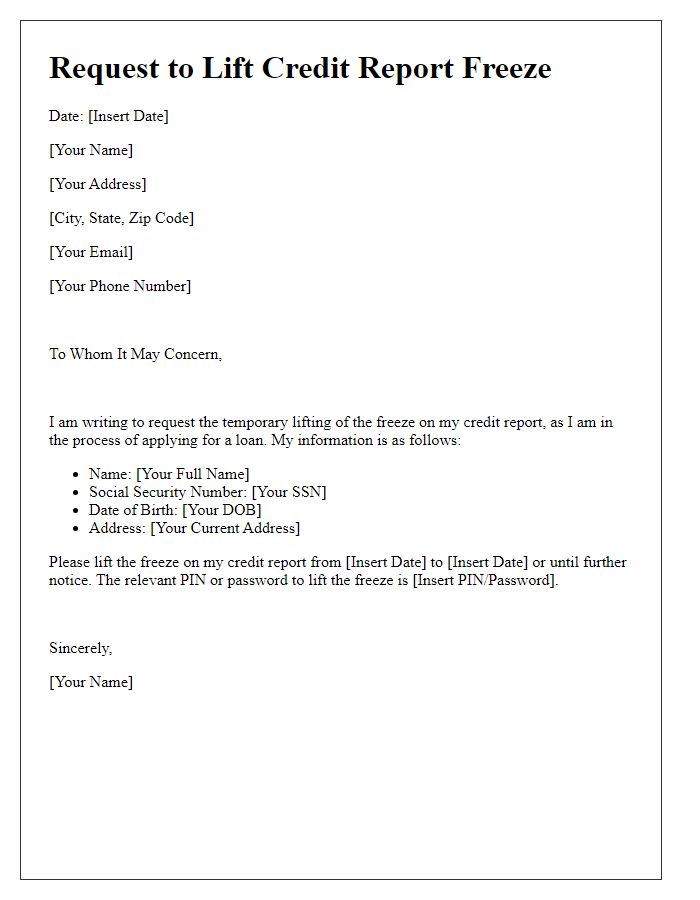

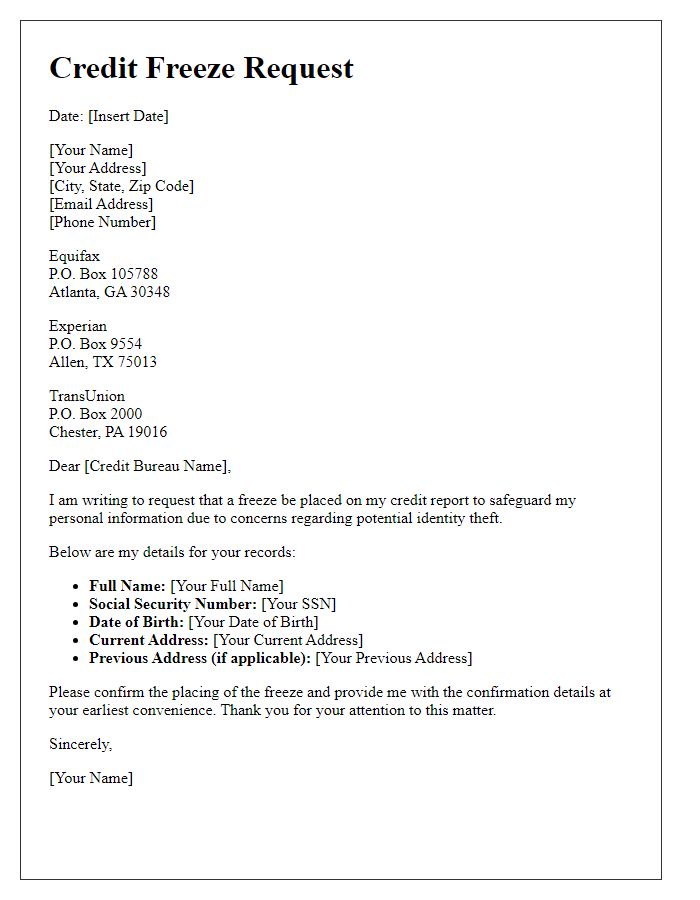

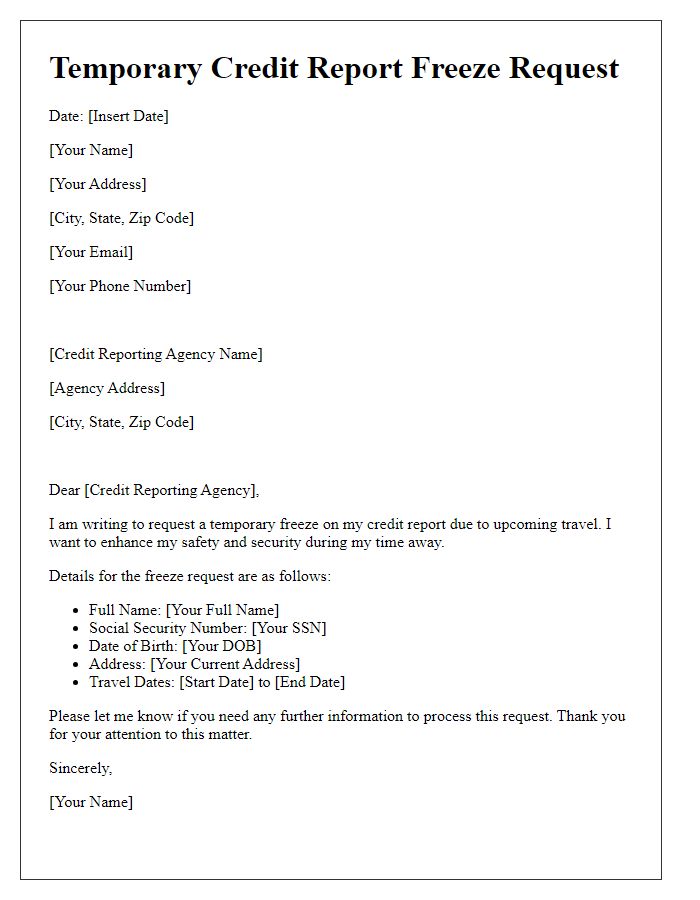

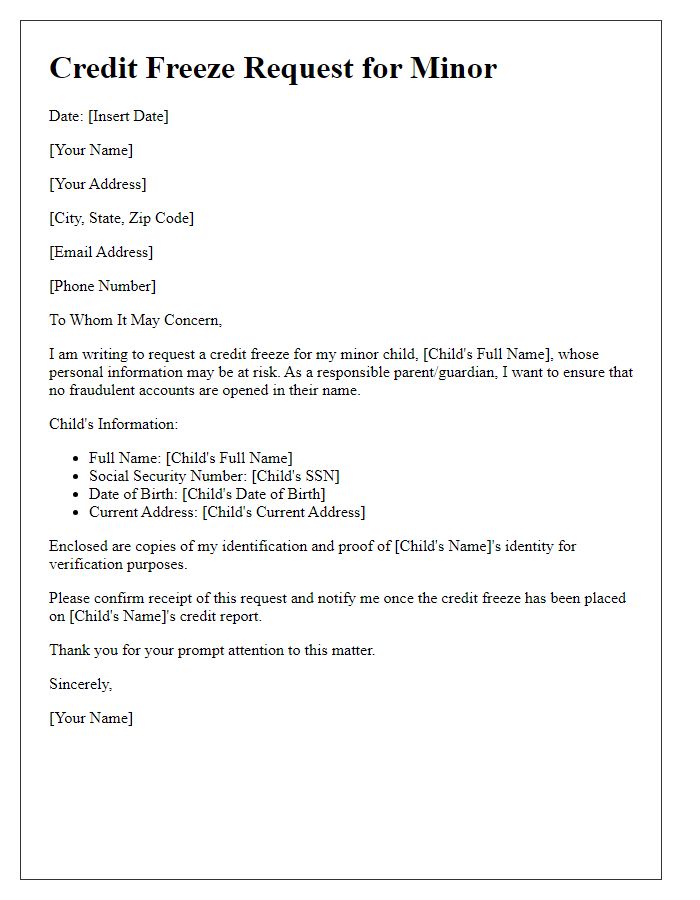

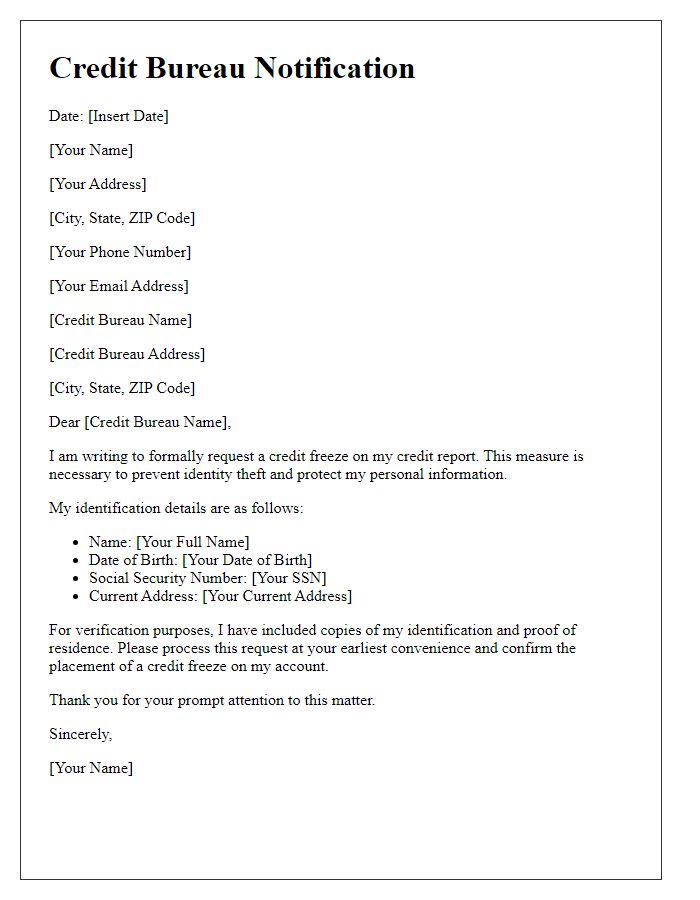

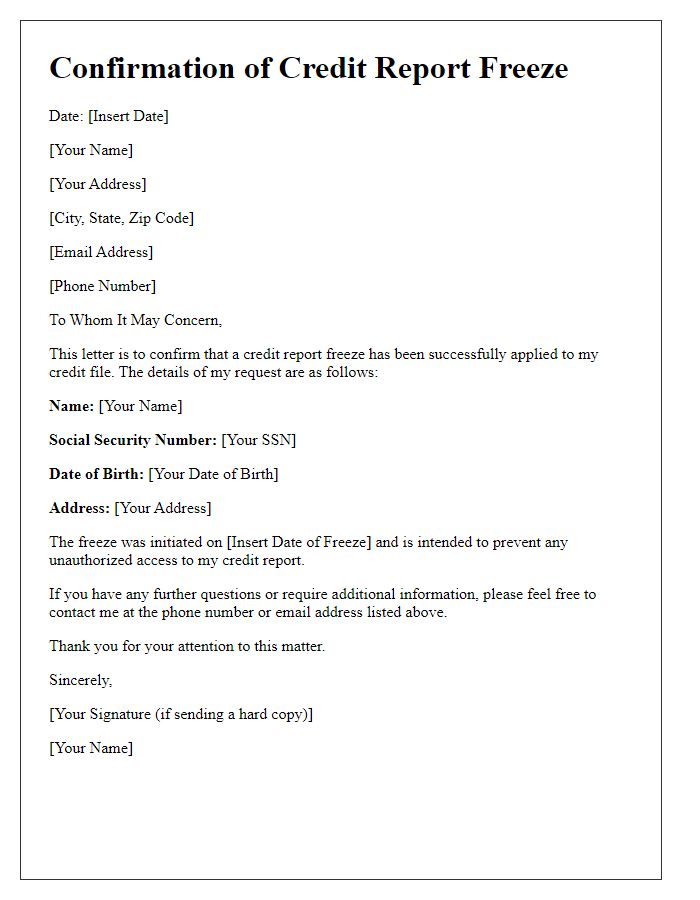

Freezing a credit report provides protection against identity theft and unauthorized access to personal financial information. An individual must submit a formal request to credit bureaus like Equifax, Experian, and TransUnion. Essential details include personal identification such as full name, Social Security number, and date of birth. The request may also require information regarding current addresses and prior addresses over the last two years to verify identity. Once the credit report is frozen, lenders cannot access the report, effectively preventing new credit accounts from being opened without the individual's consent. In some cases, the freeze can be lifted temporarily or permanently through a secure PIN or password, ensuring ongoing control over credit access.

Identification Documents: Copies of government-issued ID and utility bill or bank statement.

Freezing a credit report can effectively protect personal financial information from identity theft. To initiate this process, individuals need to provide identification documents, specifically copies of government-issued identification (such as a driver's license or passport) to verify identity. Additionally, a utility bill (like electricity or water) or a bank statement can serve as proof of residence. These documents not only confirm the individual's identity but also establish their current address, critical for accurately processing the credit freeze request. By completing this step, consumers can safeguard their credit profile from unauthorized access and potential fraudulent activities.

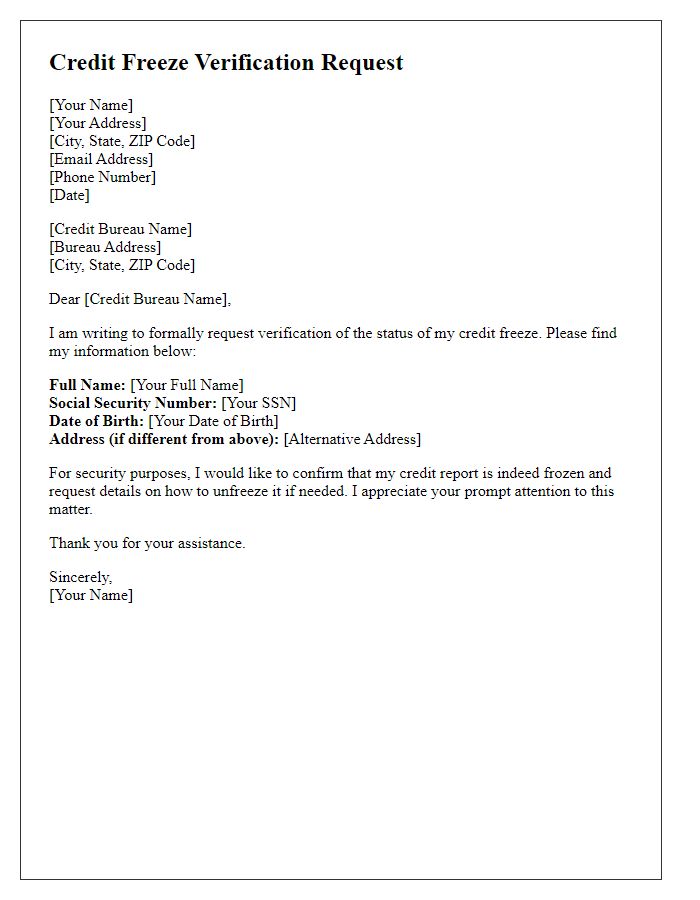

Security Questions: Answers to verification questions for identity confirmation.

Freezing a credit report helps protect individuals from identity theft by restricting access to their credit information. This proactive measure involves contacting major credit bureaus, such as Experian, TransUnion, and Equifax, to implement the freeze. Security questions, designed to confirm one's identity, typically include queries regarding past addresses, recent account activity, or personal identification numbers. Answers must be accurate and reflective of the individual's history to successfully authenticate their identity during the freeze process. A credit freeze is a valuable tool for safeguarding financial information, preventing unauthorized access, and maintaining control over personal data, especially in light of increasing cyber threats.

Contact Information: Email and phone number for correspondence.

Freezing a credit report involves notifying credit bureaus, such as Equifax, Experian, and TransUnion, to prevent unauthorized access to financial information. When initiating this process, it's essential to provide clear contact information: an email address for electronic correspondence, ensuring timely responses, and a phone number for potential follow-up queries. Additionally, it's advisable to include vital identification details, such as Social Security numbers and the address of residence, to facilitate efficient processing while maintaining security against identity theft. Each bureau may have specific procedures, requiring acknowledgment or confirmations through these communication channels.

Letter Template For Freezing Credit Report Samples

Letter template of request to freeze credit report due to identity theft.

Letter template of permanent freeze on credit report for long-term security.

Letter template of lifting a freeze on credit report for loan application.

Letter template of freeze credit report for safeguarding personal information.

Comments